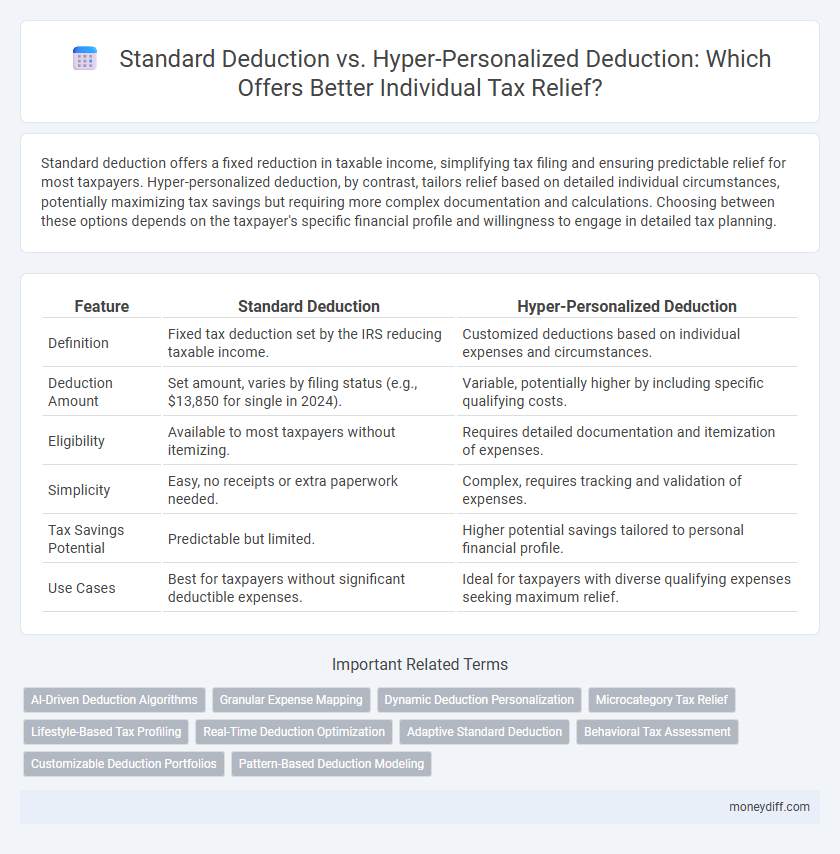

Standard deduction offers a fixed reduction in taxable income, simplifying tax filing and ensuring predictable relief for most taxpayers. Hyper-personalized deduction, by contrast, tailors relief based on detailed individual circumstances, potentially maximizing tax savings but requiring more complex documentation and calculations. Choosing between these options depends on the taxpayer's specific financial profile and willingness to engage in detailed tax planning.

Table of Comparison

| Feature | Standard Deduction | Hyper-Personalized Deduction |

|---|---|---|

| Definition | Fixed tax deduction set by the IRS reducing taxable income. | Customized deductions based on individual expenses and circumstances. |

| Deduction Amount | Set amount, varies by filing status (e.g., $13,850 for single in 2024). | Variable, potentially higher by including specific qualifying costs. |

| Eligibility | Available to most taxpayers without itemizing. | Requires detailed documentation and itemization of expenses. |

| Simplicity | Easy, no receipts or extra paperwork needed. | Complex, requires tracking and validation of expenses. |

| Tax Savings Potential | Predictable but limited. | Higher potential savings tailored to personal financial profile. |

| Use Cases | Best for taxpayers without significant deductible expenses. | Ideal for taxpayers with diverse qualifying expenses seeking maximum relief. |

Understanding Standard Deduction: The Basics

The standard deduction provides a fixed dollar amount that reduces taxable income, simplifying the tax filing process for most individuals by eliminating the need to itemize expenses. This deduction amount adjusts annually for inflation and varies based on filing status, such as single, married filing jointly, or head of household. Understanding the standard deduction's basic structure helps taxpayers determine if they benefit more from this straightforward option versus a hyper-personalized deduction tailored to specific expenses and financial situations.

