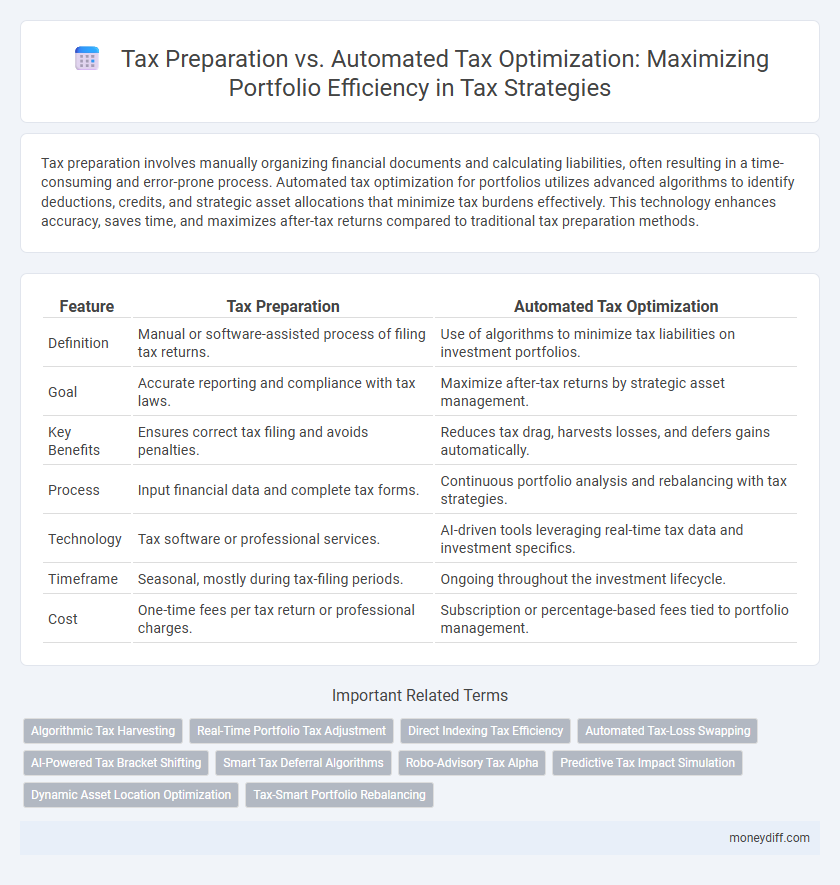

Tax preparation involves manually organizing financial documents and calculating liabilities, often resulting in a time-consuming and error-prone process. Automated tax optimization for portfolios utilizes advanced algorithms to identify deductions, credits, and strategic asset allocations that minimize tax burdens effectively. This technology enhances accuracy, saves time, and maximizes after-tax returns compared to traditional tax preparation methods.

Table of Comparison

| Feature | Tax Preparation | Automated Tax Optimization |

|---|---|---|

| Definition | Manual or software-assisted process of filing tax returns. | Use of algorithms to minimize tax liabilities on investment portfolios. |

| Goal | Accurate reporting and compliance with tax laws. | Maximize after-tax returns by strategic asset management. |

| Key Benefits | Ensures correct tax filing and avoids penalties. | Reduces tax drag, harvests losses, and defers gains automatically. |

| Process | Input financial data and complete tax forms. | Continuous portfolio analysis and rebalancing with tax strategies. |

| Technology | Tax software or professional services. | AI-driven tools leveraging real-time tax data and investment specifics. |

| Timeframe | Seasonal, mostly during tax-filing periods. | Ongoing throughout the investment lifecycle. |

| Cost | One-time fees per tax return or professional charges. | Subscription or percentage-based fees tied to portfolio management. |

Understanding Tax Preparation: Traditional Methods Explained

Traditional tax preparation involves manually gathering financial documents, calculating taxable income, and applying relevant tax laws to file accurate returns. This method often requires extensive knowledge of tax codes and extensive time investment, which can lead to errors or missed deductions. Understanding these conventional processes highlights the complexity and potential inefficiencies that automated tax optimization tools aim to address for portfolio management.

