Tax filing involves the manual submission of your annual returns with basic calculations and standard deductions, often leading to missed opportunities for savings. Automated tax optimization uses advanced algorithms to analyze your financial data, identify eligible credits, and maximize deductions, ensuring the lowest possible tax liability. This technology not only streamlines the tax preparation process but also enhances accuracy and potential refunds.

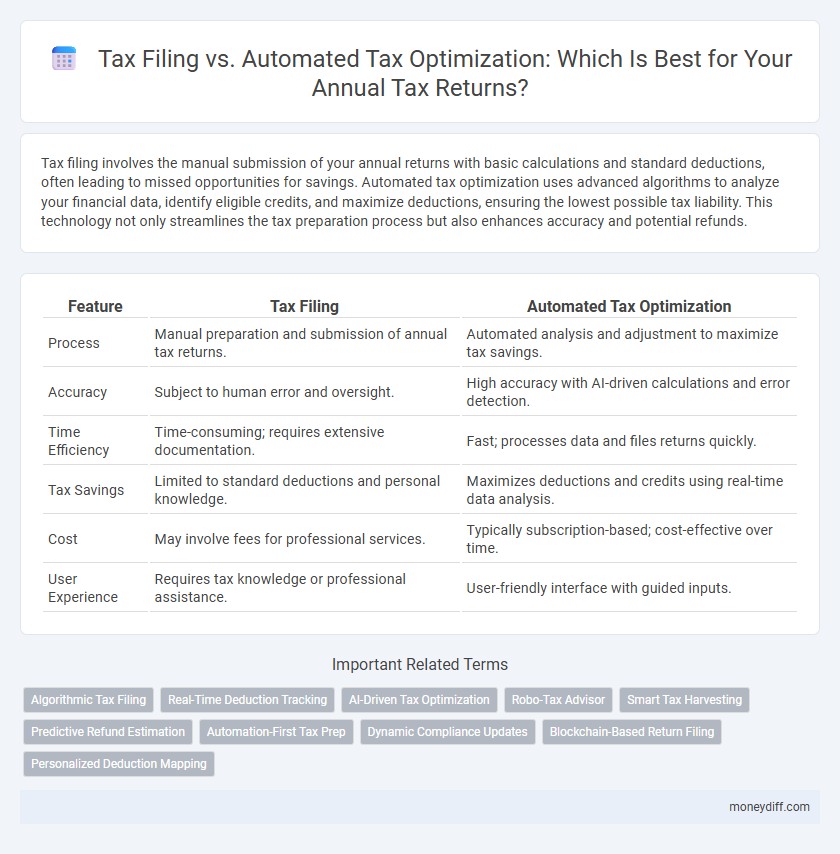

Table of Comparison

| Feature | Tax Filing | Automated Tax Optimization |

|---|---|---|

| Process | Manual preparation and submission of annual tax returns. | Automated analysis and adjustment to maximize tax savings. |

| Accuracy | Subject to human error and oversight. | High accuracy with AI-driven calculations and error detection. |

| Time Efficiency | Time-consuming; requires extensive documentation. | Fast; processes data and files returns quickly. |

| Tax Savings | Limited to standard deductions and personal knowledge. | Maximizes deductions and credits using real-time data analysis. |

| Cost | May involve fees for professional services. | Typically subscription-based; cost-effective over time. |

| User Experience | Requires tax knowledge or professional assistance. | User-friendly interface with guided inputs. |

Understanding Tax Filing: Traditional Approaches

Traditional tax filing involves manually preparing annual returns using physical forms or basic software, requiring thorough knowledge of tax laws and regulations to ensure accuracy and compliance. This approach often entails organizing income documents, deductions, and credits without the benefit of real-time optimization, potentially leading to missed savings opportunities. Understanding the limitations of manual filing emphasizes the growing need for advanced solutions that enhance precision and maximize tax benefits.

What Is Automated Tax Optimization?

Automated tax optimization leverages advanced algorithms and artificial intelligence to analyze financial data and identify the most effective strategies for minimizing tax liabilities on annual returns. Unlike traditional tax filing, which primarily focuses on compliance and reporting, automated optimization continuously evaluates deductions, credits, and tax rules to maximize refunds and reduce owed amounts. This technology-driven approach enhances accuracy, saves time, and ensures taxpayers capitalize on all available tax benefits while adhering to legal regulations.

Key Differences Between Tax Filing and Automated Tax Optimization

Tax filing involves the manual submission of annual tax returns based on reported income and deductions, adhering strictly to current tax laws and deadlines. Automated tax optimization uses advanced software algorithms to analyze financial data, identify tax-saving opportunities, and apply real-time strategies to minimize tax liabilities. Key differences include the level of automation, the ability to proactively reduce taxes, and enhanced accuracy and efficiency in automated systems compared to traditional tax filing methods.

Benefits of Traditional Tax Filing

Traditional tax filing offers greater control and accuracy in reporting annual returns, allowing taxpayers to manually review deductions, credits, and income details to ensure compliance with tax laws. This method provides a comprehensive understanding of personal financial data and maintains direct communication with tax authorities when clarification or audit support is required. Manual filing supports taxpayers in maximizing legitimate deductions through hands-on optimization tailored to unique financial situations.

Advantages of Automated Tax Optimization

Automated tax optimization leverages advanced algorithms to analyze financial data, ensuring maximum deductions and credits are applied accurately, which reduces the risk of human error in annual tax returns. This technology streamlines the filing process by continuously updating with the latest tax regulations, providing real-time optimization strategies tailored to individual or business financial profiles. Utilizing automated systems for tax filing enhances efficiency, saves time, and can significantly increase tax savings compared to traditional manual filing methods.

