Direct taxes, such as income and corporate taxes, provide governments with a stable and predictable revenue stream critical for funding public services and infrastructure. Carbon taxes, designed to reduce greenhouse gas emissions, generate revenue while encouraging environmentally sustainable behavior, but their income can be less consistent due to fluctuating economic activities and energy consumption patterns. Balancing these tax types allows governments to meet fiscal needs while promoting environmental policy goals effectively.

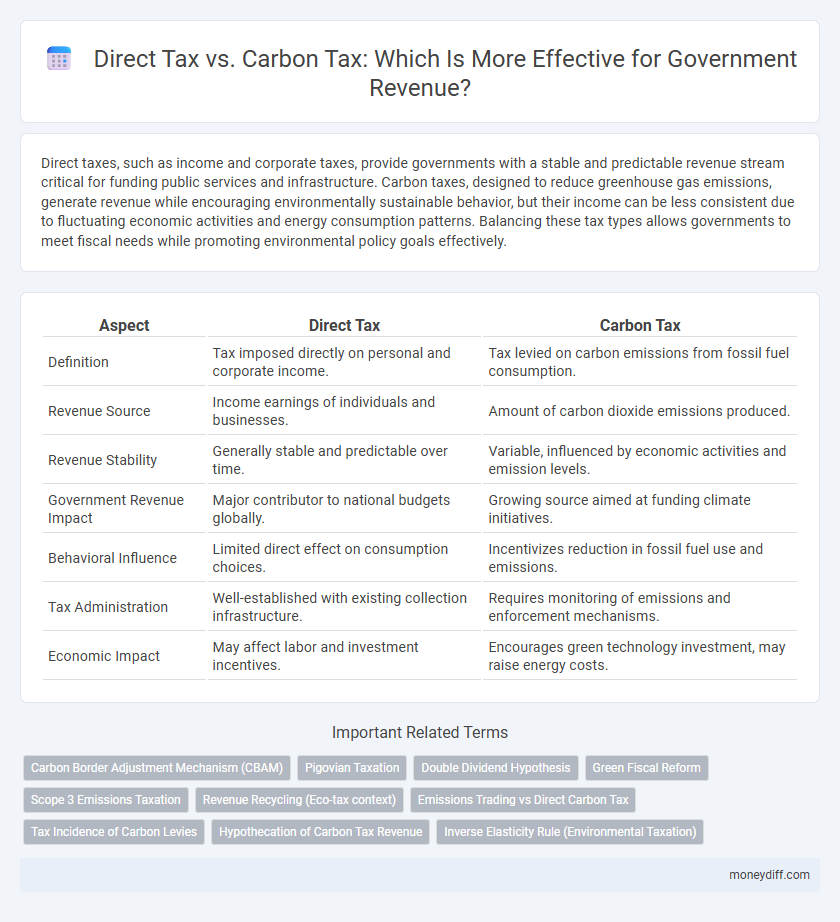

Table of Comparison

| Aspect | Direct Tax | Carbon Tax |

|---|---|---|

| Definition | Tax imposed directly on personal and corporate income. | Tax levied on carbon emissions from fossil fuel consumption. |

| Revenue Source | Income earnings of individuals and businesses. | Amount of carbon dioxide emissions produced. |

| Revenue Stability | Generally stable and predictable over time. | Variable, influenced by economic activities and emission levels. |

| Government Revenue Impact | Major contributor to national budgets globally. | Growing source aimed at funding climate initiatives. |

| Behavioral Influence | Limited direct effect on consumption choices. | Incentivizes reduction in fossil fuel use and emissions. |

| Tax Administration | Well-established with existing collection infrastructure. | Requires monitoring of emissions and enforcement mechanisms. |

| Economic Impact | May affect labor and investment incentives. | Encourages green technology investment, may raise energy costs. |

Understanding Direct Tax: Definition and Types

Direct tax is a form of taxation where the government levies taxes directly on individuals and organizations based on their income, property, or wealth. Key types of direct taxes include income tax, corporate tax, property tax, and wealth tax, all of which contribute significantly to government revenue by targeting the taxpayer's ability to pay. The impact of direct taxes on government revenue is often stable and predictable, providing a foundational source of public funds compared to indirect taxes like carbon tax.