What is Automated Tax Optimization?

Automated tax optimization leverages advanced algorithms and real-time data analysis to minimize tax liabilities within an investment portfolio by strategically managing asset allocation and transaction timing. Unlike traditional tax preparation, which primarily focuses on accurate filing and compliance, automated tax optimization continuously adjusts portfolio components to maximize after-tax returns. This technology efficiently identifies tax-loss harvesting opportunities, capital gains deferral, and optimal asset location, providing investors with a dynamic, data-driven approach to tax efficiency.

Key Differences Between Tax Preparation and Automated Optimization

Tax preparation primarily involves accurately reporting income, deductions, and credits on tax returns to ensure compliance with IRS regulations. Automated tax optimization uses advanced algorithms to analyze investment portfolios and identify strategies to minimize tax liabilities, such as tax-loss harvesting and asset location optimization. Key differences include the manual, compliance-focused nature of tax preparation versus the proactive, technology-driven approach of automated optimization aimed at enhancing after-tax returns.

Benefits of Automated Tax Optimization for Investors

Automated tax optimization leverages advanced algorithms to maximize tax efficiency by continuously analyzing portfolio transactions and identifying opportunities for tax-loss harvesting and asset location strategies. Investors benefit from real-time adjustments that minimize taxable distributions and enhance after-tax returns without manual intervention. This technology reduces errors, saves time, and ensures compliance with evolving tax regulations, offering a superior alternative to traditional tax preparation methods.

Limitations of Manual Tax Preparation in Portfolio Management

Manual tax preparation for portfolio management often overlooks complex tax-loss harvesting opportunities and real-time adjustments to maximize after-tax returns. It lacks the precision and speed of automated tax optimization tools that analyze large datasets and execute tax-saving strategies instantly. This limitation increases the risk of missed deductions, inaccurate calculations, and suboptimal portfolio rebalancing, ultimately reducing overall portfolio efficiency.

Tax Efficiency: How Automation Maximizes Returns

Automated tax optimization leverages advanced algorithms to analyze portfolio transactions and identify tax-loss harvesting opportunities in real time, significantly enhancing tax efficiency compared to traditional tax preparation. While manual tax preparation focuses on compliance and straightforward reporting, automation continuously minimizes tax liabilities by dynamically adjusting asset allocations to maximize after-tax returns. This proactive approach results in more efficient portfolio management, higher net gains, and reduced tax drag over time.

Cost Comparison: Manual Tax Prep vs Automation Tools

Manual tax preparation often incurs higher costs due to professional fees ranging from $200 to $500 per return, along with the time investment required to gather and organize financial documents. Automated tax optimization tools, such as TurboTax or H&R Block, offer subscription plans typically priced between $50 and $150, providing cost-effective solutions that streamline portfolio tax strategies with minimal user input. Companies adopting automation benefit from reduced labor expenses and enhanced accuracy, making automated tools a financially advantageous alternative to traditional manual preparation.

Security and Privacy in Automated Tax Solutions

Automated tax optimization tools leverage advanced encryption protocols and multi-factor authentication to ensure robust security and protect sensitive financial data during portfolio tax management. These solutions minimize human error and reduce the risk of unauthorized access compared to traditional tax preparation methods, enhancing privacy safeguards. Continuous software updates and compliance with regulatory standards further reinforce data protection in automated tax optimization platforms.

Choosing the Right Approach: Factors for Investors to Consider

Investors should evaluate portfolio complexity, transaction frequency, and tax filing deadlines when choosing between tax preparation and automated tax optimization. High-frequency traders with diverse assets may benefit from automated tools offering real-time tax loss harvesting and gain deferral. Conversely, investors with simpler portfolios might prefer professional tax preparation for personalized advice and comprehensive tax planning strategies.

The Future of Tax Management: Trends in Portfolio Optimization

Automated tax optimization leverages advanced algorithms and real-time data analysis to maximize portfolio tax efficiency, reducing manual errors and identifying strategic tax-loss harvesting opportunities. In contrast, traditional tax preparation relies heavily on manual input and historical reporting, limiting proactive optimization capabilities. Emerging trends in portfolio tax management emphasize AI-driven tools and integration with financial planning platforms to enhance personalized tax strategies and improve overall investment returns.

