Tax returns require meticulous data entry and manual verification, which can lead to errors and extended processing times. Tax automation streamlines the filing process by using software to accurately gather and submit information, enhancing efficiency and compliance. Automating tax returns reduces the risk of human error and ensures timely submission to tax authorities.

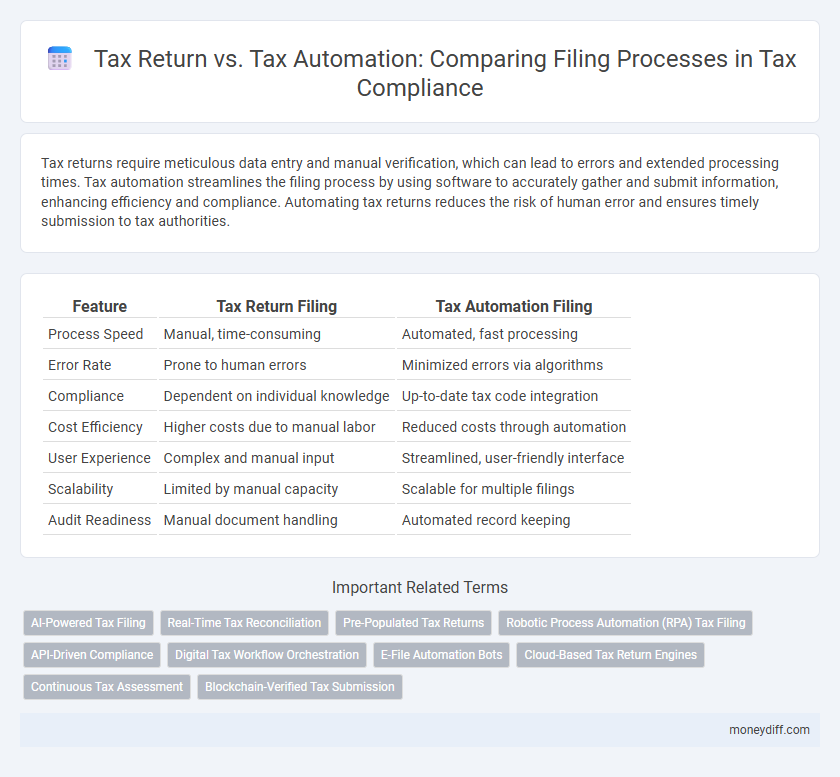

Table of Comparison

| Feature | Tax Return Filing | Tax Automation Filing |

|---|---|---|

| Process Speed | Manual, time-consuming | Automated, fast processing |

| Error Rate | Prone to human errors | Minimized errors via algorithms |

| Compliance | Dependent on individual knowledge | Up-to-date tax code integration |

| Cost Efficiency | Higher costs due to manual labor | Reduced costs through automation |

| User Experience | Complex and manual input | Streamlined, user-friendly interface |

| Scalability | Limited by manual capacity | Scalable for multiple filings |

| Audit Readiness | Manual document handling | Automated record keeping |

Understanding Tax Returns: Manual Filing Explained

Tax returns involve manually compiling income, deductions, and credits to report annual tax obligations accurately, requiring thorough understanding of tax laws and documentation. Manual filing processes can be time-consuming and prone to errors due to data entry and calculation complexities. Tax automation streamlines this by using software to digitally prepare, review, and file returns, improving accuracy and efficiency in compliance.

Tax Automation: Revolutionizing the Filing Process

Tax automation revolutionizes the filing process by leveraging advanced software to accurately compile, review, and submit returns with minimal human intervention, reducing errors and saving time. Automated systems integrate real-time tax law updates and optimize deductions, ensuring compliance and maximizing refunds. This shift enhances efficiency for individuals and businesses, transforming traditional tax return preparation into a streamlined, digitized workflow.

Key Differences Between Traditional and Automated Tax Filing

Traditional tax filing involves manual data entry and paperwork, increasing the risk of errors and requiring significant time investment. Tax automation leverages software to streamline data import, error detection, and submission processes, enhancing accuracy and efficiency. Automated systems also enable real-time compliance updates and reduce the likelihood of audits compared to conventional tax return methods.

Efficiency and Time Savings: Manual vs Automated Tax Processes

Tax automation significantly enhances efficiency by reducing the time required to file tax returns compared to manual processes, which often involve repetitive data entry and a higher risk of errors. Automated tax systems streamline data integration, enable real-time compliance checks, and expedite calculations, leading to faster submission and processing. As a result, businesses and individuals experience substantial time savings and improved accuracy in tax filing.

Accuracy and Error Reduction in Tax Return Methods

Tax automation significantly improves accuracy by minimizing human errors commonly found in manual tax return filings, using algorithms to validate data and ensure compliance with tax regulations. Automated systems efficiently detect inconsistencies and flag potential errors before submission, reducing the risk of audits and penalties. Enhanced precision in tax return methods through automation leads to faster processing times and greater confidence in filed documents.

Costs Involved: Filing Tax Returns vs Tax Automation Tools

Filing tax returns manually involves costs such as hiring professional accountants, purchasing tax forms, and potential errors leading to penalties. Tax automation tools reduce these expenses by streamlining data entry, minimizing human error, and providing real-time updates on tax regulations. Over time, automation not only lowers operational costs but also enhances accuracy and compliance, making it a cost-effective alternative to traditional filing methods.

