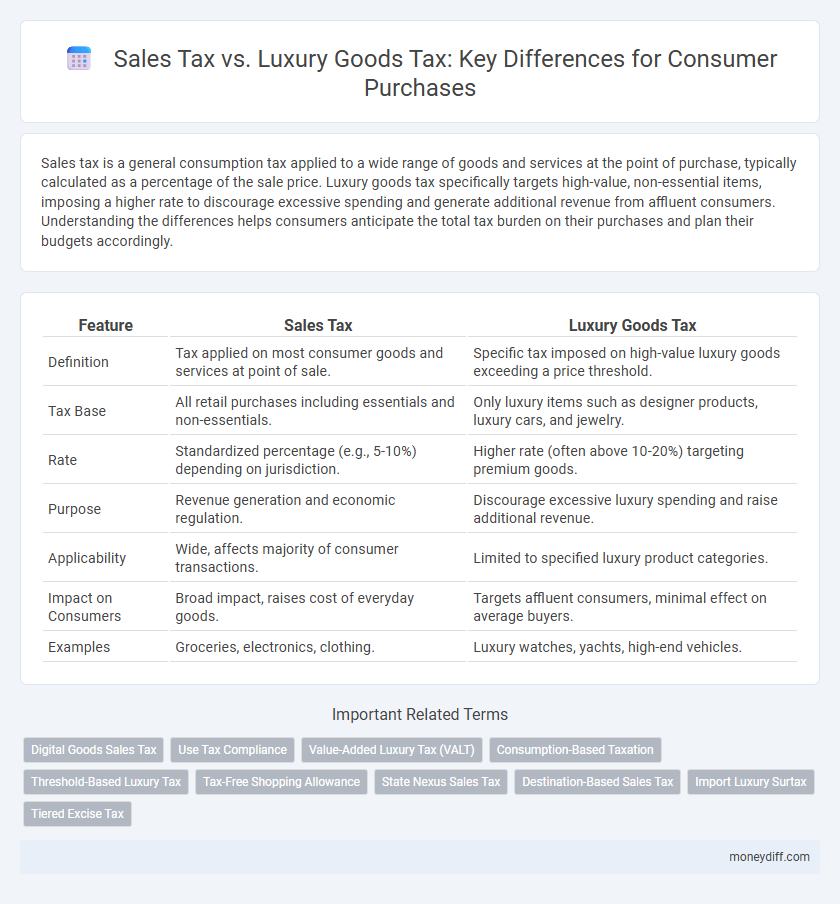

Sales tax is a general consumption tax applied to a wide range of goods and services at the point of purchase, typically calculated as a percentage of the sale price. Luxury goods tax specifically targets high-value, non-essential items, imposing a higher rate to discourage excessive spending and generate additional revenue from affluent consumers. Understanding the differences helps consumers anticipate the total tax burden on their purchases and plan their budgets accordingly.

Table of Comparison

| Feature | Sales Tax | Luxury Goods Tax |

|---|---|---|

| Definition | Tax applied on most consumer goods and services at point of sale. | Specific tax imposed on high-value luxury goods exceeding a price threshold. |

| Tax Base | All retail purchases including essentials and non-essentials. | Only luxury items such as designer products, luxury cars, and jewelry. |

| Rate | Standardized percentage (e.g., 5-10%) depending on jurisdiction. | Higher rate (often above 10-20%) targeting premium goods. |

| Purpose | Revenue generation and economic regulation. | Discourage excessive luxury spending and raise additional revenue. |

| Applicability | Wide, affects majority of consumer transactions. | Limited to specified luxury product categories. |

| Impact on Consumers | Broad impact, raises cost of everyday goods. | Targets affluent consumers, minimal effect on average buyers. |

| Examples | Groceries, electronics, clothing. | Luxury watches, yachts, high-end vehicles. |

Understanding Sales Tax: Definition and Scope

Sales tax is a percentage-based levy imposed by governments on the sale of most goods and services, collected at the point of purchase to generate revenue for public services. It applies broadly to everyday consumer transactions unless specific exemptions exist, affecting pricing and affordability for general buyers. Understanding its scope clarifies how sales tax differs from luxury goods tax, which targets high-value items with rates designed to limit consumption of non-essential purchases.

