Traditional accountants offer personalized tax assistance based on years of experience and in-depth knowledge of tax laws, providing tailored advice and comprehensive support for complex situations. AI tax advisors leverage advanced algorithms and real-time data analysis to deliver fast, accurate tax calculations and instant updates on regulatory changes. Businesses benefit from combining human expertise with AI efficiency to optimize tax planning and compliance.

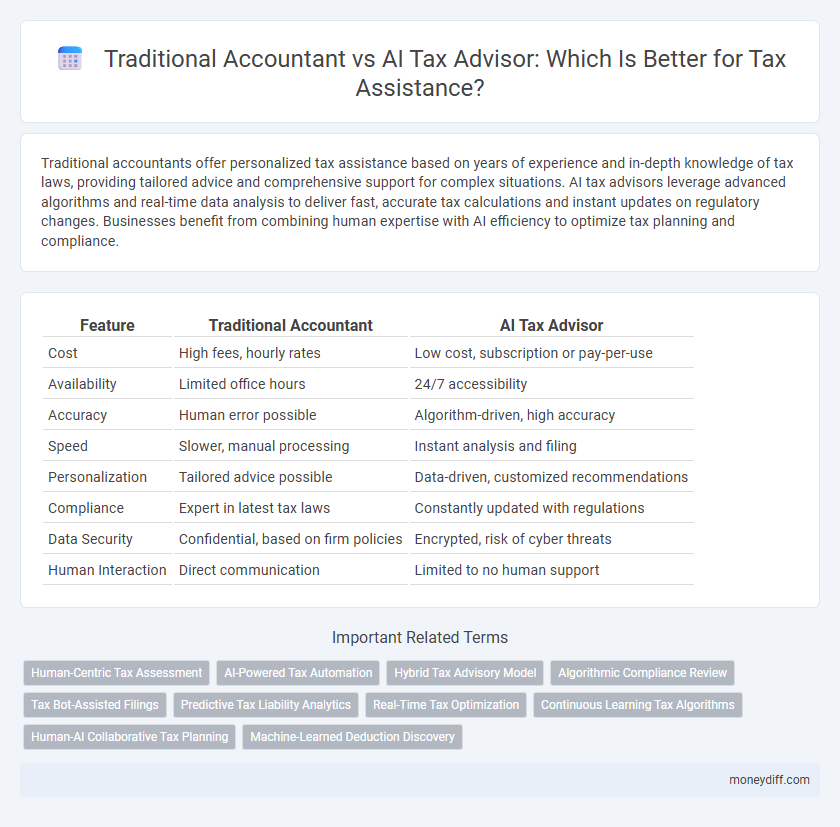

Table of Comparison

| Feature | Traditional Accountant | AI Tax Advisor |

|---|---|---|

| Cost | High fees, hourly rates | Low cost, subscription or pay-per-use |

| Availability | Limited office hours | 24/7 accessibility |

| Accuracy | Human error possible | Algorithm-driven, high accuracy |

| Speed | Slower, manual processing | Instant analysis and filing |

| Personalization | Tailored advice possible | Data-driven, customized recommendations |

| Compliance | Expert in latest tax laws | Constantly updated with regulations |

| Data Security | Confidential, based on firm policies | Encrypted, risk of cyber threats |

| Human Interaction | Direct communication | Limited to no human support |

Overview: Traditional Accountant vs AI Tax Advisor

Traditional accountants offer personalized tax assistance based on extensive experience and understanding of complex tax laws, providing tailored strategies for individual or business clients. AI tax advisors leverage advanced algorithms and machine learning to analyze large datasets quickly, ensuring accurate and efficient tax filing with real-time updates on tax regulations. The choice between traditional accountants and AI tax advisors depends on the need for human insight versus automated precision in tax planning and compliance.

