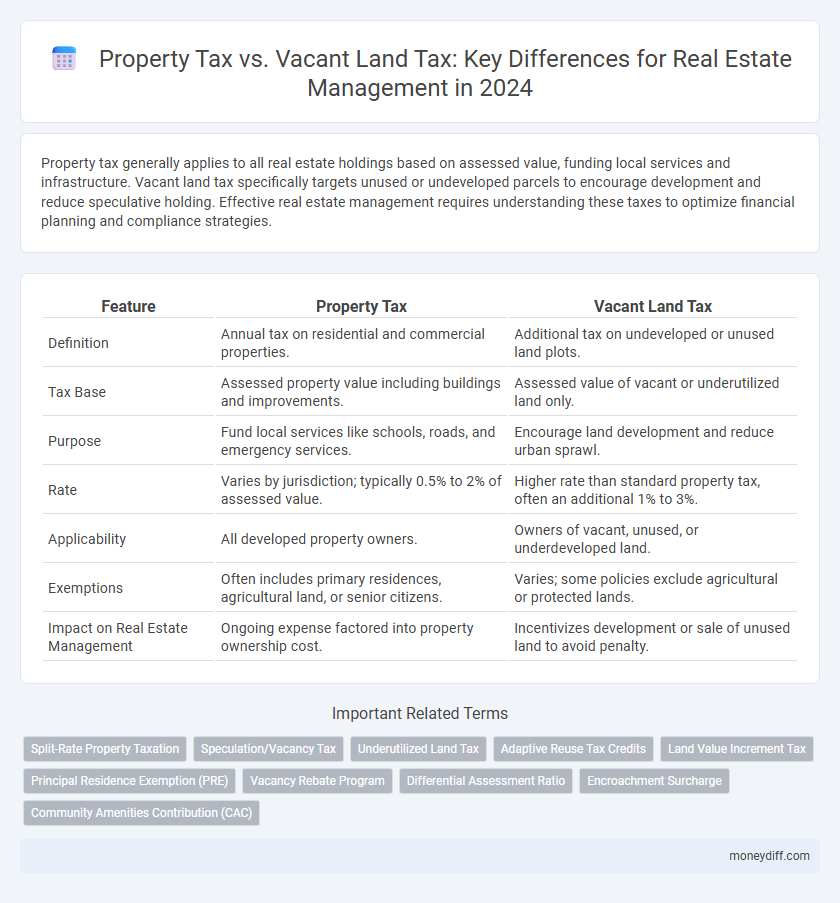

Property tax generally applies to all real estate holdings based on assessed value, funding local services and infrastructure. Vacant land tax specifically targets unused or undeveloped parcels to encourage development and reduce speculative holding. Effective real estate management requires understanding these taxes to optimize financial planning and compliance strategies.

Table of Comparison

| Feature | Property Tax | Vacant Land Tax |

|---|---|---|

| Definition | Annual tax on residential and commercial properties. | Additional tax on undeveloped or unused land plots. |

| Tax Base | Assessed property value including buildings and improvements. | Assessed value of vacant or underutilized land only. |

| Purpose | Fund local services like schools, roads, and emergency services. | Encourage land development and reduce urban sprawl. |

| Rate | Varies by jurisdiction; typically 0.5% to 2% of assessed value. | Higher rate than standard property tax, often an additional 1% to 3%. |

| Applicability | All developed property owners. | Owners of vacant, unused, or underdeveloped land. |

| Exemptions | Often includes primary residences, agricultural land, or senior citizens. | Varies; some policies exclude agricultural or protected lands. |

| Impact on Real Estate Management | Ongoing expense factored into property ownership cost. | Incentivizes development or sale of unused land to avoid penalty. |

Understanding Property Tax in Real Estate

Property tax in real estate is an annual levy based on the assessed value of residential or commercial properties, funding local government services such as schools and infrastructure maintenance. It differs from vacant land tax, which specifically targets undeveloped parcels of land to encourage utilization or development, often at higher rates to disincentivize holding idle properties. Understanding property tax assessments, exemptions, and payment deadlines is crucial for effective real estate management and financial planning.

What is Vacant Land Tax?

Vacant Land Tax is a levy imposed on undeveloped or unused land parcels to encourage property development and deter land banking. This tax supplements traditional property tax by specifically targeting land without active habitation or improvement, often calculated based on assessed land value. Real estate management must account for Vacant Land Tax to optimize portfolio costs and align development strategies with local tax regulations.

Key Differences Between Property Tax and Vacant Land Tax

Property tax is levied on the overall assessed value of real estate, including land and any improvements like buildings, reflecting its use and occupancy status. Vacant land tax specifically targets undeveloped or unoccupied parcels, often at higher rates to discourage land banking and promote development. Understanding these distinctions is crucial for real estate management, influencing budgeting, tax liabilities, and investment strategies.

Tax Calculation Methods for Properties and Vacant Land

Property tax calculations are typically based on the assessed value of the built structures and land combined, using a fixed mill rate or percentage determined by local tax authorities. Vacant land tax often employs a higher rate or additional penalties to encourage development, with assessments focused solely on the land's market value without improvements. Differentiating these tax methods allows real estate managers to optimize financial planning by factoring in distinct liability impacts depending on property usage and development status.

Impact of Property Tax on Real Estate Investments

Property tax directly affects the profitability of real estate investments by increasing annual holding costs, which can reduce net returns. Unlike vacant land tax, which targets undeveloped plots to encourage utilization, property tax applies to both developed and income-generating properties, influencing cash flow and investment decisions. Higher property taxes can deter investment or prompt owners to pass costs onto tenants, impacting occupancy rates and market dynamics.

