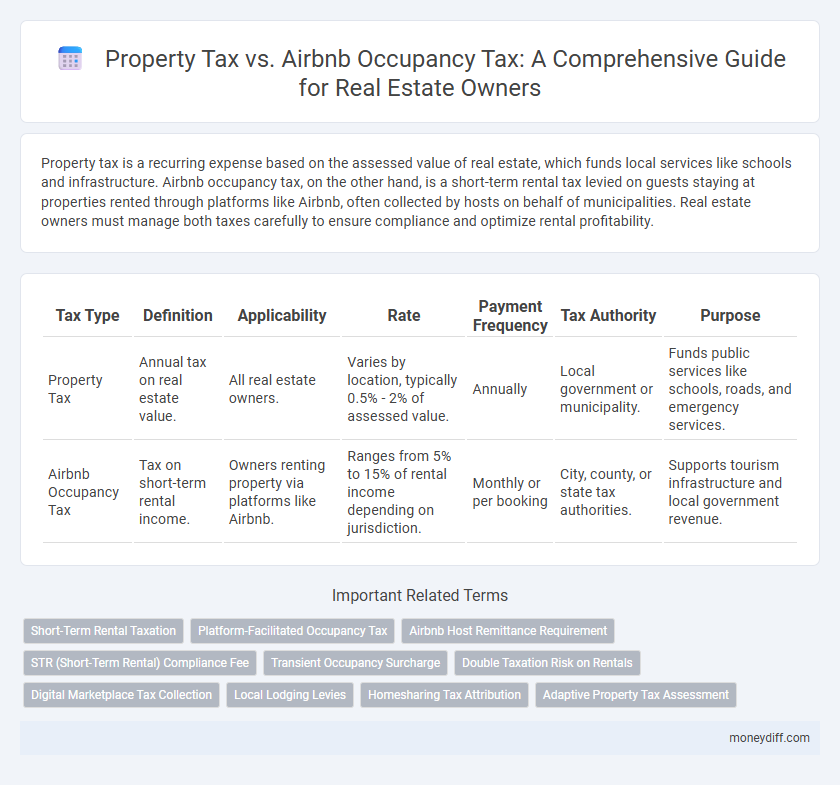

Property tax is a recurring expense based on the assessed value of real estate, which funds local services like schools and infrastructure. Airbnb occupancy tax, on the other hand, is a short-term rental tax levied on guests staying at properties rented through platforms like Airbnb, often collected by hosts on behalf of municipalities. Real estate owners must manage both taxes carefully to ensure compliance and optimize rental profitability.

Table of Comparison

| Tax Type | Definition | Applicability | Rate | Payment Frequency | Tax Authority | Purpose |

|---|---|---|---|---|---|---|

| Property Tax | Annual tax on real estate value. | All real estate owners. | Varies by location, typically 0.5% - 2% of assessed value. | Annually | Local government or municipality. | Funds public services like schools, roads, and emergency services. |

| Airbnb Occupancy Tax | Tax on short-term rental income. | Owners renting property via platforms like Airbnb. | Ranges from 5% to 15% of rental income depending on jurisdiction. | Monthly or per booking | City, county, or state tax authorities. | Supports tourism infrastructure and local government revenue. |

Understanding Property Tax: A Real Estate Owner’s Guide

Property tax is a critical obligation for real estate owners, calculated annually based on the assessed value of the property by local tax authorities, and funds essential public services such as schools and infrastructure. Unlike Airbnb occupancy tax, which applies to short-term rental income generated through platforms like Airbnb, property tax applies regardless of the property's use or rental status. Understanding local property tax rates, assessment cycles, and exemptions helps real estate owners optimize tax planning and compliance while effectively managing investment returns.

What is Airbnb Occupancy Tax? Key Definitions

Airbnb Occupancy Tax is a local tax imposed on short-term rental stays, typically applied to bookings under 30 days, distinct from traditional property tax which is based on real estate ownership. This tax is collected by platforms like Airbnb on behalf of city or state governments to fund tourism infrastructure and municipal services. Compliance with Airbnb Occupancy Tax regulations is crucial for real estate owners using their properties as short-term rentals to avoid penalties and ensure proper tax reporting.

