Value Added Tax (VAT) applies a percentage charge on goods and services at each stage of production or distribution, impacting overall consumption costs uniformly. Green Tax targets environmentally harmful products or activities, incentivizing sustainable consumption by imposing higher rates on pollution-intensive goods. Comparing both, VAT generates broad revenue while Green Tax drives eco-friendly behavior through targeted financial disincentives.

Table of Comparison

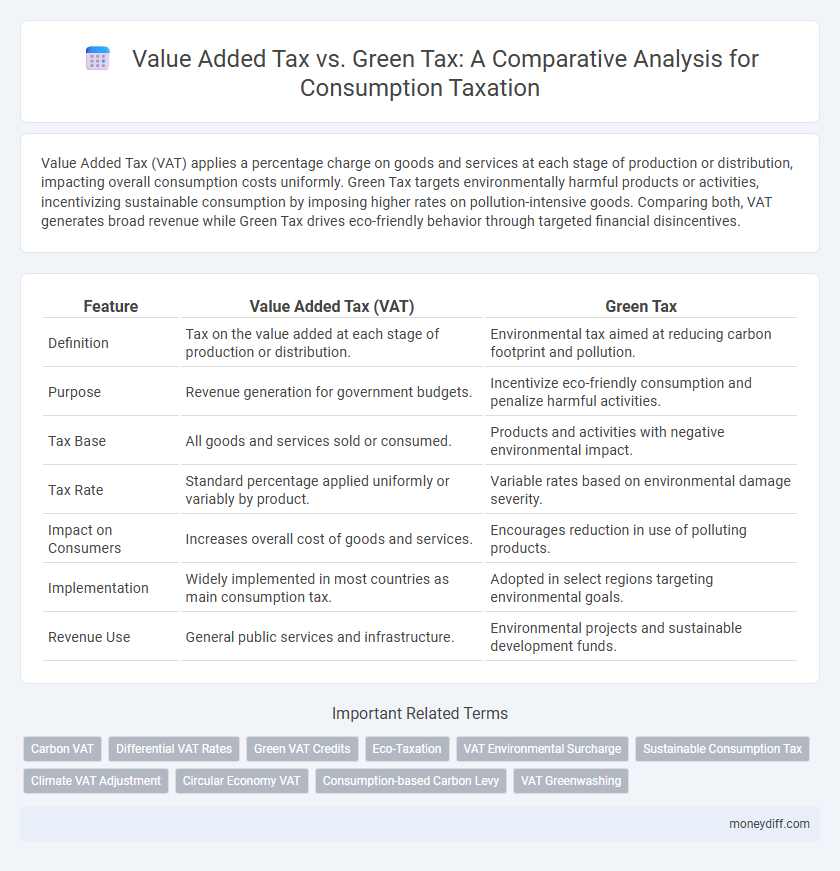

| Feature | Value Added Tax (VAT) | Green Tax |

|---|---|---|

| Definition | Tax on the value added at each stage of production or distribution. | Environmental tax aimed at reducing carbon footprint and pollution. |

| Purpose | Revenue generation for government budgets. | Incentivize eco-friendly consumption and penalize harmful activities. |

| Tax Base | All goods and services sold or consumed. | Products and activities with negative environmental impact. |

| Tax Rate | Standard percentage applied uniformly or variably by product. | Variable rates based on environmental damage severity. |

| Impact on Consumers | Increases overall cost of goods and services. | Encourages reduction in use of polluting products. |

| Implementation | Widely implemented in most countries as main consumption tax. | Adopted in select regions targeting environmental goals. |

| Revenue Use | General public services and infrastructure. | Environmental projects and sustainable development funds. |

Understanding Value Added Tax (VAT) and Green Tax

Value Added Tax (VAT) is a consumption tax applied at each stage of the supply chain, calculated as a percentage of the product's value added, ensuring revenue generation for governments. Green Tax targets environmentally harmful activities and products, encouraging sustainable consumption by imposing additional costs on goods that contribute to pollution or resource depletion. Comparing VAT and Green Tax highlights their distinct roles: VAT broadens tax bases while Green Tax incentivizes environmental responsibility.

