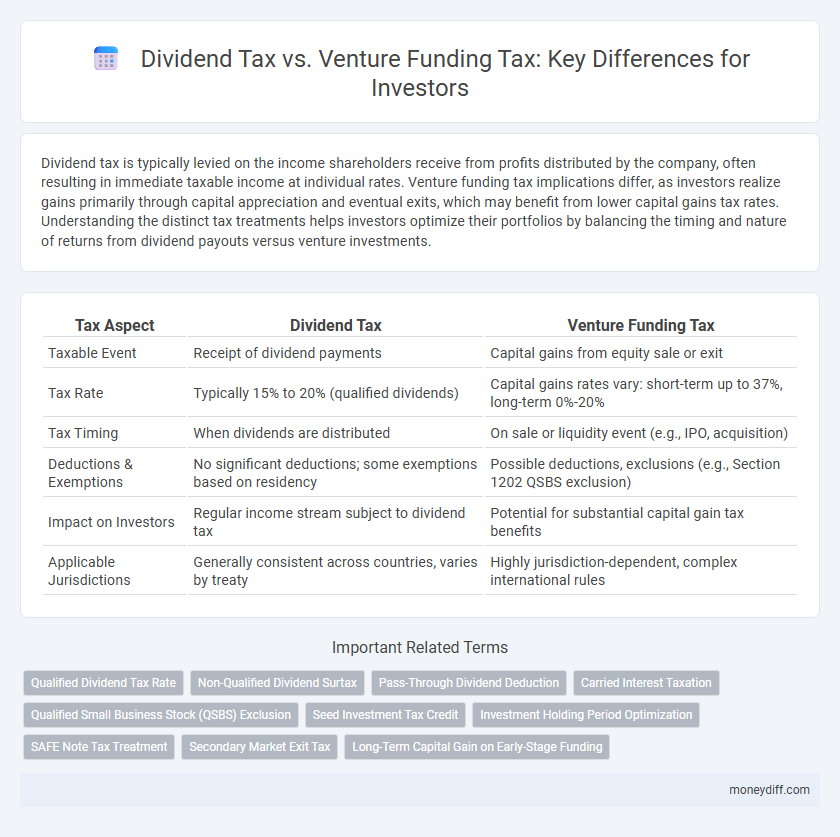

Dividend tax is typically levied on the income shareholders receive from profits distributed by the company, often resulting in immediate taxable income at individual rates. Venture funding tax implications differ, as investors realize gains primarily through capital appreciation and eventual exits, which may benefit from lower capital gains tax rates. Understanding the distinct tax treatments helps investors optimize their portfolios by balancing the timing and nature of returns from dividend payouts versus venture investments.

Table of Comparison

| Tax Aspect | Dividend Tax | Venture Funding Tax |

|---|---|---|

| Taxable Event | Receipt of dividend payments | Capital gains from equity sale or exit |

| Tax Rate | Typically 15% to 20% (qualified dividends) | Capital gains rates vary: short-term up to 37%, long-term 0%-20% |

| Tax Timing | When dividends are distributed | On sale or liquidity event (e.g., IPO, acquisition) |

| Deductions & Exemptions | No significant deductions; some exemptions based on residency | Possible deductions, exclusions (e.g., Section 1202 QSBS exclusion) |

| Impact on Investors | Regular income stream subject to dividend tax | Potential for substantial capital gain tax benefits |

| Applicable Jurisdictions | Generally consistent across countries, varies by treaty | Highly jurisdiction-dependent, complex international rules |

Understanding Dividend Tax: Basics for Investors

Dividend tax applies to the income investors receive from shares of a company, typically taxed at rates varying by jurisdiction and type of dividend, such as qualified or non-qualified. Understanding the tax implications on dividends helps investors optimize after-tax returns by considering holding periods and dividend sources. Venture funding tax, however, involves capital gains and potential carried interest taxation, highlighting the importance of distinguishing income types for accurate tax planning.

