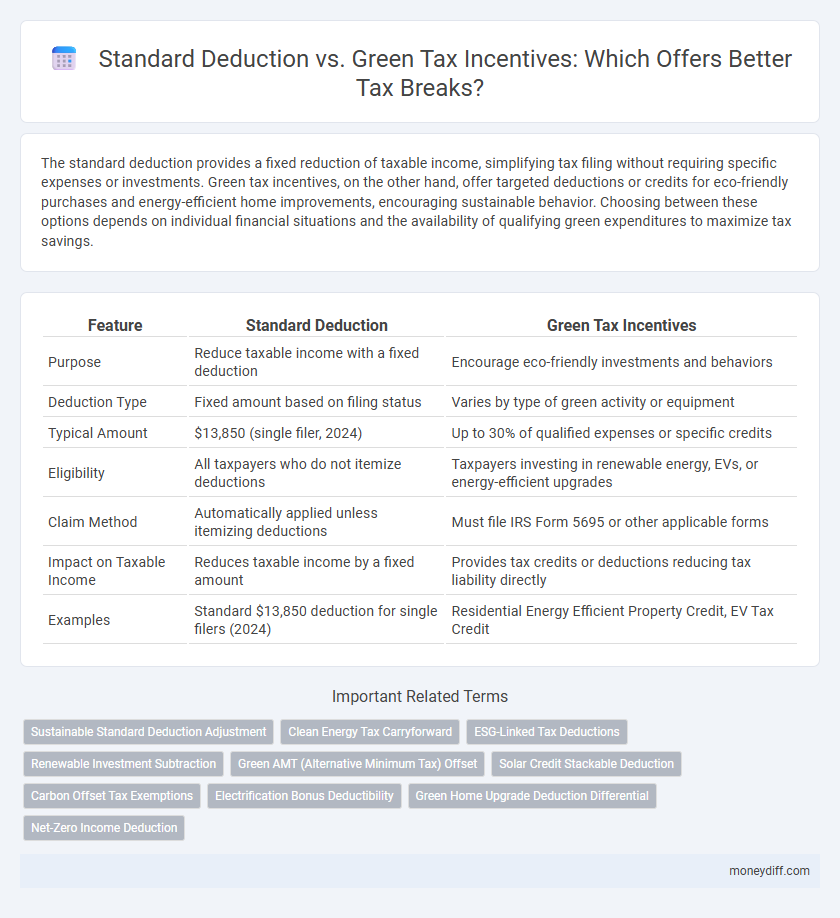

The standard deduction provides a fixed reduction of taxable income, simplifying tax filing without requiring specific expenses or investments. Green tax incentives, on the other hand, offer targeted deductions or credits for eco-friendly purchases and energy-efficient home improvements, encouraging sustainable behavior. Choosing between these options depends on individual financial situations and the availability of qualifying green expenditures to maximize tax savings.

Table of Comparison

| Feature | Standard Deduction | Green Tax Incentives |

|---|---|---|

| Purpose | Reduce taxable income with a fixed deduction | Encourage eco-friendly investments and behaviors |

| Deduction Type | Fixed amount based on filing status | Varies by type of green activity or equipment |

| Typical Amount | $13,850 (single filer, 2024) | Up to 30% of qualified expenses or specific credits |

| Eligibility | All taxpayers who do not itemize deductions | Taxpayers investing in renewable energy, EVs, or energy-efficient upgrades |

| Claim Method | Automatically applied unless itemizing deductions | Must file IRS Form 5695 or other applicable forms |

| Impact on Taxable Income | Reduces taxable income by a fixed amount | Provides tax credits or deductions reducing tax liability directly |

| Examples | Standard $13,850 deduction for single filers (2024) | Residential Energy Efficient Property Credit, EV Tax Credit |

Understanding the Standard Deduction: Basics and Benefits

The standard deduction simplifies tax filing by offering a fixed reduction in taxable income, eliminating the need for detailed expense tracking. Taxpayers who do not itemize deductions benefit from immediate tax relief, potentially lowering their overall tax liability. This deduction enhances accessibility and predictability in tax planning compared to variable green tax incentives tied to specific eco-friendly investments.

What Are Green Tax Incentives?

