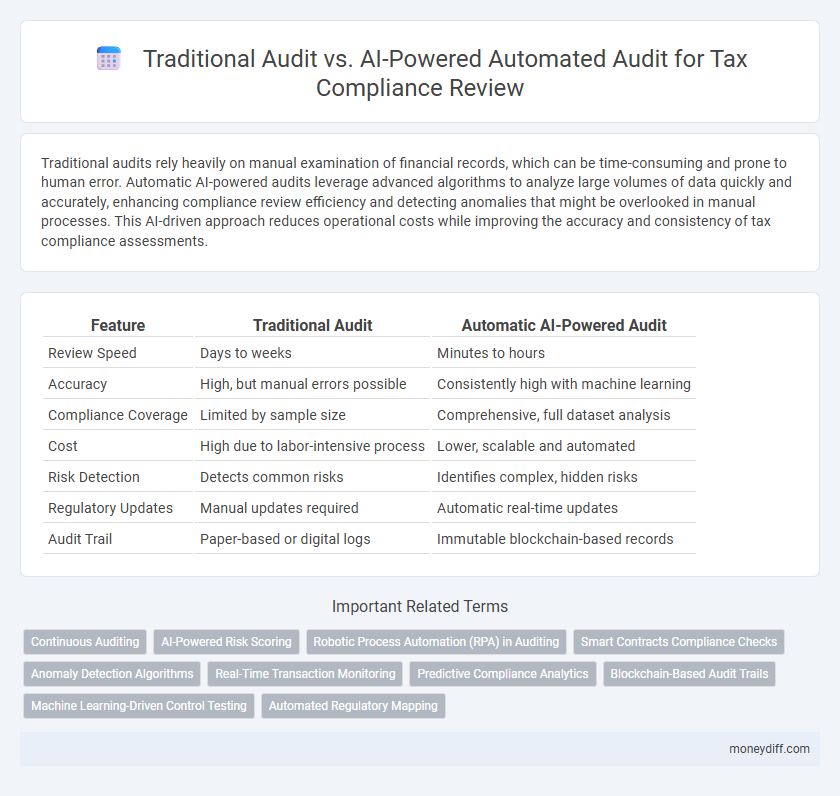

Traditional audits rely heavily on manual examination of financial records, which can be time-consuming and prone to human error. Automatic AI-powered audits leverage advanced algorithms to analyze large volumes of data quickly and accurately, enhancing compliance review efficiency and detecting anomalies that might be overlooked in manual processes. This AI-driven approach reduces operational costs while improving the accuracy and consistency of tax compliance assessments.

Table of Comparison

| Feature | Traditional Audit | Automatic AI-Powered Audit |

|---|---|---|

| Review Speed | Days to weeks | Minutes to hours |

| Accuracy | High, but manual errors possible | Consistently high with machine learning |

| Compliance Coverage | Limited by sample size | Comprehensive, full dataset analysis |

| Cost | High due to labor-intensive process | Lower, scalable and automated |

| Risk Detection | Detects common risks | Identifies complex, hidden risks |

| Regulatory Updates | Manual updates required | Automatic real-time updates |

| Audit Trail | Paper-based or digital logs | Immutable blockchain-based records |

Introduction: The Evolving Landscape of Tax Compliance Audits

Tax compliance audits are rapidly evolving from traditional manual reviews to automatic AI-powered systems that enhance accuracy and efficiency. Conventional audits rely heavily on human expertise for identifying discrepancies, often leading to longer processing times and higher error rates. AI-driven audits leverage machine learning algorithms and data analytics to detect anomalies and ensure compliance with tax regulations in real-time, transforming the landscape of tax oversight.

Defining Traditional Audits in Money Management

Traditional audits in money management involve manual examination and verification of financial records by auditors to ensure compliance with tax laws and regulations. This process includes detailed checking of bank statements, receipts, and accounting ledgers, often requiring significant time and resources. Despite its thoroughness, traditional auditing is prone to human error and may lack the efficiency provided by automated AI-powered audit systems.

What is an Automatic AI-Powered Audit?

An Automatic AI-Powered Audit utilizes advanced machine learning algorithms to analyze vast amounts of financial data quickly and accurately, identifying compliance risks and anomalies with minimal human intervention. This technology improves efficiency by continuously monitoring transactions and flagging potential issues in real time, reducing the likelihood of financial errors or fraud. Compared to traditional audits, AI-powered audits provide deeper insights through predictive analytics and pattern recognition, enhancing overall tax compliance and decision-making.

Core Differences: Manual vs. Automated Compliance Review

Traditional audits rely on manual processes where tax professionals meticulously review financial documents and compliance records, often leading to longer turnaround times and higher risks of human error. Automatic AI-powered audits leverage machine learning algorithms to analyze vast datasets in real-time, enhancing accuracy and efficiency by quickly identifying discrepancies and compliance risks. Core differences lie in automation level, error reduction, speed, and scalability, with AI audits enabling continuous monitoring and adaptive learning versus periodic, manual evaluations.

Efficiency and Speed: How Automation Transforms Tax Audits

Automatic AI-powered audits significantly enhance efficiency by rapidly analyzing vast datasets, reducing the time required for compliance review from weeks to hours. Traditional audits rely heavily on manual processes and human expertise, which often leads to slower turnaround times and increased risk of oversight. Automation improves accuracy and consistency, enabling tax authorities to identify discrepancies faster and streamline regulatory compliance.

