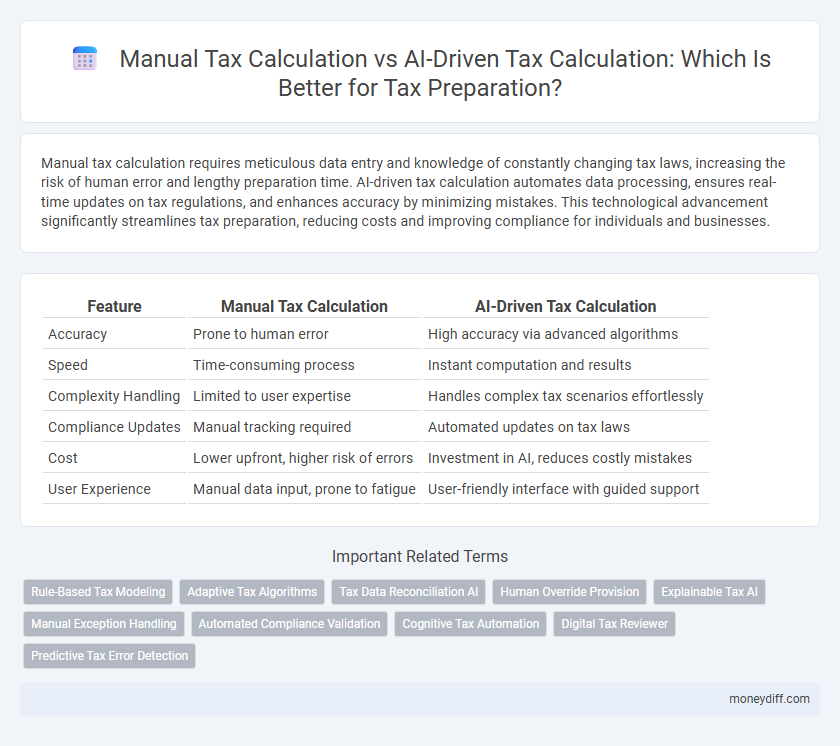

Manual tax calculation requires meticulous data entry and knowledge of constantly changing tax laws, increasing the risk of human error and lengthy preparation time. AI-driven tax calculation automates data processing, ensures real-time updates on tax regulations, and enhances accuracy by minimizing mistakes. This technological advancement significantly streamlines tax preparation, reducing costs and improving compliance for individuals and businesses.

Table of Comparison

| Feature | Manual Tax Calculation | AI-Driven Tax Calculation |

|---|---|---|

| Accuracy | Prone to human error | High accuracy via advanced algorithms |

| Speed | Time-consuming process | Instant computation and results |

| Complexity Handling | Limited to user expertise | Handles complex tax scenarios effortlessly |

| Compliance Updates | Manual tracking required | Automated updates on tax laws |

| Cost | Lower upfront, higher risk of errors | Investment in AI, reduces costly mistakes |

| User Experience | Manual data input, prone to fatigue | User-friendly interface with guided support |

Introduction: Manual vs AI-Driven Tax Calculation

Manual tax calculation relies on human expertise to interpret tax regulations and apply them to financial data, often resulting in slower processing and higher risk of errors. AI-driven tax calculation leverages machine learning algorithms to analyze vast datasets, identify relevant tax codes, and automate computations with increased accuracy and efficiency. Implementing AI systems in tax preparation enhances scalability and compliance while reducing the burden of manual data entry and complex calculations.

Understanding Manual Tax Calculation Methods

Manual tax calculation methods require a thorough understanding of tax codes, regulations, and individual financial data input. These calculations rely on human accuracy to interpret complex tax brackets, deductions, and credits without automation. Errors and time consumption are common challenges when preparing taxes using manual approaches.

How AI-Driven Tax Calculation Works

AI-driven tax calculation utilizes advanced machine learning algorithms to analyze vast amounts of financial data, identify relevant tax codes, and automatically apply deductions and credits accurately. It continuously learns from updated tax regulations and patterns in user data to optimize calculations and ensure compliance. This automation reduces human error, speeds up the tax preparation process, and enhances the precision of tax liability estimations.

Accuracy: Manual vs AI-Powered Tax Processing

Manual tax calculation often results in errors due to complex regulation interpretation and human oversight, leading to potential inaccuracies in filing. AI-powered tax processing leverages machine learning algorithms to analyze vast datasets, ensuring precise adherence to tax codes and minimizing mistakes. Enhanced accuracy through AI drastically reduces audit risks and optimizes compliance with current tax laws.

Speed and Efficiency in Tax Preparation

Manual tax calculation involves time-consuming data entry and error-prone computations, significantly slowing down the tax preparation process. AI-driven tax calculation leverages advanced algorithms to rapidly analyze complex tax codes and financial data, enhancing accuracy and drastically reducing processing time. This efficiency enables tax professionals and individuals to complete filings faster while minimizing the risk of costly mistakes.

Error Reduction: Human vs Machine

Manual tax calculation often leads to higher error rates due to human oversight and complex regulatory changes, increasing the risk of inaccurate filings and potential penalties. AI-driven tax calculation utilizes advanced algorithms and real-time data analysis to minimize mistakes by automatically identifying discrepancies and applying up-to-date tax codes. This technology consistently improves error reduction, ensuring more accurate and compliant tax preparation outcomes for individuals and businesses.

