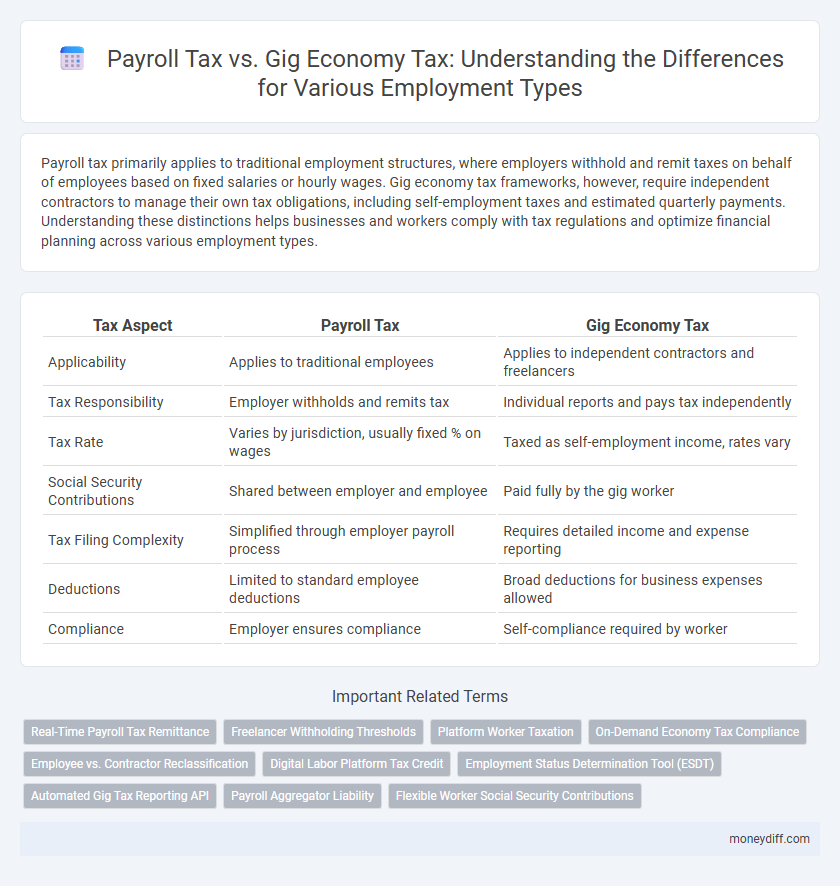

Payroll tax primarily applies to traditional employment structures, where employers withhold and remit taxes on behalf of employees based on fixed salaries or hourly wages. Gig economy tax frameworks, however, require independent contractors to manage their own tax obligations, including self-employment taxes and estimated quarterly payments. Understanding these distinctions helps businesses and workers comply with tax regulations and optimize financial planning across various employment types.

Table of Comparison

| Tax Aspect | Payroll Tax | Gig Economy Tax |

|---|---|---|

| Applicability | Applies to traditional employees | Applies to independent contractors and freelancers |

| Tax Responsibility | Employer withholds and remits tax | Individual reports and pays tax independently |

| Tax Rate | Varies by jurisdiction, usually fixed % on wages | Taxed as self-employment income, rates vary |

| Social Security Contributions | Shared between employer and employee | Paid fully by the gig worker |

| Tax Filing Complexity | Simplified through employer payroll process | Requires detailed income and expense reporting |

| Deductions | Limited to standard employee deductions | Broad deductions for business expenses allowed |

| Compliance | Employer ensures compliance | Self-compliance required by worker |

Understanding Payroll Tax: An Overview

Payroll tax is a government-mandated tax based on employee wages, typically funding social security, healthcare, and unemployment benefits. In traditional employment, employers are responsible for withholding and remitting payroll taxes, whereas gig economy workers often handle their own tax obligations as independent contractors. Understanding payroll tax is crucial for employers and workers alike to ensure legal compliance and accurate financial planning.

