Sales tax applies to the sale of physical goods and certain taxable services, varying by state regulations, while digital goods tax specifically targets electronically delivered products such as e-books, software, and streaming services. Online businesses must carefully navigate these tax distinctions to remain compliant, as digital goods taxation often involves unique rules and thresholds different from traditional sales tax. Proper understanding and application of both tax types ensure accurate reporting and avoid penalties in multi-jurisdictional sales environments.

Table of Comparison

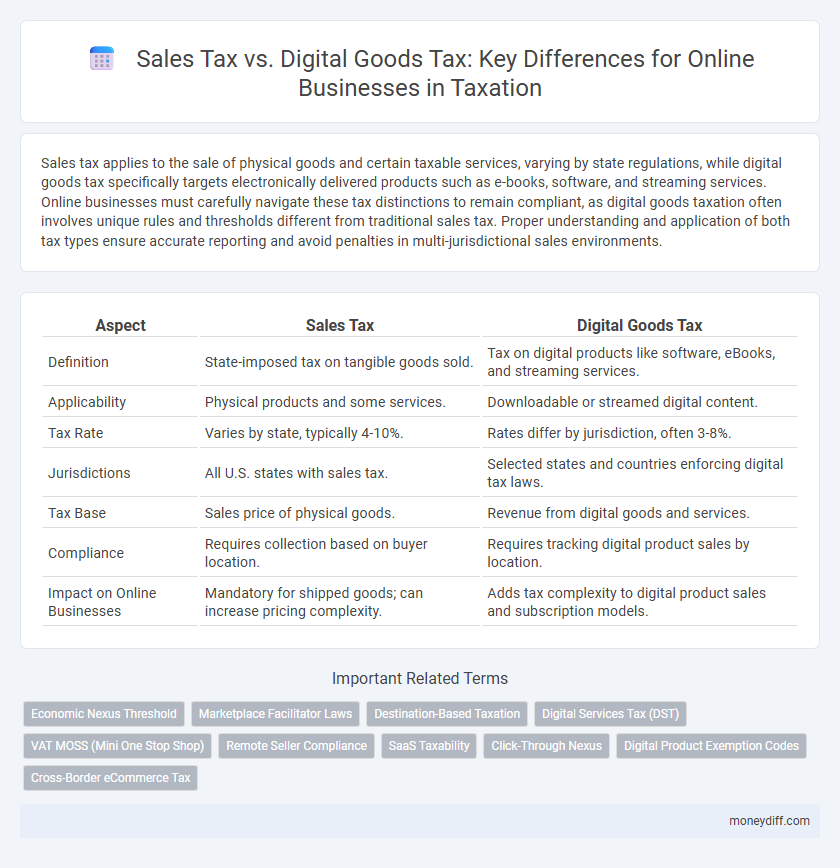

| Aspect | Sales Tax | Digital Goods Tax |

|---|---|---|

| Definition | State-imposed tax on tangible goods sold. | Tax on digital products like software, eBooks, and streaming services. |

| Applicability | Physical products and some services. | Downloadable or streamed digital content. |

| Tax Rate | Varies by state, typically 4-10%. | Rates differ by jurisdiction, often 3-8%. |

| Jurisdictions | All U.S. states with sales tax. | Selected states and countries enforcing digital tax laws. |

| Tax Base | Sales price of physical goods. | Revenue from digital goods and services. |

| Compliance | Requires collection based on buyer location. | Requires tracking digital product sales by location. |

| Impact on Online Businesses | Mandatory for shipped goods; can increase pricing complexity. | Adds tax complexity to digital product sales and subscription models. |

Understanding Sales Tax for Online Businesses

Sales tax for online businesses varies by state and depends on whether the seller has a physical or economic presence, known as nexus, in that state, requiring collection and remittance of tax on tangible goods. Digital goods tax, however, targets products like e-books, software, and streaming services, with rates and rules differing significantly between jurisdictions. Understanding the distinction ensures compliance as sales tax generally applies to physical goods, while digital goods taxes cover intangible products, influencing online business pricing and reporting obligations.

What Are Digital Goods Taxes?

Digital goods taxes specifically apply to products delivered electronically, such as software, e-books, music, and online courses, distinguishing them from traditional sales tax on physical goods. These taxes vary by jurisdiction but generally require online businesses to collect and remit tax on digital transactions, reflecting the growing shift towards digital commerce. Understanding local digital goods tax laws is essential for compliance and accurate pricing strategies in e-commerce.

Key Differences Between Sales Tax and Digital Goods Tax

Sales tax applies broadly to the sale of tangible personal property and certain services, whereas digital goods tax specifically targets electronically delivered products such as software, e-books, and streaming services. Online businesses must navigate varying tax rates and regulations depending on the jurisdiction, as some states impose sales tax on physical goods but have distinct rules or exemptions for digital goods. Understanding the nexus requirements and taxability criteria for each type of product is essential for compliance and accurate tax calculation in e-commerce.

Which Products Qualify as Digital Goods?

Digital goods subject to sales tax typically include downloadable software, e-books, music files, and streaming services, distinguishing them from physical products. Online businesses must evaluate state-specific tax laws, as definitions of digital goods and tax obligations vary significantly across jurisdictions. Proper classification ensures compliance and accurate tax collection, preventing costly penalties.

Sales Tax Compliance Requirements for E-commerce

E-commerce businesses must navigate complex sales tax compliance requirements, including nexus determination, collection, remittance, and reporting obligations across multiple states. Digital goods tax varies by jurisdiction but typically requires separate identification and taxation distinct from tangible goods, impacting pricing and compliance strategies. Automated tax software and regular updates on state regulations are essential to ensure accurate sales tax collection and avoid penalties.