What Is Hyper-Personalized Deduction in Tax Relief?

Hyper-personalized deduction in tax relief tailors deductions based on an individual's unique financial circumstances, expenses, and lifestyle, unlike the one-size-fits-all approach of the standard deduction. This method leverages detailed personal data to maximize allowable deductions, potentially reducing taxable income more effectively. By focusing on specific expenditures such as education, healthcare, and charitable contributions, hyper-personalized deductions offer a customized approach that can lead to greater tax savings.

Eligibility Criteria for Standard vs Hyper-Personalized Deductions

Standard deduction eligibility applies broadly to individual taxpayers without the need to itemize expenses, simplifying the tax filing process with fixed amounts based on filing status. Hyper-personalized deductions require detailed documentation of specific expenses such as medical costs, charitable donations, or educational expenditures, catering to taxpayers with unique financial profiles. Understanding the eligibility criteria for each deduction type maximizes potential tax relief by aligning deductions with the taxpayer's financial situation and filing requirements.

Key Differences: Standard Deduction vs Hyper-Personalized Deduction

Standard deduction offers a fixed dollar amount reducing taxable income uniformly for all eligible individuals, simplifying tax filing but limiting personalization. Hyper-personalized deduction tailors relief based on specific individual circumstances, such as medical expenses, education costs, and charitable contributions, maximizing tax benefits but requiring detailed documentation. Comparing both, standard deduction ensures ease and predictability, while hyper-personalized deductions provide potentially greater savings through customized tax relief strategies.

Pros and Cons of Standard Deduction

The standard deduction simplifies tax filing by offering a fixed amount that reduces taxable income without requiring itemization, making it beneficial for individuals with straightforward financial situations or limited deductible expenses. It enhances compliance ease and minimizes record-keeping but may result in higher tax liability for taxpayers who have significant deductible expenses exceeding the standard deduction threshold. Choosing the standard deduction often reduces audit risks but can limit total tax relief compared to hyper-personalized deductions tailored to unique financial circumstances.

Advantages and Limitations of Hyper-Personalized Deduction

Hyper-personalized deductions offer tailored tax relief by accounting for specific individual expenses, which can maximize refund potential beyond a standard deduction's fixed amount. This approach benefits taxpayers with diverse or significant deductible costs, such as medical expenses, education payments, or charitable contributions, enabling more precise tax burden reduction. However, the complexity and documentation requirements may increase filing time and risk of audit compared to the simplicity and predictability of the standard deduction.

Impact on Tax Liability: Which Deduction Offers Greater Savings?

Standard deduction offers a fixed reduction in taxable income, simplifying tax calculations but often resulting in lower savings for high-expense individuals. Hyper-personalized deductions tailor tax relief to actual expenses such as mortgage interest, medical costs, and charitable contributions, potentially maximizing savings but requiring detailed record-keeping and itemization. For taxpayers with significant deductible expenses, hyper-personalized deductions typically result in greater tax liability reduction compared to the flat-rate standard deduction.

Common Scenarios: Who Benefits Most from Each Deduction Type?

Standard deduction provides a straightforward tax relief option ideal for individuals with simple financial situations and few itemizable expenses, commonly benefiting salaried employees and retirees. Hyper-personalized deductions cater to taxpayers with diverse or significant deductible expenses, such as homeowners with mortgage interest, medical expenses, or charitable donations, maximizing tax savings through detailed expense tracking. Understanding one's specific financial circumstances and deduction eligibility is key to choosing the most beneficial deduction approach for individual tax relief.

Step-by-Step Guide to Choosing the Right Deduction Strategy

Choosing between the standard deduction and hyper-personalized deduction depends on individual financial details including income sources, deductible expenses, and filing status. Calculating itemized deductions such as mortgage interest, medical expenses, and charitable donations against the fixed standard deduction helps determine the most tax-efficient option. Utilizing tax software or consulting a tax professional can ensure accurate evaluation of eligibility criteria and maximize individual tax relief.