Gig Economy Taxation Explained

Gig economy taxation requires independent contractors and freelancers to manage their own payroll tax obligations, including self-employment tax covering Social Security and Medicare contributions. Unlike traditional payroll tax withheld by employers, gig workers must calculate and pay estimated taxes quarterly to comply with IRS regulations. Understanding gig economy tax rules is crucial for accurate reporting, avoiding penalties, and maximizing eligible deductions related to business expenses.

Key Differences Between Payroll and Gig Economy Taxes

Payroll tax involves employer withholding and contributions based on employee wages, including Social Security and Medicare taxes, while gig economy tax requires independent contractors to self-report income and pay self-employment taxes covering both employer and employee portions. Payroll tax typically applies to traditional employment with regular paychecks, whereas gig economy tax relates to freelance or contract work with variable income streams. Understanding these distinctions is crucial for compliance with IRS regulations and accurate tax filings specific to each employment classification.

Employee vs. Independent Contractor: Tax Implications

Employees have payroll taxes withheld directly by employers, including Social Security, Medicare, and unemployment taxes, ensuring compliance and simplified tax reporting. Independent contractors in the gig economy must self-report income and pay self-employment tax, covering both the employer and employee portions of Social Security and Medicare, leading to higher individual tax liability. Misclassification between employee and independent contractor status can result in significant tax penalties and liabilities for both workers and businesses.

Payroll Tax Responsibilities for Employers

Employers are responsible for payroll tax, which includes withholding income taxes, Social Security, and Medicare from employees' wages, and remitting these amounts to the IRS. In contrast, gig economy workers classified as independent contractors handle their own tax obligations, including self-employment taxes. Proper classification is essential to ensure compliance and avoid penalties related to payroll tax responsibilities.

Gig Workers’ Tax Obligations and Challenges

Gig workers face unique tax obligations distinct from traditional payroll tax systems, requiring self-employment tax payments on all income rather than employer-withheld payroll taxes. Navigating quarterly estimated tax payments and maintaining detailed records of diverse income streams pose significant challenges for gig economy workers. Tax compliance complexity increases due to varying state laws and the lack of standardized employer reporting typically found in standard employment.

Withholding and Reporting: Payroll vs. Gig Economy

Payroll tax requires employers to withhold income tax, Social Security, and Medicare contributions directly from employees' wages, ensuring timely reporting to tax authorities via regular payroll filings. In contrast, gig economy tax relies on independent contractors who receive gross payments without withholding, necessitating self-reporting and estimated tax payments throughout the year. Employers in traditional payroll setups manage tax withholding and reporting compliance, whereas gig platforms must issue informational forms like 1099-NEC, shifting withholding responsibilities to workers.

Social Security and Medicare: Payroll vs. Gig Tax Contributions

Payroll tax contributions for Social Security and Medicare are typically split between employers and employees, with each paying 6.2% for Social Security and 1.45% for Medicare. In the gig economy, independent contractors are responsible for the full 12.4% Social Security and 2.9% Medicare tax, reflecting self-employment tax rates. This discrepancy increases the tax burden on gig workers compared to traditional employees, affecting their net income and retirement benefits.

Compliance Risks in Payroll and Gig Economy Taxation

Payroll tax compliance poses significant risks due to misclassification of workers, leading to penalties for unpaid employer contributions and withheld taxes. Gig economy tax challenges arise from inconsistent reporting, varied income sources, and lack of standardized withholding, increasing audit exposure and fines. Employers and platforms must implement accurate worker classification and robust reporting systems to mitigate risks and ensure adherence to evolving tax regulations.

Choosing the Right Employment Type: Tax Impact Analysis

Choosing the right employment type requires careful analysis of payroll tax versus gig economy tax obligations, as payroll taxes impose employer and employee contributions for Social Security and Medicare, directly impacting total labor costs. In contrast, gig economy workers face self-employment taxes, encompassing both employer and employee portions, which can affect net income and tax filing responsibilities. Understanding these tax distinctions is essential for businesses and independent contractors to optimize tax liabilities and compliance.

