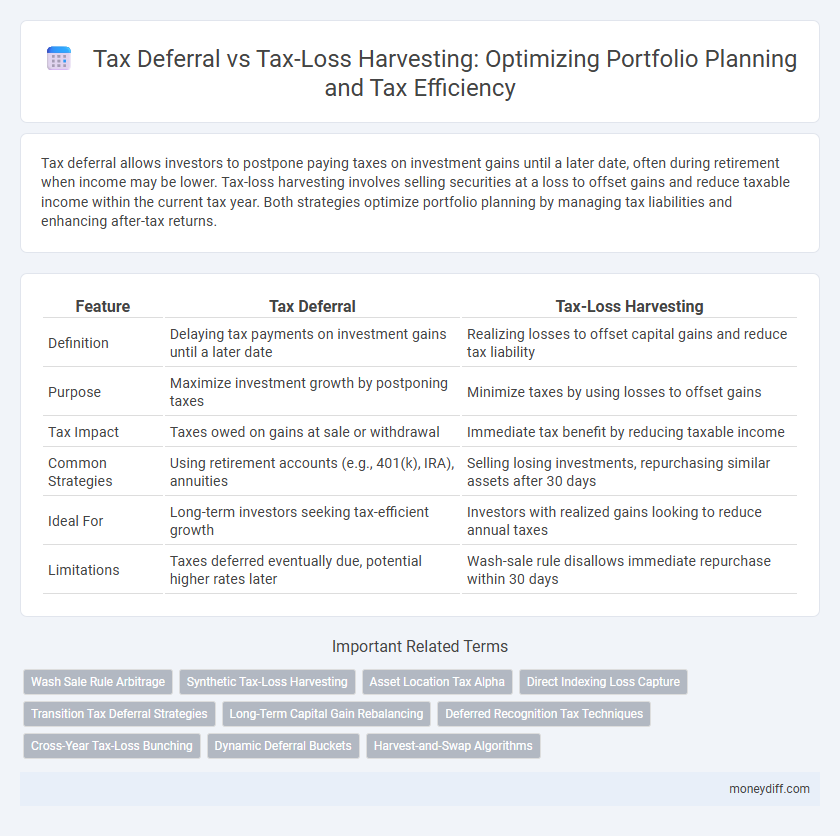

Tax deferral allows investors to postpone paying taxes on investment gains until a later date, often during retirement when income may be lower. Tax-loss harvesting involves selling securities at a loss to offset gains and reduce taxable income within the current tax year. Both strategies optimize portfolio planning by managing tax liabilities and enhancing after-tax returns.

Table of Comparison

| Feature | Tax Deferral | Tax-Loss Harvesting |

|---|---|---|

| Definition | Delaying tax payments on investment gains until a later date | Realizing losses to offset capital gains and reduce tax liability |

| Purpose | Maximize investment growth by postponing taxes | Minimize taxes by using losses to offset gains |

| Tax Impact | Taxes owed on gains at sale or withdrawal | Immediate tax benefit by reducing taxable income |

| Common Strategies | Using retirement accounts (e.g., 401(k), IRA), annuities | Selling losing investments, repurchasing similar assets after 30 days |

| Ideal For | Long-term investors seeking tax-efficient growth | Investors with realized gains looking to reduce annual taxes |

| Limitations | Taxes deferred eventually due, potential higher rates later | Wash-sale rule disallows immediate repurchase within 30 days |

Understanding Tax Deferral in Portfolio Management

Tax deferral in portfolio management allows investors to postpone paying taxes on investment gains, enabling the potential for compounded growth over time. By utilizing accounts like IRAs or 401(k)s, deferred taxes can enhance long-term wealth accumulation through uninterrupted reinvestment. Understanding the timing and rules of tax deferral strategies is essential to optimize after-tax returns and portfolio efficiency.

What Is Tax-Loss Harvesting?

Tax-loss harvesting is a strategic investment approach that involves selling securities at a loss to offset capital gains and reduce taxable income. This tactic allows investors to minimize tax liabilities while maintaining their overall portfolio allocation by reinvesting in similar assets. Implementing tax-loss harvesting can enhance after-tax returns by effectively managing realized gains and losses within a tax year.

Key Differences Between Tax Deferral and Tax-Loss Harvesting

Tax deferral allows investors to postpone paying taxes on investment gains until assets are sold, enabling potential for compounded growth over time. Tax-loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing current tax liability. While tax deferral emphasizes timing of tax payments, tax-loss harvesting focuses on actively managing tax liabilities to minimize taxable income in the short term.

Tax Deferral: Benefits and Strategic Applications

Tax deferral allows investors to postpone tax payments on investment gains, thereby enabling the growth of capital without immediate tax erosion. By leveraging tax-advantaged accounts such as 401(k)s or IRAs, portfolio growth can compound more effectively over time, maximizing long-term returns. Strategic applications include timing withdrawals to coincide with lower income years and using tax deferral to rebalance portfolios without incurring frequent taxable events.

Tax-Loss Harvesting: Advantages and Best Practices

Tax-loss harvesting offers significant advantages by allowing investors to offset capital gains with realized losses, thereby reducing taxable income and deferring tax liability. Implementing best practices such as strategically harvesting losses before year-end and avoiding wash sales maximizes tax benefits while maintaining portfolio integrity. Employing tax-loss harvesting effectively enhances after-tax returns and improves long-term portfolio efficiency in tax-optimized investment strategies.

Impact on Long-Term Portfolio Growth

Tax deferral allows investments to grow tax-free until withdrawal, enhancing compound growth and maximizing long-term portfolio appreciation. Tax-loss harvesting offsets capital gains with realized losses, reducing current tax liabilities and freeing up capital for reinvestment, which can boost after-tax returns over time. Combining both strategies effectively manages tax drag, improving sustained portfolio growth and optimizing wealth accumulation.

