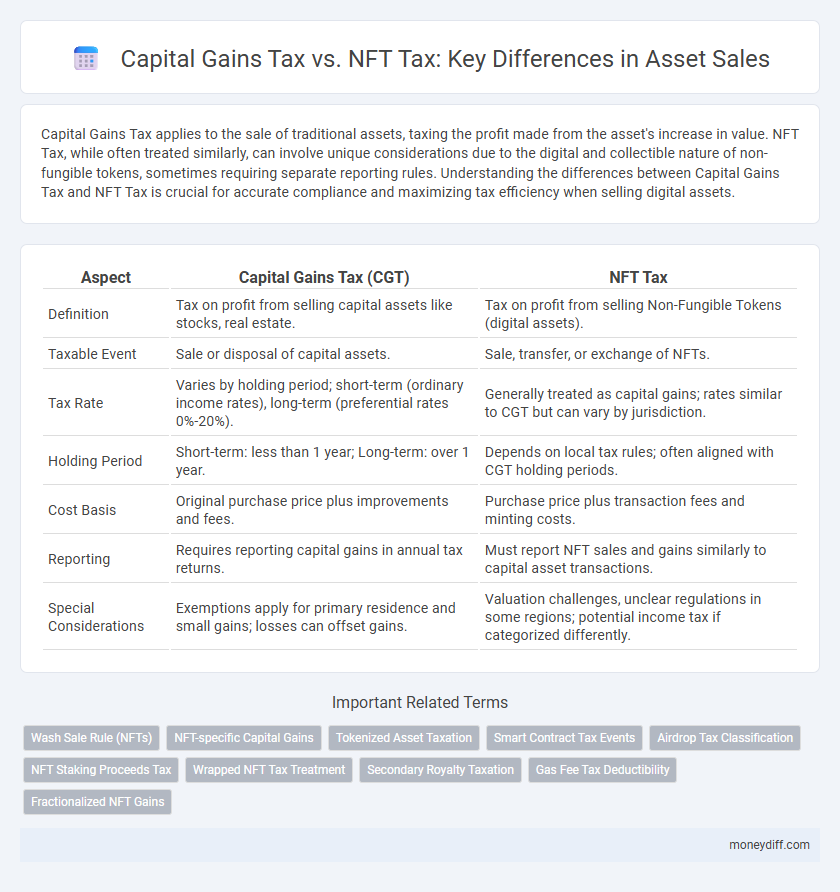

Capital Gains Tax applies to the sale of traditional assets, taxing the profit made from the asset's increase in value. NFT Tax, while often treated similarly, can involve unique considerations due to the digital and collectible nature of non-fungible tokens, sometimes requiring separate reporting rules. Understanding the differences between Capital Gains Tax and NFT Tax is crucial for accurate compliance and maximizing tax efficiency when selling digital assets.

Table of Comparison

| Aspect | Capital Gains Tax (CGT) | NFT Tax |

|---|---|---|

| Definition | Tax on profit from selling capital assets like stocks, real estate. | Tax on profit from selling Non-Fungible Tokens (digital assets). |

| Taxable Event | Sale or disposal of capital assets. | Sale, transfer, or exchange of NFTs. |

| Tax Rate | Varies by holding period; short-term (ordinary income rates), long-term (preferential rates 0%-20%). | Generally treated as capital gains; rates similar to CGT but can vary by jurisdiction. |

| Holding Period | Short-term: less than 1 year; Long-term: over 1 year. | Depends on local tax rules; often aligned with CGT holding periods. |

| Cost Basis | Original purchase price plus improvements and fees. | Purchase price plus transaction fees and minting costs. |

| Reporting | Requires reporting capital gains in annual tax returns. | Must report NFT sales and gains similarly to capital asset transactions. |

| Special Considerations | Exemptions apply for primary residence and small gains; losses can offset gains. | Valuation challenges, unclear regulations in some regions; potential income tax if categorized differently. |

Understanding Capital Gains Tax: Basics and Application

Capital Gains Tax (CGT) applies to the profit earned from selling assets such as stocks, real estate, and NFTs, calculated as the difference between the sale price and the asset's original purchase price. NFT transactions are treated similarly under CGT rules, meaning profits from selling digital collectibles are taxable events subject to specific reporting requirements. Understanding calculation methods, holding periods, and applicable tax rates is essential for accurate compliance in both traditional asset sales and NFT trades.