Core Functions of Traditional Accountants in Tax Management

Traditional accountants in tax management excel at preparing and filing accurate tax returns, ensuring compliance with current tax laws and regulations. They provide personalized insights based on a client's unique financial situation and historical data, facilitating detailed tax planning and liability minimization. Their expertise in interpreting complex tax codes and managing audits strengthens risk management and tax dispute resolution.

Advantages of Using an AI Tax Advisor for Tax Filing

AI tax advisors offer enhanced accuracy by leveraging machine learning algorithms to identify deductions and credits often overlooked by traditional accountants. These digital tools provide faster processing times and real-time updates on tax laws, ensuring compliance with the latest regulations. Cost efficiency and 24/7 accessibility make AI tax advisors a practical choice for individuals and businesses seeking seamless and reliable tax filing assistance.

Cost Comparison: Accountant Fees vs AI Tax Software Subscription

Traditional accountants typically charge fees ranging from $150 to $400 per hour, which can accumulate significantly during complex tax filings, whereas AI tax software subscriptions usually cost between $20 and $100 annually, offering a more budget-friendly alternative. The upfront expenses of hiring a professional may be justified by personalized advice, but AI tax advisors reduce ongoing costs with automated updates and instant data processing. Small businesses and individuals seeking cost efficiency often prefer AI solutions that combine affordability with scalable features, contrasting with the higher initial fees associated with human accountants.

Accuracy and Error Reduction in Tax Assistance

AI tax advisors leverage advanced algorithms and machine learning to analyze complex tax regulations, significantly enhancing accuracy and reducing human errors compared to traditional accountants. Traditional accountants, while experienced, are prone to manual mistakes and oversight due to the complexity and volume of tax data. The integration of AI in tax assistance ensures continuous updates on tax laws, minimizing errors and optimizing tax return precision.

Data Security: Human Expertise vs AI-Driven Platforms

Traditional accountants offer personalized data security through established professional ethics and regulatory compliance, ensuring sensitive financial information is carefully managed by trusted human oversight. AI tax advisor platforms rely on advanced encryption and algorithmic safeguards to protect data but may pose risks related to hacking or data breaches due to their digital nature. Balancing human expertise with AI-driven security protocols is crucial for maintaining confidentiality and accuracy in tax assistance services.

Personalized Tax Strategies: Human Judgment vs AI Algorithms

Traditional accountants leverage human judgment to tailor personalized tax strategies by evaluating unique financial situations and interpreting complex tax laws, ensuring nuanced advice that adapts to individual circumstances. AI tax advisors utilize advanced algorithms and machine learning to analyze vast datasets quickly, offering optimized tax-saving opportunities based on patterns and predictive analytics but may lack the contextual understanding of specific personal factors. Combining human expertise with AI-driven insights can enhance personalized tax planning by balancing creativity and precision in strategy development.

Time Efficiency: Manual Processing vs Automated Tax Solutions

Traditional accountants often require extensive time for manual data entry and reconciliation, leading to longer tax preparation cycles. AI tax advisors leverage advanced algorithms and machine learning to automate data processing, significantly reducing turnaround time while maintaining accuracy. Automated tax solutions enable real-time analysis and rapid generation of tax reports, optimizing time efficiency compared to conventional manual methods.

Scalability: Serving Individuals Versus Business Needs

Traditional accountants excel in personalized tax assistance for individuals and small businesses but face scalability challenges when managing large volumes or complex corporate tax needs. AI tax advisors leverage advanced algorithms and machine learning to efficiently handle diverse tax scenarios, offering scalable solutions for both individuals and large enterprises. This scalability enables AI systems to process vast datasets, ensuring timely compliance and optimized tax strategies across varied business sizes.

Future Trends in Tax Assistance: Will AI Replace Accountants?

AI tax advisors leverage machine learning algorithms and real-time data analysis to provide faster, more accurate tax assistance compared to traditional accountants, transforming tax preparation and planning processes. The integration of AI in tax services enhances predictive analytics and compliance monitoring, reducing human error and operational costs while improving client experience. Despite AI's growing capabilities, complex tax scenarios and personalized financial advice still necessitate the expertise of human accountants, indicating a collaborative future rather than full replacement.

