Income tax directly impacts cash flow by taxing earnings from assets, whereas wealth tax targets the net value of owned assets regardless of income generation. Effective asset management involves balancing these taxes to minimize overall liability and optimize portfolio growth. Strategic planning considers income streams and asset accumulation to ensure tax-efficient wealth preservation.

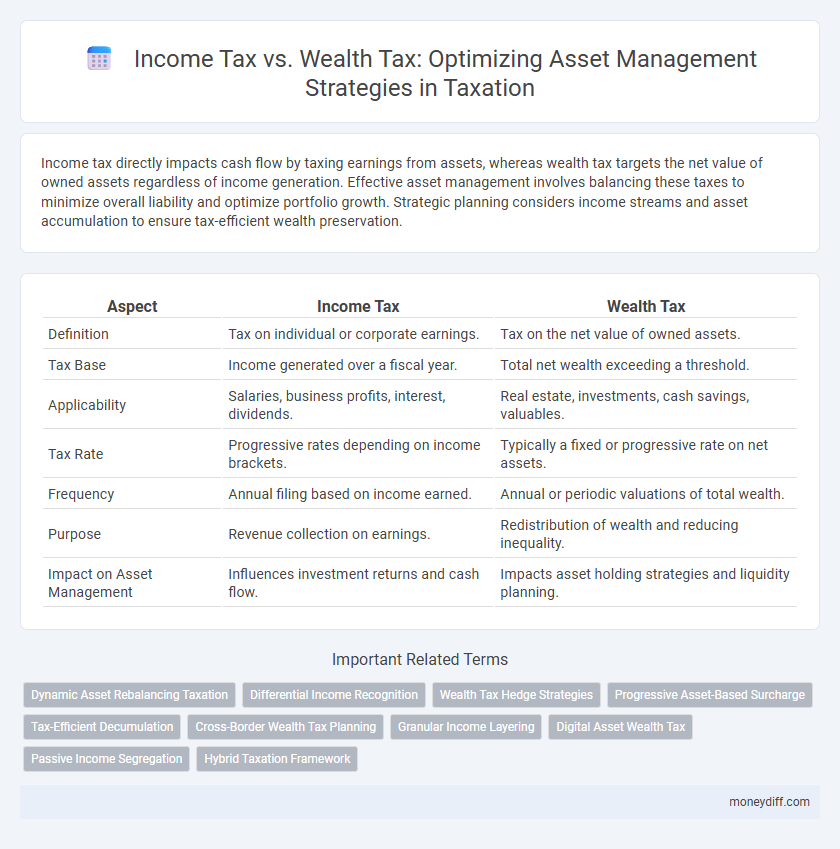

Table of Comparison

| Aspect | Income Tax | Wealth Tax |

|---|---|---|

| Definition | Tax on individual or corporate earnings. | Tax on the net value of owned assets. |

| Tax Base | Income generated over a fiscal year. | Total net wealth exceeding a threshold. |

| Applicability | Salaries, business profits, interest, dividends. | Real estate, investments, cash savings, valuables. |

| Tax Rate | Progressive rates depending on income brackets. | Typically a fixed or progressive rate on net assets. |

| Frequency | Annual filing based on income earned. | Annual or periodic valuations of total wealth. |

| Purpose | Revenue collection on earnings. | Redistribution of wealth and reducing inequality. |

| Impact on Asset Management | Influences investment returns and cash flow. | Impacts asset holding strategies and liquidity planning. |

Understanding Income Tax and Wealth Tax

Income tax is imposed on individual or corporate earnings, including wages, interest, dividends, and capital gains, directly affecting cash flow from income-generating assets. Wealth tax targets the net value of owned assets, such as real estate, investments, and savings, emphasizing total asset accumulation rather than income. Effective asset management requires balancing the impact of income tax on recurring returns with wealth tax liabilities on overall asset portfolios to optimize tax efficiency.

Key Differences Between Income Tax and Wealth Tax

Income tax is levied on the income earned by individuals or entities during a financial year, measured by profits, salaries, or other earnings, impacting cash flow and liquidity directly. Wealth tax, on the other hand, is assessed on the total value of owned assets such as property, investments, and savings, targeting net worth rather than annual income. The key differences lie in their tax bases, frequency of assessment, and implications for asset management strategies, with income tax influencing income generation and wealth tax emphasizing wealth preservation.

Impact of Income Tax on Asset Growth

Income tax directly reduces the annual returns on investments, limiting the compounding effect crucial for long-term asset growth. High income tax rates on dividends, interest, and capital gains can significantly erode the net gains, slowing portfolio accumulation over time. Understanding income tax implications enables asset managers to optimize tax-efficient investment strategies that maximize wealth accumulation potential.

How Wealth Tax Affects Asset Accumulation

Wealth tax directly reduces the net value of accumulated assets by imposing a recurrent levy on the total market value of holdings, thereby diminishing the capital available for reinvestment and growth. Unlike income tax, which targets earnings and can fluctuate annually, wealth tax applies consistently to asset stock, potentially discouraging long-term asset accumulation. This continuous depletion of wealth may lead asset managers to prioritize liquidity and tax-efficient strategies to mitigate the impact on portfolio growth.

Income Tax Strategies for Effective Asset Management

Income tax strategies play a critical role in effective asset management by optimizing taxable income and minimizing tax liabilities through deductions, credits, and deferrals. Utilizing tax-advantaged accounts such as IRAs and 401(k)s, along with strategic timing of income recognition, can enhance after-tax returns. Unlike wealth tax, which targets net asset value, income tax planning focuses on managing cash flow and investment income to sustain long-term financial growth.

