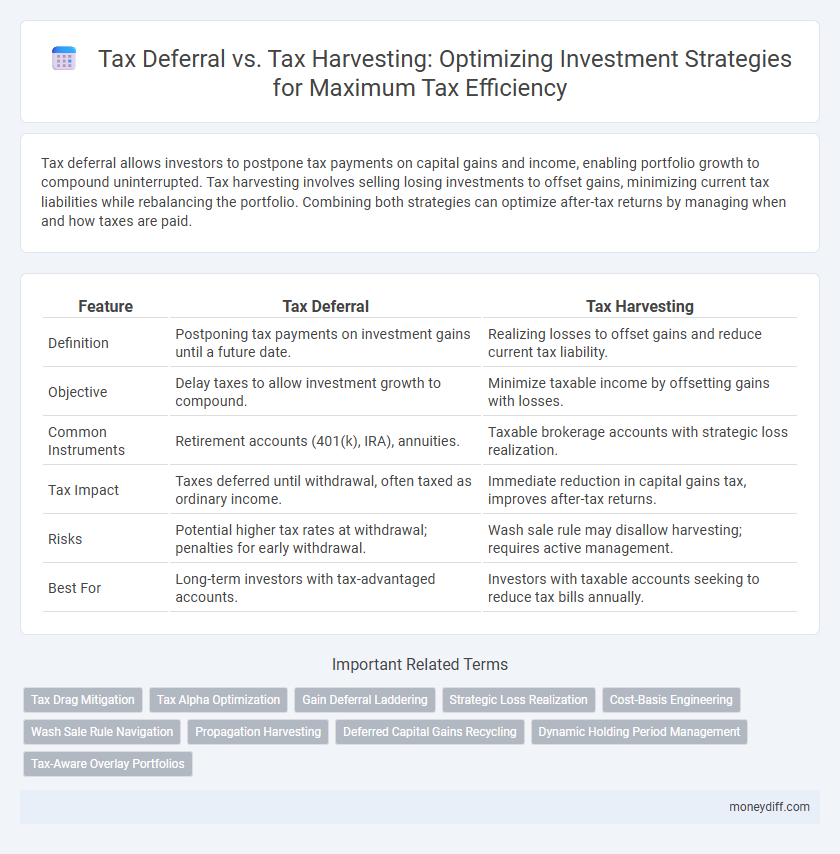

Tax deferral allows investors to postpone tax payments on capital gains and income, enabling portfolio growth to compound uninterrupted. Tax harvesting involves selling losing investments to offset gains, minimizing current tax liabilities while rebalancing the portfolio. Combining both strategies can optimize after-tax returns by managing when and how taxes are paid.

Table of Comparison

| Feature | Tax Deferral | Tax Harvesting |

|---|---|---|

| Definition | Postponing tax payments on investment gains until a future date. | Realizing losses to offset gains and reduce current tax liability. |

| Objective | Delay taxes to allow investment growth to compound. | Minimize taxable income by offsetting gains with losses. |

| Common Instruments | Retirement accounts (401(k), IRA), annuities. | Taxable brokerage accounts with strategic loss realization. |

| Tax Impact | Taxes deferred until withdrawal, often taxed as ordinary income. | Immediate reduction in capital gains tax, improves after-tax returns. |

| Risks | Potential higher tax rates at withdrawal; penalties for early withdrawal. | Wash sale rule may disallow harvesting; requires active management. |

| Best For | Long-term investors with tax-advantaged accounts. | Investors with taxable accounts seeking to reduce tax bills annually. |

Understanding Tax Deferral in Investment Strategy

Tax deferral in investment strategy allows investors to postpone paying taxes on investment gains until a later date, typically upon withdrawal, which helps in compounding returns over time. This approach is commonly used in retirement accounts like 401(k)s and IRAs, where taxes are paid only during distributions. By deferring taxes, investors can reinvest the full amount of their gains, potentially enhancing long-term portfolio growth and reducing the tax impact during peak earning years.

What is Tax Harvesting?

Tax harvesting is an investment strategy that involves selling securities at a loss to offset capital gains tax liabilities, thereby reducing taxable income. This technique allows investors to realize losses intentionally to minimize taxes on gains from other investments while maintaining their desired asset allocation by reinvesting the proceeds. Tax harvesting, often used in taxable brokerage accounts, is distinct from tax deferral, which delays tax payments without realizing losses.

Key Differences: Tax Deferral vs Tax Harvesting

Tax deferral postpones tax payments on investment gains until the assets are sold or withdrawn, allowing potential growth to compound tax-free during the deferral period. Tax harvesting involves strategically selling investments at a loss to offset capital gains taxes, effectively reducing current tax liabilities. Key differences include the timing of tax impact--deferral delays taxes, while harvesting actively manages tax exposure to minimize immediate taxes owed.

Tax Deferral: Pros and Cons for Investors

Tax deferral allows investors to postpone paying taxes on investment gains until a later date, typically at retirement, enabling potential growth through compounding. This strategy can increase after-tax returns by keeping more capital invested and delaying tax liabilities, especially beneficial for individuals in lower retirement tax brackets. However, the downside includes the risk of higher tax rates upon withdrawal and limited flexibility compared to tax-loss harvesting, which actively manages taxable events to offset gains.

Tax Harvesting: Benefits and Potential Drawbacks

Tax harvesting involves selling investments at a loss to offset capital gains, reducing overall tax liability. This strategy can enhance after-tax returns by strategically managing realized gains and losses within a portfolio. Potential drawbacks include transaction costs, the risk of violating the wash-sale rule, and the possibility of missing out on market rebounds if positions are sold and not promptly repurchased.