What Qualifies as Luxury Goods for Tax Purposes

Luxury goods for tax purposes typically include high-end items such as designer clothing, luxury vehicles, jewelry, and high-value electronics that exceed a specified price threshold set by tax authorities. These goods are distinguished from regular consumer products by their exclusivity, higher quality materials, and brand prestige, resulting in higher tax rates under luxury goods tax regulations. Sales tax generally applies to everyday purchases, whereas luxury goods tax targets expensive, non-essential items to generate additional revenue and regulate consumer spending behavior.

Key Differences Between Sales Tax and Luxury Goods Tax

Sales tax is a broad-based consumption tax applied to most goods and services at a standard rate, while luxury goods tax targets high-value or non-essential items, often at a higher rate to discourage excessive spending. Sales tax is collected on everyday consumer purchases like groceries and clothing, whereas luxury goods tax applies specifically to products such as jewelry, designer handbags, and high-end electronics. The key difference lies in the scope and purpose: sales tax generates general revenue from widespread transactions, while luxury goods tax aims to impose a higher burden on discretionary, luxury spending.

How Sales Tax Affects Everyday Consumer Purchases

Sales tax directly impacts everyday consumer purchases by increasing the total cost of goods and services, typically applied as a percentage of the sale price at the point of purchase. This tax is generally uniform across most retail items, affecting necessities such as groceries, clothing, and household supplies, thereby influencing consumer spending behavior. In contrast, luxury goods tax targets high-value, non-essential items, leaving regular purchases less burdened, which helps maintain affordability for everyday essentials.

The Impact of Luxury Goods Tax on High-End Buyers

Luxury goods tax significantly increases the cost burden on high-end buyers by imposing higher rates on premium products compared to standard sales tax, which applies uniformly to most consumer purchases. This targeted taxation can deter luxury spending, influencing purchasing behavior among affluent consumers and potentially reducing demand for high-priced items such as designer goods, luxury cars, and jewelry. As a result, luxury goods tax serves as both a revenue-generating mechanism and a tool to address economic inequality by taxing discretionary spending more heavily.

Regional Variations: Sales Tax vs Luxury Goods Tax Rates

Sales tax rates vary widely across regions, typically ranging from 2% to 10%, applied broadly on most consumer purchases. Luxury goods tax rates, however, are generally higher, often set between 10% to 25%, and target specific high-value categories like jewelry, electronics, and designer items. Regional governments use these differential tax structures to balance revenue generation with consumer spending patterns, creating significant tax rate contrasts based on locality and product classification.

Exemptions and Exceptions in Sales and Luxury Goods Taxes

Sales tax exemptions typically apply to essential goods such as groceries, prescription medications, and certain medical devices, shielding basic consumer purchases from added tax burdens, while luxury goods taxes target non-essential, high-priced items like designer apparel, luxury vehicles, and jewelry. Exceptions in luxury goods tax may include exemptions for items used in production or resale, as well as thresholds that exclude purchases under a specified value, limiting the tax impact on moderately priced goods. Both tax systems use exemptions and exceptions to balance revenue goals with economic fairness, reducing the tax incidence on essential goods and encouraging specific consumer or business behaviors.

Strategies for Consumers to Manage Tax Costs

Consumers can manage tax costs by differentiating purchases subject to sales tax from those triggering luxury goods tax, focusing on essential goods to minimize higher rates. Strategic timing of purchases during promotional tax holidays or choosing jurisdictions with lower luxury tax rates further reduces expenses. Utilizing tax-exempt status for qualifying items and keeping detailed purchase records supports maximizing tax savings and compliance.

Economic Implications of Sales and Luxury Goods Taxes

Sales tax applies broadly to most consumer purchases, generating steady revenue streams that fund public services and infrastructure, while luxury goods tax targets high-end products, aiming to reduce income inequality by taxing discretionary spending at higher rates. These taxes influence consumer behavior differently: sales tax can slightly decrease overall consumption, whereas luxury goods tax may discourage spending on non-essential, high-value items, potentially impacting luxury markets and related industries. Economically, sales taxes tend to be regressive, affecting lower-income consumers proportionally more, whereas luxury goods taxes are more progressive, targeting wealthier individuals and contributing to redistribution efforts.