Venture Funding Taxation: Key Concepts

Venture funding taxation involves the treatment of capital gains from equity investments in startups, often benefiting from preferential tax rates if held long-term, typically over one year. Investors may also qualify for specific tax incentives such as Qualified Small Business Stock (QSBS) exclusions, which can exclude up to $10 million or 10 times the investment from capital gains tax. Understanding the differences in tax timing, basis adjustments, and potential state tax implications is critical for maximizing after-tax returns in venture capital investments.

Dividend Tax Rates vs Venture Funding Returns

Dividend tax rates typically range from 0% to 23.8% depending on whether dividends are qualified or ordinary, directly impacting the net returns for investors. In contrast, venture funding returns are often realized through capital gains, which are usually taxed at lower long-term capital gains rates of 0%, 15%, or 20%, offering more favorable tax treatment. This discrepancy in taxation influences investor preference, making venture funding more attractive for higher tax efficiency and potentially larger after-tax gains.

Tax Reporting Requirements for Dividends

Dividend tax requires investors to report income earned from dividends on their annual tax returns, often using forms such as the 1099-DIV in the United States, which details dividend income and any foreign tax paid. Venture funding tax implications generally focus on capital gains and losses, with reporting required on Schedule D and Form 8949 for stock sales rather than dividend income. Accurate tax reporting for dividends ensures compliance, prevents penalties, and optimizes tax liability by properly accounting for qualified versus non-qualified dividends.

Capital Gains Tax Implications in Venture Funding

Dividend tax applies to income received regularly from investments, typically taxed at higher rates compared to capital gains taxes associated with venture funding. Investors in venture-funded startups primarily face capital gains tax on the appreciation of shares when they exit, often benefiting from preferential long-term capital gains rates if holdings exceed one year. Understanding the distinction between immediate dividend income taxation and deferred capital gains tax in venture funding is crucial for effective tax planning and maximizing investment returns.

Holding Periods and Tax Benefits

Dividend tax often applies to investors receiving regular income from shares, typically taxed at rates up to 20% depending on jurisdiction and holding periods, with shorter holding periods yielding fewer tax benefits. Venture funding tax benefits prioritize long-term capital gains, where holding periods exceeding one year can reduce tax rates significantly, sometimes to as low as 0-15%, encouraging patient investment. Investors benefit from deferring dividend taxes in venture funding, leveraging preferential capital gains rates linked to extended holding periods that enhance after-tax returns.

Dividend Tax Exemptions and Allowances

Dividend tax exemptions and allowances provide significant tax relief for investors compared to venture funding tax obligations. Eligible investors benefit from tax-free dividend income up to the annual dividend allowance, which reduces the overall taxable amount and enhances net returns. In contrast, venture funding investments often attract capital gains tax upon exit, with fewer direct exemptions, making dividend tax advantages crucial for income-focused investors.

Venture Funding Losses and Tax Deductions

Venture funding losses provide investors with significant tax deductions by allowing the write-off of capital losses against other gains, reducing overall taxable income. Unlike dividends, which are typically taxed at a preferential rate upon receipt, venture capital losses can offset gains from other investments and lower tax liabilities when properly reported. Maximizing deductions from venture funding losses requires strategic tax planning to optimize the timing and classification of these losses under current IRS regulations.

International Tax Considerations for Investors

Dividend tax on international investments often incurs withholding taxes that vary by country, affecting net returns for investors. Venture funding tax treatments differ, with capital gains on exits potentially qualifying for favorable tax rates or deferral under specific treaties or incentives. Investors must navigate double taxation treaties and transfer pricing rules to optimize tax efficiency and comply with cross-border regulations.

Strategic Tax Planning: Dividends vs Venture Investments

Strategic tax planning for investors involves analyzing dividend tax rates, typically taxed as ordinary income or qualified dividends, versus the capital gains treatment of venture funding returns, which often benefit from long-term capital gains rates and potential tax exclusions like Section 1202 Qualified Small Business Stock (QSBS). Venture investments may offer deferred taxation until exit events, enabling tax-efficient growth, while dividends result in immediate taxable income, impacting cash flow. Understanding these differences allows investors to optimize portfolio structures, leveraging venture capital incentives to minimize overall tax liability.

