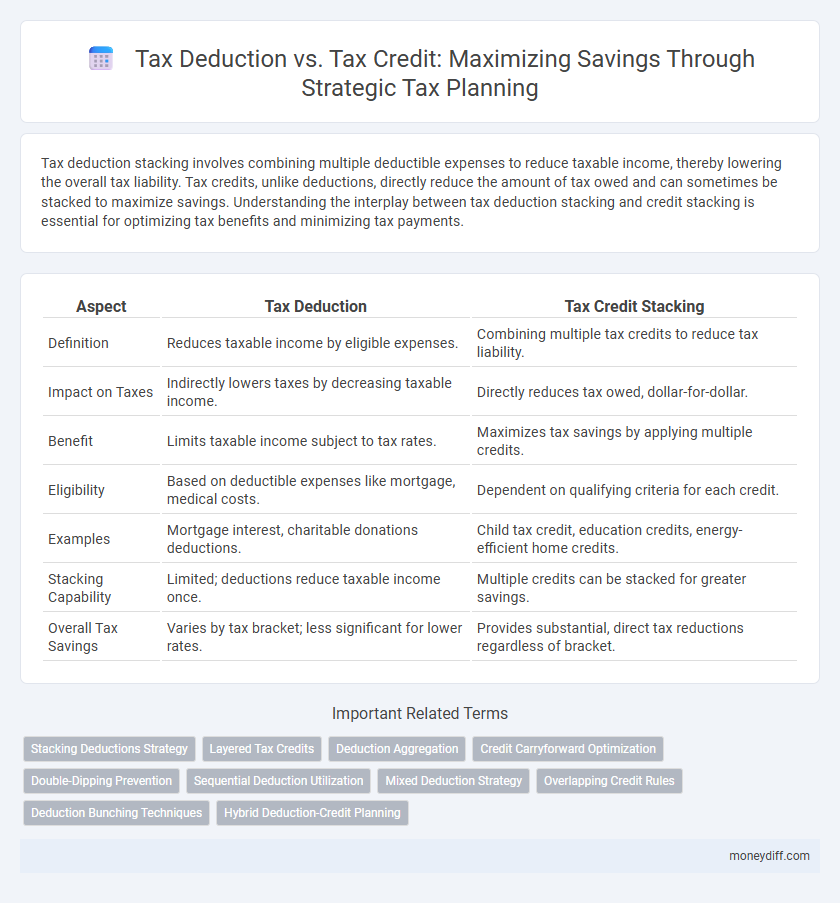

Tax deduction stacking involves combining multiple deductible expenses to reduce taxable income, thereby lowering the overall tax liability. Tax credits, unlike deductions, directly reduce the amount of tax owed and can sometimes be stacked to maximize savings. Understanding the interplay between tax deduction stacking and credit stacking is essential for optimizing tax benefits and minimizing tax payments.

Table of Comparison

| Aspect | Tax Deduction | Tax Credit Stacking |

|---|---|---|

| Definition | Reduces taxable income by eligible expenses. | Combining multiple tax credits to reduce tax liability. |

| Impact on Taxes | Indirectly lowers taxes by decreasing taxable income. | Directly reduces tax owed, dollar-for-dollar. |

| Benefit | Limits taxable income subject to tax rates. | Maximizes tax savings by applying multiple credits. |

| Eligibility | Based on deductible expenses like mortgage, medical costs. | Dependent on qualifying criteria for each credit. |

| Examples | Mortgage interest, charitable donations deductions. | Child tax credit, education credits, energy-efficient home credits. |

| Stacking Capability | Limited; deductions reduce taxable income once. | Multiple credits can be stacked for greater savings. |

| Overall Tax Savings | Varies by tax bracket; less significant for lower rates. | Provides substantial, direct tax reductions regardless of bracket. |

Understanding Tax Deductions and Tax Credits

Tax deductions reduce taxable income by lowering the amount subject to tax, while tax credits directly decrease the tax liability, offering greater dollar-for-dollar savings. Stacking tax deductions involves combining multiple deductible expenses to maximize the reduction in taxable income, whereas stacking tax credits accumulates various credits to significantly cut the overall tax owed. Understanding the interplay between deductions and credits is crucial for optimizing tax strategies and minimizing federal and state tax payments.