Future Trends: Evolving Tax Policies on Consumer Purchases

Future trends in tax policies indicate a growing shift towards differentiating sales tax and luxury goods tax to better align with consumer spending behavior and economic equity. Governments are increasingly adopting dynamic tax structures that leverage real-time data analytics to adjust rates based on product categories and purchasing power, enhancing revenue without stifling consumption. Emerging policies emphasize digital integration and environmental considerations, reflecting a move towards more responsive and sustainable taxation frameworks for consumer purchases.

Related Important Terms

Digital Goods Sales Tax

Sales tax generally applies to a wide range of consumer goods, including digital goods like software, e-books, and streaming services, while luxury goods tax targets high-value physical items such as jewelry and designer accessories. Digital goods sales tax rates vary by jurisdiction, with states like California and New York enforcing specific regulations to capture revenue from online digital transactions.

Use Tax Compliance

Sales tax applies to general consumer purchases and is collected at the point of sale, while luxury goods tax targets high-value items, often with higher rates to deter excessive consumption. Use tax compliance becomes critical when consumers purchase goods out-of-state or online, ensuring that unpaid sales or luxury goods taxes are reported and remitted to the appropriate tax authorities.

Value-Added Luxury Tax (VALT)

Value-Added Luxury Tax (VALT) targets high-end consumer purchases by imposing an additional percentage on top of the standard sales tax rate, primarily affecting luxury goods such as designer apparel, upscale electronics, and premium vehicles. Unlike regular sales tax, VALT enhances government revenue from affluent consumers while encouraging mindful spending and potentially reducing excessive consumption of non-essential luxury items.

Consumption-Based Taxation

Sales tax applies broadly to most consumer purchases, generating revenue based on the total consumption of goods and services, whereas luxury goods tax targets high-value items to impose higher rates on discretionary spending, promoting economic equity by taxing non-essential luxury consumption more heavily. Consumption-based taxation relies on these mechanisms to balance revenue generation with behavioral incentives, influencing purchasing decisions through differentiated tax rates.

Threshold-Based Luxury Tax

Threshold-based luxury tax imposes additional sales tax on consumer purchases exceeding a predetermined monetary limit, targeting high-value goods like luxury cars, jewelry, and designer items. This tax structure differentiates from general sales tax by applying only when the purchase surpasses the threshold, effectively generating revenue from affluent consumers while maintaining affordability for everyday buyers.

Tax-Free Shopping Allowance

Tax-free shopping allowances enable consumers to purchase goods without incurring sales tax up to a specified limit, often benefiting everyday items, whereas luxury goods tax applies exclusively to high-value products exceeding set thresholds. Understanding the distinction between general sales tax and luxury goods tax is crucial for maximizing savings and complying with local tax regulations during consumer transactions.

State Nexus Sales Tax

State Nexus Sales Tax applies when a business has a significant physical or economic presence in a state, requiring the collection of sales tax on consumer purchases, while Luxury Goods Tax targets high-value items regardless of nexus, imposing additional levies on luxury purchases; understanding the difference is crucial for compliance and accurate tax reporting. Sales Tax typically covers a broad range of consumer goods and services based on statewide thresholds, whereas Luxury Goods Tax specifically affects upscale products, often at higher rates and with unique state-specific regulations.

Destination-Based Sales Tax

Destination-based sales tax applies the tax rate of the buyer's location, ensuring that consumer purchases are taxed according to local jurisdiction rates, unlike luxury goods tax which targets high-value items regardless of purchase destination. This approach enhances tax fairness and revenue accuracy by reflecting regional tax laws in point-of-sale transactions.

Import Luxury Surtax

Import Luxury Surtax imposes a higher rate on premium goods exceeding standard sales tax, targeting imported luxury items such as designer apparel and high-end electronics to curb excessive consumption and generate revenue. This tax differentiates from general sales tax by applying specifically to select premium categories, ensuring that luxury imports contribute proportionally to tax revenues.

Tiered Excise Tax

Sales tax applies broadly to most consumer goods at a uniform rate, while luxury goods tax imposes tiered excise taxes specifically on high-value items such as jewelry, yachts, and designer cars, escalating rates as the purchase price increases. This tiered excise tax structure targets affluent consumers to generate higher revenue and discourage excessive luxury spending, complementing general sales tax policies.

Sales Tax vs Luxury Goods Tax for consumer purchases. Infographic

moneydiff.com

moneydiff.com