Key Differences Between VAT and Green Tax

Value Added Tax (VAT) is a broad-based consumption tax applied at each stage of the supply chain, calculated as a percentage of the product's sale price, while Green Tax specifically targets environmentally harmful goods or activities to incentivize sustainable behavior. VAT revenues contribute to general government budgets without discrimination on environmental impact, whereas Green Tax is designed to reduce ecological damage by assigning higher costs to pollution-intensive products or services. The key difference lies in their scope and purpose: VAT is a fiscal tool for revenue generation, whereas Green Tax serves as an environmental policy instrument promoting eco-friendly consumption.

How VAT Impacts Consumer Spending

Value Added Tax (VAT) directly influences consumer spending by increasing the final price of goods and services, which can reduce overall consumption levels as consumers become more price-sensitive. Higher VAT rates often lead to a decrease in disposable income, thereby limiting purchasing power and shifting consumer preferences towards essential or lower-cost items. Unlike Green Tax, which targets environmental impact by taxing specific goods or activities, VAT broadly affects a wider range of products and services, making its economic impact on spending more substantial and general.

Environmental Goals of Green Taxation

Value Added Tax (VAT) applies broadly to goods and services, generating revenue without directly targeting environmental impact, whereas Green Taxation specifically imposes levies on activities or products that contribute to environmental degradation. Green taxes incentivize sustainable consumption by increasing the cost of carbon-intensive goods and promoting eco-friendly alternatives, aligning fiscal policy with environmental goals. By integrating environmental externalities into pricing, green taxes support the reduction of pollution and encourage resource-efficient behavior, advancing national and global sustainability targets.

Calculation Methods: VAT vs Green Tax

Value Added Tax (VAT) is calculated as a percentage of the sales price at each stage of the supply chain, typically ranging from 5% to 25% depending on the country, ensuring tax is applied on the added value of goods or services. Green Tax, on the other hand, is usually a fixed or variable fee levied based on the environmental impact, such as carbon emissions or resource consumption, often calculated per unit of pollution or usage. While VAT targets overall consumption value, Green Tax calculations emphasize sustainability by incentivizing lower environmental footprints through specific measurement metrics.

Economic Implications for Businesses

Value Added Tax (VAT) imposes a uniform tax rate on goods and services, directly affecting business cash flow and pricing strategies, while Green Tax targets environmentally harmful products to incentivize sustainable practices. Businesses face altered cost structures under Green Tax due to increased expenses on non-compliant materials, potentially driving investments in eco-friendly technologies to reduce long-term liabilities. The economic implications include shifts in consumer demand, compliance costs, and opportunities to capitalize on green market trends that can enhance competitive advantage.

Social and Environmental Effects on Consumption

Value Added Tax (VAT) primarily influences consumption by increasing prices, often disproportionately affecting lower-income households due to its broad application on goods and services. Green Tax targets environmentally harmful products, incentivizing sustainable consumption patterns and reducing carbon footprints through higher costs on polluting goods. Combining both taxes can enhance social equity by reallocating revenues towards environmental initiatives and supporting vulnerable populations affected by consumption price changes.

Compliance and Administration Challenges

Value Added Tax (VAT) requires comprehensive invoicing and record-keeping systems to ensure accurate tax reporting and compliance across multiple transaction stages, leading to significant administrative burdens for businesses and tax authorities. Green Tax, often levied on environmentally harmful goods or activities, presents unique challenges in defining taxable activities and monitoring compliance, demanding specialized regulatory frameworks and enforcement mechanisms. Both taxes necessitate robust digital reporting tools and continuous taxpayer education to minimize evasion and improve adherence, yet Green Tax administration faces additional complexity due to evolving environmental standards and sector-specific applications.

VAT vs Green Tax: Global Case Studies

Value Added Tax (VAT) and Green Tax represent two distinct fiscal approaches to consumption, with VAT being a broad-based consumption tax applied globally, while Green Tax specifically targets environmentally harmful goods and activities. Case studies from countries like Sweden and Japan highlight how Green Taxes incentivize sustainable consumption by imposing higher rates on carbon-intensive products, whereas VAT systems in the European Union demonstrate uniform tax application irrespective of environmental impact. Comparative analysis reveals that integrating Green Taxes within existing VAT frameworks can enhance environmental outcomes without significantly disrupting revenue generation.

