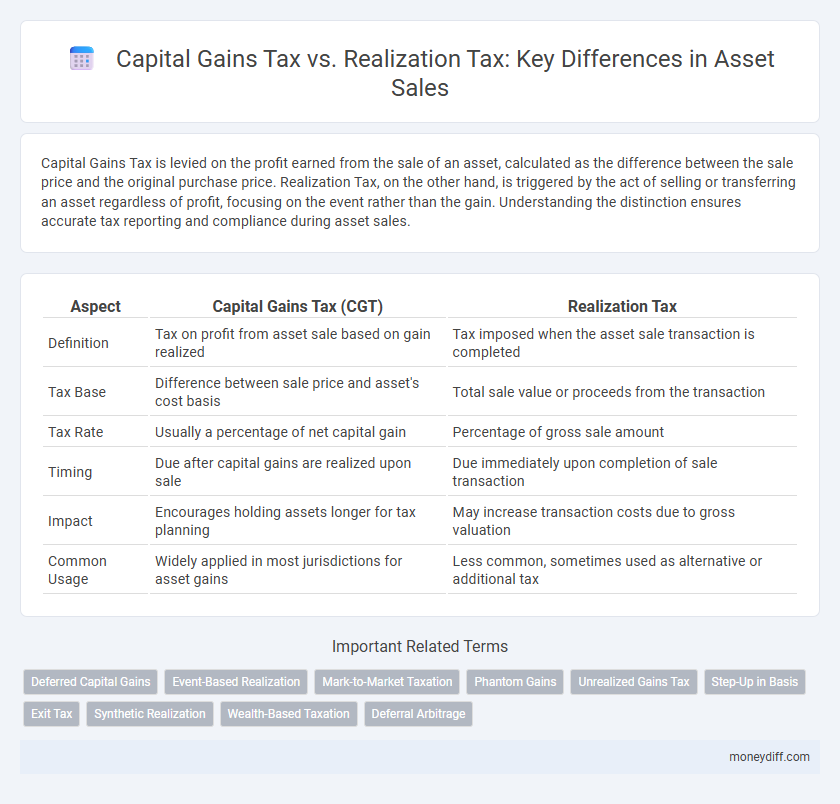

Capital Gains Tax is levied on the profit earned from the sale of an asset, calculated as the difference between the sale price and the original purchase price. Realization Tax, on the other hand, is triggered by the act of selling or transferring an asset regardless of profit, focusing on the event rather than the gain. Understanding the distinction ensures accurate tax reporting and compliance during asset sales.

Table of Comparison

| Aspect | Capital Gains Tax (CGT) | Realization Tax |

|---|---|---|

| Definition | Tax on profit from asset sale based on gain realized | Tax imposed when the asset sale transaction is completed |

| Tax Base | Difference between sale price and asset's cost basis | Total sale value or proceeds from the transaction |

| Tax Rate | Usually a percentage of net capital gain | Percentage of gross sale amount |

| Timing | Due after capital gains are realized upon sale | Due immediately upon completion of sale transaction |

| Impact | Encourages holding assets longer for tax planning | May increase transaction costs due to gross valuation |

| Common Usage | Widely applied in most jurisdictions for asset gains | Less common, sometimes used as alternative or additional tax |

Understanding Capital Gains Tax: An Overview

Capital Gains Tax (CGT) applies to the profit earned from the sale of assets, calculated as the difference between the asset's sale price and its original purchase price. Realization Tax typically refers to the tax triggered when the asset is sold or otherwise disposed of, marking the point at which capital gains become taxable income. Understanding the distinction between CGT and realization events is crucial for accurately assessing tax liabilities on asset sales and ensuring compliance with tax regulations.

What Is Realization Tax? Key Concepts Explained

Realization tax applies when an asset is sold or exchanged, triggering a taxable event based on the gain realized from the sale. Unlike capital gains tax, which specifically targets the profit from disposing of capital assets, realization tax encompasses the actual recognition of income or gain during the transaction. Understanding the realization principle is crucial, as taxes are imposed only when gains are realized through sales, exchanges, or other dispositions of assets.

