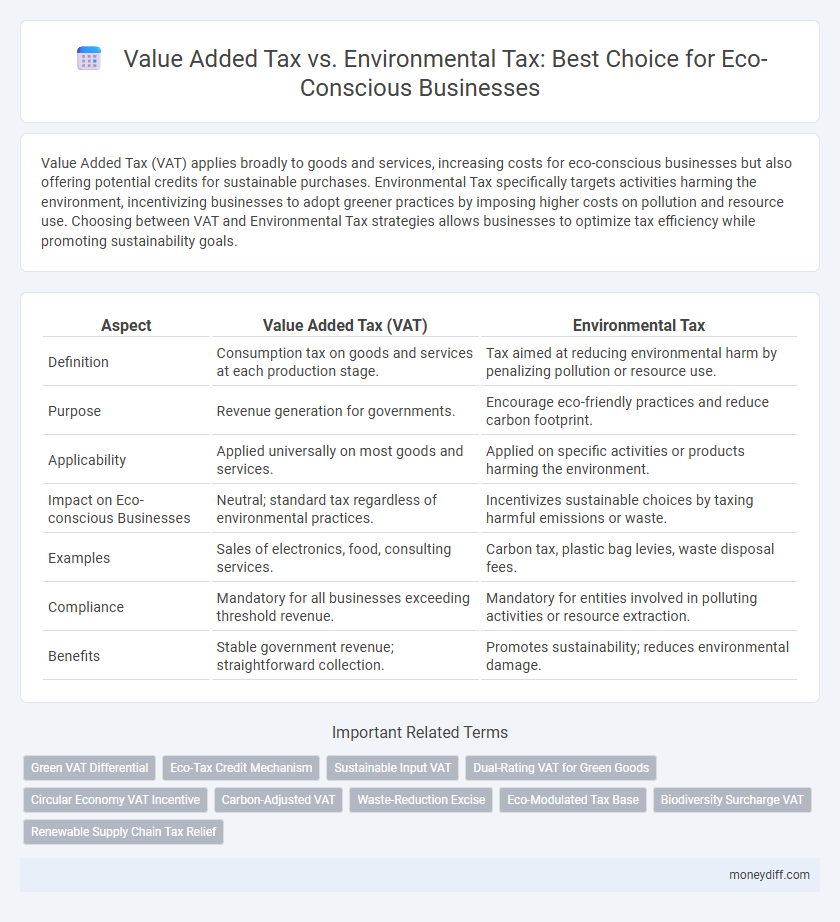

Value Added Tax (VAT) applies broadly to goods and services, increasing costs for eco-conscious businesses but also offering potential credits for sustainable purchases. Environmental Tax specifically targets activities harming the environment, incentivizing businesses to adopt greener practices by imposing higher costs on pollution and resource use. Choosing between VAT and Environmental Tax strategies allows businesses to optimize tax efficiency while promoting sustainability goals.

Table of Comparison

| Aspect | Value Added Tax (VAT) | Environmental Tax |

|---|---|---|

| Definition | Consumption tax on goods and services at each production stage. | Tax aimed at reducing environmental harm by penalizing pollution or resource use. |

| Purpose | Revenue generation for governments. | Encourage eco-friendly practices and reduce carbon footprint. |

| Applicability | Applied universally on most goods and services. | Applied on specific activities or products harming the environment. |

| Impact on Eco-conscious Businesses | Neutral; standard tax regardless of environmental practices. | Incentivizes sustainable choices by taxing harmful emissions or waste. |

| Examples | Sales of electronics, food, consulting services. | Carbon tax, plastic bag levies, waste disposal fees. |

| Compliance | Mandatory for all businesses exceeding threshold revenue. | Mandatory for entities involved in polluting activities or resource extraction. |

| Benefits | Stable government revenue; straightforward collection. | Promotes sustainability; reduces environmental damage. |

Understanding Value Added Tax (VAT) and Environmental Tax

Value Added Tax (VAT) is a consumption tax applied at each stage of the supply chain, calculated as a percentage of the added value of goods or services, typically ranging from 5% to 25% depending on the jurisdiction. Environmental Tax targets activities or products that negatively impact the environment, such as carbon emissions or plastic waste, designed to incentivize eco-friendly business practices and reduce ecological footprints. Eco-conscious businesses must accurately differentiate VAT obligations from Environmental Tax liabilities to optimize tax efficiency and align with sustainability goals.

