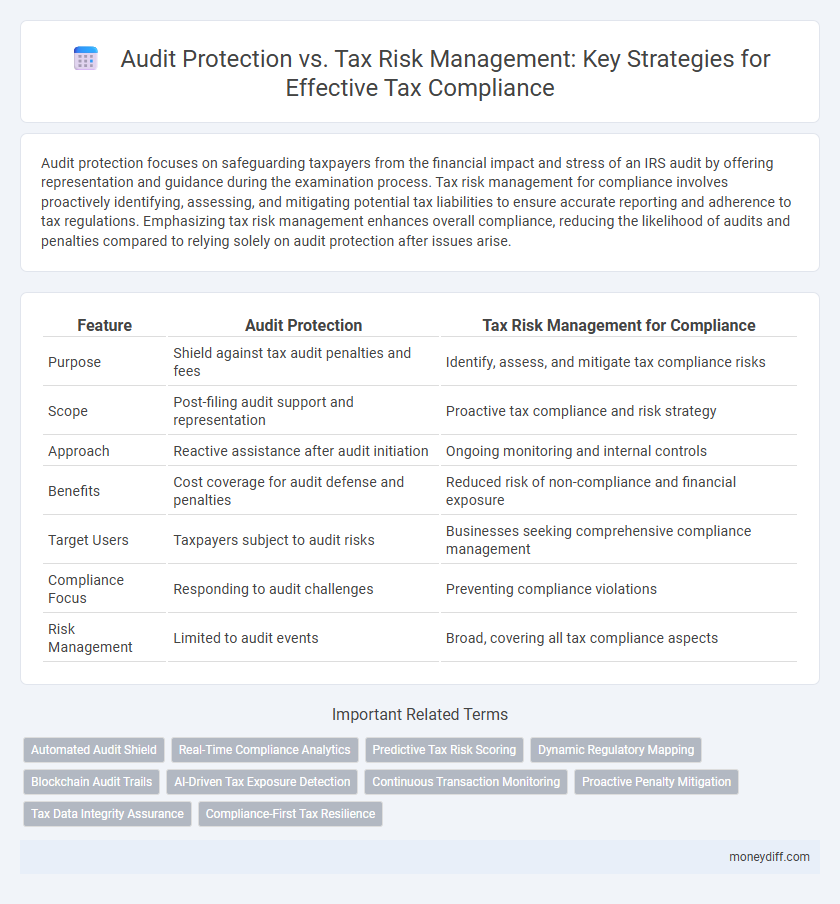

Audit protection focuses on safeguarding taxpayers from the financial impact and stress of an IRS audit by offering representation and guidance during the examination process. Tax risk management for compliance involves proactively identifying, assessing, and mitigating potential tax liabilities to ensure accurate reporting and adherence to tax regulations. Emphasizing tax risk management enhances overall compliance, reducing the likelihood of audits and penalties compared to relying solely on audit protection after issues arise.

Table of Comparison

| Feature | Audit Protection | Tax Risk Management for Compliance |

|---|---|---|

| Purpose | Shield against tax audit penalties and fees | Identify, assess, and mitigate tax compliance risks |

| Scope | Post-filing audit support and representation | Proactive tax compliance and risk strategy |

| Approach | Reactive assistance after audit initiation | Ongoing monitoring and internal controls |

| Benefits | Cost coverage for audit defense and penalties | Reduced risk of non-compliance and financial exposure |

| Target Users | Taxpayers subject to audit risks | Businesses seeking comprehensive compliance management |

| Compliance Focus | Responding to audit challenges | Preventing compliance violations |

| Risk Management | Limited to audit events | Broad, covering all tax compliance aspects |

Understanding Audit Protection: Key Concepts

Audit protection involves services that help taxpayers prepare for and manage IRS audits by providing expert guidance, document reviews, and sometimes legal representation to reduce the risk of penalties. Key concepts include understanding audit triggers, maintaining accurate records, and having professional support to respond to IRS inquiries efficiently. Tax risk management focuses on identifying potential compliance issues proactively, but audit protection specifically addresses defense strategies during the audit process.

