Tax consultancy provides personalized expert guidance tailored to complex financial situations, ensuring compliance and strategic tax planning based on current laws and individual circumstances. AI tax advisors offer rapid data analysis and automated recommendations, enhancing efficiency and identifying potential tax savings through algorithms and real-time updates. Combining both approaches can optimize decision-making by leveraging human expertise alongside advanced technological insights for accurate and efficient tax management.

Table of Comparison

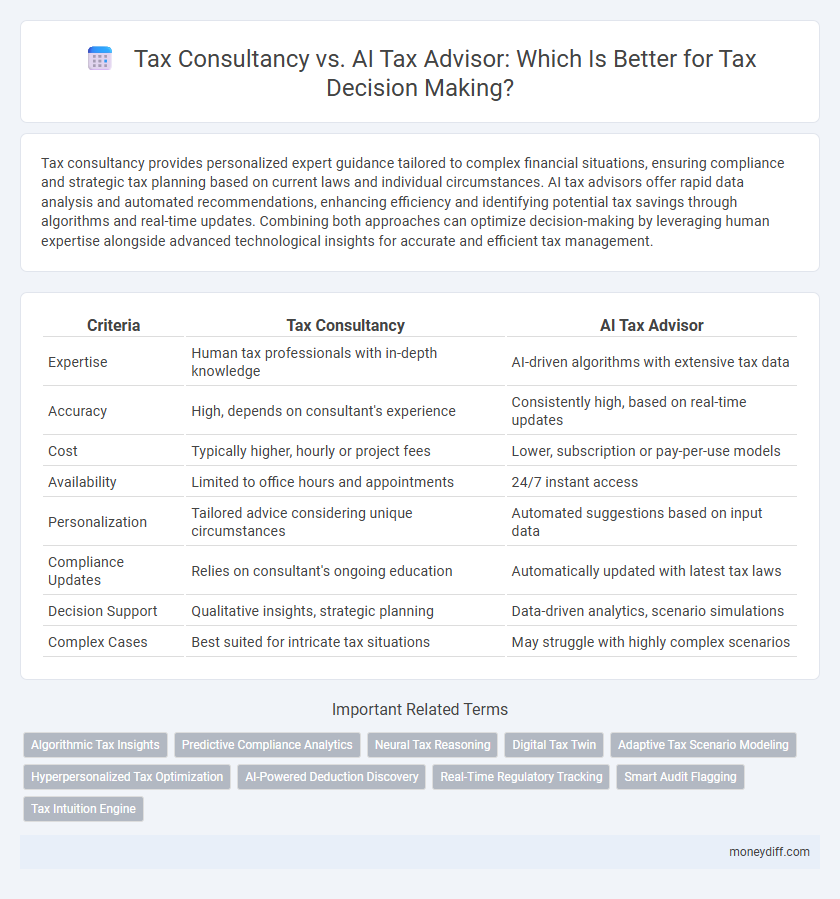

| Criteria | Tax Consultancy | AI Tax Advisor |

|---|---|---|

| Expertise | Human tax professionals with in-depth knowledge | AI-driven algorithms with extensive tax data |

| Accuracy | High, depends on consultant's experience | Consistently high, based on real-time updates |

| Cost | Typically higher, hourly or project fees | Lower, subscription or pay-per-use models |

| Availability | Limited to office hours and appointments | 24/7 instant access |

| Personalization | Tailored advice considering unique circumstances | Automated suggestions based on input data |

| Compliance Updates | Relies on consultant's ongoing education | Automatically updated with latest tax laws |

| Decision Support | Qualitative insights, strategic planning | Data-driven analytics, scenario simulations |

| Complex Cases | Best suited for intricate tax situations | May struggle with highly complex scenarios |

Understanding Tax Consultancy: Traditional Approach

Tax consultancy involves personalized guidance from experienced professionals who analyze complex financial situations to ensure accurate tax compliance and optimize tax liabilities. Traditional tax consultants utilize in-depth knowledge of current tax laws, regulations, and precedents to interpret nuanced scenarios that automated systems may overlook. The human expertise in tax consultancy remains critical for tailoring strategic tax planning and addressing unique taxpayer circumstances beyond the capabilities of AI tax advisors.