Related Important Terms

Real-Time Payroll Tax Remittance

Real-time payroll tax remittance ensures accurate and timely withholding of taxes for traditional employees, streamlining compliance with government regulations. In contrast, gig economy tax obligations often require self-reporting and periodic payments, creating challenges in aligning with real-time remittance systems.

Freelancer Withholding Thresholds

Freelancer withholding thresholds determine the minimum income level at which tax must be withheld from payments to independent contractors, contrasting with payroll tax obligations that primarily apply to traditional employees under formal employment agreements. Understanding these thresholds is crucial for gig economy workers and businesses to ensure compliance with tax regulations and avoid penalties related to underreporting or misclassification of employment types.

Platform Worker Taxation

Platform worker taxation distinguishes payroll tax, typically borne by employers on wages paid to traditional employees, from gig economy tax obligations where independent contractors manage their own tax liabilities, including self-employment and income taxes. Governments are increasingly tailoring regulations to address platform-specific challenges, ensuring gig workers contribute fairly while maintaining flexibility inherent to independent contracting arrangements.

On-Demand Economy Tax Compliance

Payroll tax requires employers to withhold income tax, Social Security, and Medicare from employees' wages, ensuring regulatory compliance for traditional employment types. In contrast, gig economy tax compliance demands self-employed individuals to track income, pay estimated quarterly taxes, and manage self-employment tax obligations to fulfill IRS requirements for independent contractors.

Employee vs. Contractor Reclassification

Payroll tax typically applies to employees with employer withholding obligations, while gig economy workers classified as independent contractors may face different tax liabilities, often resulting in complicated reclassification issues. Misclassification risks trigger audits and penalties as tax authorities increasingly scrutinize distinctions between employees and contractors to ensure proper payroll tax compliance.

Digital Labor Platform Tax Credit

Payroll tax typically applies to traditional employment relationships where employers withhold income and social security taxes, while gig economy tax regulations address independent contractors operating through digital labor platforms. The Digital Labor Platform Tax Credit incentivizes platforms to formalize tax reporting by offering credits based on accurate payroll tax remittances for gig workers, bridging compliance gaps between conventional payroll and gig economy taxation.

Employment Status Determination Tool (ESDT)

The Employment Status Determination Tool (ESDT) plays a critical role in distinguishing between payroll tax obligations for traditional employees and gig economy tax liabilities for independent contractors. Accurate use of the ESDT ensures compliance with tax regulations by correctly classifying workers, thereby optimizing payroll tax collection and minimizing disputes over employment status.

Automated Gig Tax Reporting API

Payroll tax imposes obligations on employers to withhold and remit taxes for traditional employees, while gig economy tax requires self-employed workers or platforms to report income and remit taxes, often complicating compliance. Automated Gig Tax Reporting APIs streamline this process by integrating real-time income tracking, tax calculation, and reporting for diverse gig employment types, ensuring accuracy and regulatory adherence.

Payroll Aggregator Liability

Payroll aggregators assume the liability for withholding and remitting payroll taxes on behalf of gig economy workers, streamlining compliance for multiple clients and reducing individual employer burden. Unlike traditional payroll tax systems where employers directly handle tax obligations, payroll aggregators consolidate payments, ensuring accurate reporting and minimizing risks of tax evasion in decentralized gig employment structures.

Flexible Worker Social Security Contributions

Flexible worker social security contributions differ significantly between payroll tax systems and gig economy tax frameworks, with payroll taxes typically imposing fixed employer and employee rates based on wages, while gig economy taxes require variable contributions reflecting inconsistent earnings and self-employment status. Understanding these distinctions is crucial for accurately calculating liabilities, ensuring compliance, and optimizing tax strategies for both traditional employees and independent gig workers.

Payroll tax vs Gig economy tax for employment types. Infographic

moneydiff.com

moneydiff.com