Tax return filings provide a traditional method for reporting income and calculating tax obligations, relying heavily on self-reported data that can be prone to errors or omissions. Blockchain tax ledgers offer enhanced transparency by creating immutable, time-stamped records of all transactions, enabling real-time auditing and reducing the risk of fraud. Integrating blockchain technology with tax systems could streamline compliance processes and increase trust between taxpayers and authorities.

Table of Comparison

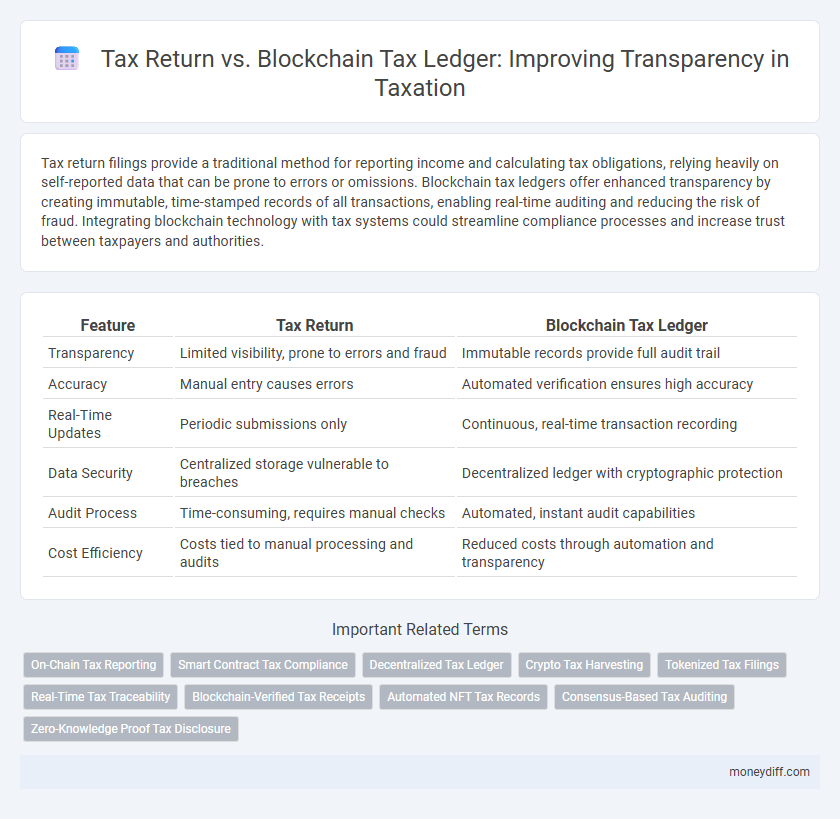

| Feature | Tax Return | Blockchain Tax Ledger |

|---|---|---|

| Transparency | Limited visibility, prone to errors and fraud | Immutable records provide full audit trail |

| Accuracy | Manual entry causes errors | Automated verification ensures high accuracy |

| Real-Time Updates | Periodic submissions only | Continuous, real-time transaction recording |

| Data Security | Centralized storage vulnerable to breaches | Decentralized ledger with cryptographic protection |

| Audit Process | Time-consuming, requires manual checks | Automated, instant audit capabilities |

| Cost Efficiency | Costs tied to manual processing and audits | Reduced costs through automation and transparency |

Understanding Tax Returns: Traditional Approach

Tax returns are formal documents filed with tax authorities to report income, calculate tax liability, and claim refunds or credits. This traditional approach relies on periodic submissions, often annually, creating opportunities for errors, delays, and audits due to manual processing and limited real-time data access. Transparency challenges arise as taxpayers depend on intermediaries and delayed verification, contrasting with emerging blockchain tax ledgers that offer immutable, real-time transaction records.

Introduction to Blockchain Tax Ledgers

Blockchain tax ledgers provide a decentralized and immutable record of all tax-related transactions, ensuring enhanced transparency and accuracy compared to traditional tax returns. By utilizing cryptographic security and real-time data updates, these ledgers reduce errors and minimize fraud risks, improving trust between taxpayers and authorities. This technology streamlines tax reporting processes while offering auditable trails that support compliance and regulatory oversight.

Transparency: Tax Returns vs Blockchain Ledgers

Tax returns provide a traditional method for reporting income and calculating tax liabilities, but they often lack real-time transparency and can be prone to errors or omissions. Blockchain tax ledgers offer enhanced transparency by recording transactions immutably and allowing tax authorities to verify records instantly, reducing fraud and discrepancies. The decentralized nature of blockchain ensures that all parties have access to a single source of truth, increasing accountability in the tax reporting process.

Data Security in Tax Reporting Systems

Tax return systems often face challenges related to data security, including risks of fraud and unauthorized access. Blockchain tax ledgers enhance transparency by providing immutable, encrypted records that ensure the integrity and confidentiality of tax reporting data. This decentralized approach significantly reduces data tampering risks while enabling auditors to verify transactions in real time.

Audit Trails: Enhanced Trust with Blockchain

Blockchain tax ledgers provide immutable audit trails that enhance transparency and reduce errors in tax reporting. Unlike traditional tax returns prone to manipulation or loss, blockchain ensures each transaction is securely recorded and easily verifiable by tax authorities. This technology fosters greater trust by enabling real-time access to accurate financial data and simplifying audit processes.