AI Tax Advisors: Revolutionizing Tax Management

AI tax advisors transform tax management by leveraging machine learning algorithms and real-time data analysis to deliver personalized and accurate tax solutions. Unlike traditional consultancy, AI systems rapidly process vast datasets, ensuring compliance, optimizing deductions, and predicting future tax liabilities with unmatched precision. This innovative technology enhances decision-making efficiency, reduces human error, and provides scalable support for both individuals and enterprises.

Key Differences Between Human and AI Tax Advisors

Human tax advisors provide personalized analysis based on nuanced understanding of complex tax laws, client history, and evolving regulations, offering tailored strategies that consider emotional and ethical factors. AI tax advisors excel in processing vast amounts of data rapidly, identifying patterns and discrepancies through machine learning algorithms, which enhances accuracy and compliance in routine tax filings. Key differences include human advisors' ability to interpret ambiguous legal scenarios versus AI's strength in data-driven optimization and real-time updates on tax code changes.

Accuracy and Reliability: Human vs. AI in Tax Decision Making

Tax consultancy relies on expert human judgment and experience to navigate complex tax regulations, ensuring tailored advice that accounts for nuanced financial contexts and evolving laws. AI tax advisors utilize advanced algorithms and vast datasets to quickly analyze tax scenarios, offering high accuracy in calculations and identifying potential deductions or compliance issues with minimal error. While AI excels in processing speed and data consistency, human consultants provide reliability through contextual understanding and ethical considerations essential for sound tax decision-making.

Cost Efficiency: Comparing Service Fees and Value

Tax consultancy typically involves higher service fees due to personalized expertise and comprehensive analysis, offering tailored advice that can address complex tax scenarios effectively. AI tax advisors provide cost-efficient solutions with lower fees by automating routine calculations and standard compliance tasks, delivering faster results but with limited customization. Evaluating cost efficiency between these options requires weighing the upfront service fees against the long-term value derived from accuracy, risk mitigation, and actionable insights in tax decision-making.

Personalization in Tax Advice: AI vs. Human Consultants

Human tax consultants offer personalized tax advice based on nuanced understanding of individual circumstances and complex financial situations, leveraging years of expertise to adapt strategies accordingly. AI tax advisors, powered by advanced algorithms and vast data analysis, provide personalized recommendations by rapidly analyzing tax codes and client data but may lack the intuitive judgment of human consultants. While AI enhances efficiency and data-driven accuracy, human consultants excel in interpreting ambiguous scenarios and tailoring advice with empathy and contextual awareness.

Compliance and Risk Management: Who Performs Better?

Tax consultancy offers personalized expertise in complex tax laws, ensuring tailored compliance strategies and proactive risk management based on human judgment and regulatory updates. AI tax advisors leverage machine learning algorithms to analyze vast datasets, identify patterns of non-compliance, and provide real-time risk assessments that enhance decision-making accuracy and efficiency. While tax consultants excel in nuanced interpretation and professional discretion, AI systems outperform in processing speed and consistency, making a hybrid approach optimal for comprehensive compliance and risk mitigation.

Technology Integration: AI Tools in Tax Consultancy

AI tax advisors leverage advanced machine learning algorithms and big data analytics to provide real-time tax optimization and compliance insights, enhancing decision-making accuracy. Tax consultancy firms integrate AI tools to automate complex calculations, detect potential risks, and customize tax strategies based on evolving regulations. The fusion of AI technology within tax consultancy streamlines workflows, reduces human error, and delivers data-driven recommendations that adapt dynamically to financial scenarios.

Data Security and Privacy: Human vs. AI Tax Solutions

Tax consultancy relies on certified professionals who ensure data security through strict compliance with legal standards and personalized privacy measures tailored to client needs. AI tax advisors utilize advanced encryption protocols and real-time threat detection but may pose risks due to potential vulnerabilities in automated systems and data sharing across platforms. Human tax consultants offer nuanced judgment in safeguarding sensitive financial information, whereas AI solutions enhance efficiency but require rigorous oversight to maintain privacy integrity.

