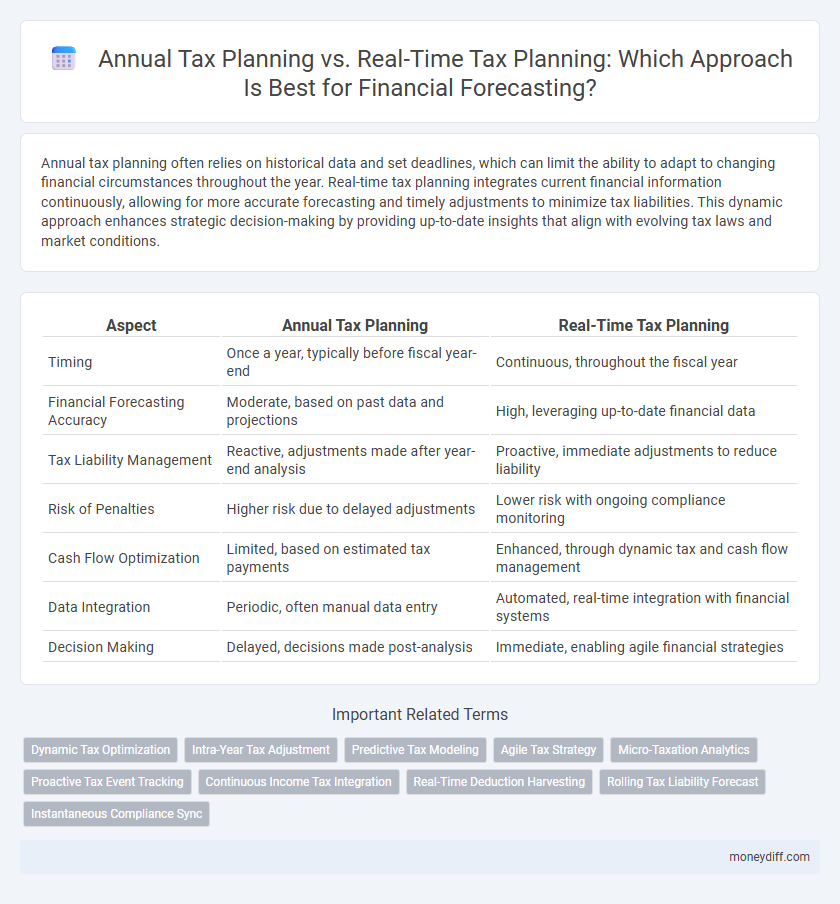

Annual tax planning often relies on historical data and set deadlines, which can limit the ability to adapt to changing financial circumstances throughout the year. Real-time tax planning integrates current financial information continuously, allowing for more accurate forecasting and timely adjustments to minimize tax liabilities. This dynamic approach enhances strategic decision-making by providing up-to-date insights that align with evolving tax laws and market conditions.

Table of Comparison

| Aspect | Annual Tax Planning | Real-Time Tax Planning |

|---|---|---|

| Timing | Once a year, typically before fiscal year-end | Continuous, throughout the fiscal year |

| Financial Forecasting Accuracy | Moderate, based on past data and projections | High, leveraging up-to-date financial data |

| Tax Liability Management | Reactive, adjustments made after year-end analysis | Proactive, immediate adjustments to reduce liability |

| Risk of Penalties | Higher risk due to delayed adjustments | Lower risk with ongoing compliance monitoring |

| Cash Flow Optimization | Limited, based on estimated tax payments | Enhanced, through dynamic tax and cash flow management |

| Data Integration | Periodic, often manual data entry | Automated, real-time integration with financial systems |

| Decision Making | Delayed, decisions made post-analysis | Immediate, enabling agile financial strategies |

Understanding the Basics: Annual vs Real-Time Tax Planning

Annual tax planning involves analyzing financial data at the end of the fiscal year to optimize tax liabilities, while real-time tax planning integrates continuous financial monitoring to adjust strategies dynamically throughout the year. This approach leverages up-to-date data analytics and forecasting models to anticipate tax obligations and maximize cash flow efficiency. Understanding the contrast between these methods enables more accurate financial forecasting and responsive tax management.