Green tax incentives are government-offered reductions or credits aimed at encouraging individuals and businesses to adopt environmentally friendly practices such as investing in renewable energy, energy-efficient appliances, or electric vehicles. These incentives directly lower tax liability by rewarding sustainable actions that reduce carbon footprints and promote conservation. Compared to the standard deduction, which provides a fixed reduction in taxable income without consideration of specific behaviors, green tax incentives strategically target eco-conscious expenditures to accelerate environmental benefits while also reducing overall tax burdens.

Eligibility Criteria: Standard Deduction vs Green Tax Credits

Standard deductions apply broadly to all taxpayers meeting basic filing requirements, regardless of specific expenses or investments. Green tax incentives require eligibility based on qualifying expenditures in environmentally friendly projects or energy-efficient improvements, verified through receipts and certification. Taxpayers must assess their eligibility carefully to maximize benefits, as standard deductions offer simplicity while green tax credits can provide targeted savings for sustainable investments.

Financial Impact: Which Tax Break Saves You More?

Evaluating the financial impact of the standard deduction versus green tax incentives reveals distinct advantages depending on taxpayer circumstances and spending habits. The standard deduction provides a fixed reduction in taxable income, offering predictable savings for most filers, whereas green tax incentives can yield larger savings by directly reducing tax liability based on specific qualifying eco-friendly investments like solar panels or electric vehicles. Taxpayers investing in renewable energy or sustainable home improvements often achieve greater overall financial benefits through green tax incentives compared to the standard deduction alone.

Environmental Benefits of Green Tax Incentives

Green tax incentives offer targeted environmental benefits by encouraging investments in renewable energy, energy-efficient appliances, and sustainable transportation, resulting in reduced carbon emissions and conservation of natural resources. Unlike the standard deduction, which provides a uniform reduction in taxable income, green tax incentives directly promote environmentally responsible behavior and help reduce a taxpayer's ecological footprint. These tax incentives play a crucial role in supporting government policies aimed at mitigating climate change and fostering sustainable economic growth.

Claiming the Standard Deduction: Step-by-Step Guide

Claiming the standard deduction simplifies tax filing by reducing taxable income without itemizing expenses, providing a fixed reduction based on filing status. Taxpayers should ensure they select the correct standard deduction amount for the tax year and accurately enter it on Form 1040 to maximize their tax savings. Unlike green tax incentives that require specific documentation of eco-friendly expenses, the standard deduction offers a straightforward, no-questions-asked approach to lowering tax liability.

How to Qualify for Green Energy Tax Credits

To qualify for green energy tax credits, taxpayers must invest in eligible renewable energy systems like solar panels, wind turbines, or geothermal heat pumps installed in their primary residence. The IRS requires proper documentation, including receipts and certification from manufacturers confirming that products meet energy efficiency standards. Meeting these criteria enables eligible taxpayers to claim significant tax credits, often surpassing the value of the standard deduction for those investing in sustainable home improvements.

Common Mistakes When Choosing Tax Breaks

Taxpayers often confuse the benefits of standard deduction with green tax incentives, leading to missed opportunities for larger savings. One common mistake is failing to evaluate eligibility criteria for green tax credits, which can exceed the flat rate advantage of the standard deduction. Overlooking documentation requirements for green tax incentives may result in denied claims and increased audit risks.

Scenario Comparison: Standard Deduction vs Renewable Energy Credits

Standard deduction offers a fixed reduction in taxable income, simplifying tax filing for most taxpayers without the need for specific expenses. Renewable energy credits, such as the Residential Energy Efficient Property Credit, provide targeted tax incentives that directly reduce tax liability based on qualified investments in solar, wind, or geothermal systems. Taxpayers with substantial renewable energy expenses benefit more from energy credits, while those with typical deductions often find the standard deduction more advantageous for maximizing tax breaks.

Maximizing Tax Savings with Both Standard and Green Incentives

Maximizing tax savings involves strategically combining the standard deduction with green tax incentives to reduce taxable income effectively. The standard deduction offers a fixed amount that lowers taxable income, while green tax incentives provide specific credits or deductions for environmentally friendly investments such as solar panels or electric vehicles. Utilizing both simultaneously can result in substantial tax breaks, optimizing overall savings by leveraging general and targeted benefits under current tax laws.