Tax Implications: Short-Term vs Long-Term Gains

Tax deferral strategies allow investors to postpone taxes on gains, potentially benefiting from long-term capital gains rates that are typically lower than short-term rates. Tax-loss harvesting involves selling securities at a loss to offset taxable gains, reducing immediate tax liability and optimizing portfolio tax efficiency. Understanding the distinction between short-term gains taxed at ordinary income rates and long-term gains taxed at preferential rates is crucial for effective portfolio tax planning.

Choosing the Right Strategy for Your Investment Goals

Tax deferral allows investors to postpone tax payments on gains, enhancing compound growth potential within retirement accounts like IRAs or 401(k)s. Tax-loss harvesting strategically sells securities at a loss to offset gains, reducing current taxable income and optimizing after-tax returns in taxable portfolios. Selecting the right strategy depends on your investment goals, time horizon, tax bracket, and account types to maximize tax efficiency and long-term wealth accumulation.

Common Mistakes in Tax Deferral and Tax-Loss Harvesting

Common mistakes in tax deferral include overestimating future tax brackets and failing to account for required minimum distributions, which can lead to unexpected tax liabilities. In tax-loss harvesting, investors often overlook wash sale rules or harvest losses without considering the overall portfolio balance, reducing potential long-term gains. Proper planning requires aligning tax strategies with investment goals and regulatory compliance to maximize portfolio efficiency.

Integrating Both Strategies for Optimal Portfolio Tax Efficiency

Integrating tax deferral and tax-loss harvesting strategies enhances portfolio tax efficiency by balancing the timing of income recognition with strategic realization of losses to offset gains. Tax deferral postpones taxable events, allowing investments to grow tax-free longer, while tax-loss harvesting captures losses to reduce current tax liabilities. Combining these approaches tailors tax outcomes to investor goals, maximizing after-tax returns in portfolio planning.

Related Important Terms

Wash Sale Rule Arbitrage

Tax deferral strategies allow investors to postpone capital gains taxes by holding onto appreciated assets, while tax-loss harvesting involves selling securities at a loss to offset gains and reduce taxable income. Navigating the wash sale rule arbitrage is critical in tax-loss harvesting, as repurchasing substantially identical securities within 30 days can disallow the loss deduction, requiring careful timing and asset substitution to maximize tax benefits without violating IRS regulations.

Synthetic Tax-Loss Harvesting

Synthetic tax-loss harvesting enables investors to realize tax losses while maintaining market exposure by using derivatives such as options or futures, optimizing portfolio tax efficiency without disrupting asset allocation. This strategy contrasts with traditional tax-loss harvesting by minimizing wash sale risk and providing enhanced flexibility in timing loss recognition for more effective tax deferral in portfolio planning.

Asset Location Tax Alpha

Tax deferral strategies maximize after-tax returns by postponing capital gains tax liabilities, allowing portfolio assets to grow tax-deferred in accounts like IRAs or 401(k)s. Tax-loss harvesting enhances asset location tax alpha by strategically realizing losses to offset gains, reducing taxable income and improving overall portfolio efficiency.

Direct Indexing Loss Capture

Direct Indexing Loss Capture leverages customized portfolios to realize tax losses by selectively selling underperforming securities, enhancing tax-loss harvesting efficiency compared to traditional methods. Tax deferral delays tax payments through retirement accounts or investment vehicles, but Direct Indexing offers proactive tax management by generating immediate losses to offset gains, optimizing after-tax returns.

Transition Tax Deferral Strategies

Transition tax deferral strategies maximize portfolio growth by postponing capital gains taxes during asset reallocation, allowing more capital to remain invested. In contrast, tax-loss harvesting involves realizing losses to offset gains, but deferral strategies prioritize timing tax payments to enhance long-term wealth accumulation.

Long-Term Capital Gain Rebalancing

Tax deferral strategies allow investors to postpone capital gains taxes, thus maximizing the compounding potential of their portfolio over time, while tax-loss harvesting involves selling securities at a loss to offset gains and reduce taxable income. Effective long-term capital gain rebalancing integrates both approaches to optimize after-tax returns and maintain target asset allocation without triggering significant tax liabilities.

Deferred Recognition Tax Techniques

Deferred recognition tax techniques in portfolio planning allow investors to postpone tax liabilities by delaying capital gains realization, effectively improving cash flow and compounding growth. Tax-loss harvesting involves selling securities at a loss to offset gains but does not provide the same long-term compounding benefits as strategic deferral of taxable events.

Cross-Year Tax-Loss Bunching

Cross-year tax-loss bunching strategically accelerates harvesting losses into a single tax year to maximize deductible offsets against gains, enhancing tax efficiency across multiple years. This approach leverages timing flexibility to optimize tax deferral benefits, reduce taxable income, and improve long-term portfolio growth by minimizing realized capital gains taxes.

Dynamic Deferral Buckets

Dynamic Deferral Buckets enable strategic tax deferral by segmenting future income into distinct time periods, optimizing tax bracket utilization and minimizing immediate tax liabilities. Incorporating tax-loss harvesting within these buckets allows for immediate offset of capital gains, enhancing after-tax portfolio returns through coordinated timing of realized losses and deferred income recognition.

Harvest-and-Swap Algorithms

Harvest-and-swap algorithms optimize tax-loss harvesting by systematically identifying underperforming assets and replacing them with similar securities to maintain portfolio diversification while realizing capital losses. These algorithms enhance tax deferral strategies by maximizing loss realization opportunities and minimizing wash-sale rule violations, ultimately improving after-tax portfolio returns.

Tax Deferral vs Tax-Loss Harvesting for portfolio planning. Infographic

moneydiff.com

moneydiff.com