Impact on Portfolio Performance: Comparing Both Strategies

Tax deferral strategies allow investments to grow tax-free until withdrawal, enhancing compounding effects and potentially increasing long-term portfolio value. Tax harvesting involves realizing losses to offset gains, effectively reducing taxable income and preserving capital, which can improve after-tax returns. Comparing both strategies reveals that while tax deferral maximizes growth within tax-advantaged accounts, tax harvesting optimizes tax efficiency in taxable accounts, together enhancing overall portfolio performance.

When to Use Tax Deferral in Your Financial Plan

Tax deferral is most effective when anticipating higher future income or tax rates, allowing investments to grow tax-deferred until withdrawal, typically during retirement. This strategy suits long-term investors with significant growth potential in tax-advantaged accounts like 401(k)s or IRAs. Incorporating tax deferral in your financial plan can maximize compounding benefits while strategically timing tax liabilities for lower tax brackets.

When Tax Harvesting Makes the Most Sense

Tax harvesting makes the most sense when investors have significant unrealized capital losses that can offset capital gains, thereby reducing taxable income in the current year. This strategy is particularly beneficial during market downturns or periods of volatility, allowing investors to rebalance portfolios and realize tax savings without disrupting long-term investment plans. Tax deferral, by contrast, is more advantageous when anticipating lower future tax rates or when delaying tax liabilities aligns better with retirement planning goals.

Tax Implications: Long-Term vs Short-Term Investments

Tax deferral allows investors to postpone tax payments on investment gains, often benefiting from long-term capital gains rates that are lower than short-term rates, which apply to holdings sold within one year. Tax harvesting strategically realizes short-term losses to offset gains, reducing current taxable income but may trigger higher tax rates on short-term gains. Understanding the implications of holding periods is crucial for optimizing tax outcomes in investment strategies, with long-term investments generally offering more favorable tax treatment.

Choosing the Right Tax Strategy for Your Investment Goals

Tax deferral allows investors to postpone tax payments on investment gains, promoting long-term growth by compounding returns without immediate tax impact. Tax harvesting involves selling investments at a loss to offset gains and reduce taxable income within a tax year, optimizing portfolio efficiency. Selecting the right strategy depends on your investment timeframe, tax bracket, and financial goals to maximize after-tax returns and align with your retirement or liquidity needs.

Related Important Terms

Tax Drag Mitigation

Tax deferral strategies postpone tax liabilities on investment gains, allowing for compounding growth and reducing immediate tax drag, while tax harvesting involves strategically selling securities at a loss to offset taxable gains and minimize overall tax impact. Both approaches aim to optimize after-tax returns by mitigating tax drag through timing and loss realization, enhancing portfolio efficiency over time.

Tax Alpha Optimization

Tax deferral strategies enable investors to postpone tax liabilities on capital gains, maximizing the growth potential of investments by keeping more capital invested over time. Tax harvesting actively realizes losses to offset gains, generating tax alpha by reducing taxable income and effectively enhancing after-tax portfolio returns.

Gain Deferral Laddering

Gain deferral laddering strategically spaces the realization of capital gains over multiple tax years, minimizing immediate tax liability and smoothing taxable income. This approach contrasts with tax harvesting, which accelerates losses to offset gains, offering a tax-efficient method to maximize after-tax investment returns.

Strategic Loss Realization

Strategic loss realization in tax harvesting involves selling investments at a loss to offset capital gains, effectively reducing taxable income and deferring tax liabilities. This approach contrasts with tax deferral strategies, which postpone tax payment by holding investments longer, emphasizing immediate tax savings through realized losses to optimize after-tax portfolio returns.

Cost-Basis Engineering

Tax deferral strategies allow investors to postpone capital gains taxes by holding investments longer, enhancing potential compound growth, while tax harvesting actively realizes losses to offset gains and reduce taxable income. Cost-basis engineering plays a critical role in both methods by strategically managing the purchase price records of securities to optimize tax outcomes and maximize after-tax returns.

Wash Sale Rule Navigation

Tax deferral strategies allow investors to postpone capital gains taxes by holding investments longer, while tax harvesting involves selling securities at a loss to offset gains, but both must carefully navigate the IRS Wash Sale Rule, which disallows claiming a loss if the same or substantially identical security is repurchased within 30 days. Proper understanding and timing of transactions are critical to avoid triggering wash sales, ensuring tax benefits are realized without penalties or disallowed losses.

Propagation Harvesting

Tax deferral strategies allow investors to postpone tax payments on earnings, enhancing compound growth by reinvesting untaxed funds, while tax loss harvesting involves selling securities at a loss to offset gains and reduce taxable income. Propagation harvesting optimizes this process by systematically identifying and realizing losses across multiple investments, amplifying tax benefits and improving after-tax portfolio returns.

Deferred Capital Gains Recycling

Deferred capital gains recycling leverages tax deferral to reinvest unrealized gains, postponing tax liabilities while maintaining portfolio growth potential. Tax harvesting involves realizing capital losses to offset gains, reducing tax burdens immediately, but deferred capital gains recycling enhances long-term compounding by strategically delaying taxes.

Dynamic Holding Period Management

Dynamic holding period management enhances tax deferral strategies by optimizing the timing of asset sales to postpone tax liabilities, maximizing investment growth. In contrast, tax harvesting actively realizes losses within the holding period to offset gains, reducing current tax burdens while maintaining portfolio alignment.

Tax-Aware Overlay Portfolios

Tax-aware overlay portfolios strategically combine tax deferral and tax harvesting to optimize after-tax investment returns by managing capital gains and losses efficiently. Utilizing tax-loss harvesting within these overlays allows investors to offset realized gains with losses, while tax deferral strategies postpone taxable events, collectively enhancing portfolio tax efficiency and long-term growth.

Tax Deferral vs Tax Harvesting for investment strategies. Infographic

moneydiff.com

moneydiff.com