What is Carbon Tax? Purpose and Mechanism

Carbon tax is a direct tax imposed on the carbon content of fossil fuels, aiming to reduce greenhouse gas emissions and combat climate change. It functions by setting a price per ton of emitted carbon dioxide, incentivizing businesses and individuals to lower their carbon footprint through energy efficiency or alternative energy sources. This tax mechanism generates government revenue while promoting environmental sustainability by internalizing the external costs of carbon emissions.

Revenue Generation: Direct Tax vs Carbon Tax

Direct taxes such as income tax and corporate tax provide a stable and predictable revenue stream for governments by taxing individual and business earnings based on ability to pay. Carbon taxes generate revenue by imposing fees on greenhouse gas emissions, incentivizing pollution reduction while creating a variable income source linked to environmental policies and economic activity. While direct taxes offer consistent budget support, carbon taxes align fiscal goals with sustainability efforts, potentially increasing revenue as carbon pricing rises to meet climate targets.

Impact on Economic Growth and Investment

Direct taxes such as income and corporate taxes directly affect disposable income and corporate profits, often leading to reduced consumer spending and lower business investments, which can slow economic growth. Carbon taxes, imposed on emissions, incentivize cleaner technologies and more efficient energy use but may increase production costs, potentially impacting investment decisions depending on the industry's carbon intensity. Governments must balance the immediate revenue benefits of direct taxes against the long-term economic incentives created by carbon taxes to foster sustainable growth and attract environmentally conscious investments.

Administrative Complexity and Compliance Issues

Direct taxes generally involve higher administrative complexity due to the need for thorough income verification, auditing, and enforcement mechanisms, leading to increased compliance costs for both the government and taxpayers. Carbon taxes offer a relatively simpler administrative framework as they apply a uniform rate on fossil fuel usage or emissions, reducing opportunities for evasion and minimizing record-keeping requirements. Despite this, compliance challenges in carbon taxation can arise from accurately measuring emissions and setting appropriate tax rates that reflect environmental costs without causing economic distortions.

Equity and Fairness: Who Bears the Tax Burden?

Direct taxes such as income tax are generally progressive, with higher earners bearing a larger share of the tax burden, promoting equity by aligning tax payments with ability to pay. Carbon taxes tend to be regressive, disproportionately affecting lower-income households that spend a higher percentage of their income on energy, raising concerns about fairness in distribution. Governments often implement rebates or targeted subsidies alongside carbon taxes to mitigate these regressivity issues and enhance overall tax equity.

Environmental Implications of Carbon Tax

Carbon tax directly targets greenhouse gas emissions by imposing fees on carbon content in fossil fuels, incentivizing reduced pollution and investment in renewable energy sources. Unlike direct taxes, which primarily generate government revenue without environmental considerations, carbon taxes encourage behavioral changes that mitigate climate change impacts. This environmental focus positions carbon tax as a crucial tool for governments aiming to align fiscal policy with sustainability goals.

Direct Tax and Fiscal Policy Alignment

Direct tax, comprising income tax and corporate tax, forms a substantial portion of government revenue, aligning closely with fiscal policy objectives by enabling progressive taxation and income redistribution. It provides stable funding essential for public services and infrastructure while incentivizing economic behavior through deductions and credits. This alignment ensures fiscal policy effectively addresses social equity and economic growth, contrasting with carbon tax's primary environmental focus.

Case Studies: Countries Implementing Carbon and Direct Taxes

Sweden's carbon tax, introduced in 1991, has effectively reduced greenhouse gas emissions while generating substantial government revenue, demonstrating a successful model of integrating environmental objectives with fiscal policy. In contrast, the United States relies heavily on direct taxes such as income and corporate taxes, which constitute the majority of federal revenue but lack direct environmental incentives. Germany combines both systems by imposing a carbon tax alongside high direct taxes, allowing balanced revenue generation and progress toward climate targets.

Future Trends: Balancing Government Revenue Sources

Government revenue strategies are shifting towards integrating direct taxes with emerging carbon taxes to address fiscal sustainability and environmental goals. Direct taxes, including income and corporate taxes, provide stable revenue but face challenges from economic fluctuations and tax avoidance. Carbon taxes are gaining prominence as governments aim to incentivize emissions reductions while generating new revenue streams, indicating a future trend of balanced tax portfolios to optimize financial and ecological outcomes.