Future Trends: Toward More Personalized Tax Relief Approaches

Future trends in individual tax relief emphasize a shift from the traditional Standard Deduction toward hyper-personalized deductions tailored to taxpayers' unique financial situations, maximizing claimable benefits through advanced data analytics. Enhanced AI-driven platforms enable real-time assessment of eligible deductions, fostering increased accuracy and equity in tax relief allocation. This evolution reflects a broader move toward leveraging big data and machine learning to optimize individual tax outcomes while reducing compliance complexity.

Related Important Terms

AI-Driven Deduction Algorithms

AI-driven deduction algorithms analyze individual financial data to optimize tax relief, offering highly tailored deductions compared to the fixed amounts of standard deductions. These hyper-personalized deductions leverage machine learning to identify unique expense patterns and eligible credits, maximizing tax savings for each filer.

Granular Expense Mapping

Granular expense mapping in hyper-personalized deductions enables precise identification and categorization of individual expenditures, maximizing eligible tax relief by aligning deductions closely with actual financial behavior. Standard deduction offers a fixed amount regardless of expenses, potentially leaving untapped benefits that hyper-personalized deductions capture through detailed expense analysis.

Dynamic Deduction Personalization

Dynamic Deduction Personalization leverages real-time financial data and behavioral analytics to tailor individual tax relief beyond the limitations of standard deductions, maximizing eligible savings. This hyper-personalized approach enhances tax efficiency by aligning deductions with unique income patterns, expenses, and life events, outperforming one-size-fits-all standard deduction models.

Microcategory Tax Relief

Standard deduction simplifies tax filing by offering a fixed reduction in taxable income, suitable for most individual taxpayers seeking straightforward relief. Hyper-personalized deductions optimize tax savings based on detailed personal expenses and financial profiles, maximizing individual tax relief within the microcategory of Tax Relief.

Lifestyle-Based Tax Profiling

Standard deduction offers a fixed reduction in taxable income regardless of individual circumstances, while hyper-personalized deduction leverages lifestyle-based tax profiling to tailor relief based on specific spending patterns and personal financial behavior. This data-driven approach enhances accuracy in tax relief allocation, maximizing benefits by aligning deductions with unique taxpayer profiles.

Real-Time Deduction Optimization

Real-Time Deduction Optimization leverages advanced analytics to dynamically choose between standard deduction and hyper-personalized deductions, maximizing individual tax relief based on current financial data. This approach enhances tax efficiency by continuously analyzing income, expenses, and eligible credits to ensure taxpayers receive the optimal deduction at filing.

Adaptive Standard Deduction

Adaptive Standard Deduction dynamically adjusts the base deduction amount based on individual income levels and specific financial circumstances, offering a more tailored tax relief compared to the fixed Standard Deduction. This approach optimizes tax efficiency by integrating real-time data inputs, reducing taxable income more accurately than traditional flat-rate deductions and minimizing the need for complex itemization.

Behavioral Tax Assessment

Standard deduction offers a fixed amount that simplifies filing and reduces taxable income uniformly for all taxpayers, while hyper-personalized deductions leverage behavioral tax assessment data to tailor relief based on individual spending patterns and financial behaviors. Behavioral tax assessment enhances accuracy in identifying deductible expenses, leading to optimized tax savings and increased taxpayer compliance through data-driven customization.

Customizable Deduction Portfolios

Customizable deduction portfolios offer taxpayers a tailored approach to maximize individual tax relief by selectively combining eligible expenses, unlike the flat-rate standard deduction that applies uniformly. Leveraging hyper-personalized deductions enhances potential savings by aligning deductions with unique financial situations and spending patterns.

Pattern-Based Deduction Modeling

Pattern-based deduction modeling leverages extensive taxpayer data to tailor hyper-personalized deductions, optimizing individual tax relief beyond the fixed Standard Deduction amounts. This advanced approach enhances accuracy in identifying eligible expenses, maximizing refunds by aligning deductions with unique spending and income patterns.

Standard Deduction vs Hyper-Personalized Deduction for individual tax relief. Infographic

moneydiff.com

moneydiff.com