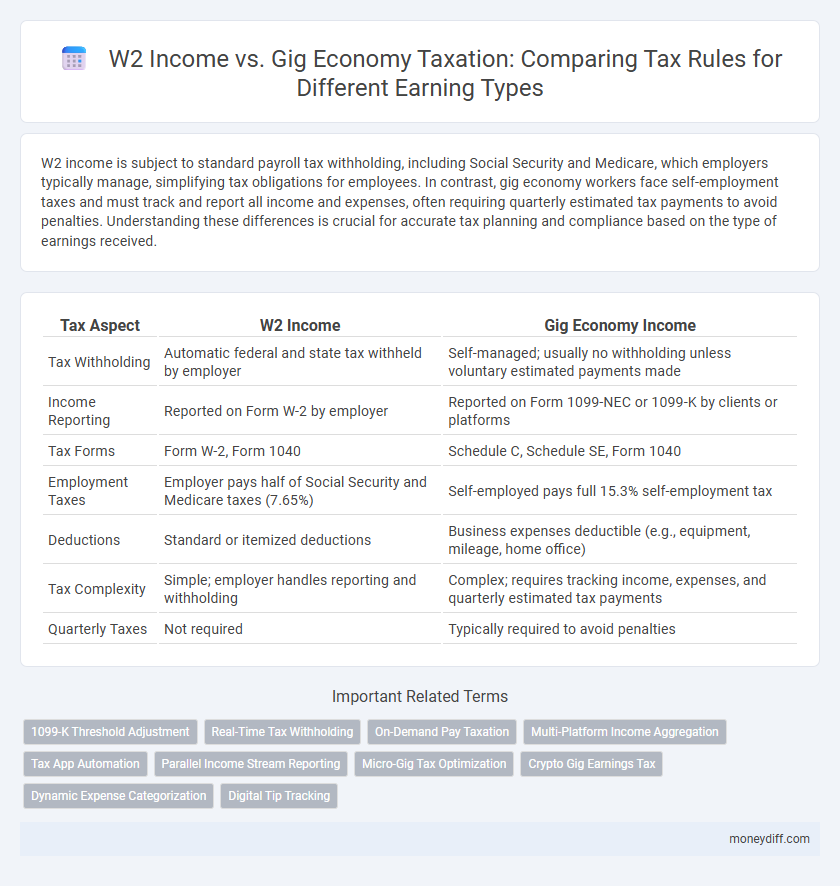

W2 income is subject to standard payroll tax withholding, including Social Security and Medicare, which employers typically manage, simplifying tax obligations for employees. In contrast, gig economy workers face self-employment taxes and must track and report all income and expenses, often requiring quarterly estimated tax payments to avoid penalties. Understanding these differences is crucial for accurate tax planning and compliance based on the type of earnings received.

Table of Comparison

| Tax Aspect | W2 Income | Gig Economy Income |

|---|---|---|

| Tax Withholding | Automatic federal and state tax withheld by employer | Self-managed; usually no withholding unless voluntary estimated payments made |

| Income Reporting | Reported on Form W-2 by employer | Reported on Form 1099-NEC or 1099-K by clients or platforms |

| Tax Forms | Form W-2, Form 1040 | Schedule C, Schedule SE, Form 1040 |

| Employment Taxes | Employer pays half of Social Security and Medicare taxes (7.65%) | Self-employed pays full 15.3% self-employment tax |

| Deductions | Standard or itemized deductions | Business expenses deductible (e.g., equipment, mileage, home office) |

| Tax Complexity | Simple; employer handles reporting and withholding | Complex; requires tracking income, expenses, and quarterly estimated tax payments |

| Quarterly Taxes | Not required | Typically required to avoid penalties |

Understanding W2 Income: Definition and Basics

W2 income refers to wages earned by an employee reported on IRS Form W-2, indicating taxes withheld for Social Security, Medicare, and federal income tax. Employers are responsible for withholding and remitting payroll taxes, simplifying tax filing for employees. Understanding W2 income is essential for accurate tax reporting and compliance compared to the self-employment obligations in gig economy taxation.