NFT Taxation: How Digital Assets Are Taxed

NFT taxation classifies digital assets as property, subjecting them to capital gains tax when sold or exchanged. The taxable gain is calculated based on the difference between the NFT's purchase price and its selling price, similar to traditional asset sales. Accurate record-keeping and reporting are essential for compliance with IRS guidelines on virtual asset transactions.

Key Differences Between Capital Gains Tax and NFT Tax

Capital Gains Tax applies to the profit realized from selling traditional assets like stocks, real estate, or collectibles, calculated based on the difference between the asset's purchase price and sale price. NFT Tax, a more specialized form of capital gains taxation, targets digital assets such as non-fungible tokens, with valuation complexities tied to blockchain transactions and market volatility. Key differences lie in the asset type, valuation methods, and regulatory treatment, with NFTs often requiring detailed tracking of token provenance and marketplace fees for accurate tax reporting.

Legal Definitions: What Qualifies as an Asset or NFT

Capital gains tax applies to the sale of assets defined legally as property, including stocks, real estate, and digital assets like NFTs, which are classified as unique cryptographic tokens representing ownership of digital or physical items. NFTs qualify as assets under tax law when they convey exclusive rights or economic benefit to the holder, making their sale subject to capital gains tax based on the difference between purchase price and sale proceeds. Understanding the legal definitions is crucial for accurate tax reporting, as misclassification of NFTs or assets can lead to penalties or audits by tax authorities.

Reporting Asset Sales: Required Documentation

Reporting asset sales for Capital Gains Tax requires detailed documentation including purchase and sale dates, acquisition costs, and sale proceeds to accurately calculate gains or losses. For NFT tax reporting, taxpayers must provide transaction records, blockchain wallet addresses, and proof of ownership transfers to validate the digital asset sale. Maintaining clear records ensures compliance with IRS regulations and supports accurate tax filings for both traditional assets and NFTs.

Calculating Tax Liability for Capital Gains

Calculating tax liability for capital gains requires determining the difference between the asset's sale price and its adjusted basis, factoring in costs of acquisition and improvements. For NFTs, tax treatment aligns with property sales, where capital gains tax applies on profits from selling the digital asset, classified as a capital asset. Accurate record-keeping of purchase dates, sale dates, and transaction values is essential for correctly reporting gains and calculating the applicable short-term or long-term capital gains tax rates.

Calculating Tax Liability for NFT Sales

Calculating tax liability for NFT sales requires distinguishing between capital gains tax rules and NFT-specific regulations, as NFTs are treated as property under IRS guidelines. The taxable event occurs when an NFT is sold or exchanged, with gains calculated by subtracting the asset's cost basis from the sale price. Holding period plays a crucial role in determining whether short-term or long-term capital gains tax rates apply, affecting the overall tax owed on NFT transactions.

Exemptions and Thresholds: Traditional vs. Digital Assets

Capital Gains Tax applies to traditional asset sales with exemptions such as the annual $12,950 exclusion for individuals and specific thresholds for retirement accounts. NFT Tax regulations are evolving, typically treating digital assets as property with gains subject to taxable events, though some jurisdictions offer exemptions below a threshold, often around $600. Understanding these thresholds and exemptions is crucial for accurate tax reporting on both traditional and digital asset transactions.

Tax Planning Strategies for NFT and Asset Sellers

Capital gains tax applies to profits from the sale of traditional assets, while NFT tax considerations involve the unique classification of digital assets and potential valuation challenges. Effective tax planning strategies for NFT and asset sellers include accurate record-keeping, understanding holding periods for long-term capital gains rates, and consulting tax experts to navigate evolving regulations. Leveraging tax-loss harvesting and timing asset sales can optimize tax liabilities and maximize after-tax returns.

