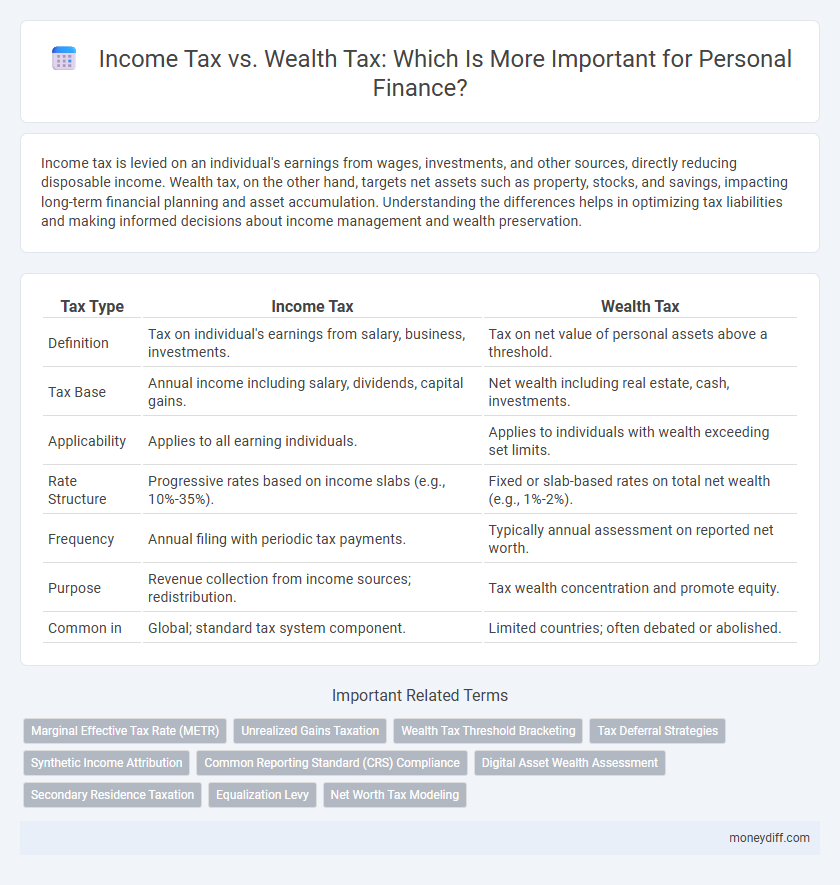

Income tax is levied on an individual's earnings from wages, investments, and other sources, directly reducing disposable income. Wealth tax, on the other hand, targets net assets such as property, stocks, and savings, impacting long-term financial planning and asset accumulation. Understanding the differences helps in optimizing tax liabilities and making informed decisions about income management and wealth preservation.

Table of Comparison

| Tax Type | Income Tax | Wealth Tax |

|---|---|---|

| Definition | Tax on individual's earnings from salary, business, investments. | Tax on net value of personal assets above a threshold. |

| Tax Base | Annual income including salary, dividends, capital gains. | Net wealth including real estate, cash, investments. |

| Applicability | Applies to all earning individuals. | Applies to individuals with wealth exceeding set limits. |

| Rate Structure | Progressive rates based on income slabs (e.g., 10%-35%). | Fixed or slab-based rates on total net wealth (e.g., 1%-2%). |

| Frequency | Annual filing with periodic tax payments. | Typically annual assessment on reported net worth. |

| Purpose | Revenue collection from income sources; redistribution. | Tax wealth concentration and promote equity. |

| Common in | Global; standard tax system component. | Limited countries; often debated or abolished. |

Understanding Income Tax and Wealth Tax

Income tax is a tax levied on individual earnings, including wages, salaries, and investment income, impacting cash flow and financial planning. Wealth tax targets the net worth of individuals by taxing assets such as property, investments, and savings above a specified threshold, influencing long-term wealth accumulation strategies. Understanding the differences between income tax and wealth tax helps optimize personal finance management by balancing immediate income obligations with overall asset growth.

