Payroll tax applies primarily to traditional employees, where employers withhold and remit taxes on wages, while gig economy tax regulations require freelancers to report and pay their own taxes, including self-employment tax. Freelancers must track income, expenses, and estimated tax payments to comply with gig economy tax obligations, often facing more complex filing requirements than standard payroll tax withholding. Understanding the differences ensures accurate tax compliance and helps optimize deductions for individuals navigating both tax systems.

Table of Comparison

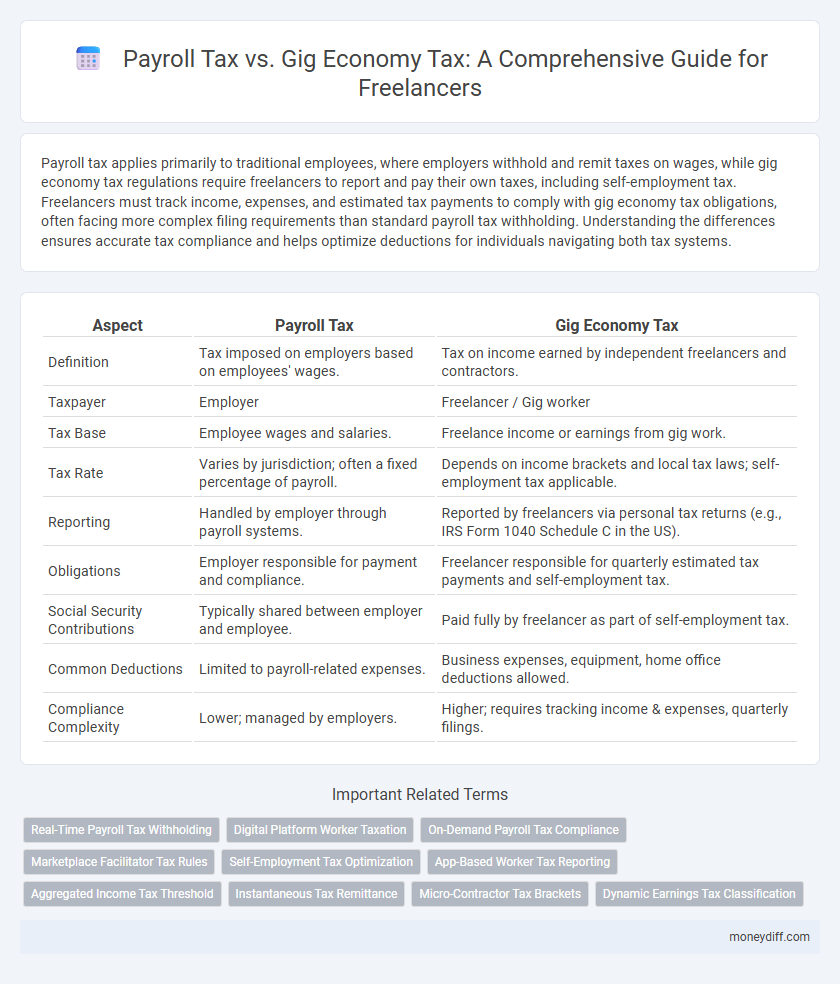

| Aspect | Payroll Tax | Gig Economy Tax |

|---|---|---|

| Definition | Tax imposed on employers based on employees' wages. | Tax on income earned by independent freelancers and contractors. |

| Taxpayer | Employer | Freelancer / Gig worker |

| Tax Base | Employee wages and salaries. | Freelance income or earnings from gig work. |

| Tax Rate | Varies by jurisdiction; often a fixed percentage of payroll. | Depends on income brackets and local tax laws; self-employment tax applicable. |

| Reporting | Handled by employer through payroll systems. | Reported by freelancers via personal tax returns (e.g., IRS Form 1040 Schedule C in the US). |

| Obligations | Employer responsible for payment and compliance. | Freelancer responsible for quarterly estimated tax payments and self-employment tax. |

| Social Security Contributions | Typically shared between employer and employee. | Paid fully by freelancer as part of self-employment tax. |

| Common Deductions | Limited to payroll-related expenses. | Business expenses, equipment, home office deductions allowed. |

| Compliance Complexity | Lower; managed by employers. | Higher; requires tracking income & expenses, quarterly filings. |

Understanding Payroll Tax: A Freelancer’s Perspective

Payroll tax is a mandatory contribution employers make based on employee wages, covering social security and Medicare, while freelancers typically handle their own tax obligations through self-employment taxes. Understanding payroll tax helps freelancers accurately estimate their tax liabilities and avoid penalties by setting aside funds for quarterly estimated tax payments. Differentiating payroll tax from gig economy taxes ensures freelancers maintain compliance and optimize deductions related to income reporting.

