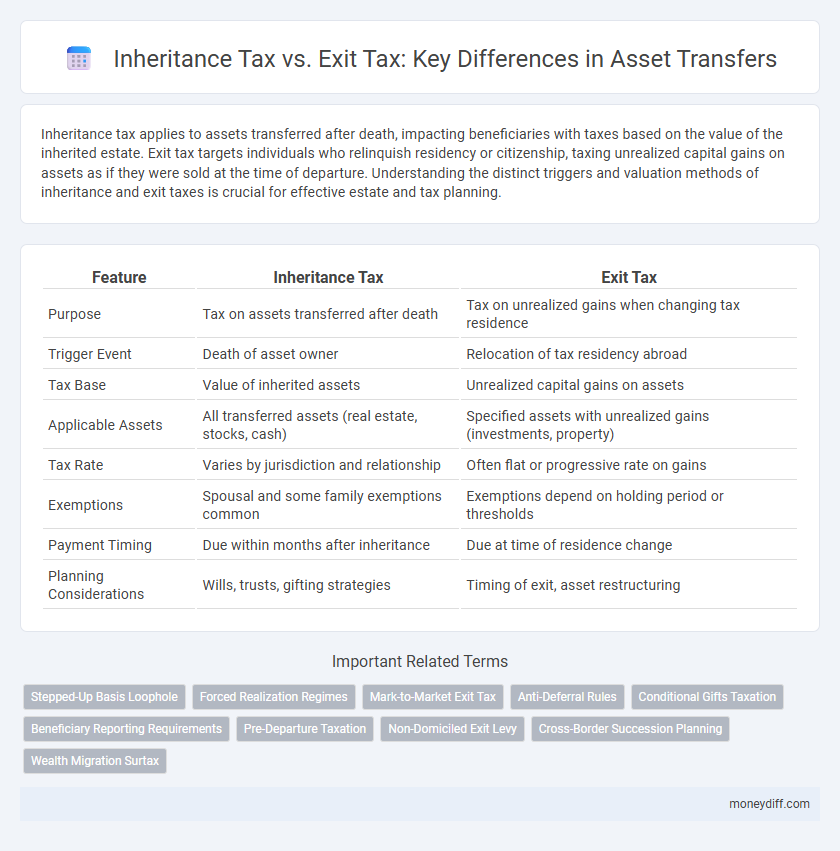

Inheritance tax applies to assets transferred after death, impacting beneficiaries with taxes based on the value of the inherited estate. Exit tax targets individuals who relinquish residency or citizenship, taxing unrealized capital gains on assets as if they were sold at the time of departure. Understanding the distinct triggers and valuation methods of inheritance and exit taxes is crucial for effective estate and tax planning.

Table of Comparison

| Feature | Inheritance Tax | Exit Tax |

|---|---|---|

| Purpose | Tax on assets transferred after death | Tax on unrealized gains when changing tax residence |

| Trigger Event | Death of asset owner | Relocation of tax residency abroad |

| Tax Base | Value of inherited assets | Unrealized capital gains on assets |

| Applicable Assets | All transferred assets (real estate, stocks, cash) | Specified assets with unrealized gains (investments, property) |

| Tax Rate | Varies by jurisdiction and relationship | Often flat or progressive rate on gains |

| Exemptions | Spousal and some family exemptions common | Exemptions depend on holding period or thresholds |

| Payment Timing | Due within months after inheritance | Due at time of residence change |

| Planning Considerations | Wills, trusts, gifting strategies | Timing of exit, asset restructuring |

Understanding Inheritance Tax: Key Concepts

Inheritance tax applies to the transfer of assets upon an individual's death, with tax rates and exemptions varying by jurisdiction to protect heirs from excessive financial burden. This tax is calculated based on the net value of the estate received by beneficiaries, often considering depreciation, liabilities, and allowable deductions. Understanding inheritance tax requires analyzing the local tax laws, estate valuation methods, and available credits to optimize asset transfer planning.