Compliance and Updates: Staying Current with Tax Laws

Tax automation streamlines filing processes by continuously updating compliance measures to align with the latest tax laws and regulations. Automated systems reduce errors and ensure timely submissions by integrating real-time legal changes directly into tax return calculations. This dynamic approach minimizes risks of penalties and audits caused by outdated or incorrect tax information.

Data Security: Protecting Your Information in Both Methods

Tax return filing and tax automation both require stringent data security measures to protect sensitive financial information from breaches and unauthorized access. Advanced encryption protocols and multi-factor authentication are essential in automated tax software to ensure data integrity and confidentiality during electronic submissions. Traditional tax return processes rely heavily on secure physical handling and trusted professional oversight, but automation enhances protection by continuously updating security features against evolving cyber threats.

User Experience: Ease of Use in Tax Returns vs Automation

Tax automation significantly enhances user experience by streamlining the filing process, reducing manual data entry, and minimizing errors compared to traditional tax return methods. Automated systems integrate with financial software, offering real-time data validation and step-by-step guidance that simplify compliance with tax regulations. This ease of use accelerates filing times and improves accuracy, making tax automation a preferred choice for individuals and businesses seeking efficient tax return submissions.

Choosing the Right Filing Process: Manual Returns or Automation?

Choosing the right tax filing process depends on the complexity of your financial situation and the volume of transactions; manual tax returns provide control and flexibility for simple cases but can be time-consuming and prone to errors. Tax automation software leverages AI and data integration to streamline the filing process, reduce human errors, and ensure compliance with the latest IRS regulations, making it ideal for businesses and individuals with extensive tax activities. Evaluating factors such as cost, accuracy requirements, and deadline sensitivity will help determine whether manual filing or automated solutions best suit your tax return needs.

Related Important Terms

AI-Powered Tax Filing

AI-powered tax filing leverages machine learning algorithms to automate data extraction, error detection, and compliance checks, significantly reducing the time and complexity of traditional tax return processes. This technology enhances accuracy in tax calculations and ensures adherence to ever-changing tax regulations, optimizing both efficiency and compliance.

Real-Time Tax Reconciliation

Real-time tax reconciliation enhances accuracy by automatically matching transaction data against tax reports during the filing process, reducing errors and audit risks compared to traditional tax return methods. Tax automation systems streamline compliance and improve efficiency with instant validation, eliminating manual data entry delays and ensuring up-to-date tax liability calculations.

Pre-Populated Tax Returns

Pre-populated tax returns streamline the filing process by automatically filling in taxpayer information using data from employers, banks, and government agencies, significantly reducing errors and processing time. Tax automation extends this efficiency by integrating AI-driven tools that validate and submit returns, enhancing accuracy and compliance while minimizing manual input.

Robotic Process Automation (RPA) Tax Filing

Robotic Process Automation (RPA) in tax filing streamlines tax return processes by automating repetitive data entry, validation, and submission tasks, significantly reducing errors and processing time. RPA enhances compliance and accuracy in tax return filing by integrating seamlessly with existing tax systems, allowing real-time data extraction and efficient handling of complex tax regulations.

API-Driven Compliance

API-driven compliance in tax automation streamlines the filing process by enabling real-time data integration between accounting systems and tax authorities, reducing errors and enhancing accuracy in tax returns. Automated workflows powered by robust APIs ensure timely submissions and seamless updates on tax regulations, significantly improving efficiency compared to manual tax return filing.

Digital Tax Workflow Orchestration

Tax return processes can be significantly streamlined through digital tax workflow orchestration, which integrates data collection, validation, and submission into a seamless automation system. By leveraging tax automation technologies, organizations reduce manual errors, ensure regulatory compliance, and accelerate filing timelines, enhancing overall tax efficiency.

E-File Automation Bots

E-File automation bots streamline tax return filing by reducing manual data entry errors and accelerating submission times, enhancing compliance with IRS e-filing requirements. These bots integrate with tax software to automatically extract, validate, and transmit taxpayer information, optimizing accuracy and efficiency in the tax return process.

Cloud-Based Tax Return Engines

Cloud-based tax return engines streamline the filing process by automating data entry, error detection, and compliance checks, significantly reducing manual workload and processing time. These platforms integrate real-time tax code updates and secure data storage, enhancing accuracy and efficiency compared to traditional tax return methods.

Continuous Tax Assessment

Continuous Tax Assessment leverages tax automation to streamline the filing process by enabling real-time data integration and instant error detection, significantly reducing manual input and compliance risks. Unlike traditional tax returns that involve periodic submissions, automated systems ensure ongoing accuracy and regulatory adherence through continuous monitoring and updates.

Blockchain-Verified Tax Submission

Blockchain-verified tax submission ensures tamper-proof, transparent tax return filing by securely recording each transaction on an immutable ledger, reducing fraud and errors in tax automation processes. This integration enhances compliance accuracy, accelerates audit trails, and streamlines verification timelines for tax authorities and filers alike.

Tax Return vs Tax Automation for filing processes. Infographic

moneydiff.com

moneydiff.com