Tax filing requires manual data entry and submission, which can increase the risk of errors and delays in meeting compliance deadlines. Tax automation streamlines the compliance process by utilizing software to accurately collect, validate, and file tax information efficiently. Implementing tax automation reduces administrative burdens and enhances accuracy, ensuring timely adherence to regulatory requirements.

Table of Comparison

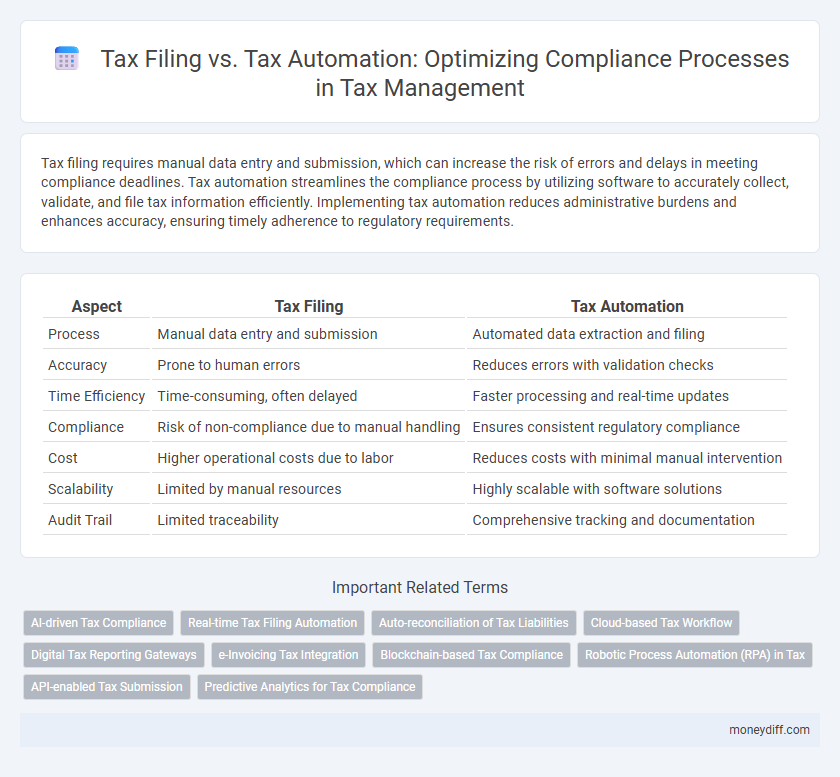

| Aspect | Tax Filing | Tax Automation |

|---|---|---|

| Process | Manual data entry and submission | Automated data extraction and filing |

| Accuracy | Prone to human errors | Reduces errors with validation checks |

| Time Efficiency | Time-consuming, often delayed | Faster processing and real-time updates |

| Compliance | Risk of non-compliance due to manual handling | Ensures consistent regulatory compliance |

| Cost | Higher operational costs due to labor | Reduces costs with minimal manual intervention |

| Scalability | Limited by manual resources | Highly scalable with software solutions |

| Audit Trail | Limited traceability | Comprehensive tracking and documentation |

Understanding Tax Filing and Tax Automation

Tax filing involves submitting required financial documents and returns to tax authorities within specified deadlines to ensure compliance with tax laws. Tax automation utilizes software solutions to streamline data collection, validation, and submission processes, reducing errors and increasing efficiency in meeting compliance requirements. Implementing tax automation enhances accuracy, accelerates filing timelines, and supports real-time monitoring of regulatory changes for effective tax management.

Key Differences Between Tax Filing and Tax Automation

Tax filing involves the manual submission of tax returns to regulatory authorities, requiring accurate data entry and adherence to deadlines, while tax automation uses software to streamline data collection, calculation, and submission processes, reducing errors and saving time. Tax automation integrates real-time compliance updates and audit trails, enhancing accuracy and transparency compared to traditional tax filing methods. Organizations adopting tax automation benefit from improved regulatory compliance, reduced operational costs, and faster processing times.

Compliance Challenges in Manual Tax Filing

Manual tax filing presents significant compliance challenges due to the high risk of human error in data entry, leading to inaccurate reporting and potential penalties. The complexity of constantly changing tax laws and regulations makes it difficult for manual processes to ensure timely updates and adherence, increasing the likelihood of non-compliance. Furthermore, manual filing consumes substantial time and resources, limiting efficiency and increasing audit risks for businesses.

How Tax Automation Simplifies Compliance

Tax automation streamlines the compliance process by reducing manual data entry errors and accelerating the preparation of accurate tax filings. Leveraging advanced software, companies can automatically update tax codes, track regulatory changes, and generate real-time compliance reports, ensuring timely and precise submissions. This digital transformation minimizes audit risks and enhances overall efficiency in meeting complex tax regulations.

Accuracy and Error Reduction: Filing vs Automation

Tax automation significantly enhances accuracy and error reduction in the compliance process compared to manual tax filing. Automated systems use algorithms and real-time data validation to minimize human errors, ensuring precise calculations and timely submissions. This technological approach reduces audit risks and improves overall compliance reliability, increasing efficiency for tax professionals and businesses.

