Traditional tax planning for investment income typically involves strategies such as tax-loss harvesting, utilizing tax-advantaged accounts, and timing asset sales to minimize capital gains taxes. Crypto tax planning requires specialized knowledge of blockchain transactions, accurate record-keeping of every trade, and awareness of complex regulations around crypto-to-crypto exchanges, staking rewards, and airdrops. Investors must consider the unique tax treatment of cryptocurrencies to optimize their overall tax liability and avoid potential penalties.

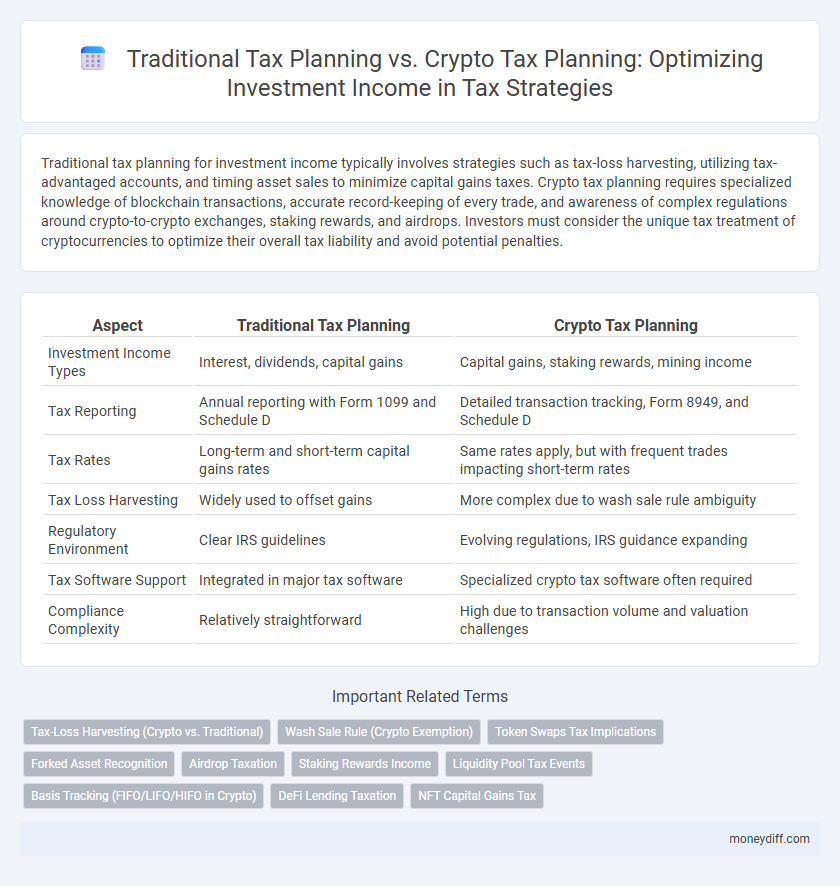

Table of Comparison

| Aspect | Traditional Tax Planning | Crypto Tax Planning |

|---|---|---|

| Investment Income Types | Interest, dividends, capital gains | Capital gains, staking rewards, mining income |

| Tax Reporting | Annual reporting with Form 1099 and Schedule D | Detailed transaction tracking, Form 8949, and Schedule D |

| Tax Rates | Long-term and short-term capital gains rates | Same rates apply, but with frequent trades impacting short-term rates |

| Tax Loss Harvesting | Widely used to offset gains | More complex due to wash sale rule ambiguity |

| Regulatory Environment | Clear IRS guidelines | Evolving regulations, IRS guidance expanding |

| Tax Software Support | Integrated in major tax software | Specialized crypto tax software often required |

| Compliance Complexity | Relatively straightforward | High due to transaction volume and valuation challenges |

Introduction to Tax Planning: Traditional vs Crypto

Traditional tax planning for investment income relies on established frameworks like capital gains tax, dividend tax, and tax-advantaged accounts to optimize returns and minimize liabilities. Crypto tax planning introduces complexity due to fluctuating regulations, varying classifications of digital assets, and the need to track transactions for taxable events such as trading, staking, or mining. Investors must adopt tailored strategies that account for both traditional principles and emerging crypto-specific rules to ensure accurate reporting and maximize after-tax income.

