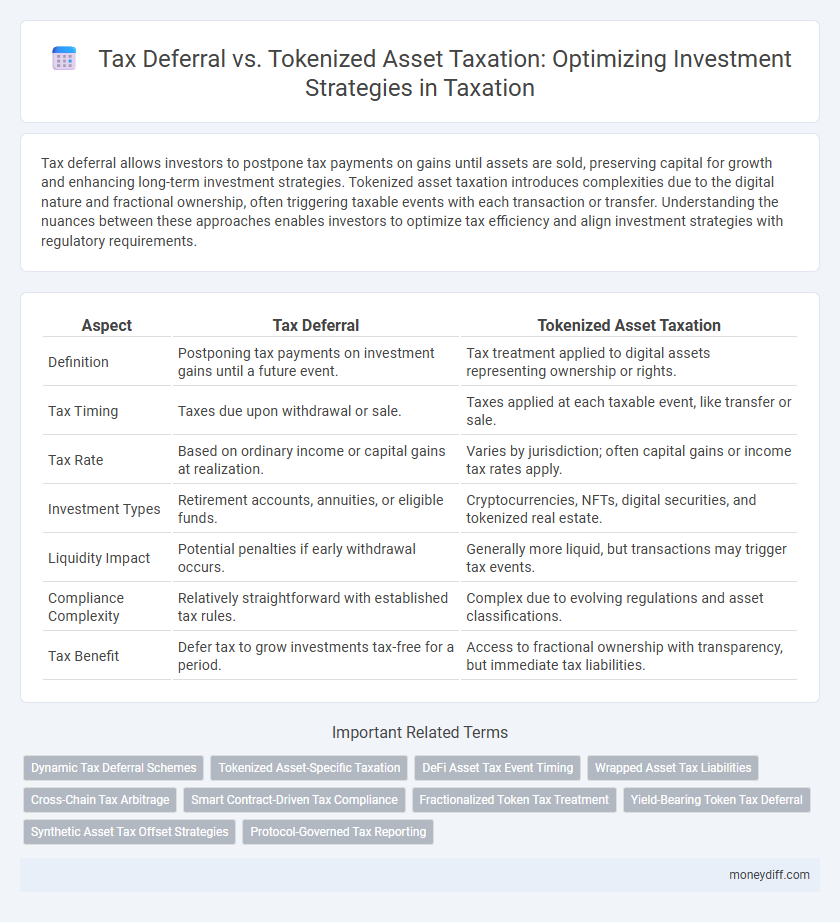

Tax deferral allows investors to postpone tax payments on gains until assets are sold, preserving capital for growth and enhancing long-term investment strategies. Tokenized asset taxation introduces complexities due to the digital nature and fractional ownership, often triggering taxable events with each transaction or transfer. Understanding the nuances between these approaches enables investors to optimize tax efficiency and align investment strategies with regulatory requirements.

Table of Comparison

| Aspect | Tax Deferral | Tokenized Asset Taxation |

|---|---|---|

| Definition | Postponing tax payments on investment gains until a future event. | Tax treatment applied to digital assets representing ownership or rights. |

| Tax Timing | Taxes due upon withdrawal or sale. | Taxes applied at each taxable event, like transfer or sale. |

| Tax Rate | Based on ordinary income or capital gains at realization. | Varies by jurisdiction; often capital gains or income tax rates apply. |

| Investment Types | Retirement accounts, annuities, or eligible funds. | Cryptocurrencies, NFTs, digital securities, and tokenized real estate. |

| Liquidity Impact | Potential penalties if early withdrawal occurs. | Generally more liquid, but transactions may trigger tax events. |

| Compliance Complexity | Relatively straightforward with established tax rules. | Complex due to evolving regulations and asset classifications. |

| Tax Benefit | Defer tax to grow investments tax-free for a period. | Access to fractional ownership with transparency, but immediate tax liabilities. |

Understanding Tax Deferral in Investment Strategies

Tax deferral in investment strategies allows investors to postpone tax liabilities on gains until the asset is sold, enhancing capital growth potential through reinvested earnings. Unlike tokenized asset taxation, which may trigger taxable events upon transactions or transfers of digital tokens, tax deferral maintains the original tax basis until liquidation. Understanding the rules governing tax deferral, such as 1031 exchanges for real estate or qualified retirement accounts, is crucial for optimizing after-tax returns.

