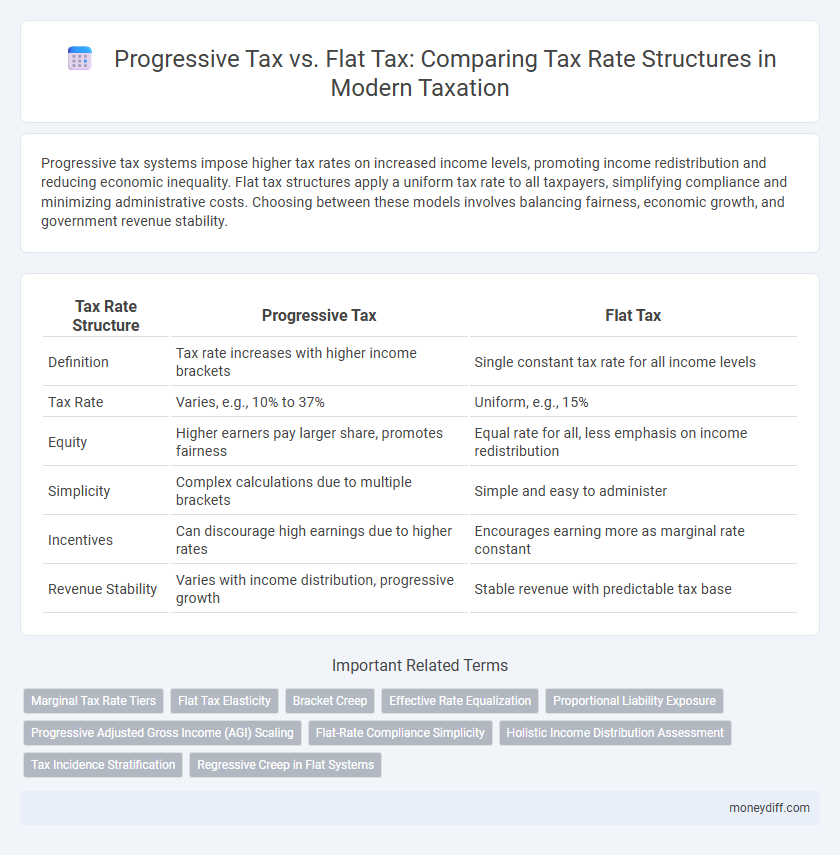

Progressive tax systems impose higher tax rates on increased income levels, promoting income redistribution and reducing economic inequality. Flat tax structures apply a uniform tax rate to all taxpayers, simplifying compliance and minimizing administrative costs. Choosing between these models involves balancing fairness, economic growth, and government revenue stability.

Table of Comparison

| Tax Rate Structure | Progressive Tax | Flat Tax |

|---|---|---|

| Definition | Tax rate increases with higher income brackets | Single constant tax rate for all income levels |

| Tax Rate | Varies, e.g., 10% to 37% | Uniform, e.g., 15% |

| Equity | Higher earners pay larger share, promotes fairness | Equal rate for all, less emphasis on income redistribution |

| Simplicity | Complex calculations due to multiple brackets | Simple and easy to administer |

| Incentives | Can discourage high earnings due to higher rates | Encourages earning more as marginal rate constant |

| Revenue Stability | Varies with income distribution, progressive growth | Stable revenue with predictable tax base |

Understanding Progressive Tax Systems

Progressive tax systems impose higher tax rates on increasing income brackets, ensuring that taxpayers with greater earnings contribute a larger percentage of their income. This structure aims to alleviate income inequality by redistributing wealth through graduated rates, often starting from low or zero rates for the lowest income levels. Understanding the mechanics of progressive taxation involves analyzing marginal tax rates, tax brackets, and their impact on disposable income and economic behavior.

What is a Flat Tax Structure?

A flat tax structure applies a single constant tax rate to all taxable income levels, eliminating brackets and varying rates. This system simplifies tax calculations and enhances transparency by treating every dollar of income equally regardless of earnings. Unlike progressive taxes, flat tax policies aim to promote fairness and economic efficiency by reducing complexity and minimizing tax avoidance opportunities.

Key Differences Between Progressive and Flat Taxes

Progressive tax systems impose higher tax rates on higher income brackets, ensuring increased revenue from wealthier individuals while aiming to reduce income inequality. Flat tax systems apply a single constant tax rate to all income levels, simplifying tax calculations but potentially placing a heavier relative burden on lower-income earners. The key difference lies in tax rate variability, with progressive taxes adjusting rates based on income and flat taxes maintaining uniform rates regardless of earnings.

Economic Impact of Progressive Taxation

Progressive taxation, where tax rates increase with income, promotes income redistribution and reduces economic inequality by imposing higher tax burdens on wealthier individuals. This tax structure can stimulate consumer spending among lower-income groups, supporting overall economic growth through increased demand. However, excessively high progressive rates may discourage investment and labor supply among higher earners, potentially impacting long-term economic productivity.

Flat Tax: Advantages and Disadvantages

Flat tax systems offer simplicity by applying a single tax rate to all income levels, reducing administrative costs and compliance burdens. This structure encourages investment and economic growth by eliminating higher marginal rates that can discourage additional earnings. However, flat taxes may increase income inequality since they lack the built-in redistribution effects of progressive tax rates, potentially placing a heavier relative burden on lower-income earners.

Equity and Fairness in Tax Rate Structures

Progressive tax systems promote equity by imposing higher rates on higher income brackets, ensuring taxpayers contribute according to their ability to pay. Flat tax structures apply a uniform rate to all incomes, simplifying the system but potentially reducing fairness for low-income earners. Equity concerns arise because progressive taxes aim to reduce income inequality, while flat taxes may disproportionately burden lower-income individuals.