Key Differences in Income Recognition

Traditional tax planning recognizes investment income primarily through realized gains, dividends, and interest based on established tax codes with fixed reporting periods. Crypto tax planning requires tracking taxable events like token trades, staking rewards, and airdrops, which often involve complex valuation methods due to price volatility and lack of standardized reporting. The key difference lies in the dynamic nature of crypto income recognition, necessitating advanced tracking tools and real-time data to ensure compliance and accurate tax reporting.

Reporting Requirements for Traditional vs Crypto Investments

Traditional tax planning for investment income typically involves reporting dividends, interest, and capital gains on IRS Form 8949 and Schedule D, with well-established guidelines and documentation standards. Crypto tax planning requires detailed tracking of each transaction, including trades, conversions, and wallet-to-wallet transfers, using IRS Form 8949 alongside newer guidance for reporting digital asset gains and losses. Failure to comply with stringent reporting requirements for cryptocurrencies can result in audits and penalties due to the IRS's increased focus on digital asset compliance.

Tax Treatment of Capital Gains: Stocks vs Cryptocurrencies

Capital gains from stocks are typically subject to well-established tax rates, including long-term and short-term classifications based on holding periods, with long-term capital gains often taxed at preferential rates. Cryptocurrency gains are treated as property by the IRS, resulting in capital gains tax obligations similar to stocks, but complexities arise due to frequent trades, forks, and airdrops requiring meticulous record-keeping. Investors must carefully track acquisition dates and transaction details for cryptocurrencies to accurately calculate taxable gains and avoid penalties, unlike the generally straightforward reporting process for stock investments.

Record-Keeping Challenges and Solutions

Traditional tax planning relies on standardized financial statements and consistent reporting from brokers, simplifying record-keeping for investment income. Crypto tax planning faces complex challenges due to diverse transaction types, frequent trades, and decentralized platforms, requiring specialized software to accurately track cost basis and transaction history. Employing blockchain analytics tools and maintaining detailed transaction logs help investors comply with tax regulations and minimize audit risks.

Tax-Loss Harvesting Strategies in Both Domains

Tax-loss harvesting in traditional tax planning involves selling depreciated stocks or assets to offset capital gains, reducing taxable income. In crypto tax planning, investors apply similar strategies by selling digital currencies at a loss to balance gains from profitable trades, while navigating complex regulations and varying holding periods. Both domains require meticulous record-keeping and timely transaction execution to maximize tax deductions and optimize investment income.

International Tax Compliance: Traditional Assets vs Digital Assets

International tax compliance for traditional investment income relies on established frameworks such as FATCA and CRS, facilitating transparent reporting and withholding across jurisdictions. In contrast, crypto tax planning demands navigating evolving regulatory environments with inconsistent global standards and tracking decentralized digital assets across multiple wallets and exchanges. This complexity necessitates advanced tools and expertise to ensure accurate reporting, prevent double taxation, and maintain compliance with emerging international crypto tax regulations.

Risk of Audits and Regulatory Scrutiny

Traditional tax planning for investment income typically involves well-established guidelines and lower risks of audits due to clear regulatory frameworks, whereas crypto tax planning faces heightened audit risks stemming from evolving regulations and increased governmental focus on digital assets. Crypto transactions often lack standardized reporting mechanisms, increasing the potential for discrepancies and triggering regulatory scrutiny. Proper documentation and adherence to current crypto tax laws are crucial to mitigate the elevated risk of audits in cryptocurrency investments.

Tax Software and Tools for Each Investment Type

Traditional tax planning relies heavily on established tax software like TurboTax and H&R Block, which offer tailored modules for reporting dividends, interest, and capital gains from stocks and bonds. Crypto tax planning requires specialized tools such as CoinTracker, Koinly, or CryptoTrader.Tax that can import blockchain transactions, calculate cost basis using FIFO or LIFO methods, and generate IRS-compliant tax reports. These dedicated crypto tax solutions help investors navigate complex issues like staking rewards, hard forks, and Airdrops, which are not supported by conventional tax software.

Future Trends in Tax Planning for Investors

Future trends in tax planning for investors highlight the increasing integration of blockchain analytics and AI-driven software to optimize both traditional and crypto investment income strategies. Regulatory frameworks are evolving rapidly, prompting investors to adopt proactive compliance tools that ensure accurate reporting and minimize liabilities. Emphasis on real-time tax tracking and automated optimization models will dominate, transforming how investment portfolios are managed for tax efficiency.