What Is Gig Economy Tax? Key Differences Explained

Gig Economy Tax refers to the specific tax obligations that freelancers and independent contractors face, distinct from traditional payroll tax applied to salaried employees. Unlike payroll tax, where employers withhold Social Security and Medicare taxes, gig economy workers are responsible for self-employment taxes, including both employer and employee portions. Key differences include the requirement for gig workers to track income and expenses meticulously and pay estimated taxes quarterly to avoid penalties.

Classification: Employee vs Independent Contractor

Payroll tax applies to employees whose employers are responsible for withholding and remitting Social Security, Medicare, and unemployment taxes, whereas gig economy tax concerns independent contractors who must self-report income and pay self-employment taxes directly. Classification hinges on behavioral control, financial control, and the nature of the relationship, determining whether a worker qualifies as an employee or an independent contractor under IRS guidelines. Misclassification can lead to significant tax liabilities, including back taxes, penalties, and interest for businesses failing to correctly categorize gig workers.

Income Reporting Requirements for Payroll and Gig Workers

Payroll tax requires employers to withhold and report employee income, including wages and tips, to tax authorities on a regular basis. Gig economy workers, classified as independent contractors, must self-report their earnings using Form 1099-NEC if income exceeds $600 annually, ensuring accurate income declaration for tax purposes. Both payroll and gig economy tax frameworks impose detailed record-keeping and income reporting obligations essential for compliance with IRS regulations and proper tax assessment.

Withholding Obligations: Who Pays and When?

Payroll tax requires employers to withhold and remit taxes on behalf of employees at each pay period, ensuring timely compliance with government regulations. In contrast, gig economy tax obligations fall on freelancers themselves, who must track income and pay estimated taxes quarterly to avoid penalties. Understanding these withholding responsibilities is crucial for accurate tax filing and avoiding unexpected liabilities.

Tax Deductions: Payroll Jobs vs Freelance Gigs

Payroll tax for traditional employees typically includes employer and employee contributions to Social Security and Medicare, which are automatically withheld and limit individual deductions. Freelancers in the gig economy, however, are responsible for self-employment tax, which encompasses both employer and employee portions but allows for a broader range of deductible business expenses such as home office costs, equipment, and travel. These deductions reduce taxable income substantially, making gig economy tax planning crucial for maximizing after-tax earnings compared to payroll jobs.

Social Security and Medicare: How Each System Applies

Payroll tax for traditional employees includes automatic Social Security and Medicare contributions, split between employer and employee, ensuring consistent funding for these programs. In contrast, freelancers in the gig economy must pay self-employment tax, combining both employer and employee portions of Social Security and Medicare, resulting in higher individual tax responsibility. Understanding these differences is essential for accurate tax planning and compliance within both employment frameworks.

Quarterly Estimated Taxes for Gig Workers

Freelancers in the gig economy must navigate quarterly estimated taxes, which differ from traditional payroll tax withheld by employers. Unlike payroll tax deducted from a paycheck, gig workers calculate and remit their own estimated taxes, covering both income and self-employment taxes each quarter. Accurate quarterly payments help avoid penalties and ensure compliance with IRS regulations specific to gig economy income.

Penalties and Audits: Risks in Both Tax Systems

Freelancers face significant risks of penalties and audits under both payroll tax and gig economy tax systems due to strict reporting requirements and complex income tracking. Payroll tax violations often lead to hefty fines and back payments, especially if employers misclassify workers or fail to remit taxes on time. Gig economy tax audits target unreported income or improper deductions, with penalties escalating for repeated non-compliance or failure to keep accurate records.