Related Important Terms

Sustainable Standard Deduction Adjustment

The Sustainable Standard Deduction Adjustment integrates environmentally-focused criteria into the traditional standard deduction, maximizing tax benefits for eco-friendly expenditures. This approach aligns tax breaks with green tax incentives, encouraging sustainable investments while simplifying compliance for individual taxpayers.

Clean Energy Tax Carryforward

Clean energy tax carryforwards allow taxpayers to apply unused credits from renewable energy investments to future tax years, enhancing long-term tax savings compared to the immediate but fixed benefit of the standard deduction. This mechanism maximizes financial incentives for clean energy adoption by reducing tax liabilities over multiple years, promoting sustained investment in green technologies.

ESG-Linked Tax Deductions

ESG-linked tax deductions provide targeted incentives for investments in environmentally sustainable projects, often yielding higher financial benefits than the standard deduction by directly reducing taxable income through verifiable green expenditures. Taxpayers leveraging green tax incentives can maximize tax breaks by aligning with government policies that promote renewable energy, carbon reduction, and sustainable business practices, enhancing both fiscal savings and corporate social responsibility metrics.

Renewable Investment Subtraction

The Renewable Investment Subtraction offers targeted tax breaks by allowing taxpayers to subtract specific expenses related to renewable energy investments from their taxable income, often exceeding the benefits of the standard deduction by directly incentivizing eco-friendly expenditures. Unlike the standard deduction's fixed amount, these green tax incentives promote sustainable development and reduce overall tax liability through strategic renewable energy investments.

Green AMT (Alternative Minimum Tax) Offset

Green AMT Offset allows taxpayers to reduce their Alternative Minimum Tax liability by claiming specific environmentally focused tax incentives, promoting investments in renewable energy and energy-efficient technologies. Standard Deduction provides a fixed reduction in taxable income but does not offer targeted benefits for sustainable initiatives or offset AMT liabilities related to green investments.

Solar Credit Stackable Deduction

The Standard Deduction offers a fixed reduction in taxable income, while Green Tax Incentives, such as the Solar Credit Stackable Deduction, provide targeted tax breaks that encourage renewable energy investments by allowing taxpayers to combine credits and deductions for solar panel installations. The Solar Credit Stackable Deduction maximizes savings by offsetting a portion of installation costs against federal income tax liability, delivering greater financial benefits than standard deductions alone.

Carbon Offset Tax Exemptions

Carbon offset tax exemptions provide targeted tax breaks for individuals and businesses investing in verified carbon reduction projects, offering potentially greater savings than the standard deduction's fixed amount. These green tax incentives effectively lower taxable income by incentivizing sustainable practices, enhancing financial benefits for environmentally conscious taxpayers beyond the standard deduction limits.

Electrification Bonus Deductibility

The Standard Deduction offers a fixed reduction on taxable income, simplifying tax breaks without requiring specific expenses, while Green Tax Incentives like the Electrification Bonus Deductibility provide targeted tax relief aimed at promoting eco-friendly investments by allowing taxpayers to deduct eligible costs linked to electric vehicle purchases or energy-efficient home upgrades. Utilizing the Electrification Bonus Deductibility can result in greater overall tax savings for individuals investing in sustainable technologies compared to the flat amount of the standard deduction.

Green Home Upgrade Deduction Differential

The Green Home Upgrade Deduction offers targeted tax breaks for energy-efficient renovations, often exceeding the standard deduction by incentivizing sustainable home improvements through higher credit limits and eligibility criteria. This differential encourages homeowners to invest in eco-friendly technologies, resulting in greater long-term tax savings compared to the flat-rate benefits of the standard deduction.

Net-Zero Income Deduction

The Net-Zero Income Deduction offers a more targeted tax break compared to the Standard Deduction by allowing taxpayers to reduce their taxable income based on investments in renewable energy and energy-efficient home improvements. This green tax incentive supports environmental sustainability while potentially yielding higher savings for individuals committed to achieving net-zero carbon footprints.

Standard Deduction vs Green Tax Incentives for tax breaks. Infographic

moneydiff.com

moneydiff.com