Tax refunds provide taxpayers with a lump sum repayment based on overpaid taxes, offering immediate liquidity but limited flexibility for investment purposes. Tokenized tax credits represent digitized, tradable assets that can be allocated strategically in a diversified portfolio to optimize tax efficiency and long-term growth. Integrating tokenized tax credits into asset allocation enhances financial planning by enabling real-time trading and unlocking new investment opportunities beyond traditional cash refunds.

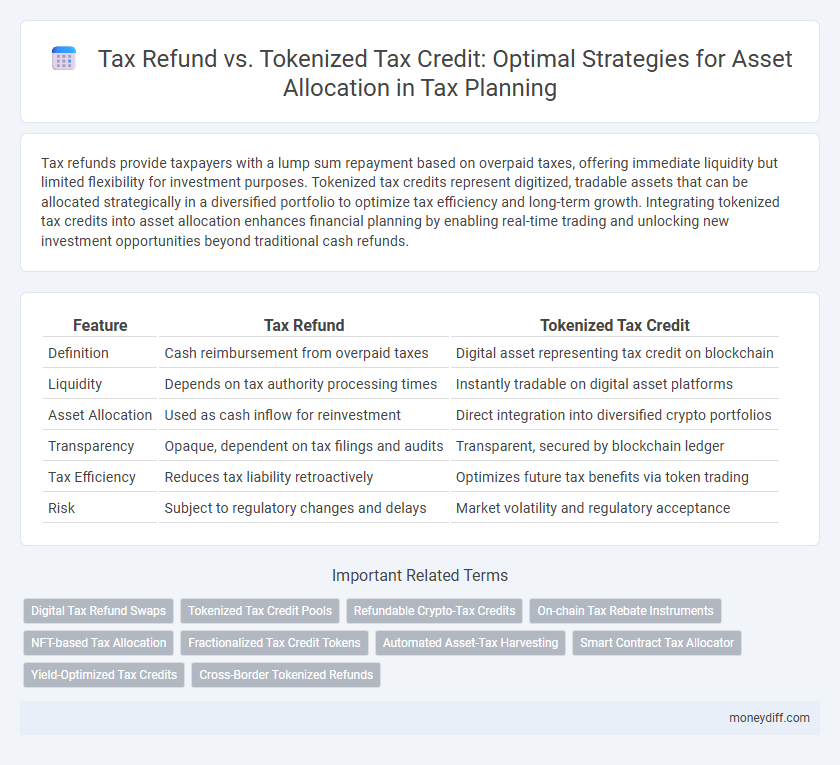

Table of Comparison

| Feature | Tax Refund | Tokenized Tax Credit |

|---|---|---|

| Definition | Cash reimbursement from overpaid taxes | Digital asset representing tax credit on blockchain |

| Liquidity | Depends on tax authority processing times | Instantly tradable on digital asset platforms |

| Asset Allocation | Used as cash inflow for reinvestment | Direct integration into diversified crypto portfolios |

| Transparency | Opaque, dependent on tax filings and audits | Transparent, secured by blockchain ledger |

| Tax Efficiency | Reduces tax liability retroactively | Optimizes future tax benefits via token trading |

| Risk | Subject to regulatory changes and delays | Market volatility and regulatory acceptance |

Understanding Tax Refunds and Tokenized Tax Credits

Tax refunds represent the reimbursement of excess taxes paid, providing liquid cash that can be readily allocated to various financial assets or expenses. Tokenized tax credits transform traditional tax benefits into digital tokens, enabling fractional ownership, enhanced liquidity, and seamless transferability on blockchain platforms. Understanding the difference between these two forms allows taxpayers to optimize asset allocation strategies by balancing immediate liquidity with innovative investment opportunities in digital tax assets.

Key Differences Between Tax Refunds and Tokenized Tax Credits

Tax refunds are direct repayments from the government based on overpaid taxes, typically issued as cash or check after filing annual returns. Tokenized tax credits represent blockchain-backed digital assets reflecting tax credit value, which can be traded or allocated across different investment portfolios. Unlike traditional tax refunds, tokenized tax credits enable real-time liquidity, transparent ownership, and diversified asset allocation strategies within decentralized finance ecosystems.