How Capital Gains Tax and Realization Tax Differ

Capital Gains Tax is imposed on the profit earned from the sale of an asset, calculated as the difference between the asset's sale price and its original purchase price, focusing solely on realized gains. Realization Tax, however, applies to the entire transaction value or proceeds from the sale, regardless of the actual profit or loss incurred. This distinction affects taxpayers' liability, with Capital Gains Tax targeting net gains and Realization Tax potentially taxing gross sale amounts.

Impact on Asset Sale Timing: Capital Gains vs Realization Tax

Capital Gains Tax directly affects the timing of asset sales by taxing the profit only upon the sale or exchange of the asset, incentivizing sellers to defer transactions to optimize tax outcomes. Realization Tax, imposed upon the occurrence of a taxable event regardless of sale completion, can accelerate decision-making and potentially reduce holding periods due to immediate tax consequences. Understanding the distinctions between Capital Gains and Realization Taxes enables investors to strategically time asset sales for maximum tax efficiency and financial benefit.

Taxation Example: Capital Gains Tax on Property Sales

Capital Gains Tax on property sales is calculated based on the difference between the sale price and the property's adjusted basis, including acquisition cost and improvements. Realization Tax applies only when the asset is sold or exchanged, triggering the taxable event, while unrealized gains remain untaxed. For example, if a property is purchased for $200,000 and sold for $300,000, the $100,000 gain is subject to Capital Gains Tax upon realization of the sale.

Tax Deferral and Liability: Comparing Both Systems

Capital Gains Tax triggers immediate tax liability upon asset sale by taxing the profit realized, while Realization Tax allows deferral of tax payment until actual income is received or realized, offering liquidity advantages. Tax deferral under Realization Tax can enhance investment growth by postponing tax payments, whereas Capital Gains Tax requires settling tax liabilities promptly, impacting cash flow. Understanding these distinctions helps taxpayers optimize tax strategies dynamically based on asset type, timing, and financial goals.

Administrative Complexity: Which System Is Simpler?

Capital Gains Tax systems typically require detailed record-keeping of purchase prices, improvements, and sale prices to accurately determine taxable gains, increasing administrative complexity for both taxpayers and tax authorities. Realization Tax, applied directly on the gross proceeds of asset sales without calculating individual gains, simplifies compliance by eliminating the need for extensive documentation and gain calculations. Thus, Realization Tax systems generally result in lower administrative burdens, making them simpler to administer and understand than Capital Gains Tax frameworks.

Effects on Investment Behavior and Asset Holding

Capital Gains Tax directly influences investor behavior by incentivizing longer asset holding periods to defer tax liabilities, often resulting in reduced market liquidity. Realization Tax, applied regardless of profit realization, can discourage asset sales and lead to reduced portfolio rebalancing, potentially impacting overall investment efficiency. Both tax structures shape the timing and volume of asset transactions, significantly affecting capital allocation and market dynamics.

International Approaches to Asset Sale Taxation

International approaches to asset sale taxation vary, with Capital Gains Tax (CGT) primarily levied on the profit realized from selling assets, calculated as the difference between the sale price and the property's original purchase price. Realization Tax, in contrast, may be imposed based on the transaction value or periodic valuation, regardless of actual gain, and is less common but used in specific jurisdictions to capture taxable events. Countries like the United States and the United Kingdom emphasize CGT for asset sales, while some developing nations apply realization-based methodologies to ensure tax compliance and revenue stability.

Pros and Cons: Capital Gains Tax vs Realization Tax

Capital Gains Tax imposes a tax on the profit realized from the sale of an asset, ensuring revenue is collected based on actual economic gain, but it may deter asset sales due to immediate tax liability. Realization Tax taxes the total value received upon asset sale regardless of gain, simplifying administration and ensuring consistent tax flow but potentially taxing unrealized gains and reducing incentives for asset appreciation. Both taxes affect investor behavior and market liquidity, with Capital Gains Tax favoring long-term holding and Realization Tax promoting tax uniformity at the expense of economic efficiency.