Impact on Efficiency and Speed in Compliance

Tax automation significantly enhances efficiency and speed in the compliance process by reducing manual data entry errors and accelerating the preparation and submission of tax returns. Automated systems integrate real-time data validation and regulatory updates, ensuring accurate and timely tax filings while minimizing the risk of penalties. This shift from traditional tax filing methods to automation streamlines workflows, allowing organizations to meet compliance deadlines faster and with greater accuracy.

Cost Comparison: Manual Filing vs Automated Solutions

Manual tax filing involves significant labor costs, prolonged processing time, and higher risks of human error, leading to potential penalties and audits. Automated tax compliance solutions reduce operational expenses by streamlining data entry, enhancing accuracy, and accelerating submission deadlines. Businesses investing in tax automation experience lower overall costs and improved compliance efficiency compared to traditional manual filing methods.

Ensuring Regulatory Updates and Timely Compliance

Tax automation streamlines the compliance process by integrating real-time regulatory updates, reducing errors and ensuring deadlines are consistently met. Automated systems continuously monitor tax laws and adjust filing parameters, minimizing risks of non-compliance and penalties. Efficient tax filing relies on manual checks, while automation enhances accuracy and adaptability to changing regulations.

Security and Data Privacy Considerations

Tax filing requires stringent security protocols to protect sensitive financial information from unauthorized access during manual submission processes. Tax automation enhances compliance by integrating encryption, secure data transfer, and access controls to minimize risks of data breaches and ensure privacy. Implementing robust cybersecurity measures in automated systems supports regulatory adherence and reduces vulnerabilities inherent in traditional tax filing methods.

Choosing the Right Approach for Effective Tax Compliance

Tax filing involves manually submitting tax returns, which can be time-consuming and prone to errors, while tax automation leverages software to streamline data processing and improve accuracy in compliance. Choosing tax automation enhances efficiency by reducing human error and ensuring timely submission aligned with regulatory changes. Organizations aiming for effective tax compliance should evaluate their complexity, volume of transactions, and resources to select between traditional filing and automated solutions.

Related Important Terms

AI-driven Tax Compliance

AI-driven tax compliance transforms the tax filing process by automating data extraction, error detection, and real-time regulatory updates, significantly reducing manual errors and processing time. Leveraging machine learning algorithms, tax automation enhances accuracy and ensures adherence to evolving tax laws, optimizing compliance and minimizing audit risks.

Real-time Tax Filing Automation

Real-time tax filing automation streamlines compliance by eliminating manual data entry errors and ensuring immediate submission of accurate tax returns, significantly reducing audit risks. This technology integrates directly with financial systems to provide continuous transaction monitoring and instant tax calculations, enhancing efficiency and regulatory adherence in the tax filing process.

Auto-reconciliation of Tax Liabilities

Automated tax reconciliation streamlines the process of matching reported tax liabilities with actual obligations, reducing errors and minimizing the risk of non-compliance. Tax automation platforms enhance accuracy and efficiency by integrating real-time data, enabling businesses to seamlessly file returns while ensuring alignment with regulatory requirements.

Cloud-based Tax Workflow

Cloud-based tax workflow streamlines tax filing by automating data aggregation, validation, and submission, reducing human error and ensuring timely compliance with evolving regulations. Tax automation platforms integrate real-time regulatory updates and audit trails, optimizing accuracy and efficiency in the compliance process.

Digital Tax Reporting Gateways

Tax filing through manual processes often leads to errors, delays, and increased compliance costs, whereas tax automation streamlines data collection and submission by integrating Digital Tax Reporting Gateways (DTRGs) that enable real-time reporting and enhance accuracy. Utilizing DTRGs ensures seamless communication between taxpayers and tax authorities, reducing audit risks and accelerating compliance workflows through automated validation and standardized data formats.

e-Invoicing Tax Integration

Tax filing traditionally involves manual entry and verification of e-invoices, increasing the risk of errors and non-compliance with tax regulations. Tax automation integrates e-invoicing systems directly with tax authorities, enabling real-time data validation, reducing compliance discrepancies, and streamlining the entire tax reporting process.

Blockchain-based Tax Compliance

Blockchain-based tax compliance enhances accuracy and transparency by automating tax filing processes through secure, immutable ledgers that reduce errors and fraud. This technology streamlines regulatory adherence, accelerates reporting times, and ensures real-time auditability compared to traditional manual tax filing methods.

Robotic Process Automation (RPA) in Tax

Robotic Process Automation (RPA) enhances tax filing accuracy and efficiency by automating repetitive compliance tasks such as data entry, validation, and report generation, reducing human errors and accelerating processing times. Integrating RPA within tax compliance processes allows organizations to streamline workflow, ensure regulatory adherence, and improve audit traceability through standardized, real-time digital records.

API-enabled Tax Submission

API-enabled tax submission streamlines the tax filing process by automating data exchange between financial systems and tax authorities, significantly reducing errors and processing time. This tax automation solution ensures real-time compliance updates and seamless integration with multiple jurisdictional requirements, enhancing accuracy and efficiency in regulatory reporting.

Predictive Analytics for Tax Compliance

Predictive analytics in tax compliance enables firms to forecast potential audit risks and identify discrepancies before filing, enhancing accuracy and reducing penalties. Automating tax processes with predictive models streamlines data validation, ensures regulatory adherence, and accelerates timely submission of tax returns.

Tax filing vs Tax automation for compliance process. Infographic

moneydiff.com

moneydiff.com