Asset Allocation Strategies Using Tax Refunds

Tax refunds provide a lump sum that can be strategically reinvested into diversified asset allocation portfolios to maximize growth and tax efficiency. Tokenized tax credits offer a novel approach, enabling fractional ownership and liquidity in tax benefits, which can be directly incorporated into asset allocation models for enhanced flexibility. Utilizing tax refunds for asset allocation prioritizes traditional investment vehicles, while tokenized tax credits introduce blockchain-based innovations to optimize tax advantages and portfolio diversification.

Leveraging Tokenized Tax Credits for Portfolio Diversification

Leveraging tokenized tax credits enhances portfolio diversification by providing a liquid, tradable asset that represents tax benefits, unlike traditional tax refunds which are one-time, non-transferable cash returns. Tokenized tax credits enable investors to allocate assets more efficiently, balancing tax optimization with liquidity and risk management. This digital approach facilitates fractional ownership and secondary market trading, expanding opportunities for strategic asset allocation and improved tax planning outcomes.

Liquidity Considerations: Tax Refund vs Tokenized Tax Credit

Tax refunds provide immediate liquidity as a direct cash return from the government, allowing investors to quickly reallocate funds into various assets without delay. Tokenized tax credits, however, offer liquidity through blockchain-enabled tradability, enabling holders to sell or use credits in fractional amounts, enhancing flexibility in asset allocation. Evaluating these options requires considering the timing, ease of transfer, and market demand for tokenized credits versus the guaranteed cash inflow from traditional tax refunds.

Impact on Investment Returns: Comparing Both Approaches

Tax refunds provide immediate liquidity by returning excess taxes paid, enabling investors to reallocate cash swiftly for new opportunities, though this may cause temporary cash drag due to timing differences. Tokenized tax credits represent a digitalized, tradable asset that can be integrated directly into an investment portfolio, potentially enhancing returns through improved liquidity and fractional ownership benefits. Comparing both, tokenized tax credits offer more seamless incorporation into asset allocation strategies, reducing opportunity costs and optimizing investment efficiency over traditional tax refund timelines.

Risk Management in Asset Allocation with Tax Tools

Tax refunds provide a straightforward recovery of overpaid taxes, offering predictable cash flow to support asset allocation decisions with low risk. Tokenized tax credits introduce a digital, tradable asset that can enhance portfolio diversification while carrying regulatory and liquidity risks. Incorporating these tax tools requires balancing the certainty of cash refunds against the speculative nature of tokenized credits to optimize risk management in asset allocation strategies.

Regulatory Factors Affecting Tax Refunds and Tokenized Credits

Regulatory factors such as government tax laws, compliance requirements, and reporting standards significantly impact both tax refunds and tokenized tax credits within asset allocation strategies. Traditional tax refunds are directly influenced by IRS guidelines and audit processes, which dictate eligibility and timing for reimbursements. In contrast, tokenized tax credits operate under emerging frameworks that integrate blockchain technology with regulatory oversight, necessitating adherence to anti-money laundering (AML) and know-your-customer (KYC) policies to ensure legitimacy and secure transferability.

Future Trends: Digital Assets and Tokenized Tax Credits

Tokenized tax credits represent a transformative evolution in asset allocation by enabling fractional ownership and enhanced liquidity compared to traditional tax refunds. Digital assets integrated with tokenized tax credits facilitate seamless trading, real-time transparency, and programmable compliance, aligning with the growing blockchain adoption in financial services. Future trends indicate a rise in regulatory frameworks supporting tokenized tax credits, driving broader institutional acceptance and unlocking new avenues for tax-efficient investment strategies.