Key Differences in Financial Forecasting Approaches

Annual tax planning relies on fixed timelines to estimate tax liabilities based on prior year data, often missing dynamic changes in income or deductions. Real-time tax planning integrates continuous financial data, enabling more accurate and adaptive forecasts that reflect current financial activities and regulatory updates. This shift improves precision in tax liability projections and facilitates proactive decision-making for cash flow management and compliance.

Impact on Cash Flow Management

Annual tax planning primarily focuses on forecasting tax liabilities once a year, resulting in less agility to adjust cash flow strategies throughout the fiscal period. Real-time tax planning integrates continuous tax data analysis, enabling dynamic cash flow management and minimizing unexpected tax burdens. This proactive approach enhances liquidity optimization and financial stability by aligning tax obligations with ongoing revenue cycles.

Flexibility and Responsiveness to Tax Changes

Annual tax planning provides a fixed framework based on previous fiscal data, which limits adaptability to sudden legislative changes. Real-time tax planning incorporates continuous monitoring of tax laws, allowing immediate adjustments to financial forecasts and minimizing compliance risks. This dynamic approach enhances responsiveness, optimizing tax efficiency and cash flow management throughout the fiscal year.

Data Requirements and Technology Integration

Annual tax planning relies on historical financial data and periodic reporting, requiring comprehensive data aggregation and manual analysis to forecast tax liabilities. Real-time tax planning integrates continuously updated financial data through advanced technologies such as cloud computing, AI, and automation, enabling dynamic and accurate tax forecasting. The seamless integration of ERP systems and tax software in real-time planning enhances decision-making efficiency and compliance accuracy, reducing risks associated with outdated information.

Pros and Cons of Annual Tax Planning

Annual tax planning offers a structured approach to managing tax liabilities by allowing businesses to assess their financial activities over a full fiscal year, facilitating long-term strategic decisions and maximizing deductions. However, this method lacks the flexibility to adapt to sudden financial changes or market volatility, potentially leading to missed opportunities for tax savings during the year. The rigidity of annual tax planning may also result in delayed responses to regulatory updates, increasing the risk of non-compliance or unexpected tax burdens.

Advantages of Real-Time Tax Planning

Real-time tax planning provides immediate insights into tax liabilities, enabling businesses to adjust strategies promptly and optimize cash flow throughout the fiscal year. This proactive approach minimizes the risk of unexpected tax burdens and enhances the accuracy of financial forecasting by incorporating up-to-date financial data. Leveraging real-time analytics ensures compliance with evolving tax regulations and supports strategic decision-making to maximize tax efficiency.

Risk Mitigation in Tax Management

Annual tax planning often relies on historical data and fixed schedules, which can leave unforeseen risks unaddressed during the fiscal year. Real-time tax planning integrates continuous financial data monitoring, enabling proactive identification and mitigation of tax compliance risks and potential liabilities. This dynamic approach enhances financial forecasting accuracy by allowing immediate adjustments to tax strategies in response to regulatory changes and business events.

Scalability for Business Growth

Annual Tax Planning often limits scalability by relying on fixed, retrospective data that may not adapt swiftly to dynamic business changes, potentially hindering accurate financial forecasting. Real-Time Tax Planning leverages continuous data integration and automated updates, enabling more agile tax strategy adjustments aligned with ongoing business growth trajectories. Businesses embracing real-time tax planning achieve enhanced scalability through proactive tax position management, minimizing risks and optimizing cash flow for sustained expansion.