Revenue Generation: Progressive vs. Flat Tax

Progressive tax systems generate higher revenue by taxing higher incomes at increased rates, effectively redistributing wealth and expanding the tax base. Flat tax structures apply a uniform rate to all taxpayers, resulting in simpler compliance but potentially lower revenue from high-income earners. Studies indicate progressive taxes typically yield greater total revenue due to their scalable rates on increasing income brackets.

Social Implications of Tax Structures

Progressive tax systems, where tax rates increase with income, reduce income inequality by redistributing wealth and funding social programs that benefit lower-income groups. Flat tax structures apply a uniform rate on all incomes, which can simplify compliance but often place a heavier relative burden on low-income earners, potentially exacerbating social disparities. The choice between progressive and flat tax systems significantly impacts social equity, poverty levels, and overall economic mobility within a society.

Efficiency of Tax Collection in Different Systems

Progressive tax systems enhance revenue generation by targeting higher income brackets with increased rates, promoting equity yet potentially complicating tax administration due to varied brackets. Flat tax structures simplify compliance and enforcement with a uniform rate, increasing efficiency in collection but possibly reducing progressiveness and equity. Studies highlight that flat tax models often lower administrative costs and improve compliance rates, while progressive systems may boost government revenues but require more complex monitoring.

Choosing the Right Tax Structure for Economic Growth

Progressive tax systems impose higher rates on increased income levels, aiming to reduce inequality while ensuring revenue generation. Flat tax structures apply a consistent rate regardless of income, promoting simplicity and potentially encouraging investment and economic expansion. Selecting the optimal tax rate structure depends on balancing equity goals with incentives for productivity and growth to maximize overall economic development.

Related Important Terms

Marginal Tax Rate Tiers

Progressive tax systems feature multiple marginal tax rate tiers where higher income levels are taxed at incrementally increased rates, promoting tax equity and redistribution. Flat tax structures apply a single marginal tax rate across all income levels, simplifying tax calculation but potentially reducing the system's progressivity and ability to address income inequality.

Flat Tax Elasticity

Flat tax systems typically exhibit lower tax elasticity compared to progressive tax structures, as uniform rates reduce incentives for income reporting distortion and minimize behavioral changes among taxpayers. Empirical studies indicate that flat tax elasticity fosters more predictable revenue streams and can enhance compliance by simplifying tax calculations and reducing marginal tax rate avoidance.

Bracket Creep

Progressive tax systems adjust tax rates based on income brackets, risking bracket creep where inflation pushes taxpayers into higher brackets without real income gains, increasing tax burdens unfairly. Flat tax systems apply a constant rate regardless of income, eliminating bracket creep but potentially reducing tax progressivity and equity.

Effective Rate Equalization

Progressive tax systems increase the marginal tax rate as income rises, potentially leading to higher effective tax rates for top earners, while flat tax structures apply a uniform rate, resulting in more consistent effective rates across income levels. Effective rate equalization seeks to balance tax burdens by adjusting brackets or exemptions in progressive systems to mimic the uniform impact typical of flat tax models, promoting perceived fairness without sacrificing revenue neutrality.

Proportional Liability Exposure

Progressive tax systems increase tax rates as income rises, leading to higher proportional liability exposure for top earners compared to flat tax systems, which apply a uniform rate to all income levels, maintaining consistent proportional liability exposure. This structure impacts equity and revenue distribution by shifting greater tax burdens to higher income brackets in progressive systems, while flat taxes emphasize simplicity and equal rate exposure across all taxpayers.

Progressive Adjusted Gross Income (AGI) Scaling

Progressive tax systems adjust rates based on Adjusted Gross Income (AGI), increasing tax liability as income rises to achieve equitable revenue generation and reduce income inequality. Flat tax structures apply a single rate regardless of AGI, offering simplicity but potentially disadvantaging lower-income earners by imposing a uniform tax burden across all income levels.

Flat-Rate Compliance Simplicity

Flat tax systems offer compliance simplicity by applying a single tax rate to all income levels, reducing the complexity of tax calculations and filing requirements. This streamlined structure minimizes administrative costs and taxpayer errors, enhancing overall efficiency in tax collection.

Holistic Income Distribution Assessment

A progressive tax system adjusts tax rates based on income levels, promoting equitable wealth distribution by imposing higher rates on higher incomes, whereas a flat tax applies a uniform rate regardless of earnings. Holistic income distribution assessment reveals that progressive taxes more effectively reduce income inequality and fund social programs compared to flat tax structures.

Tax Incidence Stratification

Progressive tax structures allocate a higher tax burden on upper income brackets, intensifying tax incidence stratification by redistributing wealth from higher to lower earners, while flat tax systems impose a uniform rate that tends to concentrate the tax burden evenly across all income levels, minimizing vertical stratification but potentially increasing regressivity. Analysis of tax incidence reveals that progressive taxation enhances equity through graduated rates affecting disposable income disparities, whereas flat taxation maintains simplicity and administrative ease but may inadequately address income inequality.

Regressive Creep in Flat Systems

Flat tax systems can inadvertently lead to regressive creep, where lower-income earners disproportionately bear a higher tax burden over time due to fixed rate limitations that do not account for inflation or income growth. Progressive tax structures mitigate this effect by increasing tax rates as income rises, ensuring a more equitable distribution of tax liability that adjusts dynamically with taxpayers' financial circumstances.

Progressive tax vs Flat tax for tax rate structure. Infographic

moneydiff.com

moneydiff.com