How Vacant Land Tax Influences Landholding Decisions

Vacant Land Tax imposes an additional financial burden on undeveloped properties, prompting landowners to reassess holding strategies to avoid unnecessary expenses. This tax incentivizes either the development or sale of vacant parcels, directly influencing market dynamics and land utilization efficiency. The comparative advantage over standard Property Tax drives strategic decisions aimed at minimizing tax liability while optimizing asset performance in real estate portfolios.

Exemptions and Deductions: Property vs Vacant Land

Property tax exemptions often apply to primary residences, senior citizens, and properties used for agricultural purposes, reducing the overall tax burden significantly. Vacant land tax deductions are typically limited, with exemptions mainly granted for land in conservation or designated for future development, making it essential for owners to verify local regulations. Understanding these specific exemptions and deductions helps real estate managers optimize tax liabilities for both developed properties and vacant parcels.

Legal Obligations for Property and Vacant Land Owners

Property owners are legally obligated to pay property tax based on the assessed value of their real estate, which funds local services such as schools and infrastructure. Vacant land owners may face additional vacant land taxes designed to discourage land hoarding and incentivize development, with penalties for non-compliance varying by jurisdiction. Compliance with these tax obligations is critical to avoid legal penalties, liens, or increased rates that can impact real estate management strategies.

Strategies to Optimize Real Estate Taxation

Implementing targeted strategies to optimize real estate taxation involves assessing the differential impact of Property Tax and Vacant Land Tax on portfolio holdings. Prioritizing tax efficiency through timely classification of properties and leveraging exemptions or deferrals for vacant land reduces fiscal liabilities. Strategic property development or leasing plans can further minimize Vacant Land Tax while maintaining compliance with local tax regulations.

Future Trends in Property and Vacant Land Taxation

Emerging trends in property and vacant land taxation indicate increasing emphasis on incentivizing development to combat urban sprawl and housing shortages. Governments are progressively adopting higher tax rates on undeveloped land to encourage utilization and generate revenue for infrastructure improvements. Technological advancements in data analytics will enable more precise valuations and dynamic tax adjustments based on real-time land use and market conditions.

Related Important Terms

Split-Rate Property Taxation

Split-rate property taxation distinguishes between land value and improvements, applying separate tax rates on vacant land and developed properties. This system incentivizes development by imposing higher taxes on vacant land, encouraging efficient land use and reducing speculation in real estate management.

Speculation/Vacancy Tax

Speculation and Vacancy Taxes target properties left unoccupied or underutilized, aiming to curb real estate speculation and encourage housing availability. While Property Tax applies broadly based on assessed property value, Vacant Land Tax specifically imposes additional levies on undeveloped or vacant plots to deter speculative holding and promote active land use.

Underutilized Land Tax

Underutilized Land Tax targets vacant or underutilized properties, encouraging landowners to develop or sell idle parcels to optimize urban spaces and increase municipal revenues. Property Tax applies broadly to all real estate based on assessed value, but Underutilized Land Tax specifically addresses inefficiencies by imposing higher rates on unused land to stimulate economic growth and housing availability.

Adaptive Reuse Tax Credits

Adaptive Reuse Tax Credits provide significant financial incentives for converting vacant land or underutilized properties into productive real estate, effectively reducing property tax burdens during redevelopment. These credits encourage property owners to transform vacant land, which often incurs higher vacant land taxes, into taxable, revenue-generating properties, enhancing urban revitalization and maximizing real estate management efficiency.

Land Value Increment Tax

Property tax typically applies to both improvements and land value, while vacant land tax targets unused parcels to encourage development. Land Value Increment Tax specifically taxes the appreciation in land value, incentivizing efficient land use and impacting real estate investment strategies.

Principal Residence Exemption (PRE)

Property tax on a principal residence often qualifies for the Principal Residence Exemption (PRE), which significantly reduces the taxable amount, whereas vacant land typically does not qualify for PRE and is taxed at a higher rate. Real estate management should prioritize leveraging PRE benefits on inhabited properties to minimize tax liability, while vacant land incurs full property tax without exemption advantages.

Vacancy Rebate Program

The Vacancy Rebate Program provides property owners with a partial refund on property taxes if their residential property remains vacant for most of the year, encouraging efficient real estate management and reducing unnecessary vacancies. This program differentiates from the Vacant Land Tax, which specifically targets undeveloped parcels, ensuring tax incentives focus on occupied properties and promoting market stability.

Differential Assessment Ratio

Property Tax typically applies a standard assessment ratio based on the property's market value to determine the tax amount, while Vacant Land Tax often uses a higher differential assessment ratio to discourage land speculation and promote development. The varying assessment ratios directly impact real estate management strategies by influencing holding costs and investment returns on vacant versus developed properties.

Encroachment Surcharge

Property Tax generally applies to developed real estate and is based on property value, while Vacant Land Tax targets undeveloped parcels to discourage land hoarding. Encroachment Surcharge imposes additional fees when structures or improvements extend beyond property boundaries, impacting tax calculations and compliance for both types of taxes.

Community Amenities Contribution (CAC)

Property Tax primarily funds municipal services, whereas Vacant Land Tax targets underutilized parcels to encourage development, both influencing real estate management costs. Community Amenities Contribution (CAC) supplements these taxes by requiring developers to contribute toward local infrastructure and services, balancing growth with community needs.

Property Tax vs Vacant Land Tax for real estate management. Infographic

moneydiff.com

moneydiff.com