Introduction to Tokenized Asset Taxation

Tokenized asset taxation introduces a regulatory framework where digital representations of assets are subject to capital gains tax upon transfer or sale, differing fundamentally from traditional tax deferral methods that postpone tax liabilities until realization events occur. This approach impacts investment strategies by requiring real-time tax compliance and may reduce the attractiveness of holding tokenized assets for long-term tax deferral benefits. Understanding the nuances of tokenized asset taxation is critical for investors seeking to optimize after-tax returns in blockchain-based investment portfolios.

Key Differences: Tax Deferral vs Tokenized Asset Taxation

Tax deferral allows investors to postpone paying taxes on gains until a later date, often providing the advantage of compounding returns without immediate tax impact. Tokenized asset taxation involves recognizing taxable events when digital tokens representing assets are traded or realized, subjecting investors to capital gains taxes at the point of transaction. Key differences include timing of tax liability--deferred in traditional tax deferral strategies versus immediate in tokenized asset transactions--and regulatory treatment, as tokenized assets often require adherence to evolving cryptocurrency tax guidelines.

Advantages of Tax Deferral for Investors

Tax deferral allows investors to postpone tax liabilities on investment gains, enhancing compound growth by keeping more capital actively invested over time. This strategy improves cash flow management and provides flexibility in timing tax payments to align with lower income periods or strategic financial goals. In contrast to tokenized asset taxation, tax deferral often results in significant long-term wealth accumulation due to delayed tax obligations on unrealized gains.

Tax Implications of Tokenized Assets

Tokenized asset taxation involves complex considerations, including capital gains recognition upon transfer or trade of digital tokens representing underlying assets. Tax deferral strategies delay the recognition of taxable events, potentially enhancing compounding returns, but tokenized assets often trigger immediate tax liabilities due to regulatory frameworks treating them as property. Investors must navigate varying jurisdictional rules, ensuring compliance to optimize after-tax investment outcomes in tokenized asset portfolios.

Efficiency and Compliance: Comparing Regulatory Frameworks

Tax deferral strategies allow investors to postpone tax liabilities, improving cash flow efficiency but requiring strict adherence to established tax codes to maintain compliance. Tokenized asset taxation involves digital assets governed by blockchain technology, demanding updated regulatory frameworks that address transparency and real-time reporting for compliance efficiency. Comparing these frameworks highlights that traditional tax deferral focuses on temporal tax benefits within existing laws, while tokenized assets necessitate innovative compliance mechanisms to match evolving investment technologies.

Impact on Portfolio Growth: Deferred Taxes vs Tokenized Assets

Tax deferral allows investors to postpone tax liabilities, enabling greater capital to remain invested and potentially compounding portfolio growth over time. Tokenized asset taxation, however, often triggers taxable events upon each transfer or sale, which may reduce net returns despite increased liquidity and fractional ownership. Understanding the timing and nature of tax obligations is critical in balancing immediate tax costs against long-term portfolio expansion.

Risks and Limitations of Tax Deferral Strategies

Tax deferral strategies can delay tax liabilities on investment gains, but they carry risks such as potential future tax rate increases and liquidity constraints when distributions are required. Investors face limitations including the possibility of penalties for early withdrawal and the uncertainty of changing tax laws impacting deferred benefits. Unlike tokenized asset taxation, which may offer more transparent, real-time tax reporting, tax deferral strategies can obscure the timing and amount of tax obligations, complicating long-term financial planning.

Opportunities in Tokenized Asset Investments

Tokenized asset investments offer unique tax deferral opportunities by allowing investors to delay capital gains taxes until the sale of digital tokens, enhancing cash flow management compared to traditional assets. The blockchain-based transparency of tokenized assets improves compliance and reduces tax reporting complexities, creating efficient tax strategies for investors. Leveraging tax deferral alongside tokenized assets can optimize returns by aligning investment timing with favorable tax regulations and market conditions.