Related Important Terms

Qualified Dividend Tax Rate

Qualified dividend tax rate often benefits investors by taxing dividends at a lower rate compared to ordinary income, typically between 0% and 20%, depending on income level. In contrast, venture funding returns might be subjected to capital gains tax, which can vary but generally aligns closely with qualified dividend rates, influencing the after-tax returns for investors.

Non-Qualified Dividend Surtax

Non-qualified dividends are taxed at higher ordinary income tax rates, often reaching up to 37%, compared to qualified dividends which benefit from lower capital gains rates, making dividend tax burdens significantly heavier for investors relying on dividend income. Venture funding investors face different tax implications, as gains are typically subject to capital gains tax rates, which may be more favorable than the non-qualified dividend surtax, influencing investment strategies to prioritize equity appreciation over dividend distributions.

Pass-Through Dividend Deduction

Investors benefit from the Pass-Through Dividend Deduction, which can reduce taxable income by up to 20% on qualified dividends from pass-through entities, distinguishing it from venture funding tax treatments that often lack such preferential deductions. This deduction enhances after-tax returns on dividends compared to the typically higher tax burdens investors face when receiving income through venture funding structures.

Carried Interest Taxation

Carried interest taxation significantly impacts investors by treating profits from venture funding as capital gains, typically taxed at a lower rate than ordinary income, unlike dividend tax which applies higher ordinary income rates on distributed earnings. This tax distinction incentivizes venture funding investments by reducing the effective tax burden on fund managers' carried interest compared to dividend income taxation.

Qualified Small Business Stock (QSBS) Exclusion

Investors in Qualified Small Business Stock (QSBS) benefit from significant tax advantages, notably the potential exclusion of up to $10 million or 10 times the adjusted basis in gains from federal capital gains tax under Section 1202. While dividend tax rates typically range from 15% to 20%, QSBS exclusion allows venture funding investors to substantially reduce or eliminate tax liability on the sale of shares, incentivizing investment in startups and small businesses.

Seed Investment Tax Credit

Dividend tax typically imposes a higher tax rate on investors' returns, whereas venture funding tax benefits, such as the Seed Investment Tax Credit, provide targeted incentives that reduce taxable income for seed-stage investments. The Seed Investment Tax Credit encourages early investment by offering credits that offset tax liabilities, making venture funding more financially advantageous compared to the direct taxation of dividend income.

Investment Holding Period Optimization

Dividend tax rates often exceed capital gains tax rates on venture funding exits, making longer investment holding periods strategically favorable for investors seeking to optimize after-tax returns. Structuring investments to capitalize on the preferential long-term capital gains treatment can significantly reduce the total tax burden compared to the immediate taxation of dividend income.

SAFE Note Tax Treatment

Dividend tax is applied to income distributed from a company's profits, typically taxed at rates ranging from 15% to 30% depending on jurisdiction, while venture funding involving SAFE (Simple Agreement for Future Equity) notes generally defers taxation until conversion to equity or liquidation event, avoiding immediate dividend tax liabilities. Investors using SAFE notes benefit from potential capital gains tax treatment upon conversion rather than dividend tax, enhancing tax efficiency during early-stage funding rounds.

Secondary Market Exit Tax

Dividend tax typically imposes a standard rate on income received from dividends, directly impacting investor returns, whereas venture funding tax considerations become crucial during secondary market exits where capital gains taxes apply to the sale of shares. Secondary market exit tax on venture-backed investments often involves complex valuation challenges and varying tax rates depending on jurisdiction, affecting the net proceeds for investors more significantly than dividend taxation.

Long-Term Capital Gain on Early-Stage Funding

Long-term capital gains on early-stage venture funding typically benefit from lower tax rates compared to dividend income, which is often taxed at higher ordinary income rates. Investors in startups can maximize returns by holding equity long enough to qualify for preferential capital gains treatment, minimizing the overall tax burden relative to dividend tax liabilities.

Dividend Tax vs Venture Funding Tax for investors Infographic

moneydiff.com

moneydiff.com