Future Trends in Consumption Taxation

Value Added Tax (VAT) remains a predominant revenue source due to its broad application on goods and services, while Green Tax is gaining traction as governments prioritize environmental sustainability by taxing carbon emissions and environmentally harmful products. Future trends indicate an increasing integration of Green Taxes within existing VAT frameworks to incentivize eco-friendly consumption and support climate policy goals. Advanced digital tax systems and real-time reporting are expected to enhance the efficiency and transparency of these consumption taxes, facilitating adaptive fiscal measures aligned with environmental targets.

Related Important Terms

Carbon VAT

Carbon VAT, a variant of Value Added Tax (VAT), specifically targets the carbon content embedded in goods and services to incentivize lower carbon footprints and promote sustainable consumption patterns. Unlike traditional VAT, which applies a uniform rate regardless of environmental impact, Carbon VAT adjusts rates based on carbon emissions, driving businesses and consumers toward greener alternatives while generating revenue for climate initiatives.

Differential VAT Rates

Differential VAT rates apply varied percentages to goods and services to promote economic or environmental goals, such as reduced VAT on essential items or increased rates on luxury products, directly influencing consumer behavior. Green Tax, often imposed alongside VAT, targets environmentally harmful consumption by adding levies on carbon-intensive goods or services, thereby incentivizing sustainable choices through economic signals.

Green VAT Credits

Value Added Tax (VAT) applies broadly to goods and services, while Green Tax targets environmentally harmful products to incentivize sustainable consumption. Green VAT Credits offer fiscal benefits by allowing businesses to offset VAT liabilities through investments in eco-friendly technologies, promoting carbon reduction and green economic growth.

Eco-Taxation

Value Added Tax (VAT) applies uniformly to goods and services, generating broad-based revenue without specifically targeting environmental outcomes, whereas Green Tax, often framed as eco-taxation, directly incentivizes sustainable consumption by imposing higher levies on products with greater environmental impacts, such as carbon-intensive goods and single-use plastics. Implementing eco-taxation shifts consumer behavior toward greener alternatives and funds environmental policies, enhancing the effectiveness of fiscal measures in reducing ecological footprints.

VAT Environmental Surcharge

Value Added Tax (VAT) Environmental Surcharge is a targeted fiscal measure applied on goods and services to incentivize environmentally sustainable consumption by increasing the cost of products with higher environmental impacts. Unlike Green Tax, which directly penalizes specific pollutant emissions or resource use, the VAT Environmental Surcharge integrates environmental costs into the broader VAT framework, influencing consumer behavior while maintaining revenue efficiency and tax compliance.

Sustainable Consumption Tax

Value Added Tax (VAT) is a broad-based consumption tax applied at each stage of production, while Green Tax specifically targets environmentally harmful goods and activities to encourage sustainable consumption. Sustainable Consumption Tax frameworks leverage Green Taxes to reduce ecological impact by incentivizing eco-friendly products and services, complementing VAT's revenue-generating role without compromising environmental goals.

Climate VAT Adjustment

Climate VAT Adjustment integrates environmental objectives by modifying Value Added Tax rates based on products' carbon footprints, incentivizing greener consumption patterns. Unlike traditional Green Tax, which imposes direct charges on emissions, Climate VAT Adjustment subtly shifts purchasing behavior through tax rate variations, promoting sustainable economic activities without significantly disrupting market dynamics.

Circular Economy VAT

Value Added Tax (VAT) on consumption applies broadly to goods and services, generating significant government revenue, while Green Tax targets environmentally harmful products to incentivize sustainable choices. Circular Economy VAT reforms promote tax incentives for recycling, reuse, and eco-friendly production, aligning fiscal policy with sustainability goals to reduce waste and carbon emissions.

Consumption-based Carbon Levy

Value Added Tax (VAT) is a general consumption tax applied to the sale of goods and services, while a Green Tax, specifically a Consumption-based Carbon Levy, targets the carbon footprint embedded in consumer products to incentivize lower emissions. The Consumption-based Carbon Levy calculates emissions from the entire supply chain, promoting sustainable consumption by directly charging consumers for the environmental impact of their purchases.

VAT Greenwashing

Value Added Tax (VAT) applies uniformly on goods and services, while Green Tax targets environmentally harmful consumption to incentivize sustainable choices; VAT greenwashing occurs when companies mislabel products as eco-friendly to exploit tax benefits without genuine environmental compliance. Misleading green claims under VAT regulations undermine tax systems and distort consumer behavior by artificially lowering the cost of supposedly green products.

Value Added Tax vs Green Tax for consumption. Infographic

moneydiff.com

moneydiff.com