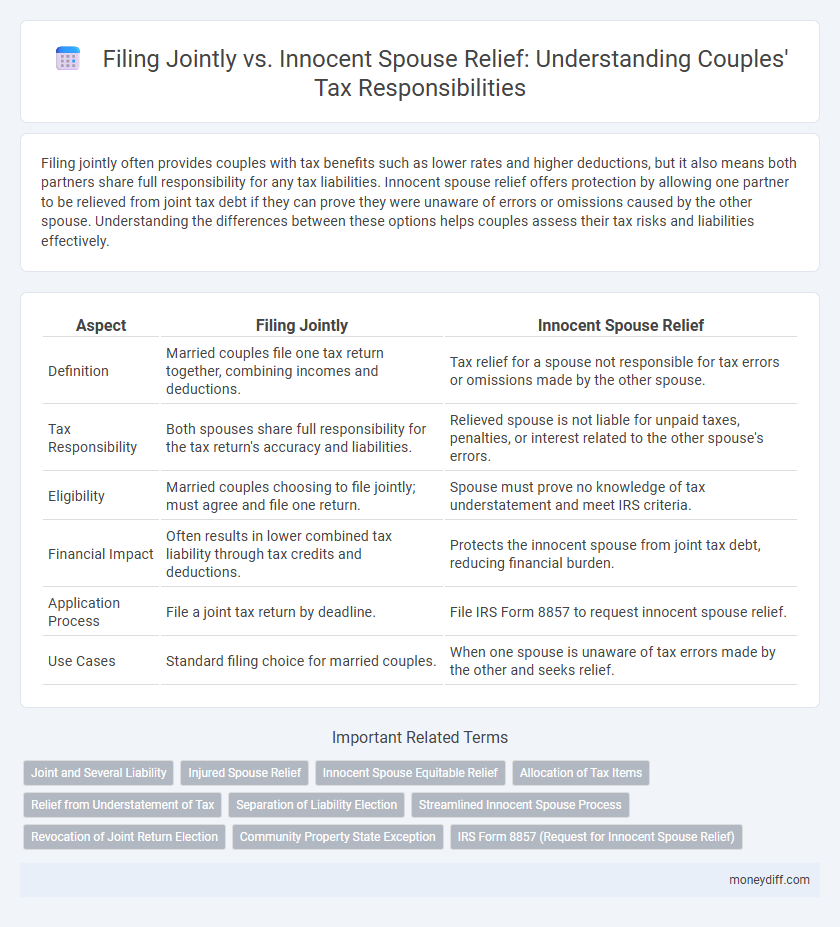

Filing jointly often provides couples with tax benefits such as lower rates and higher deductions, but it also means both partners share full responsibility for any tax liabilities. Innocent spouse relief offers protection by allowing one partner to be relieved from joint tax debt if they can prove they were unaware of errors or omissions caused by the other spouse. Understanding the differences between these options helps couples assess their tax risks and liabilities effectively.

Table of Comparison

| Aspect | Filing Jointly | Innocent Spouse Relief |

|---|---|---|

| Definition | Married couples file one tax return together, combining incomes and deductions. | Tax relief for a spouse not responsible for tax errors or omissions made by the other spouse. |

| Tax Responsibility | Both spouses share full responsibility for the tax return's accuracy and liabilities. | Relieved spouse is not liable for unpaid taxes, penalties, or interest related to the other spouse's errors. |

| Eligibility | Married couples choosing to file jointly; must agree and file one return. | Spouse must prove no knowledge of tax understatement and meet IRS criteria. |

| Financial Impact | Often results in lower combined tax liability through tax credits and deductions. | Protects the innocent spouse from joint tax debt, reducing financial burden. |

| Application Process | File a joint tax return by deadline. | File IRS Form 8857 to request innocent spouse relief. |

| Use Cases | Standard filing choice for married couples. | When one spouse is unaware of tax errors made by the other and seeks relief. |

Key Differences: Filing Jointly vs. Innocent Spouse Relief

Filing jointly allows couples to combine their income and deductions on one tax return, often resulting in lower tax rates and eligibility for certain credits, but both spouses are jointly liable for the tax owed. Innocent Spouse Relief provides legal protection for one spouse who can prove they did not know about erroneous tax reporting or unpaid taxes caused by the other spouse, potentially relieving them from joint tax liability. The key difference lies in joint responsibility during filing versus legal exemption from liability under specific conditions.