What is Exit Tax? An Overview

Exit tax is a tax imposed on individuals or entities when they transfer their tax residence or assets out of a jurisdiction, designed to capture unrealized capital gains accrued during their residence period. This tax ensures that the government collects revenues on appreciated assets before the taxpayer relocates, preventing tax avoidance through asset transfers. Unlike inheritance tax, which applies to asset transfers upon death, exit tax targets voluntary relocations or expatriations ahead of asset disposition.

Core Differences Between Inheritance Tax and Exit Tax

Inheritance tax applies to the transfer of assets upon death, taxing beneficiaries based on the value of the estate received, with rates and exemptions varying by jurisdiction. Exit tax targets individuals who relocate their tax residency, taxing unrealized capital gains on assets as if sold at the time of departure to prevent tax avoidance. The core difference lies in inheritance tax addressing post-mortem asset transfers, while exit tax deals with preemptive taxation of assets during residency changes.

Asset Transfer Scenarios: Which Tax Applies?

Inheritance Tax applies when assets are transferred upon an individual's death, affecting beneficiaries who receive property or cash from the estate. Exit Tax is triggered when an individual emigrates or transfers their tax residence, targeting unrealized capital gains on worldwide assets to prevent tax avoidance. The specific tax liability depends on asset type, recipient status, and jurisdictional rules governing estate succession and cross-border moves.

Inheritance Tax: Calculation and Rates

Inheritance tax is calculated based on the fair market value of the transferred assets at the time of the decedent's death, with rates varying according to the relationship between the heir and the deceased. Commonly, close family members benefit from lower tax rates and higher exemptions, while distant relatives or unrelated beneficiaries face higher rates and reduced thresholds. Understanding regional exemptions, progressive rate brackets, and asset valuation methods is essential for accurate inheritance tax liability assessment.

Exit Tax: Triggers and Computation

Exit tax is triggered when an individual or corporation transfers their tax residence or ownership of substantial assets across borders, often during emigration or business restructuring. The computation of exit tax typically involves calculating the unrealized capital gains on assets at their fair market value on the transfer date, with tax levied on these deemed gains despite no actual sale. Key factors influencing exit tax calculations include asset type, holding period, applicable exemptions, and specific jurisdictional tax rates.

Tax Planning Strategies for Inheritance and Exit Taxes

Effective tax planning strategies for inheritance and exit taxes involve a thorough understanding of both tax types and their implications on asset transfers. Utilizing trusts, lifetime gifts, and valuation discounts can minimize inheritance tax liabilities, while timely structuring of business ownership changes and migration plans helps mitigate exit tax burdens. Coordinating these strategies with professional advice ensures optimal tax efficiency and compliance.

Cross-Border Asset Transfers: Tax Implications

Cross-border asset transfers trigger complex tax obligations, prominently involving Inheritance Tax and Exit Tax. Inheritance Tax imposes levies on the transfer of wealth upon death, varying significantly by jurisdiction and often influenced by the residency and nationality of the decedent and beneficiaries. Exit Tax targets unrealized gains when individuals or entities relocate assets or tax residency out of a country, designed to capture deferred taxation on the appreciation of assets prior to transfer, thereby preventing tax avoidance in international estate planning.

Legal Compliance and Reporting Requirements

Inheritance tax requires beneficiaries to report received assets and settle taxes based on the asset's value at the time of inheritance, following strict legal deadlines and valuation rules enforced by tax authorities. Exit tax applies to individuals transferring tax residency or relocating assets abroad, mandating comprehensive disclosure of unrealized gains and compliance with cross-border reporting standards to prevent tax evasion. Both taxes involve detailed documentation and reporting obligations designed to ensure transparency and lawful asset transfer under national and international tax regulations.

Minimizing Tax Liabilities: Practical Tips

Minimizing tax liabilities on inheritance and exit taxes requires strategic asset transfer planning, such as utilizing exemptions, trusts, and gifting options to reduce the taxable estate value. Leveraging applicable deductions and understanding the specific thresholds for both inheritance tax and exit tax can significantly lower the overall tax burden. Consulting with tax professionals to align timing and structure transfers according to jurisdictional rules enhances efficiency and compliance while maximizing tax savings.

