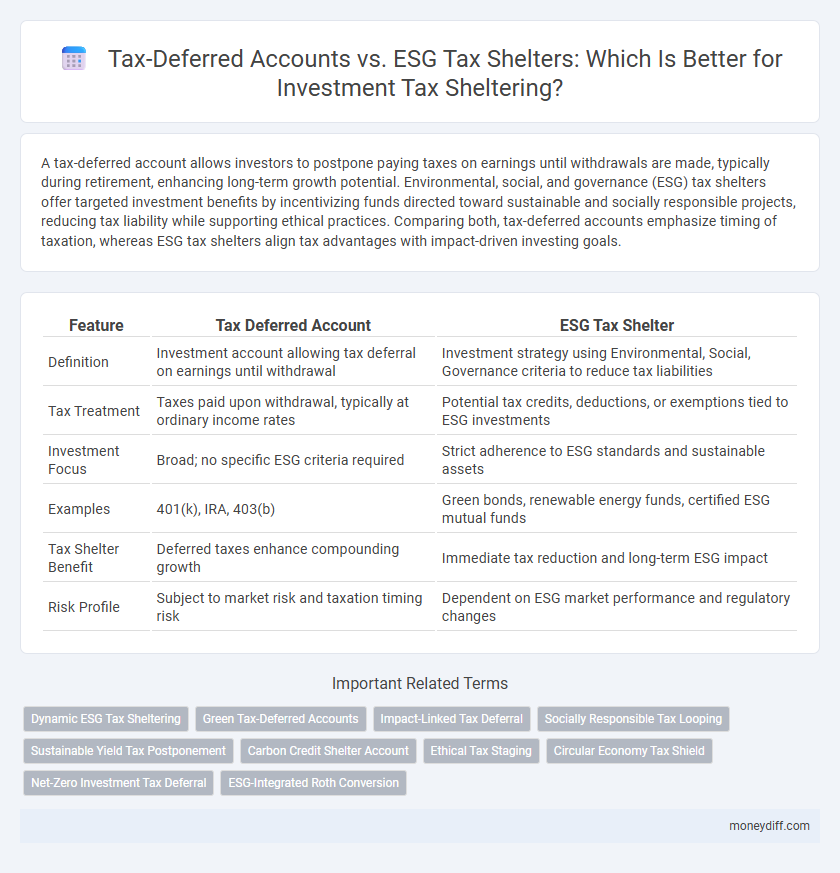

A tax-deferred account allows investors to postpone paying taxes on earnings until withdrawals are made, typically during retirement, enhancing long-term growth potential. Environmental, social, and governance (ESG) tax shelters offer targeted investment benefits by incentivizing funds directed toward sustainable and socially responsible projects, reducing tax liability while supporting ethical practices. Comparing both, tax-deferred accounts emphasize timing of taxation, whereas ESG tax shelters align tax advantages with impact-driven investing goals.

Table of Comparison

| Feature | Tax Deferred Account | ESG Tax Shelter |

|---|---|---|

| Definition | Investment account allowing tax deferral on earnings until withdrawal | Investment strategy using Environmental, Social, Governance criteria to reduce tax liabilities |

| Tax Treatment | Taxes paid upon withdrawal, typically at ordinary income rates | Potential tax credits, deductions, or exemptions tied to ESG investments |

| Investment Focus | Broad; no specific ESG criteria required | Strict adherence to ESG standards and sustainable assets |

| Examples | 401(k), IRA, 403(b) | Green bonds, renewable energy funds, certified ESG mutual funds |

| Tax Shelter Benefit | Deferred taxes enhance compounding growth | Immediate tax reduction and long-term ESG impact |

| Risk Profile | Subject to market risk and taxation timing risk | Dependent on ESG market performance and regulatory changes |

Understanding Tax-Deferred Accounts

Tax-deferred accounts, such as 401(k)s and IRAs, allow investors to postpone paying taxes on contributions and earnings until withdrawal, enhancing long-term growth through compounding. Unlike environmental, social, and governance (ESG) tax shelters, which provide targeted tax incentives for investments aligned with sustainable and ethical criteria, tax-deferred accounts offer broad tax advantages without specific investment restrictions. Understanding the mechanics of tax deferral helps investors maximize retirement savings while balancing portfolio strategies including ESG-focused tax benefits.