Best Practices for Incorporating Tax Benefits into Asset Allocation

Incorporating tax refunds and tokenized tax credits into asset allocation requires a strategic approach that maximizes after-tax returns and enhances portfolio efficiency. Tax refunds provide immediate liquidity that can be reinvested to boost asset growth, while tokenized tax credits offer flexible, tradable instruments that can optimize tax exposure and improve diversification. Best practices include balancing liquid tax refunds for short-term opportunities with tokenized tax credits to leverage long-term tax advantages and align with individual risk tolerance and investment goals.

Related Important Terms

Digital Tax Refund Swaps

Digital Tax Refund Swaps enable taxpayers to convert traditional tax refunds into tokenized tax credits that can be traded or allocated across diversified digital asset portfolios, enhancing liquidity and flexibility in tax asset management. This innovation leverages blockchain technology to provide secure, transparent, and efficient mechanisms for optimizing asset allocation beyond conventional refund methods.

Tokenized Tax Credit Pools

Tokenized Tax Credit Pools enable investors to allocate assets more efficiently by fractionalizing tax credits into tradable digital tokens, enhancing liquidity and accessibility compared to traditional tax refunds. These pools facilitate real-time valuation and transparent ownership tracking on blockchain platforms, providing greater flexibility and diversification for tax credit investors.

Refundable Crypto-Tax Credits

Refundable crypto-tax credits offer a unique advantage over traditional tax refunds by directly enhancing asset allocation through tokenized digital assets, enabling investors to optimize portfolios with blockchain-verified credits. These credits not only provide immediate financial relief but also increase liquidity and flexibility in managing tax benefits within decentralized finance ecosystems.

On-chain Tax Rebate Instruments

On-chain tax rebate instruments enable automated reconciliation of tax refunds and tokenized tax credits through blockchain technology, enhancing transparency and reducing processing times in asset allocation strategies. Tokenized tax credits offer fractional ownership and liquidity, allowing investors to optimize portfolio diversification while benefiting from real-time tax incentives on decentralized finance platforms.

NFT-based Tax Allocation

NFT-based tax allocation leverages tokenized tax credits to provide enhanced liquidity and transparency compared to traditional tax refunds, allowing taxpayers to trade or allocate credits across various asset classes. This innovation facilitates more efficient asset allocation strategies by enabling holders to seamlessly integrate tax credits into diversified investment portfolios using blockchain technology.

Fractionalized Tax Credit Tokens

Fractionalized tax credit tokens enable precise asset allocation by allowing investors to hold and trade portions of tax credits, increasing liquidity and flexibility compared to traditional lump-sum tax refunds. This tokenization enhances portfolio diversification and optimization by converting illiquid tax credits into tradable digital assets with verifiable ownership and transferability.

Automated Asset-Tax Harvesting

Automated asset-tax harvesting leverages tokenized tax credits to optimize asset allocation by enabling real-time trading and instant tax benefit realization, surpassing traditional tax refunds in efficiency and liquidity. Tokenized tax credits provide programmable, tradable assets that integrate seamlessly into digital portfolios, enhancing tax-loss harvesting strategies and maximizing after-tax returns.

Smart Contract Tax Allocator

Smart Contract Tax Allocator automates asset allocation by converting tax refunds into tokenized tax credits, enhancing liquidity and enabling fractional ownership for investors. This blockchain-driven method improves transparency, reduces processing time, and optimizes tax efficiency compared to traditional tax refund approaches.

Yield-Optimized Tax Credits

Yield-optimized tax credits offer a strategic advantage over traditional tax refunds by enabling asset allocation that maximizes after-tax returns through tokenized credit instruments. Tokenized tax credits provide liquidity and flexibility, allowing investors to seamlessly integrate these credits into diversified portfolios for enhanced yield optimization.

Cross-Border Tokenized Refunds

Cross-border tokenized tax refunds streamline asset allocation by enabling instant, transparent, and secure digital transactions across jurisdictions, reducing delays inherent in traditional tax refund processes. Tokenized tax credits enhance liquidity and flexibility for investors, allowing real-time portfolio adjustments while complying with varying international tax regulations.

Tax Refund vs Tokenized Tax Credit for Asset Allocation Infographic

moneydiff.com

moneydiff.com