Income tax filing requires accurate reporting of all sources of income, including wages, interest, and capital gains, while crypto tax reporting specifically addresses transactions involving digital assets such as cryptocurrencies. Proper crypto tax reporting involves tracking buys, sells, exchanges, and mining activities to comply with tax regulations and avoid penalties. Failing to distinguish between general income tax filing and crypto-specific reporting can result in inaccurate annual returns and potential audits.

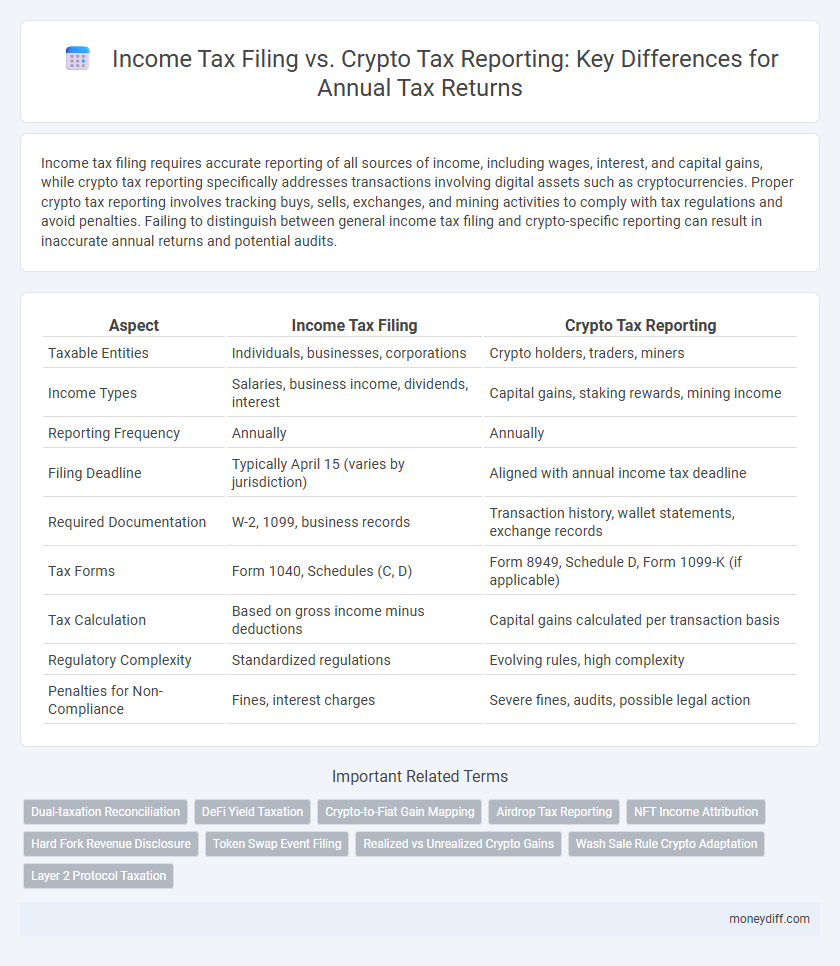

Table of Comparison

| Aspect | Income Tax Filing | Crypto Tax Reporting |

|---|---|---|

| Taxable Entities | Individuals, businesses, corporations | Crypto holders, traders, miners |

| Income Types | Salaries, business income, dividends, interest | Capital gains, staking rewards, mining income |

| Reporting Frequency | Annually | Annually |

| Filing Deadline | Typically April 15 (varies by jurisdiction) | Aligned with annual income tax deadline |

| Required Documentation | W-2, 1099, business records | Transaction history, wallet statements, exchange records |

| Tax Forms | Form 1040, Schedules (C, D) | Form 8949, Schedule D, Form 1099-K (if applicable) |

| Tax Calculation | Based on gross income minus deductions | Capital gains calculated per transaction basis |

| Regulatory Complexity | Standardized regulations | Evolving rules, high complexity |

| Penalties for Non-Compliance | Fines, interest charges | Severe fines, audits, possible legal action |

Introduction: Navigating Income Tax Filing vs Crypto Tax Reporting

Income tax filing requires accurate reporting of wages, investments, and other taxable income sources, while crypto tax reporting demands detailed records of blockchain transactions, including gains and losses from digital assets. Taxpayers must comply with IRS regulations by reporting cryptocurrency trades, mining income, and airdrops alongside traditional income sources to avoid penalties. Understanding distinct documentation requirements and leveraging specialized tax software can streamline accurate annual tax returns.