Key Differences Between Property Tax and Airbnb Occupancy Tax

Property tax is a recurring tax levied by local governments on the assessed value of real estate properties, primarily based on ownership and property value. Airbnb occupancy tax, often referred to as transient occupancy tax or hotel tax, is charged on short-term rentals and imposed on guests based on the rental price for stays typically under 30 days. Unlike property tax, which applies regardless of usage, Airbnb occupancy tax specifically targets the income-generating aspect of short-term rentals and is collected to fund local tourism and infrastructure.

Tax Liability: Who Pays What and When?

Property tax is an annual tax levied on real estate owners based on the assessed value of their property, while Airbnb occupancy tax is collected from guests renting the property short-term and remitted by the host to local tax authorities. Real estate owners are responsible for paying property tax directly to municipal governments, whereas occupancy tax liability falls on the short-term rental hosts to collect and submit, typically on a monthly or quarterly basis. Failure to comply with either tax obligation can result in penalties, emphasizing the importance of understanding both tax liabilities for effective financial and legal management in short-term rental operations.

Common Tax Compliance Challenges for Airbnb Hosts

Property tax requires real estate owners to pay based on the assessed value of their property, regardless of rental activity, while Airbnb occupancy tax is a transactional tax applied on short-term rentals. Common tax compliance challenges for Airbnb hosts include accurately tracking occupancy tax collection and remittance, understanding varying local tax rates, and ensuring proper registration with tax authorities. Misreporting rental income and failing to separate personal use from rental periods can result in costly penalties and audits.

Impact on Cash Flow: Property Tax vs Airbnb Occupancy Tax

Property tax imposes a fixed annual expense on real estate owners, directly impacting long-term cash flow stability by requiring consistent payment regardless of rental activity. Airbnb occupancy tax fluctuates with short-term rental income and guest volume, creating variable cash flow implications tied to occupancy rates and pricing strategies. Understanding these differences helps owners optimize financial planning by balancing predictable property tax obligations against the dynamic nature of Airbnb occupancy taxes.

Tax Deductions and Exemptions for Real Estate Owners

Property tax on real estate is generally deductible as a business expense for real estate owners, reducing taxable income on rental properties. Airbnb occupancy tax, often considered a pass-through tax collected from guests, typically cannot be deducted by property owners as it is remitted directly to local governments. Real estate owners should leverage exemptions on property tax where available, such as homestead or historic property exemptions, while carefully tracking occupancy tax collections separately to ensure compliance and accurate tax reporting.

How to Report Property and Airbnb Occupancy Taxes

Property owners must report property tax annually to their local tax authority using assessed property values and applicable tax rates specific to their municipality. Airbnb occupancy tax is typically reported separately through the platform or directly to local tax agencies, often requiring detailed records of rental income and nights booked. Accurate reporting of both taxes ensures compliance and avoids penalties in jurisdictions where short-term rental regulations are strictly enforced.

Legal Risks and Penalties for Non-Compliance

Real estate owners must distinguish between property tax obligations and Airbnb occupancy tax requirements to avoid significant legal risks and penalties. Failure to comply with Airbnb occupancy tax regulations can result in substantial fines, interest charges, and potential legal action from tax authorities. Proper registration, timely filing, and accurate tax remittance are critical to mitigate the risk of audits and enforcement measures related to short-term rental income.

Strategies to Optimize Your Real Estate Tax Burden

Real estate owners should differentiate between property tax, which is based on the assessed value of the property, and Airbnb occupancy tax, a transient accommodation tax calculated on rental income. Optimizing your tax burden involves strategically maximizing deductible expenses, such as mortgage interest and maintenance costs, to reduce taxable income on property taxes while ensuring accurate reporting and timely remittance of Airbnb occupancy taxes to avoid penalties. Leveraging tax credits, maintaining detailed rental records, and consulting with a tax professional can enhance compliance and optimize overall tax efficiency.