Key Features of ESG Tax Shelters

ESG tax shelters primarily focus on investments aligned with environmental, social, and governance criteria, offering tax incentives for supporting sustainable and ethical projects. These shelters enable investors to reduce taxable income through contributions to socially responsible funds, often providing benefits such as tax credits, deferrals, or exemptions tied to impact-driven initiatives. Unlike traditional tax deferred accounts, ESG tax shelters emphasize promoting long-term sustainability goals alongside financial returns.

Tax Benefits Comparison: Deferred vs. ESG Shelters

Tax-deferred accounts offer the benefit of postponing income tax on contributions and earnings until withdrawal, enabling potential growth without immediate tax liability. ESG tax shelters provide targeted incentives such as tax credits or deductions for investments in environmentally and socially responsible projects, potentially reducing current taxable income. Comparing tax benefits, deferred accounts focus on time-shifting taxes, while ESG shelters combine tax savings with promoting sustainability and social governance goals.

Eligibility Requirements for Each Strategy

Tax deferred accounts require individual eligibility, often tied to income limits, employment status, and contribution caps, such as those for 401(k)s or IRAs. Environmental, social, and governance (ESG) tax shelters typically necessitate investing in qualified projects or funds that meet specific sustainability criteria and regulatory certifications. Understanding these distinct eligibility requirements is crucial for optimizing investment sheltering strategies within tax frameworks.

Long-Term Growth Potential

Tax-deferred accounts, such as IRAs and 401(k)s, offer long-term growth potential by allowing investments to compound tax-free until withdrawal, maximizing capital accumulation. Environmental, social, and governance (ESG) tax shelters provide incentives like tax credits or deductions that align investments with sustainable practices, potentially enhancing risk-adjusted returns over time. Combining tax deferral with ESG-focused strategies can optimize portfolio growth while supporting responsible investment goals.

Environmental and Social Impact Considerations

Tax-deferred accounts allow investors to postpone tax payments on earnings until funds are withdrawn, promoting long-term growth through compound interest advantages. Environmental, social, and governance (ESG) tax shelters not only provide potential tax benefits but also align investments with sustainable practices, driving positive social impact and corporate responsibility. Prioritizing ESG tax shelters supports ethical investment strategies that address climate change, social equity, and governance transparency while optimizing tax efficiency.

Risk Profiles: Tax-Deferred vs. ESG Investing

Tax-deferred accounts offer predictable tax benefits by deferring income tax until withdrawals, typically aligning with moderate risk tolerance and long-term growth strategies. ESG tax shelters integrate environmental, social, and governance criteria, introducing unique risks linked to regulatory changes and market perceptions of sustainability initiatives. Investors must evaluate the stability of tax deferral mechanisms against the evolving regulatory landscape and reputational risks inherent in ESG-focused investment shelters.

Costs and Fees Analysis

Tax-deferred accounts often involve minimal management fees and tax deferral on earnings, enhancing long-term growth potential with predictable cost structures. Environmental, social, and governance (ESG) tax shelters may incur higher expenses due to fund management fees, certification costs, and compliance monitoring that can reduce net returns. Evaluating both options requires examining fee transparency, expense ratios, and tax benefits to optimize investment sheltering based on cost efficiency and regulatory incentives.

Regulatory and Legislative Trends

Tax-deferred accounts benefit from established regulatory frameworks such as Section 401(k) and Individual Retirement Accounts (IRAs), offering investors predictable tax advantages by deferring income taxes until withdrawal. Environmental, Social, and Governance (ESG) tax shelters are emerging under evolving legislative trends, with governments introducing incentives like the Inflation Reduction Act's clean energy tax credits to promote sustainable investment. Regulatory scrutiny increasingly targets ESG tax shelters to ensure compliance and prevent abuse, reflecting a dynamic landscape where tax policy integrates climate and social governance goals.

Choosing the Best Investment Shelter for Your Portfolio

Tax-deferred accounts, such as traditional IRAs and 401(k)s, allow investors to postpone taxes on earnings until withdrawal, maximizing compound growth over time. Environmental, Social, and Governance (ESG) tax shelters leverage investment in sustainable companies that may offer specific tax incentives or credits, aligning financial goals with ethical considerations. Evaluating your portfolio's risk tolerance, investment horizon, and tax bracket is essential to choose between conventional tax deferral and ESG-focused shelters that optimize both tax efficiency and social impact.