Potential Drawbacks: Manual Filing vs. Automation

Manual tax filing for annual returns often involves higher risks of human error, overlooked deductions, and increased time consumption, potentially leading to inaccurate submissions and penalties. Automated tax optimization tools streamline data processing and identify tax-saving opportunities, but they may lack customization for unique financial situations and depend heavily on software accuracy. Relying solely on automation could result in missed nuances of tax law changes or complex investment scenarios that require expert judgment.

Impact on Accuracy and Error Reduction

Automated tax optimization significantly enhances accuracy in annual returns by utilizing advanced algorithms to identify deductions and credits that manual filing often misses. This technology reduces human errors such as data entry mistakes and miscalculations, leading to more precise tax outcomes. Consequently, taxpayers experience fewer audits and penalties, ensuring compliant and optimized filings.

Efficiency and Time Savings: A Comparative Analysis

Automated tax optimization significantly enhances efficiency by leveraging algorithms to identify deductions and credits often missed in manual tax filing, reducing human error and accelerating the process. Tax filing manually involves substantial time investment to gather documents, calculate liabilities, and ensure compliance, whereas automated systems streamline data entry and offer real-time updates, effectively shortening the annual return cycle. This comparative analysis highlights that adopting automated solutions can lead to considerable time savings and optimized tax outcomes, making it a superior choice for individuals and businesses seeking to maximize efficiency during tax season.

Cost Comparison: Filing Methods That Save You Money

Automated tax optimization significantly reduces costs by minimizing human errors and maximizing available deductions, often resulting in higher returns compared to traditional tax filing. Manual tax filing can incur fees for professional services and potential penalties from incorrect submissions, increasing overall expenses. Choosing automated solutions leverages advanced algorithms to optimize tax benefits efficiently, offering a cost-effective alternative to conventional tax preparation methods.

Choosing the Right Tax Solution for Your Financial Goals

Selecting the appropriate tax solution depends on your financial goals and complexity of your tax situation. Tax filing services ensure compliance by accurately reporting income and deductions on annual returns, while automated tax optimization uses advanced algorithms to identify potential savings and credits tailored to your profile. Integrating automated optimization can maximize refunds and minimize tax liabilities, making it ideal for individuals seeking efficiency and personalized financial outcomes.

Related Important Terms

Algorithmic Tax Filing

Algorithmic tax filing leverages advanced machine learning models to analyze financial data, ensuring precise identification of deductions, credits, and tax obligations while minimizing errors commonly found in manual tax filing. Automated tax optimization enhances annual returns by continuously adapting algorithms to current tax laws, maximizing refunds, and reducing liabilities through real-time data integration and predictive analytics.

Real-Time Deduction Tracking

Real-time deduction tracking in automated tax optimization continuously monitors eligible expenses throughout the year, ensuring maximum tax savings by capturing deductions immediately as they occur. This proactive approach contrasts with traditional tax filing, which often relies on retrospective data collection that can miss timely opportunities to reduce taxable income.

AI-Driven Tax Optimization

AI-driven tax optimization leverages advanced algorithms and machine learning to identify deductions, credits, and strategic filing options that maximize tax savings beyond standard tax filing processes. Automated systems analyze vast financial data, ensuring compliance while optimizing tax outcomes by adapting to regulatory changes and personal financial nuances in annual returns.

Robo-Tax Advisor

Robo-Tax Advisors leverage artificial intelligence to streamline tax filing while optimizing deductions and credits automatically, ensuring maximum refund accuracy for annual returns. These platforms analyze extensive financial data and current tax laws to deliver personalized, data-driven tax optimization strategies beyond traditional manual filing methods.

Smart Tax Harvesting

Smart Tax Harvesting enhances annual tax filing by automatically identifying and realizing tax-loss opportunities to minimize taxable income, improving after-tax returns. This automated process outperforms traditional manual tax filing through real-time data analysis and optimized asset management strategies.

Predictive Refund Estimation

Tax filing relies on accurate data submission and compliance with regulatory deadlines, while automated tax optimization enhances annual returns through predictive refund estimation using AI algorithms. Predictive refund estimation analyzes historical tax data and real-time financial inputs to maximize refunds and identify potential deductions efficiently.

Automation-First Tax Prep

Automated tax optimization leverages AI algorithms to identify deductions and credits often missed in manual tax filing, significantly enhancing refund outcomes and compliance accuracy. This automation-first approach streamlines annual return preparation by minimizing human error and accelerating the submission process, making tax filings more efficient and strategically optimized.

Dynamic Compliance Updates

Automated tax optimization integrates dynamic compliance updates to ensure annual returns reflect the latest tax laws and regulations, minimizing errors and maximizing deductions. Traditional tax filing methods often lag in adapting to regulatory changes, increasing the risk of non-compliance and missed optimization opportunities.

Blockchain-Based Return Filing

Blockchain-based return filing enhances tax accuracy and security by leveraging decentralized ledgers that reduce errors and fraud in annual tax returns. Automated tax optimization integrated with blockchain technology ensures real-time data verification and maximizes deductions through smart contracts, streamlining the entire tax filing process.

Personalized Deduction Mapping

Personalized Deduction Mapping in automated tax optimization analyzes individual financial data to identify all eligible deductions, surpassing traditional tax filing methods that often rely on standard deductions and manual input. This tailored approach maximizes annual return savings by leveraging precise tax codes and real-time updates, ensuring compliance and enhanced refund accuracy.

Tax Filing vs Automated Tax Optimization for annual returns. Infographic

moneydiff.com

moneydiff.com