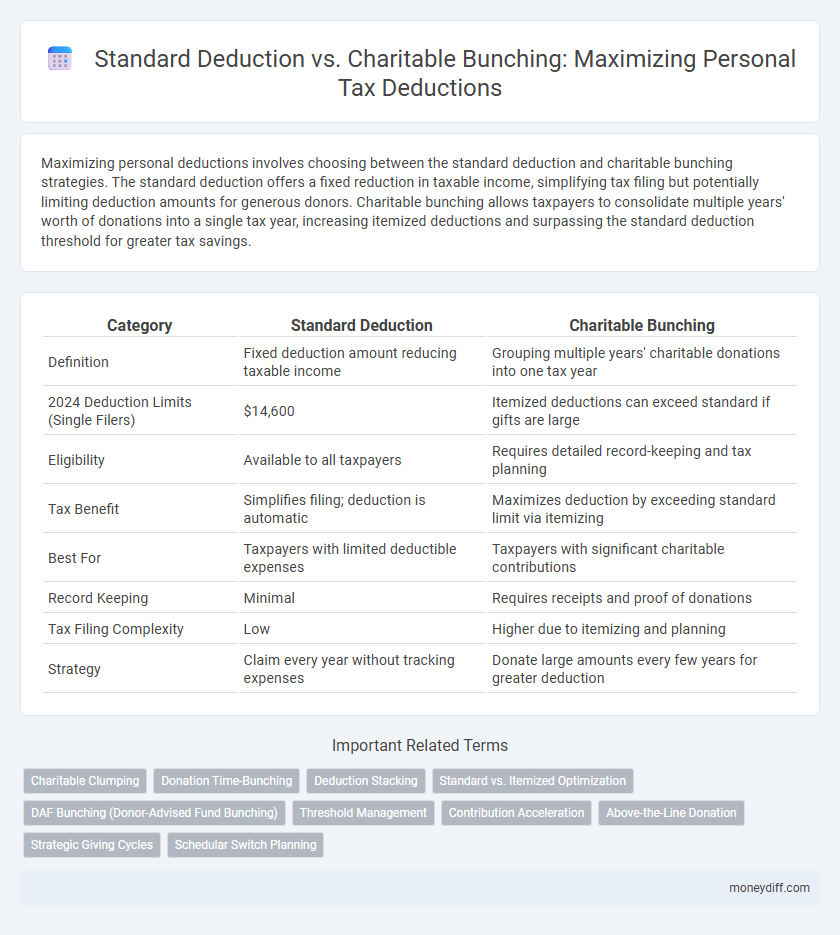

Maximizing personal deductions involves choosing between the standard deduction and charitable bunching strategies. The standard deduction offers a fixed reduction in taxable income, simplifying tax filing but potentially limiting deduction amounts for generous donors. Charitable bunching allows taxpayers to consolidate multiple years' worth of donations into a single tax year, increasing itemized deductions and surpassing the standard deduction threshold for greater tax savings.

Table of Comparison

| Category | Standard Deduction | Charitable Bunching |

|---|---|---|

| Definition | Fixed deduction amount reducing taxable income | Grouping multiple years' charitable donations into one tax year |

| 2024 Deduction Limits (Single Filers) | $14,600 | Itemized deductions can exceed standard if gifts are large |

| Eligibility | Available to all taxpayers | Requires detailed record-keeping and tax planning |

| Tax Benefit | Simplifies filing; deduction is automatic | Maximizes deduction by exceeding standard limit via itemizing |

| Best For | Taxpayers with limited deductible expenses | Taxpayers with significant charitable contributions |

| Record Keeping | Minimal | Requires receipts and proof of donations |

| Tax Filing Complexity | Low | Higher due to itemizing and planning |

| Strategy | Claim every year without tracking expenses | Donate large amounts every few years for greater deduction |

Understanding the Standard Deduction

The standard deduction simplifies tax filing by allowing a fixed deduction amount based on filing status, eliminating the need to itemize individual expenses. For 2024, the IRS sets the standard deduction at $13,850 for single filers and $27,700 for married couples filing jointly, providing a straightforward way to reduce taxable income. Understanding this baseline deduction helps taxpayers decide whether charitable bunching--grouping multiple years of donations into one tax year--offers greater tax benefits through itemized deductions.

