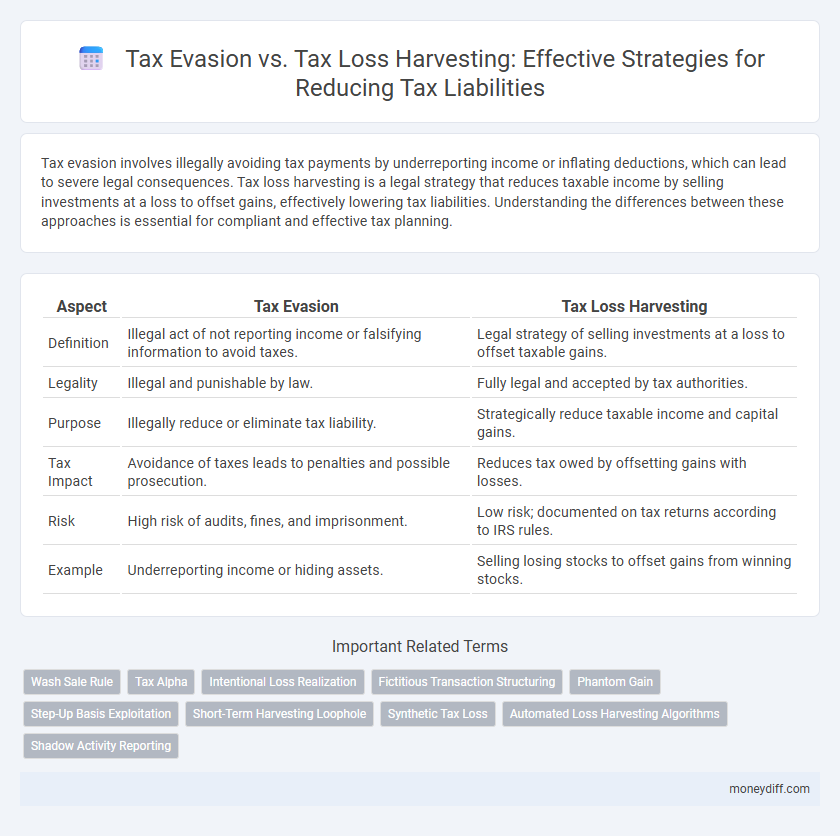

Tax evasion involves illegally avoiding tax payments by underreporting income or inflating deductions, which can lead to severe legal consequences. Tax loss harvesting is a legal strategy that reduces taxable income by selling investments at a loss to offset gains, effectively lowering tax liabilities. Understanding the differences between these approaches is essential for compliant and effective tax planning.

Table of Comparison

| Aspect | Tax Evasion | Tax Loss Harvesting |

|---|---|---|

| Definition | Illegal act of not reporting income or falsifying information to avoid taxes. | Legal strategy of selling investments at a loss to offset taxable gains. |

| Legality | Illegal and punishable by law. | Fully legal and accepted by tax authorities. |

| Purpose | Illegally reduce or eliminate tax liability. | Strategically reduce taxable income and capital gains. |

| Tax Impact | Avoidance of taxes leads to penalties and possible prosecution. | Reduces tax owed by offsetting gains with losses. |

| Risk | High risk of audits, fines, and imprisonment. | Low risk; documented on tax returns according to IRS rules. |

| Example | Underreporting income or hiding assets. | Selling losing stocks to offset gains from winning stocks. |

Understanding Tax Evasion vs. Tax Loss Harvesting

Tax evasion involves illegal practices to avoid paying taxes by underreporting income or inflating deductions, which carries severe penalties and legal risks. Tax loss harvesting is a legal strategy that offsets capital gains with investment losses to reduce taxable income within regulatory guidelines. Understanding the distinction is critical for maximizing tax efficiency while complying with tax laws.