Choosing the Right Tax Strategy for Long-Term Wealth

Tax deferral strategies allow investors to postpone tax liabilities on gains, maximizing capital growth potential through compounding without immediate tax erosion. Tokenized asset taxation introduces complexities due to the classification of digital assets, requiring careful consideration of capital gains rates, transaction frequency, and reporting standards. Selecting the right tax strategy hinges on evaluating long-term investment goals, asset liquidity, and regulatory landscapes to optimize after-tax wealth accumulation.

Related Important Terms

Dynamic Tax Deferral Schemes

Dynamic tax deferral schemes enable investors to postpone capital gains taxes by reinvesting profits into qualifying assets, enhancing liquidity and potential returns. Tokenized asset taxation, while offering fractional ownership and increased market access, often triggers immediate tax liabilities on transactions, reducing deferral opportunities inherent in traditional deferral strategies.

Tokenized Asset-Specific Taxation

Tokenized asset-specific taxation requires careful consideration of capital gains events triggered by fractional ownership transfers and smart contract executions, which differ fundamentally from traditional tax deferral mechanisms that postpone tax liabilities on unrealized gains. Understanding the distinct tax reporting obligations and valuation challenges associated with tokenized assets can optimize compliance and enhance strategic investment outcomes.

DeFi Asset Tax Event Timing

Tax deferral strategies in DeFi enable investors to postpone tax liabilities by holding or reinvesting assets, optimizing cash flow and compounding growth. Tokenized asset taxation triggers tax events upon transfers, sales, or swaps, requiring precise tracking of transaction timestamps to accurately determine capital gains or losses.

Wrapped Asset Tax Liabilities

Wrapped asset tax liabilities often complicate tax deferral strategies due to the layered ownership structure and realization events triggered by tokenized asset transfers. Investors must carefully navigate IRS guidelines on wrapped tokens to optimize tax efficiency and avoid unexpected immediate tax obligations on capital gains.

Cross-Chain Tax Arbitrage

Cross-chain tax arbitrage leverages discrepancies in tax deferral rules and tokenized asset taxation across multiple blockchain platforms to optimize investment returns. By strategically timing asset transfers and utilizing varied jurisdictional tax treatments, investors can minimize taxable events and enhance after-tax gains.

Smart Contract-Driven Tax Compliance

Smart contract-driven tax compliance automates tax deferral and tokenized asset taxation by encoding regulatory rules directly into blockchain transactions, ensuring accurate, real-time tax calculations and reporting. This technology streamlines investment strategies by reducing manual errors, accelerating tax processing, and enhancing transparency for decentralized finance participants.

Fractionalized Token Tax Treatment

Fractionalized token tax treatment often falls under property tax regulations, requiring investors to recognize gains or losses upon each fractional transaction, which may complicate tax deferral strategies typically available in traditional investments. Tax deferral strategies, such as 1031 exchanges, are generally not applicable to digital tokenized assets, making it essential for investors to carefully consider the timing and frequency of fractionalized token trades to optimize tax outcomes.

Yield-Bearing Token Tax Deferral

Yield-bearing tokens enable tax deferral by allowing investors to postpone capital gains taxes until the asset is sold, enhancing compounding returns within digital investment strategies. In contrast, tokenized asset taxation often triggers taxable events upon distribution of yields or token transfers, reducing the overall tax efficiency compared to deferral benefits.

Synthetic Asset Tax Offset Strategies

Synthetic asset tax offset strategies leverage tax deferral benefits by postponing taxable events until asset liquidation, optimizing investment growth. Tokenized asset taxation often triggers immediate taxable events during transactions, making synthetic assets more efficient for minimizing current tax liabilities and enhancing after-tax returns.

Protocol-Governed Tax Reporting

Protocol-governed tax reporting enhances transparency and accuracy in tax deferral and tokenized asset taxation by automating compliance through smart contracts and blockchain data integrity. This system minimizes errors and reduces audit risks, optimizing investment strategies by ensuring real-time tax event recognition and streamlined reporting.

Tax Deferral vs Tokenized Asset Taxation for investment strategies. Infographic

moneydiff.com

moneydiff.com