Tax Risk Management: An Overview

Tax risk management involves identifying, assessing, and mitigating potential tax liabilities to ensure compliance and minimize financial penalties. It incorporates proactive strategies such as thorough documentation, regular internal audits, and updates on changing tax laws to reduce exposure to tax-related risks. Effective tax risk management not only safeguards an organization from non-compliance but also enhances long-term financial stability by anticipating audit challenges and regulatory scrutiny.

Audit Protection vs Tax Risk Management: Core Differences

Audit protection primarily focuses on safeguarding taxpayers from the financial and legal consequences of an IRS audit by providing support and representation during the audit process. Tax risk management involves proactive identification, assessment, and mitigation of potential tax liabilities and compliance issues to minimize exposure before an audit occurs. The core difference lies in audit protection addressing risks after tax return submission, whereas tax risk management aims to prevent risks through ongoing compliance strategies.

Benefits of Implementing Audit Protection

Implementing audit protection significantly reduces financial exposure by covering costs related to IRS audits, including legal fees and expert representation. This approach enhances compliance confidence, ensuring businesses maintain accurate records and adhere to tax regulations, which minimizes the risk of penalties and interest. Furthermore, audit protection provides peace of mind, allowing companies to focus on growth without the constant worry of potential tax disputes.

The Role of Tax Risk Management in Compliance

Tax risk management plays a crucial role in maintaining compliance by proactively identifying, assessing, and mitigating potential tax risks before they result in audits or penalties. Implementing robust tax risk management frameworks reduces the likelihood of non-compliance and enhances accurate reporting, which complements audit protection strategies. Effective tax risk management ensures ongoing adherence to evolving tax laws and regulations, safeguarding organizations from financial and reputational damage.

Common Misconceptions About Audit Protection

Many taxpayers mistakenly believe audit protection guarantees exemption from IRS audits, but it primarily offers assistance during the audit process rather than prevention. Audit protection services often cover representation and guidance but do not eliminate the inherent tax risks stemming from errors or aggressive tax positions. Understanding that audit protection is a reactive measure, whereas tax risk management involves proactive strategies to ensure compliance and minimize audit triggers, is crucial for effective tax planning.

Essential Components of Tax Risk Management Strategies

Effective tax risk management strategies encompass comprehensive identification, assessment, and mitigation of tax liabilities to ensure compliance and minimize financial exposure. Key components include continuous monitoring of regulatory changes, implementation of robust internal controls, and thorough documentation to support tax positions. Integrating advanced data analytics enhances accuracy and early detection of potential audit triggers, fostering proactive risk management over reactive audit protection.

Audit Protection Costs vs Potential Tax Penalties

Audit protection services typically involve fixed fees ranging from $500 to $2,000 annually, providing representation and negotiation support during IRS audits. Potential tax penalties for non-compliance can far exceed these costs, with fines reaching up to 25% or more of the underreported tax amount, plus interest and additional penalties for negligence or fraud. Investing in audit protection can therefore be a cost-effective strategy compared to the unpredictable and often significant financial risks associated with tax penalties.

Best Practices for Ensuring Tax Compliance

Audit protection involves proactive measures like maintaining detailed documentation and engaging professional auditors to safeguard against IRS audits, while tax risk management emphasizes identifying, assessing, and mitigating potential tax liabilities through robust internal controls and regular compliance reviews. Best practices for ensuring tax compliance include implementing automated reporting systems to ensure accuracy, conducting periodic training for staff on regulatory updates, and establishing a clear escalation process for addressing discrepancies. Combining these strategies creates a comprehensive framework that minimizes exposure to penalties and enhances overall tax governance.

Choosing the Right Approach: Audit Protection or Risk Management?