What Is Charitable Bunching?

Charitable bunching is a tax strategy that involves consolidating multiple years' worth of charitable contributions into a single tax year to surpass the standard deduction threshold and maximize itemized deductions. This approach allows taxpayers to benefit from larger overall tax savings by alternating between itemizing deductions one year and taking the standard deduction the next. By carefully timing donations, taxpayers can reduce their taxable income more effectively than by spreading contributions evenly across multiple years.

Tax Benefits of the Standard Deduction

The standard deduction offers a fixed, straightforward reduction in taxable income, simplifying tax filing without the need for itemizing expenses. Its amount adjusts annually for inflation, currently providing significant tax relief--$13,850 for single filers and $27,700 for married couples filing jointly in 2024. Taxpayers who do not have qualifying itemized deductions exceeding the standard deduction maximize their tax benefits by opting for the standard deduction, avoiding the complexity and record-keeping required by charitable bunching strategies.

How Charitable Bunching Maximizes Deductions

Charitable bunching maximizes tax deductions by consolidating multiple years' worth of charitable contributions into a single tax year, allowing taxpayers to exceed the standard deduction threshold and itemize their deductions for a higher overall tax benefit. This strategy is particularly effective for taxpayers whose annual charitable donations fall just below the standard deduction, enabling them to cluster gifts and maximize deductible amounts in alternate years. By leveraging this approach, individuals can optimize their itemized deductions while still taking advantage of the increased standard deduction in non-bunching years.

Key Differences Between Standard Deduction and Bunching

Standard deduction provides a fixed reduction in taxable income, regardless of actual expenses, while charitable bunching involves timing multiple years' worth of donations into a single year to exceed the standard deduction threshold. Bunching maximizes itemized deductions by concentrating charitable contributions, allowing taxpayers to potentially lower tax liability more effectively than taking the standard deduction annually. Key differences include the predictability and simplicity of the standard deduction versus the strategic planning and record-keeping required for successful charitable bunching.

Who Should Consider Charitable Bunching?

Taxpayers who regularly donate to qualified charities and have itemized deductions close to the standard deduction threshold should consider charitable bunching to maximize tax benefits. By consolidating several years of charitable contributions into a single tax year, they can surpass the standard deduction limit and reduce taxable income more effectively. This strategy is particularly advantageous for those with high-value donations, mortgage interest, or medical expenses that, combined with charitable gifts, exceed the standard deduction amount.

Impact on Itemized Deductions

Choosing between the standard deduction and charitable bunching significantly impacts itemized deductions, often influencing overall tax savings for taxpayers. Charitable bunching consolidates multiple years of donations into a single tax year, increasing itemized deductions beyond the standard deduction threshold, thereby maximizing tax benefits. Taxpayers with substantial charitable contributions typically see greater value from itemizing using bunching strategies rather than claiming the standard deduction.

Practical Examples: Bunching vs Standard Deduction

Taxpayers facing the choice between standard deduction and charitable bunching often save more by grouping donations into a single tax year to exceed the standard deduction threshold. For example, a married couple filing jointly with a $27,700 standard deduction can maximize deductions by donating $30,000 in one year, itemizing that year and taking the standard deduction the next. This strategic bunching approach enhances tax savings compared to claiming the standard deduction annually without itemizing.

Tax Planning Strategies for Charitable Giving

Charitable bunching enables taxpayers to maximize itemized deductions by aggregating multiple years' donations into a single tax year, surpassing the standard deduction threshold and increasing overall tax savings. Standard deduction offers a fixed, no-itemization-required reduction of taxable income, but limits the ability to leverage specific deductions like charitable contributions for tax planning. Strategic tax planning with charitable bunching benefits high-income individuals aiming to reduce taxable income effectively while supporting philanthropic goals.