Related Important Terms

Algorithmic Tax Harvesting

Algorithmic tax harvesting leverages advanced algorithms to systematically identify and realize tax losses within a portfolio, optimizing tax efficiency beyond traditional tax preparation methods. Automated tax optimization continuously analyzes real-time portfolio data to maximize after-tax returns by strategically offsetting gains with losses, minimizing tax liabilities more effectively than manual preparation.

Real-Time Portfolio Tax Adjustment

Real-time portfolio tax adjustment leverages automated tax optimization algorithms to continuously analyze transactions, maximizing tax efficiency by harvesting losses and deferring gains instantly compared to traditional tax preparation that relies on retrospective data review. Automated systems integrate with brokerage accounts to provide dynamic, personalized tax strategies that adapt to market fluctuations, reducing tax liabilities more effectively throughout the fiscal year.

Direct Indexing Tax Efficiency

Direct indexing enhances tax efficiency by allowing customized loss harvesting and precise asset-level tax management, surpassing traditional tax preparation methods that rely on end-of-year adjustments. Automated tax optimization integrates real-time portfolio rebalancing with personalized tax strategies, maximizing after-tax returns through continuous identification of tax-loss harvesting opportunities.

Automated Tax-Loss Swapping

Automated tax-loss swapping enhances portfolio tax efficiency by systematically identifying and executing trades that realize losses to offset gains, reducing taxable income without manual intervention. This technology leverages algorithms to optimize timing and selection of asset sales, surpassing traditional tax preparation methods focused solely on compliance and basic deductions.

AI-Powered Tax Bracket Shifting

AI-powered tax bracket shifting leverages advanced machine learning algorithms to analyze portfolio data and strategically reallocate assets, optimizing tax liabilities more efficiently than traditional tax preparation methods. Automated tax optimization tools continuously monitor real-time market changes and tax code updates, enabling dynamic adjustments that minimize tax burdens and enhance after-tax returns.

Smart Tax Deferral Algorithms

Smart tax deferral algorithms in automated tax optimization enhance portfolio performance by strategically delaying tax liabilities to maximize after-tax returns, outperforming traditional tax preparation methods that often overlook timing advantages. These algorithms leverage real-time data and predictive analytics to identify optimal tax-loss harvesting opportunities, ensuring efficient tax deferrals and improved long-term wealth accumulation.

Robo-Advisory Tax Alpha

Robo-Advisory Tax Alpha leverages automated tax optimization techniques, such as tax-loss harvesting and strategic asset location, to enhance portfolio after-tax returns more efficiently than traditional tax preparation services. By continuously analyzing real-time market data and tax regulations, these platforms minimize tax liabilities and maximize portfolio growth without the manual effort required in conventional tax filing.

Predictive Tax Impact Simulation

Predictive Tax Impact Simulation leverages advanced algorithms to forecast tax liabilities and optimize portfolio adjustments before filing, enhancing precision beyond traditional tax preparation methods. Automated Tax Optimization integrates real-time data and predictive analytics to minimize tax burdens dynamically, outperforming static tax preparation approaches by anticipating changing tax regulations and market conditions.

Dynamic Asset Location Optimization

Dynamic Asset Location Optimization enhances tax efficiency by strategically placing investments across taxable and tax-advantaged accounts to minimize tax liabilities. Unlike traditional tax preparation that focuses on compliance and reporting, automated tax optimization continuously adjusts asset allocation to maximize after-tax returns based on real-time portfolio data and tax regulations.

Tax-Smart Portfolio Rebalancing

Tax-smart portfolio rebalancing integrates automated tax optimization algorithms to minimize capital gains taxes while maintaining desired asset allocation. Unlike traditional tax preparation, which focuses on reporting past transactions, automated systems proactively adjust portfolios to enhance after-tax returns through strategic asset sales and harvesting tax losses.

Tax Preparation vs Automated Tax Optimization for Portfolio Infographic

moneydiff.com

moneydiff.com