Related Important Terms

Stepped-Up Basis Loophole

Inheritance tax applies to the transfer of assets upon death, often benefiting from the stepped-up basis loophole that resets the asset's cost basis to its market value, minimizing capital gains tax for heirs. Exit tax targets individuals who expatriate or transfer assets while alive, eliminating the stepped-up basis advantage by taxing unrealized gains at departure, thus reducing opportunities for tax avoidance through asset transfers.

Forced Realization Regimes

Inheritance Tax applies to the transfer of wealth upon death, taxing beneficiaries based on the value of inherited assets, while Exit Tax targets individuals or entities transferring residency or tax domicile, forcing the realization of unrealized capital gains on assets as if sold immediately. Forced Realization Regimes under Exit Tax compel the instant valuation and taxation of accrued asset gains to prevent tax avoidance through relocation, contrasting with Inheritance Tax which is triggered only upon death events.

Mark-to-Market Exit Tax

Mark-to-Market Exit Tax applies when individuals transfer assets out of a jurisdiction, triggering taxation on unrealized gains as if the assets were sold at market value, differing from Inheritance Tax which is levied on the value of assets received by heirs after death. This tax mechanism aims to prevent tax avoidance through migration by capturing capital gains accrued during ownership prior to exit.

Anti-Deferral Rules

Anti-deferral rules in inheritance tax prevent beneficiaries from postponing tax liabilities on inherited assets by requiring immediate valuation and taxation upon transfer. Exit tax enforces similar principles by taxing unrealized gains when individuals or entities transfer residency or assets abroad, ensuring deferred tax obligations are collected promptly.

Conditional Gifts Taxation

Conditional gifts in inheritance tax are often subject to specific valuation rules that determine whether the transferred asset triggers a taxable event based on the donor's conditions. Exit tax applies when individuals transfer assets internationally or change tax residency, potentially incurring taxation on unrealized gains as if the assets were sold, impacting estate planning and conditional gift strategies.

Beneficiary Reporting Requirements

Beneficiary reporting requirements for inheritance tax mandate detailed disclosure of received assets and their value to tax authorities, ensuring accurate tax liability assessment. In contrast, exit tax obligations require beneficiaries to report the acquisition of assets transferred from expatriates, emphasizing valuation at the time of transfer to prevent tax evasion.

Pre-Departure Taxation

Pre-departure taxation under Inheritance Tax targets the transfer of assets upon death, ensuring heirs pay taxes based on the decedent's domicile and worldwide assets. Exit Tax applies to individuals emigrating, taxing unrealized capital gains on assets as if sold, designed to prevent tax avoidance through relocation.

Non-Domiciled Exit Levy

The Non-Domiciled Exit Levy targets individuals who cease UK residency, applying a deemed disposal charge on worldwide assets to mitigate tax avoidance through relocation. In contrast, Inheritance Tax primarily taxes the transfer of assets upon death, emphasizing domestic asset transfers with specific reliefs for long-term residents.

Cross-Border Succession Planning

Inheritance Tax applies to asset transfers upon death, often varying by jurisdiction and potentially including exemptions or reliefs based on the heirs' residency status, while Exit Tax targets unrealized capital gains when individuals transfer tax residency abroad. Effective cross-border succession planning requires analyzing both tax regimes to minimize liabilities and ensure seamless asset transition across different countries' rules.

Wealth Migration Surtax

Inheritance Tax applies to the transfer of assets upon death, often subjecting beneficiaries to tax liabilities based on estate value, while Exit Tax targets individuals who renounce residency, taxing unrealized capital gains on worldwide assets. Wealth Migration Surtax intensifies tax burdens during asset relocation by imposing supplementary charges on high-net-worth individuals transferring significant wealth across jurisdictions.

Inheritance Tax vs Exit Tax for asset transfers. Infographic

moneydiff.com

moneydiff.com