Understanding Joint Tax Return Obligations

Filing jointly requires both spouses to report combined income, deductions, and credits, making both equally responsible for the tax liability. Innocent spouse relief offers protection by allowing an individual to seek exemption from tax, interest, and penalties if their spouse improperly reported or omitted tax items. Understanding joint tax return obligations is crucial to navigate potential liabilities and determine eligibility for relief under circumstances involving errors or fraud by a spouse.

Benefits and Risks of Filing Jointly

Filing jointly allows couples to maximize tax benefits such as higher income thresholds for tax brackets, increased deductions, and eligibility for credits like the Earned Income Tax Credit, resulting in potentially lower combined tax liability. However, joint filing creates joint and several liabilities, meaning both spouses are fully responsible for any tax debt, penalties, or errors on the return, which can pose significant risks if one spouse underreports income or claims improper deductions. Understanding the balance between these financial advantages and shared liabilities is crucial for couples navigating their tax responsibilities.

What Is Innocent Spouse Relief?

Innocent spouse relief protects a taxpayer from being held responsible for their spouse's erroneous tax omissions or underpayments when filing jointly. This relief applies if the innocent spouse can prove they had no knowledge or reason to know about the incorrect item on the tax return. Qualifying for this relief requires meeting specific IRS criteria, including the separation of liabilities and demonstrating that it would be unfair to hold the innocent spouse accountable.

Eligibility Requirements for Innocent Spouse Relief

Innocent Spouse Relief eligibility requires that the couple filed a joint tax return and the requesting spouse demonstrates they had no knowledge or reason to know about the understated tax or erroneous items. The relief is applicable when holding joint liability for tax debts arising from errors or fraud caused solely by the other spouse. To qualify, the requesting spouse must prove that it would be unfair to hold them responsible, considering all facts and circumstances, including financial dependency and marital status changes.

Scenarios When Innocent Spouse Relief Applies

Innocent spouse relief applies when one spouse can prove they did not know or have reason to know about errors or underreported income on a joint tax return, typically in cases of fraud or omission by the other spouse. Couples filing jointly may face joint liability, but innocent spouse relief protects the non-responsible spouse from paying tax debt created by the other's wrongdoing. Common scenarios include undisclosed income, incorrect deductions, or tax evasion committed by one spouse without the other's awareness.

Pros and Cons of Each Filing Option

Filing jointly allows couples to combine incomes, often resulting in lower tax rates and increased eligibility for credits like the Earned Income Tax Credit, but both spouses are equally liable for any tax debt or errors. Innocent spouse relief offers protection when one partner is unaware of underreported taxes or fraud, relieving them from joint tax liabilities, although it requires meeting strict IRS criteria and may take time to process. Choosing between these options depends on the couple's trust level, financial transparency, and risk tolerance concerning potential tax liabilities.

Steps to Apply for Innocent Spouse Relief

To apply for Innocent Spouse Relief, the couple must complete IRS Form 8857, providing detailed information about their tax return and circumstances contributing to the erroneous tax liability. The applicant must prove they had no knowledge or reason to know about the errors or omissions made by their spouse or former spouse when signing the tax return. Submitting the form along with a clear explanation and supporting documentation to the IRS initiates the review process for potential relief from joint tax liabilities.

Protecting Yourself from Spouse’s Tax Liabilities

Filing jointly allows couples to combine incomes and often results in tax benefits, but it also makes both spouses jointly liable for any tax debt or errors. Innocent spouse relief provides protection for individuals who filed jointly but did not know and had no reason to know about their spouse's incorrect tax reporting or unpaid tax. Claiming innocent spouse relief can help shield one spouse from paying the other's tax liabilities, penalties, and interest, minimizing financial risk and ensuring fair treatment under tax law.