Future Trends: Evolving Roles in Tax Advisory Services

Tax consultancy is rapidly integrating AI-driven tools to enhance accuracy and predictive analysis in decision making, transforming traditional advisory roles. AI tax advisors leverage machine learning algorithms to process complex datasets and provide real-time, personalized tax strategies, driving efficiency and compliance. Future trends indicate a hybrid model where human expertise and AI capabilities coexist, optimizing tax planning and regulatory adherence for diverse client needs.

Related Important Terms

Algorithmic Tax Insights

Algorithmic tax insights generated by AI tax advisors enable real-time analysis of complex tax regulations, offering personalized recommendations that adapt to evolving financial scenarios. While traditional tax consultancy relies on expert judgment and experience, AI-driven platforms leverage machine learning to identify optimization opportunities and compliance risks with greater precision and speed.

Predictive Compliance Analytics

Predictive Compliance Analytics enhances decision-making in tax consultancy by leveraging AI algorithms to analyze vast datasets, identify potential compliance risks, and forecast tax outcomes with high accuracy. While traditional tax consultants provide expert judgment based on experience, AI tax advisors offer scalable, data-driven insights that optimize tax strategy and ensure proactive regulatory adherence.

Neural Tax Reasoning

Neural Tax Reasoning leverages advanced AI algorithms to analyze complex tax regulations and provide precise, data-driven recommendations, surpassing traditional tax consultancy methods in efficiency and accuracy. This technology enables real-time scenario simulations and predictive compliance, enhancing decision-making while reducing human error and operational costs.

Digital Tax Twin

Tax consultancy leverages expert human judgment and tailored strategies to navigate complex tax regulations, while AI tax advisors utilize machine learning and predictive analytics to generate data-driven insights for real-time decision making. The integration of digital tax twins enhances both approaches by creating dynamic, virtual representations of tax scenarios, enabling precise simulation and optimization of tax outcomes in a rapidly evolving digital economy.

Adaptive Tax Scenario Modeling

Tax consultancy professionals leverage adaptive tax scenario modeling to tailor strategies based on dynamic regulatory changes and individual client profiles, ensuring precise compliance and optimized tax outcomes. AI tax advisors enhance decision-making by rapidly processing vast datasets and simulating multiple tax scenarios, enabling real-time adaptive adjustments for complex tax environments and increased accuracy in projections.

Hyperpersonalized Tax Optimization

Hyperpersonalized tax optimization leverages AI tax advisors to analyze vast datasets and individual financial profiles, delivering tailored strategies that adapt in real-time to legislative changes. Traditional tax consultancy relies on expert interpretation and experience, which can be less scalable and slower in providing customized, dynamic insights for complex decision-making.

AI-Powered Deduction Discovery

AI-powered tax advisors enhance decision-making by leveraging advanced algorithms to identify complex and often overlooked deductions faster than traditional tax consultancy methods. This technology significantly improves tax savings and compliance accuracy through continuous learning and real-time data analysis.

Real-Time Regulatory Tracking

Tax consultancy provides expert human insight and tailored advice for complex regulatory environments, while AI tax advisors excel in real-time regulatory tracking by quickly processing vast amounts of legal updates and flagging relevant changes instantly. Leveraging AI's ability to monitor continuous tax law revisions enhances decision-making efficiency and compliance accuracy compared to traditional consultancy methods.

Smart Audit Flagging

Tax consultancy leverages expert judgment and industry experience to interpret complex regulations and identify nuanced risk factors during smart audit flagging, ensuring compliance and strategic decision-making. AI tax advisors enhance this process by quickly analyzing large datasets and detecting anomalies, providing efficient preliminary audits but lacking the contextual understanding of human consultants for final decisions.

Tax Intuition Engine

Tax consultancy leverages expert analysis and personalized strategies, while AI tax advisors, powered by Tax Intuition Engine technology, utilize machine learning algorithms to process vast financial datasets for optimized decision-making. The Tax Intuition Engine enhances tax efficiency by predicting potential outcomes and offering data-driven recommendations tailored to complex tax regulations.

Tax Consultancy vs AI Tax Advisor for Decision Making Infographic

moneydiff.com

moneydiff.com