Choosing the Best Deduction Method for Your Finances

Choosing between the standard deduction and charitable bunching depends on your total deductible expenses and tax filing status. Taxpayers with significant charitable contributions exceeding the standard deduction threshold benefit from charitable bunching, which involves consolidating donations into a single tax year to maximize itemized deductions. Evaluating your annual expenses and projecting future contributions ensures optimal tax savings by selecting the method that reduces taxable income most effectively.

Related Important Terms

Charitable Clumping

Charitable bunching maximizes tax benefits by concentrating donations into a single tax year to exceed the standard deduction threshold, enabling itemized deductions on Schedule A. This strategy is particularly effective when annual itemized deductions, including charitable gifts, are just below the standard deduction limit, allowing taxpayers to alternate between standard and itemized deductions across multiple years.

Donation Time-Bunching

Donation time-bunching maximizes tax benefits by concentrating charitable contributions into a single tax year to exceed the standard deduction threshold, enabling taxpayers to itemize deductions rather than taking the standard deduction. This strategy leverages the higher deduction amounts in lump sums, increasing overall tax savings compared to spreading donations evenly across multiple years.

Deduction Stacking

Deduction stacking leverages charitable bunching by concentrating multiple years of donations into a single tax year, enabling taxpayers to exceed the standard deduction threshold and itemize deductions for greater tax savings. This strategy maximizes personal deductions by combining standard deduction benefits with strategically timed charitable contributions to optimize tax liabilities.

Standard vs. Itemized Optimization

Taxpayers must compare the standard deduction amount, which is $13,850 for single filers and $27,700 for married couples filing jointly in 2024, against the total value of itemized deductions, including charitable contributions. Charitable bunching involves concentrating donations into a single tax year to exceed the standard deduction threshold, allowing for greater tax savings through itemized deductions in that year while taking the standard deduction in other years for optimal tax efficiency.

DAF Bunching (Donor-Advised Fund Bunching)

Donor-Advised Fund (DAF) bunching maximizes tax benefits by consolidating charitable contributions into a single year to exceed the standard deduction threshold, allowing for a larger itemized deduction and potential tax savings. This strategy is particularly advantageous compared to taking the standard deduction annually, as it accelerates giving while optimizing personal deduction claims within IRS guidelines.

Threshold Management

Standard deduction simplifies tax filing by providing a fixed amount that reduces taxable income without itemizing expenses, suitable when total deductions fall below threshold limits. Charitable bunching strategically times donations to exceed itemization thresholds, maximizing tax benefits while managing deduction phases and Alternative Minimum Tax (AMT) impacts.

Contribution Acceleration

Contribution acceleration maximizes tax benefits by concentrating charitable donations into a single tax year, allowing taxpayers to exceed the standard deduction threshold for itemization. This strategy leverages lump-sum giving to enhance deductible amounts, reducing overall taxable income more effectively than spreading contributions annually.

Above-the-Line Donation

Above-the-line donations allow taxpayers to deduct charitable contributions directly from gross income, reducing adjusted gross income (AGI) regardless of whether they itemize deductions or claim the standard deduction. This strategy offers tax benefits in addition to standard deduction limits and can be combined with charitable bunching to maximize overall tax savings.

Strategic Giving Cycles

Strategic giving cycles enhance tax efficiency by aligning charitable contributions into specific years to maximize itemized deductions, often surpassing the standard deduction threshold. Taxpayers employing charitable bunching take advantage of higher deduction amounts in selected years, reducing taxable income more significantly than consistently claiming the standard deduction annually.

Schedular Switch Planning

Schedular switch planning leverages the timing of itemized deductions, such as charitable contributions, to exceed the standard deduction threshold, maximizing tax benefits by bunching donations into a single tax year. This strategy allows taxpayers to alternate between claiming the standard deduction and itemized deductions on Schedule A, optimizing overall tax liability based on individual financial activity.

Standard Deduction vs Charitable Bunching for Personal Deductions Infographic

moneydiff.com

moneydiff.com