Key Differences Between VAT and Environmental Tax

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution, while Environmental Tax is designed to promote eco-friendly practices by taxing activities or products harmful to the environment. VAT applies broadly across most goods and services uniformly, whereas Environmental Tax targets specific pollutants, carbon emissions, or resource usage to incentivize sustainability. The key difference lies in VAT's revenue-generating role for governments versus Environmental Tax's regulatory aim to reduce environmental impact and encourage greener business operations.

How VAT Impacts Eco-Conscious Businesses

Value Added Tax (VAT) affects eco-conscious businesses by increasing the cost of green products and services, which can reduce their competitive pricing advantage. Unlike environmental taxes aimed at incentivizing sustainable practices, VAT is applied uniformly, potentially discouraging consumer adoption of eco-friendly alternatives. Understanding VAT implications helps businesses optimize pricing strategies while promoting environmental responsibility.

The Role of Environmental Tax in Promoting Sustainability

Environmental tax incentivizes eco-conscious businesses to reduce carbon emissions and invest in renewable energy by imposing levies on pollution-intensive activities, thereby directly supporting sustainability goals. Unlike Value Added Tax (VAT), which applies uniformly to goods and services without environmental considerations, environmental taxes target specific behaviors to encourage resource efficiency and waste reduction. This dynamic tax structure fosters a greener economy by aligning fiscal policy with environmental performance metrics and sustainability standards.

Compliance Challenges: VAT vs Environmental Tax

Eco-conscious businesses face distinct compliance challenges when managing Value Added Tax (VAT) versus Environmental Tax. VAT requires meticulous tracking of taxable transactions and accurate reporting to avoid penalties, while Environmental Tax compliance demands precise measurement of environmental impacts and adherence to sector-specific rates. Navigating these tax obligations necessitates robust accounting systems and specialized knowledge to balance financial and sustainability goals effectively.

Financial Implications for Green Enterprises

Value Added Tax (VAT) impacts green enterprises by increasing the cost of goods and services, potentially affecting cash flow and pricing strategies, while Environmental Tax specifically targets activities that harm the environment, encouraging eco-friendly practices through financial incentives or penalties. For eco-conscious businesses, understanding the differences in tax liabilities helps optimize tax planning and maximize sustainability investments. Properly managing VAT credits and leveraging environmental tax rebates can significantly improve the financial health and competitive advantage of environmentally responsible companies.

Tax Incentives for Sustainable Business Practices

Eco-conscious businesses benefit from tax incentives that promote sustainable practices through both Value Added Tax (VAT) exemptions and Environmental Tax credits. VAT reductions on eco-friendly products lower costs while Environmental Taxes impose fees on carbon-intensive activities, encouraging greener alternatives. These tax mechanisms drive investment in renewable technologies and resource-efficient processes, enhancing overall corporate sustainability.

Aligning Tax Strategies with Eco-Friendly Goals

Eco-conscious businesses benefit from aligning their tax strategies by prioritizing Value Added Tax (VAT) mechanisms that promote sustainable products and services while leveraging Environmental Tax incentives designed to reduce carbon footprints and encourage green investments. Implementing VAT schemes with reduced rates for eco-friendly goods complements the use of Environmental Taxes on pollution and carbon emissions, optimizing financial efficiency and environmental impact. Strategic integration of VAT and Environmental Tax policies supports both regulatory compliance and the advancement of corporate sustainability objectives.

Future Trends: Environmental Tax Reform and VAT Updates

Environmental tax reform is gaining momentum as governments worldwide aim to incentivize sustainable business practices by adjusting tax rates and expanding tax bases to include carbon emissions and resource depletion. Value Added Tax (VAT) updates increasingly integrate eco-friendly policies by offering reduced rates or exemptions on green products and services, boosting demand for environmentally responsible goods. Future trends indicate a convergence of VAT and environmental tax frameworks to create a comprehensive fiscal approach that supports carbon neutrality and circular economy objectives.

Choosing the Right Tax Approach for Eco-Conscious Growth

For eco-conscious businesses, selecting the right tax approach hinges on balancing compliance costs with sustainability goals. Value Added Tax (VAT) impacts cash flow and pricing structures, while Environmental Taxes directly incentivize reducing carbon footprints through levies on pollution or resource use. Integrating environmental tax benefits with strategic VAT management can optimize financial efficiency and promote green growth initiatives.