Common Pitfalls and How to Avoid Tax Issues

Capital Gains Tax on traditional asset sales often triggers pitfalls such as misreporting the asset's cost basis and failing to account for holding periods, leading to inaccurate tax liabilities. NFT transactions complicate tax reporting due to valuation challenges and the frequent lack of clarity on taxable events, increasing the risk of audit and penalties. Maintaining detailed transaction records, using robust valuation methods, and consulting tax professionals specialized in digital assets enable taxpayers to avoid common tax issues and ensure compliance.

Related Important Terms

Wash Sale Rule (NFTs)

Capital Gains Tax applies to the profit from selling traditional assets, but the Wash Sale Rule, which disallows claiming a loss if the same or substantially identical asset is repurchased within 30 days, is not yet firmly established for NFTs due to their unique blockchain-based nature. NFT transactions must be closely monitored as evolving regulations may soon address wash sale implications, impacting how losses and gains are reported for tax purposes.

NFT-specific Capital Gains

Capital Gains Tax on NFTs applies to profits from the sale of digital assets, with tax rates depending on the holding period and individual income brackets. Unlike traditional assets, NFTs require detailed record-keeping of transaction dates, purchase prices, and selling prices to accurately calculate the taxable capital gain.

Tokenized Asset Taxation

Capital gains tax on tokenized assets typically applies to the profit realized from the sale of NFTs, calculated as the difference between the selling price and the original purchase price. Tax authorities increasingly classify NFTs as digital assets subject to capital gains tax, requiring detailed record-keeping of transaction dates, costs, and sales proceeds to ensure accurate reporting and compliance.

Smart Contract Tax Events

Smart contract tax events automate the reporting of capital gains tax liabilities by accurately recording NFT transactions on the blockchain, ensuring precise calculation of taxable gains from asset sales. Unlike traditional capital gains tax, NFT tax reporting leverages blockchain transparency and real-time data tracking to minimize errors and improve compliance.

Airdrop Tax Classification

Capital gains tax applies to profits from asset sales, including NFTs, where the difference between the selling price and the acquisition cost is taxable; NFT tax considerations also encompass the classification of airdrops, which the IRS may treat as ordinary income at the fair market value upon receipt. Proper tax treatment of airdropped NFTs requires detailed record-keeping to accurately report income and future capital gains when sold or exchanged.

NFT Staking Proceeds Tax

Capital gains tax applies to profits from selling traditional assets, while NFT staking proceeds are often taxed as ordinary income, reflecting their treatment as earnings rather than capital gains. The IRS typically requires reporting NFT staking rewards at fair market value, impacting tax liabilities distinct from standard capital gains on asset sales.

Wrapped NFT Tax Treatment

Capital gains tax on wrapped NFTs is generally treated similarly to traditional capital assets, where taxable gains are recognized upon the sale or transfer of the NFT. Taxpayers must carefully track the acquisition cost and holding period of wrapped NFTs to accurately report gains or losses, as the IRS treats these digital assets as property rather than currency.

Secondary Royalty Taxation

Capital Gains Tax applies to the profit realized from selling an asset, including NFTs, based on the difference between the purchase price and the sale price, while NFT Secondary Royalty Taxation specifically targets ongoing royalties paid to creators on secondary market sales of NFTs. Secondary Royalty Taxation on NFTs ensures that artists receive a percentage of resale value, creating a continuous revenue stream distinct from one-time capital gains taxes imposed on asset sales.

Gas Fee Tax Deductibility

Capital gains tax applies to the profit from selling assets, including NFTs, but only the net gain after deducting allowable costs like gas fees is taxable, making accurate tracking essential for minimizing tax liabilities. Gas fees incurred during NFT transactions are deductible expenses that reduce the overall capital gain, effectively lowering the taxable amount in jurisdictions recognizing these costs.

Fractionalized NFT Gains

Capital gains tax on fractionalized NFT gains is calculated based on the appreciation of the individual token's value at the time of sale, similarly to traditional asset selling, but requires precise valuation methods due to the NFT's unique and divisible nature. Taxpayers must report gains from fractionalized NFTs separately, as each fraction represents a distinct capital asset subject to capital gains tax rates that vary depending on the holding period and jurisdiction.

Capital Gains Tax vs NFT Tax for asset selling. Infographic

moneydiff.com

moneydiff.com