Strategies for Freelancers to Manage Payroll and Gig Taxes Efficiently

Freelancers in the gig economy must differentiate between payroll tax obligations and gig economy tax liabilities to optimize their financial management. Utilizing strategies such as accurate expense tracking, quarterly estimated tax payments, and leveraging tax deductions related to home office and business expenses can significantly reduce tax burdens. Employing accounting software tailored for gig workers enhances compliance and streamlines the process of managing payroll taxes and self-employment taxes.

Related Important Terms

Real-Time Payroll Tax Withholding

Real-time payroll tax withholding automates the deduction of payroll taxes at the moment income is earned, ensuring immediate compliance and accurate tax remittance for freelancers in the gig economy. This system contrasts with traditional gig economy tax reporting, which often relies on end-of-year filings and can result in underpayment or penalties due to irregular income streams.

Digital Platform Worker Taxation

Payroll tax typically applies to traditional employees, mandating employers to withhold and contribute to Social Security, Medicare, and unemployment taxes, whereas gig economy tax for digital platform workers requires freelancers to manage self-employment taxes, including income and Medicare contributions directly. Regulatory frameworks increasingly target digital platform worker taxation to ensure compliance and proper contribution of payroll-related taxes despite the independent contractor status.

On-Demand Payroll Tax Compliance

On-demand payroll tax compliance for freelancers requires accurate tracking and timely remittance of payroll taxes, including Social Security and Medicare contributions, distinguishing it from traditional payroll tax obligations that employers manage. Gig economy tax compliance emphasizes self-reporting income and expenses on IRS Form 1099-K or 1099-NEC, making automated tax calculation and withholding services essential to reduce errors and penalties.

Marketplace Facilitator Tax Rules

Marketplace facilitator tax rules require platforms to collect and remit payroll taxes on behalf of freelancers, shifting compliance responsibilities from individual gig workers to the platform. This regulation impacts payroll tax obligations versus traditional gig economy tax practices, streamlining tax collection and reducing filing complexities for freelancers operating through marketplaces.

Self-Employment Tax Optimization

Freelancers can optimize self-employment tax by understanding the distinctions between payroll tax, which applies to traditional employees, and gig economy tax obligations that require reporting income as independent contractors. Strategic expense tracking and quarterly estimated tax payments help minimize tax liabilities while ensuring compliance with IRS self-employment tax regulations.

App-Based Worker Tax Reporting

Freelancers in the gig economy must navigate distinct payroll tax obligations compared to traditional employees, as app-based worker tax reporting requires platforms to issue Form 1099-NEC detailing income paid. Accurate reporting ensures compliance with self-employment tax responsibilities, including Social Security and Medicare contributions, critical to avoiding IRS penalties.

Aggregated Income Tax Threshold

Freelancers navigating payroll tax and gig economy tax must consider the aggregated income tax threshold, which combines multiple income streams to determine tax liability. Crossing this threshold triggers higher tax rates and additional reporting requirements, crucial for accurate tax compliance in gig economy earnings.

Instantaneous Tax Remittance

Payroll tax mandates employers to withhold and remit taxes instantly on employee wages, ensuring real-time compliance, while gig economy tax frameworks for freelancers often require self-reporting with less immediate remittance, posing challenges for timely tax collection. Instantaneous tax remittance in payroll systems reduces fiscal discrepancies and enhances government revenue flow compared to the more fragmented and delayed payments typical in gig economy taxation.

Micro-Contractor Tax Brackets

Micro-contractor tax brackets in the gig economy often differ from traditional payroll tax structures, with freelancers typically subjected to self-employment taxes that combine Social Security and Medicare contributions, unlike employees whose payroll taxes are split with employers. Understanding these distinct tax brackets is crucial for freelancers to accurately calculate quarterly tax payments and avoid penalties.

Dynamic Earnings Tax Classification

Payroll tax typically applies to traditional employees with fixed wages, while gig economy tax for freelancers requires dynamic earnings tax classification to account for variable income streams and project-based payments. This classification ensures accurate tax obligations by adjusting contributions based on real-time earnings fluctuations typical in freelancing platforms and gig work.

Payroll Tax vs Gig Economy Tax for freelancers Infographic

moneydiff.com

moneydiff.com