Legal Definitions: Tax Evasion and Tax Loss Harvesting

Tax evasion is the illegal act of deliberately misrepresenting or concealing income to reduce tax liabilities, violating tax laws and subject to penalties or prosecution. Tax loss harvesting is a legal tax strategy involving the sale of investments at a loss to offset capital gains and reduce taxable income. Understanding these distinct legal definitions is crucial for compliant tax planning and minimizing liabilities without risking legal consequences.

Key Differences Between Tax Evasion and Tax Loss Harvesting

Tax evation involves illegally concealing income or falsifying information to reduce tax liability, whereas tax loss harvesting is a legal strategy that entails selling investments at a loss to offset capital gains and reduce taxable income. Key differences lie in compliance with tax laws, with tax evasion carrying criminal penalties and tax loss harvesting being an IRS-approved method to optimize tax outcomes. Understanding these distinctions is crucial for taxpayers seeking to minimize liabilities without risking legal consequences.

How Tax Loss Harvesting Reduces Your Tax Liabilities

Tax loss harvesting strategically offsets capital gains by selling securities at a loss, thereby reducing taxable income and lowering overall tax liabilities. This method preserves the portfolio's investment strategy while deferring tax payments, unlike illegal tax evasion, which involves concealing income or falsifying records. Effectively implemented, tax loss harvesting enhances after-tax returns without violating IRS regulations.

Risks and Consequences of Tax Evasion

Tax evasion involves illegally underreporting income or inflating deductions to reduce tax liabilities, exposing individuals and businesses to severe penalties such as hefty fines, interest charges, and potential imprisonment. Unlike tax loss harvesting, which legally offsets capital gains by strategically selling investments at a loss, tax evasion undermines tax laws and can result in audits, reputational damage, and long-term financial setbacks. Understanding the legal boundaries is crucial to avoid the significant risks and consequences associated with tax evasion.

Legal Methods for Minimizing Tax Bills

Tax loss harvesting is a legal strategy that involves selling investments at a loss to offset taxable gains, effectively reducing overall tax liabilities while complying with tax regulations. In contrast, tax evasion involves illegal actions such as underreporting income or inflating deductions, which can lead to severe penalties and criminal charges. Utilizing tax loss harvesting enables investors to manage their tax burden prudently without risking legal consequences.

Compliance Requirements for Tax Loss Harvesting

Tax loss harvesting involves selling securities at a loss to offset capital gains, requiring strict compliance with IRS rules such as the wash-sale rule that disallows repurchasing the same or substantially identical security within 30 days. Accurate record-keeping of transactions and timing is essential to demonstrate adherence to tax laws and avoid triggering audits or penalties for tax evasion. Unlike tax evasion, which is illegal, tax loss harvesting is a legitimate strategy when properly documented and executed within established regulatory frameworks.

Common Tax Evasion Schemes and Red Flags

Common tax evasion schemes include underreporting income, inflating deductions, and hiding assets in offshore accounts, which significantly violate IRS regulations and can result in severe penalties. Taxpayers engaging in these schemes often exhibit red flags such as inconsistent financial records, unexplained wealth, and excessive deductions that deviate from industry norms. Understanding these red flags helps differentiate illegal evasion from legitimate tax loss harvesting, a legal strategy aimed at reducing tax liabilities by offsetting capital gains with capital losses.

Maximizing Deductions with Tax Loss Harvesting

Tax loss harvesting maximizes deductions by strategically selling securities at a loss to offset capital gains, effectively lowering taxable income within the current fiscal year. Unlike illegal tax evasion, which involves deceit and penalties, tax loss harvesting is a legitimate strategy sanctioned by the IRS to optimize tax liabilities. Implementing this approach can enhance portfolio performance while adhering to tax regulations, providing financial benefits without legal risks.

Choosing Ethical Strategies to Lower Tax Liability

Tax loss harvesting involves legally selling investments at a loss to offset gains and reduce taxable income, aligning with ethical tax planning practices. Tax evasion, which includes illegal methods like underreporting income or inflating deductions, carries significant legal risks and penalties. Opting for tax loss harvesting ensures compliance with tax laws while effectively minimizing tax liability.