Choosing between audit protection and tax risk management depends on a company's compliance priorities and risk tolerance. Audit protection offers coverage for potential penalties and additional taxes arising from IRS audits, providing financial security but not preventing errors. Tax risk management focuses on proactive strategies to identify, assess, and mitigate tax compliance risks, reducing the likelihood of audits and non-compliance through thorough documentation and procedural controls.

Related Important Terms

Automated Audit Shield

Automated Audit Shield leverages advanced algorithms to provide real-time monitoring and comprehensive audit protection, reducing the risk of costly IRS penalties and enhancing compliance accuracy. By integrating continuous tax risk management, it identifies potential red flags early, ensuring timely corrective actions and minimizing exposure during tax audits.

Real-Time Compliance Analytics

Real-time compliance analytics enhance tax risk management by continuously monitoring transactions to detect anomalies and ensure adherence to evolving tax regulations, reducing the likelihood of audits. Audit protection focuses on defending past filings, whereas proactive analytics enable immediate identification and resolution of compliance issues, fostering more accurate and timely tax reporting.

Predictive Tax Risk Scoring

Predictive tax risk scoring leverages advanced data analytics to identify potential audit triggers and quantify compliance risks, enhancing both audit protection and tax risk management strategies. This proactive approach enables businesses to prioritize high-risk areas, reduce exposure to penalties, and streamline tax compliance efforts.

Dynamic Regulatory Mapping

Dynamic regulatory mapping enhances tax risk management by continuously tracking changes in tax laws and compliance requirements, reducing the likelihood of costly audits. Audit protection offers reactive support during IRS examinations, but dynamic mapping proactively mitigates tax risks through real-time regulatory insights and compliance adjustments.

Blockchain Audit Trails

Blockchain audit trails enhance tax risk management by providing immutable, transparent records that simplify compliance monitoring and reduce audit susceptibility. Integrating blockchain technology ensures real-time verification of transactions, minimizing discrepancies and supporting robust audit protection strategies.

AI-Driven Tax Exposure Detection

AI-driven tax exposure detection enhances audit protection by identifying discrepancies and potential risks in real-time, reducing the likelihood of costly audits. Integrating AI tools into tax risk management improves compliance accuracy and proactively mitigates tax exposure, safeguarding organizations from penalties and reputation damage.

Continuous Transaction Monitoring

Continuous transaction monitoring enhances audit protection by providing real-time visibility into financial activities, enabling early detection of discrepancies and potential compliance issues. This proactive approach to tax risk management reduces the likelihood of costly audits and penalties by ensuring consistent adherence to evolving tax regulations.

Proactive Penalty Mitigation

Audit protection primarily safeguards taxpayers from unexpected penalties during IRS examinations by providing representation and expert guidance, while tax risk management involves strategic planning to identify and mitigate potential compliance issues before they arise. Proactive penalty mitigation through tax risk management reduces exposure to fines and interest by ensuring accurate reporting and timely tax payments, thereby fostering long-term compliance and financial stability.

Tax Data Integrity Assurance

Audit Protection focuses on shielding taxpayers from penalties during IRS examinations, while Tax Risk Management emphasizes proactive strategies to identify, assess, and mitigate potential tax compliance issues. Ensuring tax data integrity assurance through robust validation processes and accurate record-keeping minimizes the likelihood of discrepancies, thereby strengthening overall compliance and reducing audit exposure.

Compliance-First Tax Resilience

Audit protection services primarily shield taxpayers from the financial impact and stress of IRS examinations, whereas tax risk management for compliance emphasizes proactive identification and mitigation of compliance gaps to build tax resilience. Prioritizing compliance-first tax resilience reduces the likelihood of audits by ensuring accurate reporting and adherence to tax regulations, ultimately fostering sustainable financial stability.

Audit Protection vs Tax Risk Management for Compliance Infographic

moneydiff.com

moneydiff.com