Sales tax directly targets the purchase of goods and services, making it a broad consumption tax that generates revenue based on consumer spending. Carbon tax, on the other hand, specifically aims to reduce carbon emissions by taxing fossil fuels and activities that emit greenhouse gases, promoting environmentally sustainable consumption. Both taxes influence consumer behavior, but sales tax affects overall consumption patterns while carbon tax encourages shifts toward cleaner energy and low-carbon alternatives.

Table of Comparison

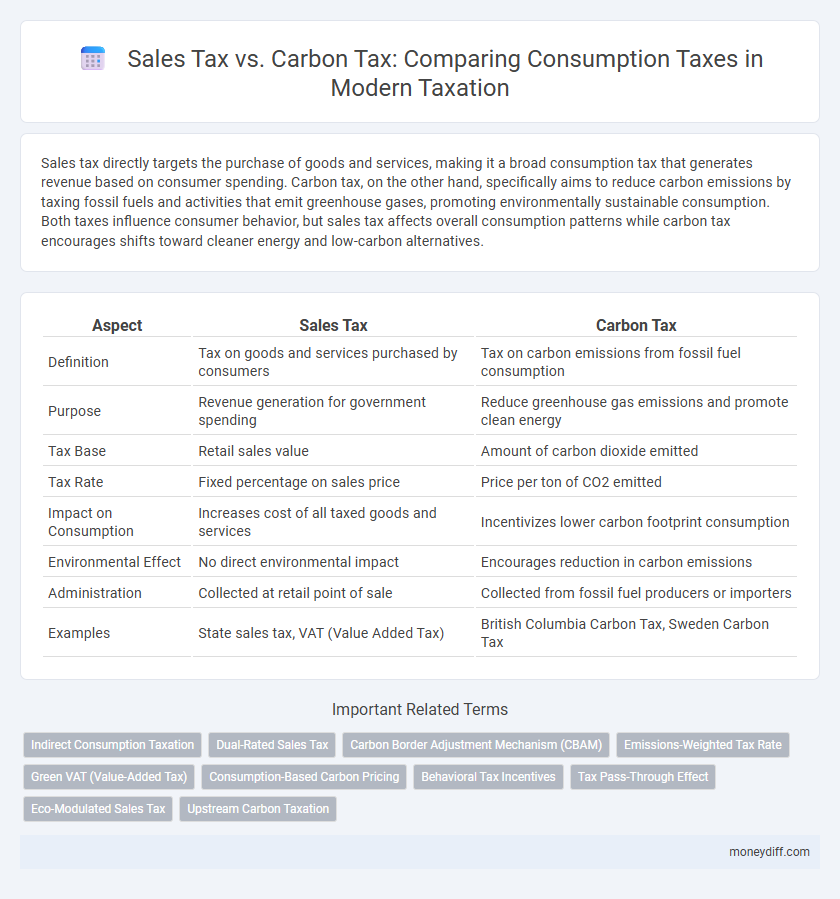

| Aspect | Sales Tax | Carbon Tax |

|---|---|---|

| Definition | Tax on goods and services purchased by consumers | Tax on carbon emissions from fossil fuel consumption |

| Purpose | Revenue generation for government spending | Reduce greenhouse gas emissions and promote clean energy |

| Tax Base | Retail sales value | Amount of carbon dioxide emitted |

| Tax Rate | Fixed percentage on sales price | Price per ton of CO2 emitted |

| Impact on Consumption | Increases cost of all taxed goods and services | Incentivizes lower carbon footprint consumption |

| Environmental Effect | No direct environmental impact | Encourages reduction in carbon emissions |

| Administration | Collected at retail point of sale | Collected from fossil fuel producers or importers |

| Examples | State sales tax, VAT (Value Added Tax) | British Columbia Carbon Tax, Sweden Carbon Tax |

Understanding Consumption Taxes: Sales Tax vs Carbon Tax

Sales tax directly applies to the purchase of goods and services, generating revenue based on consumer spending patterns, while carbon tax imposes a fee on carbon emissions associated with fossil fuel consumption, incentivizing lower greenhouse gas emissions. Both taxes influence consumption behavior, but sales tax broadly affects all taxable goods, whereas carbon tax specifically targets environmental externalities by pricing carbon intensity. Evaluating the effectiveness of these taxes involves comparing their economic efficiency, environmental impact, and fairness in distribution across different income groups.