Accuracy and Error Reduction: Human Auditors vs. AI Algorithms

Traditional audits rely heavily on human auditors whose accuracy depends on experience and manual data review, often leading to higher risks of oversight and errors. AI-powered audits leverage advanced algorithms designed to analyze vast datasets with precision, significantly reducing errors and enhancing compliance accuracy. The automation enables continuous monitoring and pattern recognition, outperforming traditional methods in identifying anomalies and ensuring regulatory adherence.

Cost Implications: Traditional Audit vs. AI-Powered Audit

Traditional audits often incur higher labor costs due to extensive manual review processes, while AI-powered audits reduce expenses by automating data analysis and anomaly detection. AI-driven compliance reviews minimize the need for large audit teams and shorten audit cycles, resulting in significant cost savings. Companies adopting AI-powered audits experience improved efficiency and lower total cost of ownership in tax compliance management.

Data Security and Privacy Considerations

Traditional audits involve manual data handling, increasing the risks of data breaches and unauthorized access to sensitive taxpayer information. Automatic AI-powered audits utilize advanced encryption, real-time monitoring, and strict access controls to enhance data security and ensure compliance with privacy regulations such as GDPR and CCPA. AI-driven systems also provide audit trails and anomaly detection, reducing human error and protecting confidential data throughout the compliance review process.

Scalability: Meeting Complex Compliance Demands with AI

AI-powered audits offer unmatched scalability by rapidly analyzing extensive datasets and adapting to evolving tax regulations, making them ideal for complex compliance scenarios. Traditional audits often struggle with resource limitations and time constraints, hindering their effectiveness in managing large-scale tax compliance reviews. Leveraging machine learning algorithms, AI solutions continuously improve accuracy and efficiency, enabling organizations to meet intricate regulatory demands with greater confidence.

Future Trends: The Integration of AI in Tax Audit Practices

AI-powered audits leverage machine learning algorithms to analyze vast datasets with greater accuracy and speed than traditional manual audits, significantly reducing human error and resource expenditure. Future tax audit practices will increasingly integrate AI to enhance real-time compliance monitoring and predictive risk assessment, enabling proactive identification of discrepancies. This technological shift promises improved regulatory adherence and streamlined audit processes, transforming the landscape of tax compliance review.

Related Important Terms

Continuous Auditing

Continuous auditing leverages AI-powered automation to provide real-time compliance review, significantly reducing manual errors and ensuring timely detection of discrepancies in tax records. Traditional audits rely on periodic, manual assessments that often delay issue identification and increase the risk of non-compliance penalties.

AI-Powered Risk Scoring

AI-powered risk scoring enhances compliance review by analyzing vast datasets with precision, identifying anomalies and potential risks faster than traditional audits. This technology improves accuracy and efficiency, enabling real-time monitoring and proactive risk mitigation in tax audits.

Robotic Process Automation (RPA) in Auditing

Robotic Process Automation (RPA) enhances audit efficiency by automating repetitive compliance review tasks, reducing errors and accelerating data processing compared to traditional manual audits. AI-powered audits leverage RPA to analyze large datasets in real-time, improving accuracy and enabling continuous monitoring of tax compliance.

Smart Contracts Compliance Checks

Traditional audits rely on manual verification and are often time-consuming with increased risk of human error, whereas automatic AI-powered audits enable real-time Smart Contracts compliance checks by analyzing large datasets efficiently and detecting anomalies using advanced algorithms. This AI-driven approach enhances accuracy and scalability in ensuring adherence to tax regulations embedded within smart contracts.

Anomaly Detection Algorithms

Anomaly detection algorithms in automatic AI-powered audits enhance compliance reviews by identifying irregular tax patterns and discrepancies faster and more accurately than traditional audits. These algorithms analyze large datasets in real time, enabling early detection of potential fraud, errors, and non-compliance, significantly reducing manual effort and increasing audit efficiency.

Real-Time Transaction Monitoring

Traditional audits rely on periodic sampling and manual review, often leading to delays and incomplete compliance insights, whereas automatic AI-powered audits utilize real-time transaction monitoring to continuously analyze vast datasets, detect anomalies instantly, and ensure immediate regulatory adherence. Real-time monitoring leverages machine learning algorithms to enhance accuracy, reduce human error, and provide dynamic risk assessments crucial for tax compliance.

Predictive Compliance Analytics

Traditional audit relies on manual review and historical data analysis, often leading to slower detection of compliance risks and potential errors. AI-powered audits leverage predictive compliance analytics to identify patterns and forecast potential tax issues in real time, significantly enhancing accuracy and efficiency in compliance review.

Blockchain-Based Audit Trails

Blockchain-based audit trails enhance transparency and immutability in tax compliance reviews, significantly reducing the risk of data manipulation compared to traditional audit methods. AI-powered automatic audits leverage real-time blockchain data to swiftly identify discrepancies, ensuring more accurate and efficient tax assessments.

Machine Learning-Driven Control Testing

Machine learning-driven control testing enhances traditional audits by automating the analysis of vast datasets, improving accuracy and efficiency in identifying compliance risks. AI-powered audits continuously learn from new data patterns, enabling proactive detection of anomalies and ensuring timely adherence to tax regulations.

Automated Regulatory Mapping

Automated AI-powered audits enhance compliance review by leveraging advanced regulatory mapping technology that continuously updates tax laws and regulations, ensuring accurate identification of relevant compliance requirements. Traditional audits rely heavily on manual processes, which often result in slower updates and increased risk of overlooking critical regulatory changes, whereas AI-driven systems enable real-time adaptation and more efficient error detection.

Traditional audit vs Automatic AI-powered audit for compliance review. Infographic

moneydiff.com

moneydiff.com