Key Differences: Deductions vs Credits

Tax deductions reduce taxable income by lowering the amount of income subject to tax, whereas tax credits provide a dollar-for-dollar reduction in the actual tax owed. Deductions stack by decreasing your adjusted gross income (AGI), which can indirectly affect the phaseout of other credits and deductions, while credits directly reduce tax liability with some being refundable, offering potential refunds beyond the amount owed. Understanding the interplay between stacking multiple deductions and credits is crucial for maximizing overall tax savings in a given fiscal year.

The Concept of Stacking Deductions

Stacking deductions involves combining multiple tax deductions to reduce taxable income more effectively, maximizing overall tax savings. Deductions directly lower the amount of income subject to tax, unlike tax credits which reduce tax liability dollar-for-dollar. Understanding the strategic use of deduction stacking allows taxpayers to optimize their filing by leveraging allowable expenses across different categories within IRS guidelines.

Eligibility Criteria for Stacked Tax Benefits

Eligibility criteria for stacking tax deductions and tax credits require careful assessment of income limits, filing status, and specific expense categories to ensure compliance with IRS regulations. Taxpayers must verify whether the same expense qualifies for multiple benefits, as some deductions and credits cannot be combined without restrictions. Understanding phase-out thresholds and documentation requirements is crucial to maximize stacked tax advantages effectively.

Maximizing Savings: Which Should You Stack?

Stacking tax deductions reduces your taxable income, while stacking tax credits directly decreases your tax liability, making credits generally more valuable for maximizing savings. Prioritize tax credits like the Earned Income Tax Credit or Child Tax Credit for immediate tax reductions, and combine them with deductions such as mortgage interest or charitable contributions to lower overall taxable income. Strategically stacking both ensures the greatest tax savings by leveraging reductions in taxable income alongside dollar-for-dollar tax credits.

Common Tax Deductions to Stack

Common tax deductions to stack include mortgage interest, state and local taxes, and charitable contributions, which collectively reduce adjusted gross income for greater tax savings. Employing deductions such as student loan interest and medical expenses alongside business-related expenses enhances the total deductible amount, optimizing taxable income reduction. Combining standard deductions with itemized deductions selectively maximizes overall tax benefits, ensuring taxpayers capitalize on available allowances.

Popular Tax Credits to Consider

Popular tax credits such as the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and Lifetime Learning Credit offer substantial dollar-for-dollar reductions in tax liability, making them more valuable than tax deductions which lower taxable income. Tax deduction stacking allows taxpayers to combine multiple deductions like mortgage interest, charitable contributions, and student loan interest to reduce taxable income, but tax credits directly reduce the amount of tax owed. Understanding how to strategically combine tax deduction stacking with high-value tax credits can maximize overall tax savings for individuals and families.

Strategies for Effective Tax Benefit Stacking

Maximizing tax benefit stacking requires a strategic approach to combining tax deductions and credits that align with specific taxpayer profiles. Identifying high-value deductions, such as mortgage interest and charitable contributions, alongside non-refundable and refundable tax credits ensures optimal tax liability reduction. Leveraging software tools and consulting tax professionals enhances precision in applying phase-out thresholds and income limits for effective tax benefit stacking.

IRS Rules and Limitations on Stacking

The IRS imposes strict rules on stacking tax deductions and tax credits, limiting taxpayers from claiming multiple benefits on the same expense to prevent double-dipping. Tax deductions reduce taxable income, while tax credits directly lower tax liability, but the IRS requires separate qualification criteria for each, restricting their simultaneous application. Understanding IRS Publication 17 and Form 1040 instructions is essential for compliance with limits on combining deductions and credits, ensuring taxpayers maximize benefits without violating tax laws.