Key Differences Between Income Tax and Wealth Tax

Income tax is levied on an individual's earnings, including salary, business income, and capital gains, calculated annually based on tax slabs and rates. Wealth tax, by contrast, targets the net value of an individual's assets such as property, investments, and cash holdings above a specified threshold, often assessed yearly on the total asset value. While income tax directly impacts disposable income, wealth tax affects asset accumulation, influencing long-term financial planning and investment strategies.

How Income Tax Impacts Your Finances

Income tax directly affects your disposable income by reducing the amount of earnings available for savings and investments. Higher income tax rates can limit cash flow, influencing budgeting decisions and the ability to build wealth over time. Understanding tax brackets and applicable deductions helps optimize financial planning and minimize tax liabilities.

How Wealth Tax Influences Personal Net Worth

Wealth tax directly reduces personal net worth by imposing a levy on the total value of an individual's assets, unlike income tax, which targets annual earnings. This tax affects high-net-worth individuals by diminishing accumulated wealth through periodic charges on properties, investments, and other valuables. Consequently, wealth tax can influence investment strategies and asset allocation to minimize taxable exposure and preserve overall net worth.

Eligibility Criteria for Income Tax vs Wealth Tax

Income tax eligibility is determined by an individual's annual income exceeding the basic exemption limit set by tax authorities, typically including salaries, business profits, and investment returns. Wealth tax, where applicable, targets individuals or entities holding net wealth above a specified threshold, often excluding basic assets like residence and personal belongings. Understanding these distinct eligibility criteria helps taxpayers efficiently plan financial obligations and optimize tax liabilities.

Calculation Methods: Income Tax vs Wealth Tax

Income tax is calculated based on an individual's annual earnings, including salaries, bonuses, and investment income, using progressive tax rates that increase with higher income brackets. Wealth tax is assessed on the net value of an individual's total assets, such as real estate, cash, and investments, typically using a fixed percentage rate on the net wealth exceeding a specified threshold. Income tax focuses on cash flow and earnings, whereas wealth tax targets accumulated assets, influencing financial planning and asset management strategies.

Tax Planning Strategies for Income and Wealth Taxes

Effective tax planning strategies for income tax and wealth tax involve leveraging deductions, exemptions, and investment options to optimize liabilities. Utilizing tax-efficient instruments like retirement accounts, tax-saving fixed deposits, and real estate investments can minimize taxable income and wealth. Strategic asset allocation and timely tax filings ensure compliance while maximizing after-tax wealth growth.

Legal Implications and Compliance Requirements

Income tax requires accurate reporting of annual earnings and adherence to progressive tax brackets, with legal obligations including timely filing and payment to avoid penalties. Wealth tax mandates disclosure of net assets exceeding specified thresholds, imposing compliance through valuation documentation and potential audits. Both taxes entail strict regulatory frameworks enforced by tax authorities to ensure transparency and prevent evasion.

Impact of Taxation on Long-Term Financial Goals

Income tax directly reduces annual disposable income, affecting the ability to save and invest consistently towards long-term financial goals such as retirement or purchasing property. Wealth tax imposes a recurring liability on accumulated assets, potentially diminishing net worth growth and altering investment strategies to minimize tax exposure. Understanding the differential impact of income tax versus wealth tax is crucial for effective financial planning and optimizing wealth accumulation over time.

Choosing the Right Tax Approach for Personal Finance

Income tax targets annual earnings such as salaries, interest, and dividends, impacting cash flow and budgeting strategies, while wealth tax is levied on net assets like property, investments, and savings, influencing long-term financial planning and asset allocation. Selecting the appropriate tax approach depends on an individual's income level, asset composition, and financial goals, optimizing tax liabilities and maximizing growth potential. Effective integration of income tax deductions and wealth tax exemptions can enhance personal finance management and improve after-tax wealth accumulation.