Understanding Traditional Income Tax Filing Requirements

Traditional income tax filing requires reporting all sources of taxable income, including wages, interest, dividends, and capital gains, using standardized forms like the IRS Form 1040. Taxpayers must maintain accurate records of earnings, deductions, and credits to ensure compliance and maximize refunds or minimize liabilities. Unlike crypto tax reporting, traditional income tax filing follows well-established regulations and deadlines that apply universally to individuals and businesses.

What Is Crypto Tax Reporting?

Crypto tax reporting involves documenting all cryptocurrency transactions, including purchases, sales, trades, and income received in digital assets, for accurate inclusion in annual tax returns. It requires tracking transaction dates, values in local currency, and calculating capital gains or losses to comply with tax regulations. Unlike traditional income tax filing, crypto tax reporting demands specialized knowledge of blockchain data and often uses software tools to ensure precision and transparency.

Key Differences Between Income and Crypto Tax Reporting

Income tax filing generally involves reporting wages, salaries, investments, and other traditional income sources with established forms like W-2s and 1099s, while crypto tax reporting requires detailing transactions such as trades, mining, or sales using blockchain records to calculate capital gains and losses. Unlike standard income reporting, cryptocurrency transactions often necessitate tracking each event's fair market value at the time of trade, adding complexity to tax compliance. Taxpayers must navigate IRS guidelines specific to digital assets, including treatment of crypto as property and the need for detailed transaction histories, making crypto tax reporting markedly different from conventional income tax filing.

Required Documentation for Income Tax and Crypto Tax Returns

For income tax filing, essential documentation includes W-2 forms, 1099 forms, investment income statements, and proof of deductions such as mortgage interest and charitable contributions. Crypto tax reporting requires detailed transaction records, including dates, amounts, transaction types, wallet addresses, and fair market value at the time of each trade or sale. Accurate and complete record-keeping for both income and cryptocurrency transactions is critical to ensure compliance and avoid penalties during annual tax returns.

Common Mistakes in Income vs Crypto Tax Filings

Common mistakes in income tax filing often include improper documentation of deductions and failure to report all sources of income, whereas crypto tax reporting errors typically involve incorrect valuation of digital assets and misunderstanding taxable events like trades or hard forks. Many taxpayers neglect the necessity to track transaction history accurately for cryptocurrencies, leading to underreporting or non-reporting of capital gains. Using specialized software for cryptocurrency tax calculations and maintaining detailed records can significantly reduce errors in annual returns.

Reporting Deadlines: Income Tax Versus Crypto Tax

Income tax filing deadlines typically fall on April 15th for individuals, while crypto tax reporting deadlines often align with the same annual tax return due date but may require additional documentation to accurately report gains and losses. Failure to meet these deadlines can result in penalties, making it essential to understand the nuances of both income tax and cryptocurrency reporting requirements. Taxpayers should keep detailed records of all crypto transactions throughout the year to ensure timely and accurate filing.

Tax Deductions and Exemptions: Income vs Crypto Activities

Income tax filing allows taxpayers to claim various deductions such as mortgage interest, charitable donations, and retirement contributions, which reduce taxable income significantly. In contrast, crypto tax reporting primarily focuses on capital gains and losses, with limited exemptions or deductions, often requiring detailed transaction records for accurate reporting. Understanding the distinctions between income-based deductions and cryptocurrency-specific tax rules is essential for maximizing tax efficiency and compliance during annual returns.

Legal Compliance and Penalties for Incorrect Tax Reporting

Income tax filing requires accurate reporting of all income sources, including cryptocurrency transactions, to ensure legal compliance with tax authorities. Failure to properly report crypto tax can lead to significant penalties, interest charges, and potential audits due to underreporting or misclassification of digital assets. Maintaining detailed records of crypto transactions and adhering to specific tax guidelines is essential to avoid non-compliance risks and costly enforcement actions.