Related Important Terms

Deferred Capital Gains

Deferred Capital Gains tax allows taxpayers to postpone paying capital gains taxes on asset sales if the proceeds are reinvested in like-kind assets within a specified timeframe, reducing immediate tax liabilities compared to Realization Tax, which taxes the gain at the point of sale regardless of reinvestment. This deferral strategy is crucial for investors seeking to preserve capital and optimize tax efficiency by delaying taxable events until the asset is eventually disposed of without reinvestment.

Event-Based Realization

Capital Gains Tax is triggered by the event-based realization of asset sales, where tax liability arises only when an actual transaction or sale occurs, reflecting the true economic gain. Realization Tax emphasizes the timing of tax imposition upon the specific event of asset disposition, ensuring taxable income is recognized when assets are converted into cash or equivalents.

Mark-to-Market Taxation

Capital Gains Tax applies upon the sale of assets, taxing the difference between purchase and sale price, whereas Realization Tax triggers taxation based on an asset's appreciated value without requiring an actual sale. Mark-to-Market Taxation mandates annual revaluation of assets at market prices, recognizing unrealized gains as taxable income to prevent deferral of tax liabilities.

Phantom Gains

Capital Gains Tax applies only when an asset is sold and the gain is realized, whereas Realization Tax can target phantom gains by taxing unrealized increases in asset value. Phantom gains occur when asset values appreciate but no actual sale has occurred, potentially triggering tax liabilities under Realization Tax regimes.

Unrealized Gains Tax

Capital Gains Tax is levied only upon the sale or disposal of an asset, recognizing profits when gains are realized, whereas Unrealized Gains Tax targets the increase in asset value regardless of sale, taxing accumulated appreciation annually. Unrealized Gains Tax aims to capture wealth increments in real time, impacting long-term asset holding strategies and liquidity management for investors.

Step-Up in Basis

Capital Gains Tax applies to the profit realized from the sale of an asset, while Realization Tax triggers tax liability only upon the actual sale event, emphasizing the timing of gains recognition. The Step-Up in Basis increases the asset's tax basis to its current market value at inheritance or specific transfer events, reducing taxable capital gains upon future sales.

Exit Tax

Capital Gains Tax is imposed on the profit realized from the sale of an asset, calculated as the difference between the sale price and the asset's adjusted basis. Exit Tax, a specific form of Realization Tax, applies when individuals or corporations transfer their tax residence or assets out of a jurisdiction, effectively taxing unrealized gains as if the assets were sold.

Synthetic Realization

Synthetic realization enables investors to defer capital gains tax by maintaining economic exposure to an asset while effectively realizing gains through derivatives or similar financial instruments. This strategy contrasts with traditional realization tax, which triggers tax liability only upon an actual sale or disposition of the asset.

Wealth-Based Taxation

Capital Gains Tax applies to the profit earned from the sale of assets, calculated as the difference between the sale price and the asset's adjusted basis, while Realization Tax triggers taxation only when the gain is realized through an actual transaction, emphasizing the timing of tax liability. Wealth-based taxation targets the overall net worth or value of assets owned, independent of sale or realization events, potentially incorporating unrealized capital gains into tax assessments for comprehensive asset wealth measurement.

Deferral Arbitrage

Capital Gains Tax requires recognition of profit upon asset sale, while Realization Tax may allow deferral of tax liability until actual cash receipt, enabling deferral arbitrage opportunities by strategically timing income recognition. Deferral arbitrage leverages the timing difference between when gains are realized for tax purposes and when cash is received, minimizing immediate tax impact and optimizing after-tax returns.

Capital Gains Tax vs Realization Tax for asset sales. Infographic

moneydiff.com

moneydiff.com