Wealth Tax Minimization Techniques

Wealth tax minimization techniques in asset management prioritize strategies such as strategic asset allocation, use of tax-exempt investments, and timely valuation reviews to reduce taxable wealth. Implementing trusts, gifting assets, and investing in tax-efficient funds help lower the net asset value subject to wealth tax. Regularly reassessing portfolio composition ensures alignment with current tax laws, optimizing wealth preservation and minimizing tax liabilities.

Tax Implications for Investment Assets

Income tax impacts investment assets by taxing the returns generated, such as dividends, interest, and capital gains, which can reduce overall portfolio growth. Wealth tax applies to the net value of total investment assets, creating an ongoing cost irrespective of asset performance, potentially influencing asset allocation and investment strategies. Understanding these tax implications helps optimize asset management by balancing income generation with the preservation of wealth.

Comparing Tax Efficiency: Income vs Wealth

Income tax impacts asset management by taxing earnings generated each year, often reducing reinvestment potential due to immediate liabilities on dividends, interest, and capital gains. Wealth tax targets the total value of assets annually, potentially discouraging accumulation by imposing ongoing costs regardless of income flow or realized gains. Evaluating tax efficiency involves considering income tax's effect on cash flow and reinvestment opportunities against wealth tax's influence on long-term asset retention and growth strategies.

Planning Asset Allocation for Tax Optimization

Income tax impacts cash flow by taxing earnings and investment returns annually, influencing asset allocation towards tax-advantaged accounts and income-producing assets with lower tax rates. Wealth tax targets the net value of assets, prompting strategies to shift holdings into exempt or lower-valued categories to minimize annual tax liabilities. Effective planning balances income tax efficiency with wealth tax exposure, optimizing portfolio structure for long-term after-tax growth and preservation.

Choosing the Right Tax Approach for Long-term Wealth

Selecting the appropriate tax strategy is crucial for effective long-term wealth management, with income tax focusing on earnings like salaries and dividends, while wealth tax targets net asset value. Income tax planning allows for optimizing deductions and deferrals, enhancing cash flow and investment growth. Wealth tax considerations require structuring assets to minimize tax liabilities on holdings, preserving capital for future generations.

Related Important Terms

Dynamic Asset Rebalancing Taxation

Dynamic asset rebalancing in income tax regimes triggers taxable events upon realized gains, impacting portfolio returns through capital gains tax liabilities and adjustments in income brackets. Wealth tax, levied on net asset value regardless of liquidity events, offers tax predictability but may discourage asset accumulation, altering long-term asset allocation strategies in portfolio management.

Differential Income Recognition

Income tax applies to earned income and capital gains, requiring recognition based on realized profits during the tax year, while wealth tax targets the total value of assets held, often assessed annually regardless of income generation. This differential income recognition affects asset management strategies, emphasizing timing and realization of income to optimize tax liabilities under income tax but imposing ongoing valuation for wealth tax considerations.

Wealth Tax Hedge Strategies

Wealth tax hedge strategies involve legally minimizing taxable assets through trusts, family limited partnerships, and asset transfers to reduce net worth below taxable thresholds, preserving capital and optimizing asset management. Effective wealth tax planning includes leveraging exemptions, valuations discounts, and offshore holdings to shield assets from high wealth tax liabilities while complying with regulations.

Progressive Asset-Based Surcharge

The Progressive Asset-Based Surcharge applies a tiered tax rate on high-value assets, significantly impacting wealth tax calculations and shifting emphasis from income tax obligations to asset holdings. This surcharge incentivizes efficient asset management strategies by targeting accumulated wealth rather than annual income, influencing portfolio structuring and long-term tax planning.

Tax-Efficient Decumulation

Income tax impacts annual withdrawals from retirement accounts, influencing the timing and amount of distributions to minimize taxable income during decumulation. Wealth tax, levied on net assets, affects long-term asset retention strategies, prompting asset managers to balance portfolio growth with tax-efficient estate planning.

Cross-Border Wealth Tax Planning

Income tax impacts cash flow through annual earnings taxation, while wealth tax targets net asset value, requiring strategic cross-border structuring to minimize liabilities. Effective cross-border wealth tax planning integrates jurisdictional tax treaties, asset location optimization, and residency considerations to reduce exposure and enhance asset preservation.

Granular Income Layering

Granular income layering enhances asset management by targeting income tax liabilities through detailed tracking of diverse income sources, enabling precise tax planning and optimization. Wealth tax focuses on overall net asset value, but income tax strategies leveraging granular income layers provide more actionable insights for maximizing after-tax returns.

Digital Asset Wealth Tax

Income tax targets earnings from digital assets such as cryptocurrencies, while digital asset wealth tax applies levies on the total value of held assets, impacting long-term asset management strategies. Understanding the nuances between these taxes is crucial for optimizing portfolio growth and compliance in decentralized finance ecosystems.

Passive Income Segregation

Income tax applies to passive income generated from assets such as dividends, interest, and rental income, impacting asset management strategies by encouraging segregation of income streams to optimize tax liabilities. Wealth tax targets the net value of total assets owned, prompting asset managers to differentiate between income-producing assets and capital holdings to minimize overall tax exposure.

Hybrid Taxation Framework

A Hybrid Taxation Framework combines Income Tax and Wealth Tax principles to optimize asset management by balancing tax liabilities on earned income and accumulated wealth. This approach enhances fiscal equity and encourages strategic investment decisions by taxing income flows and net asset holdings simultaneously.

Income Tax vs Wealth Tax for asset management. Infographic

moneydiff.com

moneydiff.com