Choosing the Best Filing Status for Your Situation

Filing jointly typically offers couples lower tax rates and higher deductions, making it the preferred choice for many seeking to optimize their tax benefits. Innocent spouse relief provides a safeguard for individuals who filed jointly but should not be held responsible for their partner's tax debt due to lack of knowledge about errors or omissions. Evaluating income disparity, liability exposure, and eligibility criteria helps determine whether filing jointly or pursuing innocent spouse relief aligns best with each couple's financial and legal circumstances.

Related Important Terms

Joint and Several Liability

Joint filing in tax returns exposes both spouses to joint and several liability, meaning each partner can be held responsible for the entire tax debt. Innocent spouse relief offers protection by potentially absolving one spouse from liability if they were unaware of errors or omissions in the joint return.

Injured Spouse Relief

Injured Spouse Relief allows a taxpayer to recover their portion of a joint tax refund when their share is withheld due to their spouse's separate debt, such as past-due child support or federal tax liabilities. Filing jointly may increase refund amounts, but Injured Spouse Relief protects innocent spouses from losing their rightful refund due to the other spouse's financial obligations.

Innocent Spouse Equitable Relief

Innocent Spouse Equitable Relief offers protection for taxpayers who filed jointly but face tax liabilities due to their spouse's erroneous or fraudulent reporting, allowing them to seek relief if it's unfair to hold them responsible for the unpaid taxes. This form of relief considers factors such as the couple's marital status, economic hardship, and whether the innocent spouse knew or had reason to know about the understatement of tax.

Allocation of Tax Items

Filing jointly combines both spouses' income, deductions, and credits on a single tax return, resulting in joint liability for all tax owed, while innocent spouse relief allows one spouse to be shielded from responsibility for errors or omissions made by the other, particularly on underreported income or unpaid taxes. The allocation of tax items under innocent spouse relief often requires detailed separation of each spouse's income and deductions to determine the taxpayer's individual tax responsibility.

Relief from Understatement of Tax

Filing jointly combines spouses' income and deductions, potentially increasing tax liability but offering eligibility for higher credits, while Innocent Spouse Relief specifically protects an individual from responsibility for tax understatement due to a spouse's erroneous reporting. Innocent Spouse Relief allows one spouse to avoid paying additional tax if they can prove they were unaware of the understated tax and it would be unfair to hold them accountable.

Separation of Liability Election

Filing jointly typically consolidates tax liabilities for a couple, whereas the Separation of Liability Election under Innocent Spouse Relief allows a separated spouse to allocate tax liabilities individually, limiting their responsibility for the other spouse's tax debts. This election is crucial when one spouse is unaware of errors or omissions on joint returns, providing protection from shared penalties and interest.

Streamlined Innocent Spouse Process

Filing jointly allows couples to combine income and tax liabilities, often resulting in lower overall tax rates but shared responsibility for all tax obligations, including any errors or omissions on the return. The Streamlined Innocent Spouse Process offers relief by enabling one spouse to be freed from joint tax liabilities when unaware of errors or underreporting by the other, provided specific criteria are met, simplifying the application and expediting approval.

Revocation of Joint Return Election

Filing jointly allows couples to combine income and deductions, but revocation of a joint return election can relieve one spouse from joint tax liability if innocent spouse relief is granted, protecting them from errors or omissions made by the other. Revocation must be filed within two years after the tax liability is assessed, ensuring fair allocation of tax responsibilities under IRS guidelines.

Community Property State Exception

In community property states, filing jointly generally means both spouses share equal responsibility for tax liabilities on community income, but innocent spouse relief can provide protection if one spouse is unaware of errors or fraud. This exception allows the non-offending spouse to avoid joint liability, emphasizing the importance of understanding state-specific tax rules when managing couple's tax responsibilities.

IRS Form 8857 (Request for Innocent Spouse Relief)

Filing jointly exposes both spouses to full tax liability, whereas IRS Form 8857 enables the non-liable spouse to seek Innocent Spouse Relief, alleviating responsibility for erroneous tax debts caused by the other spouse. Properly submitting Form 8857 requires detailed personal and financial information to demonstrate unawareness of the understated tax or erroneous reporting.

Filing jointly vs Innocent spouse relief for couple's tax responsibilities. Infographic

moneydiff.com

moneydiff.com