What Qualifies as Gig Economy Earnings?

Gig economy earnings typically come from freelance, contract, or temporary work performed through digital platforms like Uber, Lyft, or TaskRabbit, where individuals are classified as independent contractors rather than employees. Unlike W2 income, these earnings do not have taxes withheld automatically, requiring workers to manage self-employment tax obligations including Social Security and Medicare contributions. Accurate reporting of gig economy income is essential for compliance with IRS regulations and to avoid penalties.

Tax Withholding: W2 Employees vs. Gig Workers

W2 employees have taxes automatically withheld from their paychecks, including federal income tax, Social Security, and Medicare contributions, simplifying their tax obligations. Gig workers receive gross payments without tax withholding, requiring them to manage estimated tax payments quarterly to avoid penalties. Accurate record-keeping and understanding self-employment tax responsibilities are essential for gig economy participants to remain compliant.

Self-Employment Tax Explained for Gig Earners

Gig economy earners face unique tax challenges as they are subject to self-employment tax, which covers both the employer and employee portions of Social Security and Medicare taxes, totaling 15.3%. Unlike W2 employees whose employers withhold payroll taxes, gig workers must calculate and remit estimated quarterly taxes directly to the IRS, increasing their responsibility for accurate record-keeping and tax payments. Understanding self-employment tax obligations is crucial for gig earners to avoid penalties and optimize tax deductions related to business expenses.

Reporting Income: Forms and Documentation Differences

W-2 income is reported on Form W-2, issued by employers, detailing wages and tax withholdings directly to the IRS, simplifying tax filing for employees. Gig economy workers receive Form 1099-NEC from clients if earnings exceed $600, requiring self-reporting of income and expenses on Schedule C for accurate tax calculation. The key difference lies in employer tax withholding for W-2 wages versus self-employment tax liabilities and extensive record-keeping responsibilities for gig workers.

Deductions Available: W2 vs. Gig Economy Taxes

W2 employees have limited deductions, primarily restricted to those allowed under standard or itemized deductions, whereas gig economy workers can deduct a wider range of business expenses such as home office costs, vehicle mileage, and equipment purchases. Gig workers report income on Schedule C, enabling them to claim self-employment tax deductions and reduce taxable income through business-related expenses. The difference in available deductions significantly impacts the effective tax rate, with gig economy taxation offering more opportunities for expense deductions than traditional W2 income.

Estimated Tax Payments for Gig Workers

Gig workers must make quarterly estimated tax payments to cover income and self-employment taxes since taxes are not automatically withheld, unlike traditional W2 income employees. Failure to make accurate estimated tax payments can result in penalties and interest from the IRS. Keeping detailed income records and using IRS Form 1040-ES helps gig workers calculate and submit timely estimated tax payments.

Social Security and Medicare Contributions Compared

W2 income subjects employees to automatic Social Security and Medicare tax withholding at a combined rate of 7.65%, matched equally by employers, ensuring consistent contributions to these federal programs. Gig economy workers classified as independent contractors must pay self-employment tax, currently 15.3%, covering both the employee and employer portions of Social Security and Medicare taxes. This difference in tax treatment significantly impacts net earnings and quarterly tax obligations, requiring gig workers to proactively manage their contributions to avoid underpayment penalties.

Audit Risks: W2 Employees vs. Freelancers

W2 employees face lower audit risks due to employer-reported income and tax withholdings that simplify IRS verification. Freelancers and gig economy workers encounter higher audit risks because their income relies on self-reporting and deductions, increasing scrutiny for underreported earnings and misclassified expenses. Accurate record-keeping and consulting tax professionals are essential for gig workers to minimize audit exposure and compliance errors.