Related Important Terms

Marginal Effective Tax Rate (METR)

Marginal Effective Tax Rate (METR) measures the total tax burden on additional income or wealth, highlighting how Income Tax targets earned income through progressive rates, while Wealth Tax imposes a levy on net assets, affecting accumulated capital. Comparing METR reveals Income Tax often results in higher penalties on incremental earnings, whereas Wealth Tax elevates costs on wealth accumulation and retention, influencing saving and investment decisions in personal finance.

Unrealized Gains Taxation

Income tax primarily targets earned income while unrealized gains remain untaxed until asset sales trigger capital gains tax; wealth tax, by contrast, may levy annual charges on the total value of assets including unrealized gains, impacting long-term investment strategies and personal financial planning. Understanding differences in unrealized gains taxation is essential for optimizing tax liabilities and preserving wealth in diverse economic conditions.

Wealth Tax Threshold Bracketing

Wealth tax threshold bracketing categorizes individuals based on net asset values, ensuring progressive rates apply only above specific wealth levels, thereby targeting high-net-worth individuals more effectively than income tax. This system prevents middle-income earners from wealth tax liability, contrasting with income tax's broader application on annual earnings regardless of asset accumulation.

Tax Deferral Strategies

Income tax applies to yearly earnings and can be deferred through retirement accounts like 401(k)s and IRAs, allowing investments to grow tax-deferred until withdrawal. Wealth tax targets net assets but is less common, making income tax deferral strategies more impactful for personal finance optimization and long-term tax planning.

Synthetic Income Attribution

Synthetic Income Attribution in personal finance links wealth tax obligations to unrealized gains by imputing income from capital appreciation, unlike income tax which targets realized earnings. This method ensures comprehensive taxation on assets, addressing hidden economic benefits that traditional income tax systems may overlook.

Common Reporting Standard (CRS) Compliance

Income tax targets annual earnings and requires detailed reporting of income sources under Common Reporting Standard (CRS) guidelines to ensure transparency and global tax compliance. Wealth tax, levied on an individual's net assets, demands extensive asset disclosure across jurisdictions, making CRS compliance critical to avoid penalties and ensure accurate cross-border reporting.

Digital Asset Wealth Assessment

Income tax on digital assets is calculated based on realized gains from transactions, reflecting taxable income during the fiscal year, while wealth tax assesses the total value of digital asset holdings at a specific date, targeting net worth rather than income flow. Accurate digital asset wealth assessment requires real-time valuation tools and regulatory compliance to ensure proper reporting and tax liability determination for both income and wealth tax purposes.

Secondary Residence Taxation

Income tax on secondary residences typically targets rental income and capital gains, affecting cash flow and investment returns, while wealth tax directly levies the net value of the property annually, impacting overall asset accumulation. Understanding the interplay between income tax deductions and wealth tax thresholds is crucial for optimizing tax liabilities on secondary real estate investments.

Equalization Levy

Income Tax targets individual earnings such as salaries, investments, and business profits, while Wealth Tax, though abolished in many countries, historically taxed net wealth above a certain threshold; the Equalization Levy specifically addresses digital transactions by taxing foreign companies earning revenue from online services, ensuring fair tax contribution in the digital economy. This levy complements Income Tax and Wealth Tax frameworks by capturing revenues that traditional tax models might miss due to the intangible nature of digital assets and services.

Net Worth Tax Modeling

Income tax is levied on annual earnings such as salaries, dividends, and capital gains, impacting cash flow and disposable income, while wealth tax targets the net worth including assets like real estate, investments, and savings, influencing long-term financial strategy. Effective net worth tax modeling requires integrating asset valuation, income streams, and tax brackets to optimize personal finance planning and minimize overall tax liability.

Income Tax vs Wealth Tax for personal finance Infographic

moneydiff.com

moneydiff.com