Defining Sales Tax: Key Features and Mechanisms

Sales tax is a consumption tax imposed on the sale of goods and services, collected at the point of purchase and typically calculated as a percentage of the sale price. Key features include its broad application to retail transactions and the responsibility placed on retailers to collect and remit the tax to government authorities. This mechanism creates a direct link between consumer spending and tax revenue, influencing purchasing behavior and government funding.

What is a Carbon Tax? Purpose and Implementation

A carbon tax is a consumption tax levied on the carbon content of fossil fuels to reduce greenhouse gas emissions and combat climate change. Its purpose is to incentivize businesses and consumers to decrease carbon-intensive activities by increasing the cost of carbon emissions. Implementation involves setting a fixed price per ton of emitted CO2, collected at the point of fuel production or import, encouraging energy efficiency and investment in renewable energy sources.

Economic Impacts: Sales Tax Compared to Carbon Tax

Sales tax directly influences consumer spending by increasing the cost of goods and services, often disproportionately affecting lower-income households and potentially reducing overall consumption. Carbon tax specifically targets carbon emissions by pricing pollution, incentivizing cleaner energy use and driving innovation toward sustainable technologies while generating revenue that can be redistributed or invested in green initiatives. Compared to sales tax, carbon tax aligns economic incentives with environmental goals, potentially leading to long-term economic benefits through reduced climate change impacts and enhanced energy efficiency.

Revenue Generation: Which Tax Is More Profitable?

Sales tax generates steady and predictable revenue by applying a fixed percentage to the sale of goods and services, making it highly reliable for governments. Carbon tax revenue varies based on emission levels and fuel consumption, offering potential for growth as carbon pricing intensifies but posing uncertainty due to fluctuating industrial activity. Empirical data from jurisdictions like British Columbia and California show sales tax typically delivers more consistent revenue streams, while carbon tax revenue can be substantial but less predictable.

Behavioral Effects: How Sales and Carbon Taxes Influence Consumers

Sales taxes commonly impact consumer purchasing behavior by increasing the overall price of goods, often leading to reduced consumption across a broad range of products. Carbon taxes specifically target goods and services with high carbon footprints, incentivizing consumers to shift towards environmentally friendly alternatives and reduce emissions. Studies indicate carbon taxes can effectively drive behavioral change by embedding environmental costs directly into consumer choice, unlike general sales taxes that do not differentiate based on product sustainability.

Environmental Considerations: Carbon Tax vs Sales Tax

Carbon tax directly targets carbon emissions by imposing costs based on the amount of carbon dioxide released, incentivizing consumers and businesses to reduce fossil fuel consumption and adopt cleaner energy alternatives. Sales tax applies broadly to purchases regardless of their environmental impact, lacking the specificity needed to drive reductions in carbon footprints. Implementing a carbon tax aligns economic incentives with environmental goals, making it a more effective tool for addressing climate change compared to traditional sales tax.

Administrative Complexity: Ease of Collection and Enforcement

Sales tax is generally easier to administer due to its direct application at the point of sale, with established systems for collection and enforcement in retail environments. Carbon tax involves measuring emissions, requiring complex monitoring and reporting mechanisms that increase administrative burden and enforcement challenges. The straightforward nature of sales tax collection often results in lower compliance costs compared to the specialized oversight needed for carbon tax implementation.

Equity and Fairness: Who Bears the Burden of Each Tax?

Sales tax disproportionately affects low- and middle-income households because it is levied on goods and services they spend a larger share of their income on, making it regressive. Carbon tax, when designed with rebates or dividends, can be more equitable by taxing carbon emissions and using revenues to offset burdens on vulnerable populations. Equity in consumption taxes depends on the policy design, with carbon tax offering potential for greater fairness through targeted compensation mechanisms.

Policy Challenges and Future Outlook for Consumption Taxes

Sales tax and carbon tax both target consumption but present distinct policy challenges; sales tax is easier to administer and provides predictable revenue, whereas carbon tax directly incentivizes emission reductions but faces political resistance and potential economic disruption. Future outlook for consumption taxes involves integrating carbon pricing mechanisms to align fiscal policy with environmental goals while maintaining equity and minimizing economic burden. Policymakers must balance efficiency, fairness, and administrative feasibility to design sustainable consumption tax frameworks that support climate action and revenue stability.