Tips for Optimizing Your Tax Position

Maximize tax savings by strategically stacking tax deductions such as mortgage interest, charitable contributions, and business expenses to lower taxable income effectively. Prioritize combining deductions that apply to different income categories to avoid limitations and maximize overall benefit. Consult with a tax professional to ensure alignment with the latest IRS guidelines and to optimize your specific financial situation.

Related Important Terms

Stacking Deductions Strategy

Stacking deductions strategy maximizes tax savings by combining multiple eligible deductions, reducing taxable income more effectively than claiming individual deductions separately. This approach leverages itemized deductions such as mortgage interest, charitable contributions, and medical expenses to lower the overall tax liability before applying tax credits.

Layered Tax Credits

Layered tax credits enhance tax savings by allowing multiple tax credits to be claimed sequentially, maximizing the overall reduction in tax liability beyond simple deductions. Unlike tax deductions that lower taxable income, stacking layered tax credits directly reduces the tax owed, providing a more powerful financial benefit for taxpayers leveraging eligible credits.

Deduction Aggregation

Tax deduction stacking involves aggregating multiple deductions, which reduces taxable income by combining expenses such as mortgage interest, medical costs, and charitable contributions, thereby lowering overall tax liability. Effective deduction aggregation maximizes the total deductible amount before applying the tax rate, unlike tax credits that directly reduce the tax owed.

Credit Carryforward Optimization

Tax credit stacking enhances overall tax savings by allowing multiple credits to be combined, while tax deduction stacking primarily reduces taxable income without directly decreasing tax liability. Effective credit carryforward optimization maximizes the benefit of unused tax credits by applying them against future tax years, ensuring sustained reductions in tax obligations over time.

Double-Dipping Prevention

Tax deduction stacking allows multiple deductions to reduce taxable income but is limited by income thresholds, while tax credit stacking offers dollar-for-dollar reductions in tax liability, often subject to eligibility criteria. Double-dipping prevention mechanisms ensure taxpayers cannot claim both a deduction and a credit for the same expense, maintaining compliance and preventing fraudulent tax benefits.

Sequential Deduction Utilization

Sequential deduction utilization maximizes tax savings by applying multiple tax deductions one after another, reducing taxable income step-by-step before calculating tax liability. Unlike tax credits, which directly reduce tax owed, stacking deductions sequentially leverages the cumulative effect of lowering the taxable base efficiently.

Mixed Deduction Strategy

A mixed deduction strategy leverages both tax deductions and tax credits by stacking eligible expenses to maximize overall tax savings, balancing reduced taxable income with direct tax reductions. This approach optimizes financial benefits by carefully combining deductions that lower taxable income and credits that directly reduce tax liability, enhancing after-tax cash flow more effectively than relying on either method alone.

Overlapping Credit Rules

Tax deduction reduces taxable income, lowering overall tax liability based on the taxpayer's marginal rate, whereas tax credits provide a dollar-for-dollar reduction of tax owed, making credits generally more valuable in stacking scenarios. Overlapping credit rules restrict the simultaneous application of multiple tax credits on the same expense, requiring careful planning to maximize tax benefit without violating limitations imposed by the IRS.

Deduction Bunching Techniques

Tax deduction bunching techniques involve timing deductible expenses to exceed the standard deduction threshold, maximizing itemized deductions in a single tax year to reduce taxable income more effectively. Leveraging deduction stacking by grouping expenses such as medical costs, charitable contributions, and mortgage interest can significantly increase overall tax savings compared to spreading deductions across multiple years.

Hybrid Deduction-Credit Planning

Hybrid deduction-credit planning leverages the strategic combination of tax deductions, which reduce taxable income, with tax credits that directly lower tax liability, maximizing overall tax savings. This approach enables stacking tax benefits, allowing taxpayers to optimize their effective tax rate by carefully balancing itemized deductions and non-refundable or refundable credits.

Tax Deduction vs Tax Credit Stacking for Deductions Infographic

moneydiff.com

moneydiff.com