Related Important Terms

Human-Centric Tax Assessment

Traditional accountants leverage years of expertise and personalized client interactions to deliver nuanced, human-centric tax assessments tailored to individual financial situations. AI tax advisors utilize advanced algorithms and vast datasets to provide rapid, data-driven tax assistance, yet may lack the empathetic understanding and contextual judgment inherent in human professionals.

AI-Powered Tax Automation

AI-powered tax automation streamlines the tax filing process by quickly analyzing vast datasets to identify deductions and optimize returns, reducing human error and saving significant time compared to traditional accountants. Leveraging machine learning algorithms, AI tax advisors provide real-time updates on tax laws and personalized strategies that enhance accuracy and compliance in complex tax scenarios.

Hybrid Tax Advisory Model

The Hybrid Tax Advisory Model combines the deep expertise of traditional accountants with the efficiency and data-processing capabilities of AI tax advisors, delivering personalized tax assistance with enhanced accuracy and speed. This integration reduces human error and offers real-time tax optimization, leveraging AI algorithms while maintaining the nuanced judgment of experienced professionals.

Algorithmic Compliance Review

Traditional accountants rely on manual expertise to interpret tax codes during compliance reviews, whereas AI tax advisors utilize algorithmic compliance review systems that analyze large datasets for error detection and regulatory adherence with higher speed and accuracy. Algorithmic compliance review enhances tax assistance by automating the identification of discrepancies and ensuring real-time updates in line with evolving tax laws.

Tax Bot-Assisted Filings

Tax bot-assisted filings enhance accuracy and efficiency by automating data entry and error detection, reducing human errors common with traditional accountants. AI tax advisors analyze complex tax codes and personalized financial data to optimize deductions and savings, providing tailored assistance beyond standard manual preparation.

Predictive Tax Liability Analytics

Traditional accountants rely on historical data and manual calculations to estimate tax liabilities, often leading to slower and less precise predictions. AI tax advisors utilize predictive tax liability analytics through machine learning algorithms that analyze real-time financial data, enabling more accurate forecasting and proactive tax planning.

Real-Time Tax Optimization

Traditional accountants rely on periodic reviews and manual calculations, often resulting in delayed tax optimization opportunities, while AI tax advisors leverage real-time data analysis and machine learning algorithms to continuously adjust strategies for maximizing deductions and minimizing liabilities. Real-time tax optimization powered by AI ensures up-to-date compliance and personalized financial insights, significantly enhancing accuracy and efficiency compared to conventional accounting methods.

Continuous Learning Tax Algorithms

Traditional accountants rely on static knowledge and manual updates to tax codes, whereas AI tax advisors utilize continuous learning tax algorithms that adapt dynamically to the latest tax regulations and individual financial patterns. These AI-driven systems enhance accuracy and efficiency by consistently analyzing real-time data, minimizing errors, and optimizing tax strategies with up-to-date compliance insights.

Human-AI Collaborative Tax Planning

Human-AI collaborative tax planning merges the expertise of traditional accountants with advanced AI tax advisors to enhance accuracy and efficiency in tax preparation. This synergy allows for personalized insights, real-time data analysis, and optimized tax strategies tailored to individual financial situations, ultimately improving compliance and maximizing returns.

Machine-Learned Deduction Discovery

Machine-learned deduction discovery leverages advanced algorithms to analyze complex financial data and uncover tax deductions often overlooked by traditional accountants, enhancing the accuracy and efficiency of tax assistance. AI tax advisors continuously learn from vast datasets to provide personalized, up-to-date tax strategies that adapt to changing regulations faster than manual analysis.

Traditional Accountant vs AI Tax Advisor for tax assistance. Infographic

moneydiff.com

moneydiff.com