Related Important Terms

Indirect Consumption Taxation

Sales tax is an indirect consumption tax levied on the sale of goods and services at the point of purchase, directly impacting consumer spending patterns and broad-based revenue generation. Carbon tax, also an indirect consumption tax, specifically targets the carbon content of fossil fuels to internalize environmental costs and incentivize reduced carbon emissions, aligning fiscal policy with climate change mitigation goals.

Dual-Rated Sales Tax

Dual-rated sales tax applies differential rates to goods and services, optimizing revenue while addressing consumption disparities, whereas carbon tax specifically targets emissions-intensive products to incentivize environmental responsibility. Implementing dual-rated sales tax alongside carbon tax can balance economic growth and sustainability by taxing general consumption separately from carbon output.

Carbon Border Adjustment Mechanism (CBAM)

The Carbon Border Adjustment Mechanism (CBAM) imposes taxes on imports based on their embedded carbon emissions, contrasting with traditional sales taxes that apply uniformly to goods regardless of environmental impact. By targeting carbon-intensive products, CBAM incentivizes lower emissions globally while safeguarding domestic industries from unfair competition and preventing carbon leakage.

Emissions-Weighted Tax Rate

An emissions-weighted tax rate integrates the carbon intensity of products into the sales tax framework, incentivizing lower-emission consumption by imposing higher tax rates on goods with greater carbon footprints. This approach enhances the effectiveness of consumption taxes by aligning fiscal policy with environmental objectives, promoting sustainable consumer behavior while maintaining revenue generation.

Green VAT (Value-Added Tax)

Sales tax and carbon tax serve distinct roles in consumption taxation, with sales tax applied broadly to goods and services, while carbon tax targets carbon emissions to incentivize environmental responsibility. Green VAT, a type of Value-Added Tax adjusted to promote sustainable consumption, integrates environmental considerations into the tax base by taxing products and services based on their carbon footprint, effectively combining revenue generation with climate policy goals.

Consumption-Based Carbon Pricing

Consumption-based carbon pricing targets greenhouse gas emissions embedded in imported goods and services, promoting cleaner supply chains and reducing carbon leakage compared to traditional sales tax systems focused solely on final retail transactions. Integrating sales tax frameworks with consumption-based carbon taxes incentivizes consumers to shift towards low-carbon products while generating revenue for climate mitigation and adaptation efforts.

Behavioral Tax Incentives

Sales tax primarily influences consumer behavior by increasing the overall cost of goods, which can reduce consumption across a broad spectrum, while carbon tax targets emissions-intensive products to directly incentivize lower carbon footprints and promote sustainable choices. Carbon tax's ability to internalize environmental costs creates stronger behavioral incentives for consumers and producers to shift towards cleaner alternatives compared to the generalized impact of sales tax on consumption patterns.

Tax Pass-Through Effect

Sales tax typically exhibits a high pass-through rate to consumers, directly affecting retail prices on goods and services, while carbon tax pass-through varies depending on the industry's ability to absorb costs or shift them upstream. Empirical studies show sales tax pass-through often approaches 100%, whereas carbon tax pass-through can be less predictable, influenced by market structure and regulatory design.

Eco-Modulated Sales Tax

Eco-modulated sales tax adjusts rates based on the environmental impact of products, incentivizing consumers to choose sustainable options while maintaining revenue generation similar to traditional sales taxes. Unlike carbon taxes that directly target greenhouse gas emissions, eco-modulated sales tax integrates ecological considerations into broader consumption tax frameworks, promoting greener purchasing behavior across multiple sectors.

Upstream Carbon Taxation

Upstream carbon taxation targets fossil fuel producers by levying taxes on the carbon content before fuels reach consumers, promoting emission reductions at the source and providing clear incentives for cleaner energy production. In contrast, sales taxes broadly apply to consumer purchases, lacking direct linkage to carbon emissions and often missing opportunities to drive systemic environmental change.

Sales Tax vs Carbon Tax for consumption taxes. Infographic

moneydiff.com

moneydiff.com