Related Important Terms

Green VAT Differential

Eco-conscious businesses benefit from the Green VAT Differential, which reduces the Value Added Tax rate on environmentally friendly products and services, incentivizing sustainable consumption. This fiscal mechanism complements Environmental Tax by providing direct tax relief on green goods, promoting investment in eco-friendly practices while supporting government revenue goals.

Eco-Tax Credit Mechanism

Eco-conscious businesses benefit from the Eco-Tax Credit Mechanism, which allows them to offset Value Added Tax (VAT) liabilities through investments in environmental projects, effectively bridging VAT and Environmental Tax policies. This mechanism incentivizes sustainable practices by providing tax credits that reduce overall tax burden while promoting eco-friendly operations and compliance.

Sustainable Input VAT

Sustainable Input VAT allows eco-conscious businesses to reclaim Value Added Tax on purchases directly related to environmentally friendly activities, reducing overall tax liability while promoting green investments. Unlike Environmental Tax, which imposes levies on harmful practices, Sustainable Input VAT actively incentivizes sustainable operations by offsetting tax costs on eco-efficient inputs.

Dual-Rating VAT for Green Goods

Dual-Rating VAT for Green Goods incentivizes eco-conscious businesses by applying reduced VAT rates to environmentally friendly products, promoting sustainable consumption while maintaining standard rates for non-green items. This strategy effectively balances fiscal policy and environmental goals, encouraging businesses to prioritize green goods without the financial burden of higher taxes.

Circular Economy VAT Incentive

Value Added Tax (VAT) exemptions and reduced rates for circular economy activities incentivize eco-conscious businesses to prioritize reuse, recycling, and waste reduction, fostering sustainable practices while lowering tax burdens. Environmental taxes, by contrast, impose levies on pollution and resource depletion, encouraging businesses to minimize environmental impact but often without direct financial incentives for circular economy innovations.

Carbon-Adjusted VAT

Carbon-Adjusted VAT incentivizes eco-conscious businesses by reducing value-added tax rates on goods and services with lower carbon footprints, promoting sustainable production and consumption. Unlike traditional Environmental Tax, which directly targets emissions through levies or fees, Carbon-Adjusted VAT integrates carbon costs into the existing tax system to drive market shifts toward greener alternatives without imposing additional fiscal burdens.

Waste-Reduction Excise

Waste-Reduction Excise, a specific form of Environmental Tax, incentivizes eco-conscious businesses to minimize waste generation by imposing levies on products based on their environmental impact, contrasting with the broader Value Added Tax (VAT) which applies uniformly on goods and services without environmental differentiation. Integrating Waste-Reduction Excise into corporate tax strategies promotes sustainable practices while potentially reducing overall tax liability by encouraging waste minimization and eco-friendly product choices.

Eco-Modulated Tax Base

Eco-modulated tax bases integrate environmental impact metrics into Value Added Tax (VAT) frameworks, encouraging eco-conscious businesses to reduce carbon footprints while maintaining revenue generation. Environmental Taxes, by contrast, directly levy fees on harmful activities, but combining them with VAT structures enables more precise incentives through variable rates tied to sustainability practices.

Biodiversity Surcharge VAT

Eco-conscious businesses face distinct financial impacts from Value Added Tax (VAT) and Environmental Tax, with the Biodiversity Surcharge VAT specifically targeting activities that threaten ecosystem diversity by imposing additional costs on goods and services linked to habitat degradation. This surcharge incentivizes sustainable practices by internalizing environmental externalities, driving companies to reduce biodiversity-related footprints while navigating standard VAT obligations for compliance and fiscal strategy.

Renewable Supply Chain Tax Relief

Value Added Tax (VAT) impacts eco-conscious businesses by taxing the value added at each supply chain stage, whereas Environmental Tax targets activities harming the environment to incentivize sustainable practices. Renewable Supply Chain Tax Relief specifically reduces tax burdens on businesses adopting renewable energy sources, promoting green investments and lowering operational costs in eco-friendly supply chains.

Value Added Tax vs Environmental Tax for eco-conscious businesses Infographic

moneydiff.com

moneydiff.com