Related Important Terms

Dynamic ESG Tax Sheltering

Dynamic ESG tax sheltering integrates environmental, social, and governance factors into tax-deferred investment accounts to optimize capital growth while minimizing tax liabilities. Utilizing real-time ESG data and advanced portfolio management, investors benefit from enhanced tax efficiency and alignment with sustainability goals, surpassing traditional tax-deferred plans.

Green Tax-Deferred Accounts

Green tax-deferred accounts allow investors to postpone taxes on contributions and earnings while supporting environmentally sustainable projects, integrating tax efficiency with ESG principles. These accounts maximize investment growth by combining the benefits of tax deferral with incentives for funding green initiatives, offering a strategic advantage over traditional tax shelters.

Impact-Linked Tax Deferral

Impact-linked tax deferral strategies allow investors to postpone tax liabilities on gains tied directly to environmental, social, and governance (ESG) performance metrics, enhancing both financial and social outcomes. Unlike traditional tax-deferred accounts, ESG tax shelters incentivize sustainable investing by linking tax benefits to measurable positive impacts in areas such as carbon reduction, social equity, and corporate governance improvements.

Socially Responsible Tax Looping

Tax-deferred accounts allow investors to postpone taxes on earnings until withdrawal, optimizing long-term growth, while Environmental, Social, and Governance (ESG) tax shelters provide targeted benefits by supporting socially responsible investments that align with ethical standards. Socially Responsible Tax Looping integrates ESG criteria into tax deferral strategies, enhancing both financial returns and positive social impact through sustainable investment practices.

Sustainable Yield Tax Postponement

Tax-deferred accounts allow investors to postpone tax liabilities on earnings until withdrawals are made, optimizing long-term growth by leveraging compound interest. Environmental, social, and governance (ESG) tax shelters provide targeted investment benefits by enabling sustainable yield tax postponement through incentives for socially responsible assets, enhancing both financial returns and ethical impact.

Carbon Credit Shelter Account

Tax deferred accounts allow investors to postpone taxes on investment gains until withdrawal, providing flexibility in managing taxable income over time. In contrast, Environmental, Social, and Governance (ESG) tax shelters like Carbon Credit Shelter Accounts offer targeted incentives by enabling tax relief through investments in carbon offset projects, promoting sustainable practices while sheltering returns.

Ethical Tax Staging

Tax-deferred accounts allow investors to postpone tax payments on earnings until withdrawals, optimizing wealth growth through compounding without immediate tax liabilities. Environmental, social, and governance (ESG) tax shelters provide ethical tax staging by combining investment growth with socially responsible practices, offering tax benefits while promoting sustainable and equitable economic outcomes.

Circular Economy Tax Shield

Tax-deferred accounts allow investors to postpone tax payments on earnings until withdrawal, optimizing long-term growth by leveraging compound interest. The Circular Economy Tax Shield, an ESG-focused tax shelter, incentivizes sustainable investments by offering targeted tax credits and deductions, aligning financial gains with environmental and social governance goals.

Net-Zero Investment Tax Deferral

A Net-Zero Investment Tax Deferral leverages tax-deferred accounts allowing investors to postpone capital gains taxes on eco-friendly investments aligned with environmental, social, and governance (ESG) principles. This strategy integrates traditional tax deferral benefits with targeted ESG tax shelters to promote sustainable investing while optimizing tax efficiency and long-term portfolio growth.

ESG-Integrated Roth Conversion

ESG-Integrated Roth conversions offer a unique tax sheltering strategy by combining the tax-deferred growth of traditional retirement accounts with investment in Environmental, Social, and Governance-focused assets, potentially enhancing long-term returns while supporting sustainable initiatives. Unlike conventional Tax Deferred accounts, which postpone taxes until withdrawal, ESG-Integrated Roth Conversions entail paying taxes upfront, allowing for tax-free growth and withdrawals, aligning both financial and ethical investment goals.

Tax deferred account vs Environmental, social, and governance tax shelter for investment sheltering. Infographic

moneydiff.com

moneydiff.com