Real-Time Tax Data Access and Updates

Real-time tax data access through blockchain tax ledgers enhances transparency by enabling continuous updates and immutable recording of transactions. Unlike traditional tax returns that provide periodic snapshots, blockchain technology allows tax authorities and taxpayers to interact with up-to-date, verifiable data instantly. This real-time synchronization reduces errors, streamlines audits, and ensures compliance by providing a dynamic and transparent tax reporting ecosystem.

Fraud Prevention: Manual vs Automated Systems

Tax return processes rely heavily on manual data entry and reconciliation, which increases the risk of human error and fraud through falsified documentation. Blockchain tax ledgers utilize automated, immutable records that enable real-time tracking of transactions, significantly enhancing transparency and reducing opportunities for tax evasion. Automated blockchain systems create a decentralized audit trail that strengthens fraud prevention by eliminating reliance on intermediaries and centralized control.

Compliance Efficiency for Individuals and Businesses

Tax returns streamline reporting taxable income and deductions, ensuring compliance with government regulations through detailed disclosures. Blockchain tax ledgers enhance transparency by providing immutable, real-time transaction records verifiable by tax authorities, reducing errors and fraud. This technology increases compliance efficiency for individuals and businesses by automating data reconciliation and audit trails, minimizing manual intervention and regulatory risks.

Cost Implications of Adopting Blockchain Tax Ledgers

Adopting blockchain tax ledgers can significantly reduce the operational costs associated with traditional tax return processing by minimizing manual audits and errors, while providing an immutable and transparent transaction history. However, initial implementation expenses, including infrastructure setup, training, and integration with existing systems, pose a considerable financial challenge for tax authorities. Over time, blockchain's ability to streamline compliance and improve accuracy may offset upfront costs, resulting in long-term savings and enhanced fiscal accountability.

Future Outlook: Digital Tax Management and Transparency

The future of digital tax management emphasizes blockchain tax ledgers as a transformative solution for transparency and accuracy in tax reporting. Unlike traditional tax returns, blockchain enables real-time, immutable records that reduce errors and fraud while enhancing auditability for tax authorities and taxpayers. This shift towards decentralized ledger technology promises streamlined compliance, faster processing, and improved trust in fiscal governance.

Related Important Terms

On-Chain Tax Reporting

On-chain tax reporting leverages blockchain tax ledgers to provide immutable, transparent records of financial transactions, enhancing accuracy and reducing audit risks compared to traditional tax returns. This technology enables real-time tax compliance monitoring and streamlines the verification process, improving regulatory transparency and taxpayer accountability.

Smart Contract Tax Compliance

Smart contract tax compliance enhances transparency by automating real-time tax calculations and reporting within blockchain tax ledgers, reducing errors and fraud in traditional tax returns. Blockchain tax ledgers provide immutable and auditable records, ensuring accuracy and accountability while streamlining regulatory compliance for tax authorities and businesses.

Decentralized Tax Ledger

Decentralized tax ledgers leverage blockchain technology to provide immutable, transparent records of all tax transactions, enhancing accuracy and reducing fraud in tax returns. Unlike traditional tax returns, which rely on centralized agencies and manual reporting, blockchain-based tax ledgers enable real-time proofs of compliance and automated audits through cryptographic verification.

Crypto Tax Harvesting

Crypto tax harvesting benefits from blockchain tax ledgers by providing immutable transaction records that enhance transparency and accuracy compared to traditional tax returns. These ledgers enable precise tracking of gains and losses, reducing audit risks and simplifying compliance with evolving tax regulations.

Tokenized Tax Filings

Tokenized tax filings on blockchain tax ledgers enhance transparency by providing immutable, real-time records of tax returns, reducing fraud and errors in tax reporting. This decentralized approach ensures accurate audit trails and instant verification, revolutionizing traditional tax return processes with increased security and efficiency.

Real-Time Tax Traceability

Blockchain tax ledgers enable real-time tax traceability by securely recording every transaction with timestamped data, enhancing transparency and reducing errors compared to traditional tax returns. This innovation ensures immediate access to accurate tax information for auditors and authorities, streamlining compliance and minimizing fraud risks.

Blockchain-Verified Tax Receipts

Blockchain-verified tax receipts provide immutable, real-time records that enhance transparency and accuracy compared to traditional tax returns, which rely on periodic self-reporting and manual verification. This decentralized ledger system ensures every transaction is securely logged, minimizing disputes and enabling tax authorities to audit with unprecedented precision and efficiency.

Automated NFT Tax Records

Automated NFT tax records leverage blockchain tax ledgers to enhance transparency by providing immutable, real-time tracking of transactions, reducing errors and audit risks commonly associated with traditional tax returns. This integration ensures accurate tax reporting, streamlines compliance processes, and enables seamless verification for tax authorities through decentralized ledger technology.

Consensus-Based Tax Auditing

Consensus-based tax auditing enhances transparency by leveraging blockchain tax ledgers, which provide immutable, time-stamped transaction records that simplify verification and reduce fraud risks. Unlike traditional tax returns, blockchain enables decentralized consensus mechanisms that ensure data integrity and real-time auditing, fostering higher trust between taxpayers and authorities.

Zero-Knowledge Proof Tax Disclosure

Zero-Knowledge Proof (ZKP) technology enhances tax transparency by allowing taxpayers to verify the accuracy of their tax returns without revealing sensitive financial details, ensuring privacy and compliance simultaneously. Integrating ZKP into blockchain tax ledgers creates a tamper-proof, auditable record that strengthens trust between taxpayers and tax authorities while protecting confidential information.

Tax Return vs Blockchain Tax Ledger for Transparency Infographic

moneydiff.com

moneydiff.com