Smart Tax Strategies for Mixed Income Earners

Smart tax strategies for mixed income earners require understanding the differences between W2 income and gig economy earnings. W2 income is subject to standard withholding and Social Security taxes, while gig income demands self-employment tax payments and quarterly estimated tax filings. Optimizing deductions, such as home office expenses and business-related costs, can significantly reduce taxable income for gig workers managing diverse revenue streams.

Related Important Terms

1099-K Threshold Adjustment

The 1099-K threshold adjustment lowers the reporting requirement to $600 in gross payments, significantly impacting gig economy workers compared to traditional W2 employees whose income is reported directly by employers. This change increases tax reporting transparency for independent contractors but also necessitates diligent expense tracking to optimize deductions under IRS guidelines.

Real-Time Tax Withholding

W2 income benefits from automatic, real-time tax withholding directly by employers, ensuring accurate and consistent tax payments throughout the year. In contrast, gig economy workers must calculate and remit estimated taxes quarterly, lacking real-time withholding mechanisms, which increases the risk of underpayment penalties and tax-time surprises.

On-Demand Pay Taxation

On-demand pay in the gig economy is typically treated as self-employment income, requiring workers to manage estimated tax payments and self-employment taxes, unlike W-2 income where employers withhold taxes automatically. This distinction impacts bookkeeping, tax deductions, and quarterly tax filing obligations for gig workers compared to traditional employees.

Multi-Platform Income Aggregation

Multi-platform income aggregation complicates tax reporting by requiring individuals to combine W2 income with various gig economy earnings, often reported via 1099 forms, leading to potential underreporting or misclassification risks. Accurate aggregation and categorization of income streams are essential for compliance with IRS regulations and to optimize deductions related to business expenses across multiple platforms.

Tax App Automation

W2 income reporting is streamlined through consistent employer withholding and standardized tax forms, enabling tax app automation to efficiently process and file returns with high accuracy. Gig economy taxation involves variable income streams and expense deductions, challenging tax apps to integrate real-time tracking, automated expense categorization, and estimated tax calculations for accurate self-employment tax compliance.

Parallel Income Stream Reporting

W2 income is reported on Form W-2 by employers, reflecting consistent payroll withholding for federal, state, and Social Security taxes, streamlining tax filing for employees. Gig economy earnings require self-reporting via Form 1099-NEC or Schedule C, necessitating detailed record-keeping for income and expenses to accurately manage tax liabilities and avoid underpayment penalties.

Micro-Gig Tax Optimization

W2 income is subject to payroll tax withholding, simplifying tax reporting and reducing year-end liabilities, while gig economy earnings require self-employment tax payments and quarterly estimated filings, increasing administrative responsibilities. Micro-gig tax optimization involves tracking deductible expenses like mileage, home office, and equipment to lower taxable income and strategically managing quarterly payments to avoid penalties.

Crypto Gig Earnings Tax

W2 income is subject to standard federal and state withholding taxes, while gig economy and crypto earnings require self-reporting and payment of estimated taxes, including self-employment tax. Crypto gig earnings must be reported as taxable income at fair market value when received, with capital gains taxes applying to subsequent transactions or conversions.

Dynamic Expense Categorization

Dynamic expense categorization in gig economy taxation allows workers to optimize deductions by accurately matching expenses like vehicle costs, equipment, and home office use to specific income streams, unlike static W2 income reporting which typically lacks such granularity. Utilizing real-time tracking and AI-driven tools enhances tax efficiency by capturing eligible deductions dynamically, reducing taxable income and improving overall financial outcomes for gig workers.

Digital Tip Tracking

Digital tip tracking for W2 income offers precise record-keeping and automatic withholding of taxes, ensuring compliance and reducing audit risks. In contrast, gig economy workers must manually report digital tips as self-employment income, facing variable tax obligations and the need to manage quarterly estimated payments.

W2 Income vs Gig Economy Taxation for earning types. Infographic

moneydiff.com

moneydiff.com