Related Important Terms

Carbon Border Adjustment Mechanism (CBAM)

The Carbon Border Adjustment Mechanism (CBAM) introduces a carbon tax on imported goods based on their carbon content, aiming to prevent carbon leakage and encourage emission reductions, while direct taxes such as income or corporate taxes remain traditional sources of government revenue. CBAM's implementation reshapes fiscal strategies by generating targeted environmental revenue and complementing existing direct tax frameworks, supporting climate goals alongside economic objectives.

Pigovian Taxation

Direct taxes such as income and corporate taxes provide stable government revenue but often fail to address externalities, whereas carbon taxes, a form of Pigovian taxation, are designed to internalize environmental costs by charging emitters for greenhouse gas emissions. Implementing carbon taxes not only generates revenue but also incentivizes businesses and individuals to reduce carbon footprints, aligning fiscal policy with environmental sustainability goals.

Double Dividend Hypothesis

The Double Dividend Hypothesis suggests that implementing a carbon tax can simultaneously generate government revenue and improve environmental outcomes by reducing carbon emissions. Unlike direct taxes, which primarily fund public services, carbon taxes incentivize behavioral changes that may lead to economic efficiency gains while addressing climate change.

Green Fiscal Reform

Green Fiscal Reform emphasizes shifting government revenue streams from direct taxes, such as income and corporate taxes, to carbon taxes that incentivize reduced greenhouse gas emissions. Carbon tax revenue not only supports environmental goals but also provides a predictable and sustainable funding source for public services while encouraging cleaner energy consumption.

Scope 3 Emissions Taxation

Direct tax primarily targets corporate and individual income based on profits and earnings, providing a stable revenue source for governments, whereas carbon tax on Scope 3 emissions imposes costs on the indirect emissions from supply chains and product use, enabling governments to internalize environmental externalities and incentivize sustainable practices across entire value chains. Scope 3 emissions taxation expands the tax base by addressing upstream and downstream activities, potentially increasing government revenue while driving systemic carbon reduction beyond direct operational emissions.

Revenue Recycling (Eco-tax context)

Direct taxes such as income and corporate taxes provide stable government revenue but often lack targeted environmental incentives, whereas carbon taxes generate funds specifically linked to carbon emissions, enabling efficient revenue recycling into renewable energy projects or green subsidies. Effective revenue recycling of carbon tax proceeds can drive sustainable economic growth by funding clean technology, reducing overall tax burdens, and supporting social equity measures.

Emissions Trading vs Direct Carbon Tax

Emissions Trading Systems (ETS) set a cap on total carbon emissions and allow governments to generate revenue by auctioning permits, promoting cost-effective emissions reductions through market mechanisms. Direct Carbon Taxes impose a fixed price per ton of carbon emitted, providing predictable revenue streams but lacking the flexibility of emissions trading to adapt to fluctuating market conditions.

Tax Incidence of Carbon Levies

Carbon tax incidence primarily falls on consumers through higher prices for carbon-intensive goods, shifting the economic burden indirectly rather than directly taxing income or profits like direct taxes. This displacement effect impacts household spending patterns and can lead to regressive outcomes unless revenue recycling or compensatory measures are implemented by governments.

Hypothecation of Carbon Tax Revenue

Hypothecation of carbon tax revenue directs funds specifically toward environmental projects, enhancing government accountability and ensuring targeted use for climate mitigation efforts. In contrast, direct tax revenues are generally non-earmarked, offering broader fiscal flexibility but less transparency in environmental spending.

Inverse Elasticity Rule (Environmental Taxation)

Direct taxes generate consistent government revenue but may distort labor supply and investment, whereas carbon taxes leverage the Inverse Elasticity Rule to optimize efficiency by imposing higher rates on goods with inelastic demand, maximizing emissions reductions with minimal economic disruption. Applying the Inverse Elasticity Rule in environmental taxation ensures carbon tax rates align with pollutant responsiveness, enhancing revenue predictability while promoting sustainable behavioral change.

Direct Tax vs Carbon Tax for government revenue. Infographic

moneydiff.com

moneydiff.com