Related Important Terms

Short-Term Rental Taxation

Property tax is assessed annually based on the value of the real estate, impacting all property owners regardless of rental activity, while Airbnb occupancy tax specifically targets short-term rental income, collected either by the platform or the host to comply with local regulations. Short-term rental taxation requires owners to carefully separate property tax obligations from occupancy tax liabilities to avoid penalties and ensure full compliance with municipal and state tax codes.

Platform-Facilitated Occupancy Tax

Platform-facilitated occupancy tax requires Airbnb and similar platforms to collect and remit occupancy taxes on behalf of real estate owners, simplifying compliance and ensuring timely payments compared to traditional property tax obligations. This tax specifically targets short-term rental income, distinguishing it from annual property tax assessments tied to real estate value.

Airbnb Host Remittance Requirement

Real estate owners who rent properties on Airbnb must comply with both property tax obligations and Airbnb occupancy tax remittance requirements, with the latter typically necessitating monthly collection and payment of local transient occupancy taxes to municipal authorities. Failure to remit Airbnb occupancy taxes accurately can result in penalties, emphasizing the importance of understanding jurisdiction-specific tax rates and timely reporting for short-term rental hosts.

STR (Short-Term Rental) Compliance Fee

Property owners operating short-term rentals must differentiate between property tax obligations and Airbnb occupancy tax, which includes compliance fees imposed by local jurisdictions to regulate short-term rental activities. The STR Compliance Fee ensures adherence to municipal regulations, covering enforcement costs specifically tied to short-term rental licensing and occupancy monitoring, separate from traditional property tax liabilities.

Transient Occupancy Surcharge

Property owners renting through Airbnb must differentiate between general property tax obligations and the Transient Occupancy Surcharge (TOS), a specialized tax applied to short-term rental stays typically less than 30 days. The Transient Occupancy Surcharge, levied alongside local Transient Occupancy Taxes (TOT), targets income generated from transient lodging, requiring hosts to comply with specific reporting and remittance rules distinct from annual property tax assessments.

Double Taxation Risk on Rentals

Property tax is a recurring levy on real estate ownership based on assessed property value, while Airbnb occupancy tax targets short-term rental income generated through platforms like Airbnb. Real estate owners face double taxation risk when both taxes apply to the same rental property, increasing financial burdens and complicating tax compliance.

Digital Marketplace Tax Collection

Property owners renting through Airbnb must navigate both property tax obligations and Airbnb occupancy tax, where digital marketplace tax collection streamlines the remittance of occupancy taxes directly from rental transactions. This digital tax collection system enhances compliance by automatically withholding and remitting local occupancy taxes, reducing administrative burdens for real estate owners while ensuring accurate tax reporting.

Local Lodging Levies

Property tax is a recurring tax based on the assessed value of real estate, typically funding local services and infrastructure, while Airbnb occupancy tax falls under local lodging levies imposed on short-term rentals, collected per night of stay to regulate and generate revenue from transient lodging. Real estate owners listing properties on platforms like Airbnb must comply with local occupancy tax regulations, which vary by jurisdiction and are separate from traditional property tax obligations.

Homesharing Tax Attribution

Property tax is assessed annually based on the assessed value of real estate, whereas Airbnb occupancy tax applies to short-term rental income generated through platforms like Airbnb, requiring clear attribution for homesharing activities. Real estate owners must accurately differentiate and report homesharing income to comply with local regulations and avoid double taxation scenarios.

Adaptive Property Tax Assessment

Adaptive property tax assessment adjusts the taxable value of real estate based on current market conditions and property use, providing a dynamic alternative to static property tax models. Real estate owners renting through Airbnb must consider occupancy tax separately, as it targets short-term rental income and often requires distinct compliance from traditional property tax obligations.

Property Tax vs Airbnb Occupancy Tax for real estate owners Infographic

moneydiff.com

moneydiff.com