Digital Goods Tax Laws by State

Digital goods tax laws vary significantly by state, impacting online businesses selling products such as eBooks, software, and streaming services. States like Washington, Texas, and New York have specific regulations imposing sales tax on digital goods, while others exempt them or apply different tax rates. Understanding these state-by-state variations is crucial for compliance and accurate tax collection in online sales.

Nexus and Its Impact on Online Taxation

Nexus determines whether an online business must collect sales tax or digital goods tax in a particular state, based on physical presence or economic thresholds such as revenue or transaction volume. The rise of digital goods complexities requires businesses to understand varying state definitions of nexus, which can trigger tax obligations even without traditional physical operations. Failure to comply with nexus rules for sales or digital goods tax can result in penalties and back taxes, significantly impacting online business profitability.

Sales Tax Collection Strategies for Online Sellers

Effective sales tax collection strategies for online sellers require identifying nexus requirements based on states like California, Texas, and New York, where economic presence triggers tax obligations. Utilizing automated tax software integrations, such as Avalara or TaxJar, ensures accurate calculation and remittance of state-specific sales taxes on tangible goods versus digital products. Compliance with marketplace facilitator laws and continuously updating product taxability, including exemptions for digital goods, minimizes audit risks and potential penalties.

Managing Taxation on International Digital Sales

Managing taxation on international digital sales requires understanding the differences between sales tax and digital goods tax, as each jurisdiction applies distinct rules based on product classification and location of the buyer. Online businesses must navigate complex regulations, often facing variable tax rates and reporting obligations for digital products such as downloadable software, streaming services, and e-books. Leveraging automated tax compliance software can optimize accuracy in tax collection, ensuring adherence to country-specific digital goods tax laws and minimizing the risk of audits or penalties.

Tools and Software for Digital Goods Tax Management

Effective digital goods tax management for online businesses requires specialized tools and software designed to navigate complex jurisdictional regulations and automate tax calculations. Solutions such as Avalara, TaxJar, and Sovos offer real-time tax rate updates, compliance reporting, and integration with e-commerce platforms to reduce errors and ensure accurate sales tax collection on digital products. Leveraging these technologies helps businesses avoid penalties, streamline tax filing, and adapt to evolving tax laws in the digital economy.

Related Important Terms

Economic Nexus Threshold

Economic nexus thresholds determine when an online business must collect sales tax based on revenue or transaction volume within a state, affecting both traditional sales tax and digital goods tax obligations. States with digital goods taxes often set specific thresholds that may differ from general sales tax rules, requiring businesses to carefully track in-state sales of software, streaming services, and downloadable content to ensure compliance.

Marketplace Facilitator Laws

Marketplace facilitator laws require platforms to collect and remit sales tax on behalf of sellers, simplifying compliance for online businesses but extending tax obligations to digital goods alongside physical products. Digital goods tax varies by jurisdiction, often including downloads, subscriptions, and streaming services, necessitating accurate categorization to ensure proper tax treatment under evolving marketplace rules.

Destination-Based Taxation

Sales tax for online businesses is primarily destination-based, meaning tax rates depend on the buyer's location, ensuring compliance with state and local tax laws. Digital goods tax varies by jurisdiction but often follows similar destination-based principles, taxing items like e-books, software downloads, and streaming services according to the purchaser's state or locality.

Digital Services Tax (DST)

Digital Services Tax (DST) targets revenue generated from digital services such as online advertising, streaming, and marketplaces, differing from traditional sales tax which applies to physical goods and some digital products. Online businesses must navigate DST regulations that impose tax based on digital revenue thresholds, often varying by jurisdiction, complicating compliance compared to standard sales tax frameworks.

VAT MOSS (Mini One Stop Shop)

Sales tax applies to physical goods and certain services within specific jurisdictions, while digital goods tax targets electronically delivered products like software, e-books, and streaming services. VAT MOSS (Mini One Stop Shop) simplifies VAT compliance for online businesses by allowing them to report and remit VAT on digital sales across multiple EU countries through a single registration, avoiding separate filings in each member state.

Remote Seller Compliance

Remote sellers must navigate varying sales tax regulations and digital goods tax laws, as states impose different rules on taxability and collection thresholds for online transactions. Compliance requires thorough understanding of nexus standards, product classification, and timely tax filing to avoid penalties and ensure accurate tax remittance.

SaaS Taxability

Sales tax on digital goods varies by jurisdiction, with many states taxing Software as a Service (SaaS) as a tangible personal property or digital product, while others exempt SaaS from traditional sales tax. Understanding specific state regulations and nexus requirements is crucial for online businesses to ensure compliance and accurate tax collection on SaaS offerings.

Click-Through Nexus

Sales tax applies to tangible goods and certain services, but digital goods tax specifically targets electronically delivered products, requiring online businesses to navigate differing tax obligations based on product type and jurisdiction. Click-through nexus establishes tax collection responsibilities when affiliates or referrals in a state generate sales, expanding the reach of state tax authority for both sales tax and digital goods tax compliance.

Digital Product Exemption Codes

Sales tax regulations for online businesses variably apply to physical goods and digital products, with digital product exemption codes enabling certain digital goods to be tax-exempt depending on jurisdiction-specific tax laws. Proper classification and application of these exemption codes ensure compliance and optimize tax liability management for e-commerce platforms selling digital content such as software, e-books, and streaming services.

Cross-Border eCommerce Tax

Cross-border eCommerce transactions require careful navigation of sales tax and digital goods tax regulations, as sales tax typically applies to tangible products while digital goods tax targets digital content and services. Online businesses must comply with varying tax rates and nexus rules across jurisdictions to avoid penalties and ensure accurate tax collection on both physical and digital cross-border sales.

Sales Tax vs Digital Goods Tax for online businesses Infographic

moneydiff.com

moneydiff.com