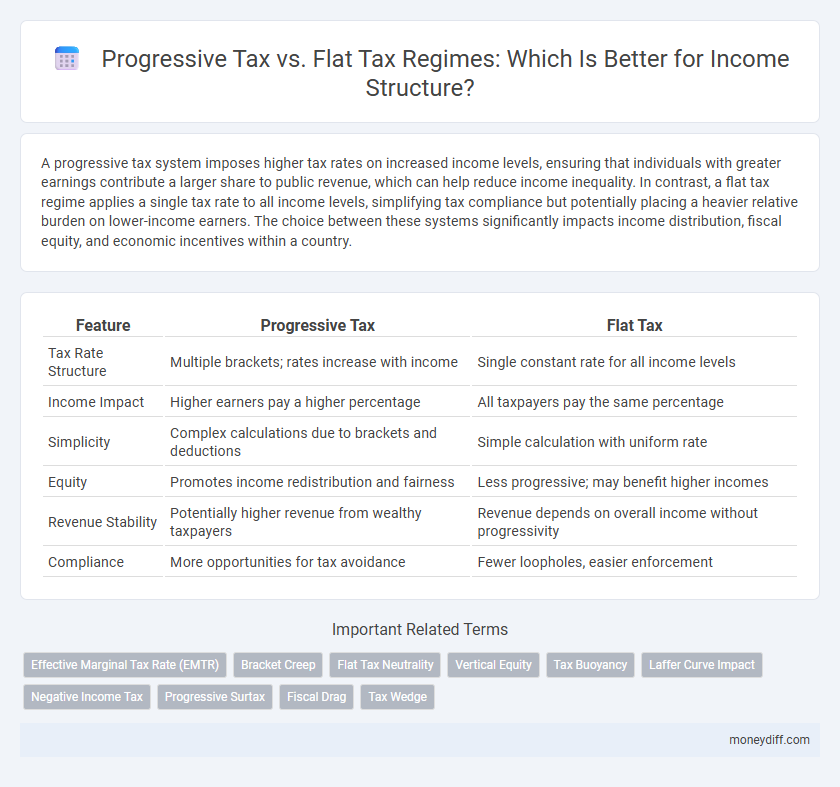

A progressive tax system imposes higher tax rates on increased income levels, ensuring that individuals with greater earnings contribute a larger share to public revenue, which can help reduce income inequality. In contrast, a flat tax regime applies a single tax rate to all income levels, simplifying tax compliance but potentially placing a heavier relative burden on lower-income earners. The choice between these systems significantly impacts income distribution, fiscal equity, and economic incentives within a country.

Table of Comparison

| Feature | Progressive Tax | Flat Tax |

|---|---|---|

| Tax Rate Structure | Multiple brackets; rates increase with income | Single constant rate for all income levels |

| Income Impact | Higher earners pay a higher percentage | All taxpayers pay the same percentage |

| Simplicity | Complex calculations due to brackets and deductions | Simple calculation with uniform rate |

| Equity | Promotes income redistribution and fairness | Less progressive; may benefit higher incomes |

| Revenue Stability | Potentially higher revenue from wealthy taxpayers | Revenue depends on overall income without progressivity |

| Compliance | More opportunities for tax avoidance | Fewer loopholes, easier enforcement |

Understanding Progressive Tax: Key Features

Progressive tax features multiple tax brackets where tax rates increase as income levels rise, targeting higher earners with greater tax burdens to promote income redistribution. It incorporates exemptions and deductions to reduce taxable income, ensuring lower-income groups benefit from reduced liability. This tax structure supports social equity by balancing revenue generation with taxpayers' ability to pay.

Flat Tax Regime: An Overview

A flat tax regime applies a single fixed tax rate to all income levels, simplifying the tax structure and reducing compliance costs for taxpayers. This system promotes transparency and can encourage economic growth by eliminating high marginal tax rates associated with progressive taxes. Critics argue it may increase income inequality, but proponents highlight its efficiency and ease of administration.

Historical Context of Progressive and Flat Taxes

The historical context of progressive and flat tax regimes reveals distinct approaches to income taxation, with progressive taxes dating back to the ancient civilizations of Egypt and Rome, where higher income earners paid larger shares to fund public services. Flat tax systems emerged more recently, gaining popularity in the late 20th century as simpler models aimed at promoting economic growth through uniform tax rates for all income levels. These contrasting frameworks reflect ongoing debates about equity, efficiency, and fiscal policy design in modern tax systems.

Income Brackets and Tax Structures Explained

Progressive tax regimes impose increasing tax rates on higher income brackets, ensuring that individuals with greater earnings contribute a larger percentage of their income compared to those in lower brackets. Flat tax systems apply a uniform tax rate across all income levels, simplifying compliance but often placing a relatively higher burden on lower-income earners. Understanding these tax structures is crucial for evaluating their impact on income distribution and government revenue.

Economic Impacts of Progressive Tax Systems

Progressive tax systems impose higher tax rates on increased income levels, promoting income redistribution and reducing economic inequality. This tax structure can enhance social welfare by funding public services and social programs that support lower-income groups. However, excessive progressivity may discourage investment and labor participation, potentially slowing economic growth.

Social Equity Concerns of Progressive vs Flat Taxation

Progressive tax systems enhance social equity by imposing higher rates on top income brackets, thereby reducing income inequality through wealth redistribution. Flat tax regimes apply a uniform rate to all income levels, which may limit the tax burden on high earners but often exacerbates disparities by placing relatively heavier burdens on lower-income groups. Evaluating social equity concerns requires examining how progressive taxation supports funding for social programs that benefit vulnerable populations, while flat taxes may constrain public revenue essential for social safety nets.