Best Practices for Accurate Annual Tax Returns

Accurate annual tax returns require clear differentiation between income tax filing and crypto tax reporting, with meticulous documentation of all income sources and crypto transactions. Utilizing specialized tax software designed for cryptocurrency can ensure precise capital gains calculations and compliance with IRS guidelines. Maintaining detailed records of purchase dates, acquisition costs, and sale prices is essential for minimizing errors and avoiding penalties during tax audits.

Related Important Terms

Dual-taxation Reconciliation

Income tax filing requires accurate reporting of all sources of income, including wages and investments, while crypto tax reporting necessitates detailed documentation of transactions, gains, and losses due to fluctuating asset values. Effective dual-taxation reconciliation involves identifying overlapping taxable events and applying credits or deductions to prevent double taxation on the same income in both traditional and cryptocurrency categories.

DeFi Yield Taxation

Income tax filing requires accurate reporting of all income sources, including wages, dividends, and capital gains, while crypto tax reporting specifically addresses the complex regulation of DeFi yield earnings, which are often subject to capital gains and ordinary income tax depending on jurisdiction. DeFi yield taxation involves tracking transactions on decentralized platforms, where staking, lending, and liquidity provision generate taxable events that require meticulous record-keeping for compliance in annual returns.

Crypto-to-Fiat Gain Mapping

Income tax filing requires accurate reporting of all income sources, with crypto tax reporting specifically demanding precise mapping of crypto-to-fiat gains to comply with IRS guidelines on capital gains calculation. Failure to convert cryptocurrency transactions into their U.S. dollar equivalents can result in incorrect tax liability and potential penalties during annual returns submission.

Airdrop Tax Reporting

Income tax filing requires reporting all sources of income, including airdrops from cryptocurrency, which must be declared at their fair market value at the time of receipt to comply with tax regulations. Failure to accurately report airdrop income can result in penalties, making it essential to differentiate crypto tax reporting requirements from traditional income tax filings when preparing annual returns.

NFT Income Attribution

Income tax filing requires accurate reporting of all income sources, including NFT transactions, which must be attributed properly to avoid discrepancies in annual returns. Crypto tax reporting for NFTs demands detailed documentation to distinguish between capital gains and ordinary income, ensuring compliance with IRS guidelines for digital asset taxation.

Hard Fork Revenue Disclosure

Income tax filing requires detailed reporting of all revenue sources, including hard fork gains that are considered taxable income by the IRS and must be disclosed separately in annual returns. Accurate crypto tax reporting mandates itemizing hard fork income to ensure compliance with tax regulations and avoid penalties related to unreported digital asset transactions.

Token Swap Event Filing

Income tax filing requires detailed reporting of all income sources, while crypto tax reporting for annual returns necessitates specific documentation of token swap events, which are treated as taxable exchanges triggering capital gains or losses. Accurate token swap event filing involves calculating the fair market value at the time of the swap and reporting it as a disposal, ensuring compliance with IRS guidelines on cryptocurrency transactions.

Realized vs Unrealized Crypto Gains

Realized crypto gains occur when digital assets are sold or exchanged, triggering taxable events that must be reported on annual income tax filings, whereas unrealized gains represent the increase in value of held assets without a sale, generally not subject to tax until realized. Accurate crypto tax reporting requires distinguishing between these gains to ensure compliance with IRS regulations and avoid penalties during annual returns submission.

Wash Sale Rule Crypto Adaptation

Income tax filing for annual returns requires meticulous reporting of all cryptocurrency transactions, integrating the wash sale rule adaptation to prevent taxpayers from claiming losses on crypto sales followed by repurchases within 30 days. The IRS's evolving guidance on crypto wash sales emphasizes a stricter compliance framework, mandating detailed tracking to ensure accurate capital gains and losses reporting under federal tax regulations.

Layer 2 Protocol Taxation

Income tax filing for Layer 2 protocol transactions requires detailed reporting of gas fees and token swaps to comply with IRS regulations, as these affect capital gains calculations distinct from conventional asset reporting. Crypto tax reporting mandates tracing transfers on Layer 2 solutions like Optimism and Arbitrum to accurately capture taxable events, ensuring correct annual return submissions.

Income Tax Filing vs Crypto Tax Reporting for Annual Returns Infographic

moneydiff.com

moneydiff.com