Choosing the Right Tax Planning Strategy

Selecting the optimal tax planning strategy requires understanding the distinct advantages of annual tax planning and real-time tax planning for financial forecasting. Annual tax planning offers a comprehensive overview allowing businesses to identify deductions and credits before year-end, optimizing tax liabilities based on projected income and expenses. Real-time tax planning integrates continuous financial data analysis, enabling timely adjustments to minimize tax burdens and capitalize on immediate opportunities.

Related Important Terms

Dynamic Tax Optimization

Annual tax planning often relies on static projections that may miss opportunities for savings throughout the year, whereas real-time tax planning leverages dynamic tax optimization techniques to adjust financial strategies instantly based on current data. This approach enhances forecasting accuracy and maximizes tax efficiency by continuously analyzing changes in income, deductions, and tax laws.

Intra-Year Tax Adjustment

Annual tax planning provides a static framework based on historical data and projected year-end outcomes, limiting flexibility for intra-year tax adjustments. Real-time tax planning leverages continuous financial monitoring and updated regulatory insights, enabling precise intra-year tax adjustments that optimize cash flow and minimize unexpected tax liabilities throughout the fiscal year.

Predictive Tax Modeling

Predictive tax modeling enhances real-time tax planning by leveraging dynamic financial data to forecast tax liabilities accurately, enabling immediate adjustments to optimize tax outcomes. Unlike annual tax planning, which relies on static historical data, real-time predictive models integrate continuous updates, improving decision-making precision and cash flow management for businesses.

Agile Tax Strategy

Agile Tax Strategy emphasizes Real-Time Tax Planning over traditional Annual Tax Planning by leveraging continuous data analysis and adaptive forecasting models, enhancing accuracy in tax liability predictions and cash flow management. This dynamic approach aligns tax decisions with evolving market conditions, regulatory changes, and business performance, optimizing financial outcomes and compliance throughout the fiscal year.

Micro-Taxation Analytics

Micro-taxation analytics leverages detailed, real-time transaction data to enhance financial forecasting accuracy, enabling dynamic tax liability estimations and immediate adjustments. Unlike traditional annual tax planning, this approach minimizes risks of compliance errors and optimizes cash flow management through continuous monitoring and precise tax impact analysis.

Proactive Tax Event Tracking

Annual tax planning relies on fixed deadlines and historical data, often missing opportunities for proactive tax event tracking that can optimize financial forecasts. Real-time tax planning leverages up-to-date transaction monitoring and dynamic tax code changes to anticipate liabilities and maximize tax savings throughout the fiscal year.

Continuous Income Tax Integration

Continuous income tax integration enhances real-time tax planning by seamlessly incorporating up-to-date tax regulations and financial data into forecasting models. This dynamic approach improves accuracy and responsiveness compared to traditional annual tax planning, enabling businesses to optimize cash flow and tax liabilities throughout the fiscal year.

Real-Time Deduction Harvesting

Real-time deduction harvesting allows taxpayers to dynamically adjust their financial activities based on current income and expense data, optimizing tax deductions throughout the fiscal year. This approach enhances financial forecasting accuracy by integrating up-to-date tax implications, unlike annual tax planning which relies on retrospective data and fixed assumptions.

Rolling Tax Liability Forecast

Rolling Tax Liability Forecast enhances real-time tax planning by continuously updating expected tax obligations based on current financial data, improving accuracy over static annual tax planning methods. This dynamic approach allows businesses to proactively manage cash flow and optimize tax strategies by anticipating liabilities throughout the fiscal year.

Instantaneous Compliance Sync

Annual tax planning relies on pre-set schedules and historical data, often leading to delayed compliance adjustments, whereas real-time tax planning enables instantaneous compliance sync by continuously integrating updated financial data, improving accuracy in tax forecasting and reducing risks of penalties. Leveraging real-time tax planning technology enhances financial transparency and agility, ensuring tax strategies adapt instantly to regulatory changes and transactional events.

Annual Tax Planning vs Real-Time Tax Planning for financial forecasting. Infographic

moneydiff.com

moneydiff.com