Administrative Complexity: Progressive vs Flat Tax

Progressive tax regimes involve multiple tax brackets and varying rates, resulting in increased administrative complexity due to the need for detailed income assessments and calculations. Flat tax systems apply a single uniform rate to all income levels, significantly reducing the administrative burden and simplifying tax filing procedures. This streamlined approach in flat tax regimes can lead to lower compliance costs and faster processing times for both taxpayers and tax authorities.

Revenue Generation Comparisons

Progressive tax regimes generate higher revenue by imposing increasing tax rates on higher income brackets, effectively capturing more funds from top earners. Flat tax systems apply a uniform rate to all income levels, resulting in simpler administration but often less revenue from wealthier individuals. Studies show that progressive taxes enhance redistributive effects and yield greater total tax revenue compared to flat tax models, especially in economies with significant income inequality.

Taxpayer Compliance and Behavioral Responses

Progressive tax regimes, with increasing marginal rates for higher incomes, often encourage greater compliance due to perceived fairness, while flat tax systems simplify filing and reduce administrative costs but may diminish incentives for compliance among lower-income taxpayers. Behavioral responses under progressive taxation can include efforts to minimize taxable income through deductions and tax planning, whereas flat tax systems tend to reduce such avoidance strategies by applying a uniform rate. Empirical studies indicate that taxpayer compliance improves when the tax structure aligns with taxpayer perceptions of equity and ease of compliance, influencing overall tax revenue collection efficiency.

Choosing the Right Tax Regime for Sustainable Growth

A progressive tax regime ensures higher income earners contribute a larger percentage, promoting income redistribution and reducing inequality, which supports sustainable economic growth. In contrast, a flat tax regime simplifies tax administration and incentivizes investment by applying a uniform rate to all income levels, potentially boosting economic efficiency. Balancing equity and efficiency is crucial when selecting a tax regime that fosters long-term fiscal stability and inclusive development.

Related Important Terms

Effective Marginal Tax Rate (EMTR)

The Effective Marginal Tax Rate (EMTR) under a progressive tax regime increases with higher income brackets, incentivizing income redistribution but potentially discouraging additional earnings. In contrast, a flat tax regime maintains a constant EMTR regardless of income level, simplifying tax calculations and promoting consistent incentives for earning more.

Bracket Creep

Bracket creep occurs in a progressive tax system when inflation pushes taxpayers into higher income tax brackets, increasing their tax burden without real income growth, whereas a flat tax regime applies a constant rate on income regardless of inflation, preventing bracket creep and simplifying tax calculations. The impact of bracket creep on taxpayers is significant in progressive systems, leading to higher effective tax rates and potential decreases in disposable income over time.

Flat Tax Neutrality

Flat tax regimes offer neutrality by applying a consistent tax rate across all income levels, eliminating distortions in economic decision-making and simplifying compliance. This neutrality can encourage investment and productivity, contrasting with progressive tax systems that impose higher rates on increased income, potentially disincentivizing additional earnings.

Vertical Equity

The progressive tax regime enhances vertical equity by imposing higher tax rates on higher income brackets, ensuring wealthier individuals contribute a larger share relative to their income. In contrast, the flat tax system applies a uniform tax rate across all income levels, potentially reducing vertical equity by taxing low and high earners proportionally without addressing income disparities.

Tax Buoyancy

Progressive tax regimes enhance tax buoyancy by increasing revenue responsiveness as higher income brackets are taxed at elevated rates, promoting a more elastic tax base during economic growth. Flat tax systems often exhibit lower tax buoyancy since a single rate limits the capacity to capture expanding incomes, potentially constraining fiscal adaptability.

Laffer Curve Impact

Progressive tax regimes, where tax rates increase with income, can discourage high earners' productivity and investment, potentially reducing overall tax revenue as illustrated by the Laffer Curve. In contrast, flat tax systems maintain a constant rate, which may encourage economic growth and maximize revenue without pushing taxpayers into higher brackets that reduce incentives.

Negative Income Tax

The Negative Income Tax (NIT) system provides a guaranteed minimum income by supplementing earnings below a certain threshold, contrasting with progressive tax regimes where tax rates increase with income, potentially discouraging additional work. Flat tax regimes apply a uniform rate regardless of income, but combining NIT with a flat tax can enhance equity and efficiency by ensuring low-income individuals receive support while maintaining a simplified tax structure.

Progressive Surtax

Progressive surtax increases tax rates as income rises, ensuring higher earners contribute a larger share, which reduces income inequality and funds public services effectively. Unlike flat tax systems that apply a uniform rate, progressive surtax adjusts tax liabilities based on income brackets, optimizing revenue collection and social equity.

Fiscal Drag

A progressive tax regime, which increases tax rates as income rises, can intensify fiscal drag by pushing taxpayers into higher brackets due to inflation-driven nominal income growth, reducing their real disposable income. In contrast, a flat tax regime applies a constant rate regardless of income level, minimizing fiscal drag but potentially limiting the government's ability to redistribute income effectively.

Tax Wedge

The tax wedge, representing the difference between total labor costs to the employer and net take-home pay for the employee, varies significantly under progressive and flat tax regimes, with progressive taxes typically creating a higher wedge for higher earners. A flatter tax regime often results in a more uniform tax wedge across income levels, potentially encouraging labor market participation but reducing the tax system's ability to redistribute income.

Progressive tax vs Flat tax regime for income structure. Infographic

moneydiff.com

moneydiff.com