Related Important Terms

Wash Sale Rule

Tax loss harvesting legally reduces tax liabilities by offsetting gains with losses, while tax evasion involves illegal concealment of income; the Wash Sale Rule prevents claiming a tax loss on a security repurchased within 30 days, ensuring compliance and limiting abusive loss claims. Understanding the IRS Wash Sale Rule is crucial for effectively timing transactions to maximize tax benefits without triggering penalties.

Tax Alpha

Tax loss harvesting strategically realizes investment losses to offset capital gains, legally reducing taxable income and enhancing Tax Alpha by optimizing after-tax returns. In contrast, tax evasion involves illegal concealment of income or falsification of records, resulting in significant legal penalties without contributing to genuine Tax Alpha.

Intentional Loss Realization

Tax evasion involves the illegal concealment of income or falsification of information to reduce tax liabilities, whereas tax loss harvesting is a legitimate strategy that intentionally realizes investment losses to offset capital gains and decrease taxable income. Intentional loss realization in tax loss harvesting must comply with IRS rules, including the wash-sale rule, to avoid penalties and ensure tax benefits are valid.

Fictitious Transaction Structuring

Fictitious transaction structuring in tax evasion involves creating false or artificial deals to illegally reduce tax liabilities, whereas in tax loss harvesting, real investment losses are strategically realized to offset gains and legitimately lower taxable income. Distinguishing genuine asset reallocation from fabricated transactions is crucial for regulatory compliance and avoiding severe penalties.

Phantom Gain

Phantom gains arise when taxpayers face taxable income from asset appreciation without actual cash realization, often triggering unexpected tax liabilities in tax evasion scenarios. Tax loss harvesting strategically sells underperforming assets to offset gains, effectively managing phantom gains and reducing overall tax burdens within legal frameworks.

Step-Up Basis Exploitation

Tax evasion involves illegally hiding income or falsifying information to avoid paying taxes, while tax loss harvesting legally offsets capital gains by realizing losses, optimizing tax liabilities without deception. Exploiting the step-up basis in estate planning allows heirs to reset the asset's cost basis to its market value at the owner's death, significantly reducing capital gains taxes and enhancing tax loss harvesting strategies.

Short-Term Harvesting Loophole

Short-term tax loss harvesting allows investors to offset gains by selling assets at a loss within a year, exploiting a loophole that can significantly reduce taxable income despite IRS regulations targeting quick repurchases. Unlike illegal tax evasion, this strategy leverages legal provisions to minimize tax liabilities while complying with wash-sale rules designed to prevent abuse.

Synthetic Tax Loss

Synthetic tax loss strategies involve creating artificial losses through derivatives or securities lending to offset capital gains and reduce taxable income, distinguishing them from tax evasion, which is illegal concealment of income or falsification of records. Leveraging synthetic tax losses as part of tax loss harvesting offers a legal and strategic method to optimize tax liabilities while maintaining compliance with tax regulations.

Automated Loss Harvesting Algorithms

Automated loss harvesting algorithms optimize tax loss harvesting by systematically identifying and selling securities at a loss to offset capital gains, effectively minimizing tax liabilities without violating tax evasion laws. Unlike illegal tax evasion, these algorithms ensure compliance with IRS regulations by accurately timing transactions and maintaining proper documentation for audit trails.

Shadow Activity Reporting

Tax evasion involves illegally concealing income or information to reduce tax liabilities, often triggering Shadow Activity Reporting to detect suspicious transactions. Tax loss harvesting, a legitimate strategy under tax law, offsets taxable gains with losses on investments, minimizing liabilities without invoking Shadow Activity Reporting alerts.

Tax evasion vs Tax loss harvesting for reducing liabilities. Infographic

moneydiff.com

moneydiff.com