Cost Implications: Manual vs AI Tax Calculation

Manual tax calculation often incurs higher labor costs due to the time-intensive processes and potential human errors requiring corrections. AI-driven tax calculation reduces expenses by automating data entry and error detection, streamlining tax preparation workflows. Over time, AI systems lower overall operational costs and improve accuracy, making them a more cost-effective solution for tax firms and individuals.

Compliance and Regulatory Updates

Manual tax calculation often struggles to keep pace with frequent compliance and regulatory updates, leading to higher risks of errors and missed deductions. AI-driven tax calculation systems automatically integrate real-time regulatory changes and complex compliance rules, ensuring greater accuracy and adherence to current tax laws. This automated approach reduces audit risks and enhances the reliability of tax preparations by continuously adapting to new legislation.

User Experience and Accessibility

Manual tax calculation often leads to user frustration due to the complexity and time-consuming nature of handling numerous tax forms and regulations. AI-driven tax calculation significantly enhances user experience by providing real-time error detection, personalized recommendations, and streamlined data entry, making tax preparation faster and more accurate. Accessibility improves as AI platforms support multiple languages, accommodate disabilities with voice commands, and offer mobile-friendly interfaces, broadening reach beyond traditional accounting professionals.

Future Trends in Tax Preparation Technologies

AI-driven tax calculation is revolutionizing tax preparation by enhancing accuracy and reducing processing time through advanced machine learning algorithms. Manual tax calculations remain prone to human error and inefficiency, especially as tax codes become increasingly complex. Future trends indicate widespread adoption of AI technologies, integration with real-time data sources, and automation of compliance checks to streamline tax filing and optimize financial outcomes.

Related Important Terms

Rule-Based Tax Modeling

Manual tax calculation relies heavily on rule-based tax modeling, requiring tax professionals to interpret and apply complex tax codes accurately, which can be time-consuming and prone to human error. AI-driven tax calculation automates these processes by utilizing advanced algorithms to quickly analyze and apply tax regulations, increasing accuracy and efficiency in tax preparation.

Adaptive Tax Algorithms

Adaptive tax algorithms enhance AI-driven tax calculation by dynamically adjusting to the latest tax codes and regulations, significantly reducing errors and increasing accuracy compared to manual tax calculations. These intelligent systems analyze complex tax scenarios in real-time, optimizing deductions and credits while ensuring compliance with evolving tax laws.

Tax Data Reconciliation AI

Manual tax calculation relies on human input and traditional methods for data reconciliation, often leading to errors and time-consuming processes, whereas AI-driven tax calculation leverages Tax Data Reconciliation AI to automatically cross-verify tax records, identify discrepancies, and ensure higher accuracy. This technology enhances efficiency by integrating large datasets and applying machine learning algorithms to detect anomalies, reduce compliance risks, and optimize tax preparation workflows.

Human Override Provision

Human override provision in manual tax calculation allows tax professionals to apply judgment and customize computations based on unique taxpayer circumstances, enhancing accuracy in complex scenarios. AI-driven tax calculation systems incorporate override features enabling experts to adjust automated results, blending machine efficiency with human expertise for optimized tax preparation.

Explainable Tax AI

Explainable Tax AI enhances accuracy and transparency in tax preparation by providing clear, interpretable insights into complex tax calculations, reducing errors inherent in manual methods. Integrating explainable models ensures compliance and facilitates informed decision-making by elucidating how tax liabilities and deductions are determined.

Manual Exception Handling

Manual tax calculation relies heavily on human expertise to identify and address exceptions, often resulting in time-consuming processes and increased risk of errors. AI-driven tax calculation leverages machine learning algorithms to automatically detect and handle exceptions, improving accuracy and efficiency while reducing the need for manual intervention.

Automated Compliance Validation

Manual tax calculation often leads to errors and overlooked deductions, increasing the risk of non-compliance with complex tax regulations. AI-driven tax calculation enhances automated compliance validation by continuously cross-checking data against updated tax codes, reducing errors and ensuring accurate filings.

Cognitive Tax Automation

Manual tax calculation relies heavily on human input and is prone to errors, inefficiencies, and time-consuming processes, whereas AI-driven tax calculation leverages cognitive tax automation to analyze vast datasets, identify patterns, and ensure compliance with ever-changing tax regulations. Cognitive tax automation enhances accuracy, accelerates tax preparation, and reduces risks by continuously updating tax codes and optimizing deductions through machine learning algorithms.

Digital Tax Reviewer

Manual tax calculation often leads to errors and consumes significant time due to the complexity of tax codes, whereas AI-driven tax calculation powered by Digital Tax Reviewer automates data analysis, ensuring higher accuracy and compliance with current regulations. Utilizing AI enhances efficiency by detecting discrepancies and optimizing deductions, ultimately reducing audit risks and improving client satisfaction.

Predictive Tax Error Detection

Manual tax calculation relies heavily on human expertise and is prone to errors due to oversight or misinterpretation of complex tax codes, resulting in increased risk of costly mistakes during tax preparation. AI-driven tax calculation leverages predictive tax error detection algorithms that analyze large datasets and historical discrepancies, significantly enhancing accuracy and reducing the likelihood of omissions or incorrect entries in tax filings.

Manual Tax Calculation vs AI-Driven Tax Calculation for tax preparation. Infographic

moneydiff.com

moneydiff.com