Related Important Terms

Tax-Loss Harvesting (Crypto vs. Traditional)

Tax-loss harvesting in traditional investment portfolios allows investors to offset capital gains with realized losses by selling depreciated assets, typically providing tax benefits within established securities regulations. In crypto tax planning, tax-loss harvesting involves navigating specific IRS guidelines for digital assets, where the absence of wash-sale rules enables more flexible sale and repurchase strategies to maximize tax efficiency on investment income.

Wash Sale Rule (Crypto Exemption)

Traditional tax planning for investment income often involves navigating the wash sale rule, which disallows claiming a loss on a security repurchased within 30 days, whereas crypto tax planning benefits from the current IRS stance that exempts cryptocurrencies from the wash sale rule, allowing investors to realize losses and immediately repurchase digital assets for strategic tax advantages. This exemption provides crypto investors with enhanced flexibility to optimize capital gains and offset taxable income more effectively compared to traditional securities.

Token Swaps Tax Implications

Traditional tax planning for investment income typically involves strategies such as tax-loss harvesting and capital gains deferral, focusing on stocks, bonds, and mutual funds, whereas crypto tax planning requires understanding the unique tax implications of digital assets, especially token swaps. Token swaps are often treated as taxable events by the IRS, triggering capital gains or losses at the time of exchange, making accurate record-keeping essential to comply with cryptocurrency tax regulations.

Forked Asset Recognition

Traditional tax planning recognizes investment income based on realized gains and losses from standard asset sales, while crypto tax planning requires specific attention to forked asset recognition, where hard forks create new tokens considered taxable events. Properly identifying and reporting these forked assets is crucial to avoid unexpected tax liabilities and ensure compliance with IRS guidelines on cryptocurrency transactions.

Airdrop Taxation

Traditional tax planning for investment income typically involves reporting dividends, interest, and capital gains according to IRS guidelines, while crypto tax planning must address unique scenarios like airdrop taxation, where received tokens are considered taxable income at fair market value upon receipt. Ignoring airdrop tax obligations can lead to significant IRS penalties, requiring investors to carefully track and report these digital asset transfers for accurate tax compliance.

Staking Rewards Income

Traditional tax planning for investment income typically involves strategies to minimize capital gains and dividend taxes, while crypto tax planning must also address the unique challenges of staking rewards income, which is often treated as ordinary income and subject to specific reporting requirements. Accurate tracking and valuation of staking rewards at the time of receipt are essential to comply with tax regulations and avoid penalties, making specialized crypto tax software and expert advice critical for investors.

Liquidity Pool Tax Events

Traditional tax planning for investment income typically involves reporting dividends and capital gains with clear taxable events, whereas crypto tax planning must account for liquidity pool tax events such as token swaps, liquidity provision, and impermanent loss, which trigger taxable realized gains or losses. Investors providing liquidity in decentralized finance (DeFi) protocols face complex tax implications requiring meticulous tracking of each transaction's fair market value and potential taxable impact under IRS guidance.

Basis Tracking (FIFO/LIFO/HIFO in Crypto)

Traditional tax planning for investment income typically relies on established cost basis tracking methods like FIFO (First-In, First-Out) to calculate gains, whereas crypto tax planning demands more complex strategies including LIFO (Last-In, First-Out) and HIFO (Highest-In, First-Out) due to the volatile and frequent nature of cryptocurrency transactions. Accurate basis tracking in crypto not only minimizes taxable gains but also ensures compliance with IRS regulations amidst the unique challenges of digital asset accounting.

DeFi Lending Taxation

Traditional tax planning for investment income typically involves reporting interest, dividends, and capital gains with established IRS guidelines, while crypto tax planning, especially for DeFi lending, requires tracking complex transactions, including token swaps, staking rewards, and smart contract interactions that generate taxable events. DeFi lending taxation demands meticulous record-keeping of loan interest earned, the fair market value at the time of receipt, and potential capital gains or losses from collateral liquidation, which are not addressed in conventional tax frameworks.

NFT Capital Gains Tax

Traditional tax planning for investment income typically involves strategies to defer or reduce capital gains tax through mechanisms like tax-loss harvesting and retirement accounts, whereas crypto tax planning must address the unique challenges of NFT capital gains tax, including calculating fair market value at the time of each transaction and reporting gains from NFT sales or trades as taxable events under IRS guidelines. Accurate record-keeping and understanding the specific IRS rules for NFTs, such as recognizing taxable events when NFTs are sold, transferred, or used in decentralized finance, are critical to optimizing tax outcomes in crypto investments.

Traditional Tax Planning vs Crypto Tax Planning for investment income. Infographic

moneydiff.com

moneydiff.com