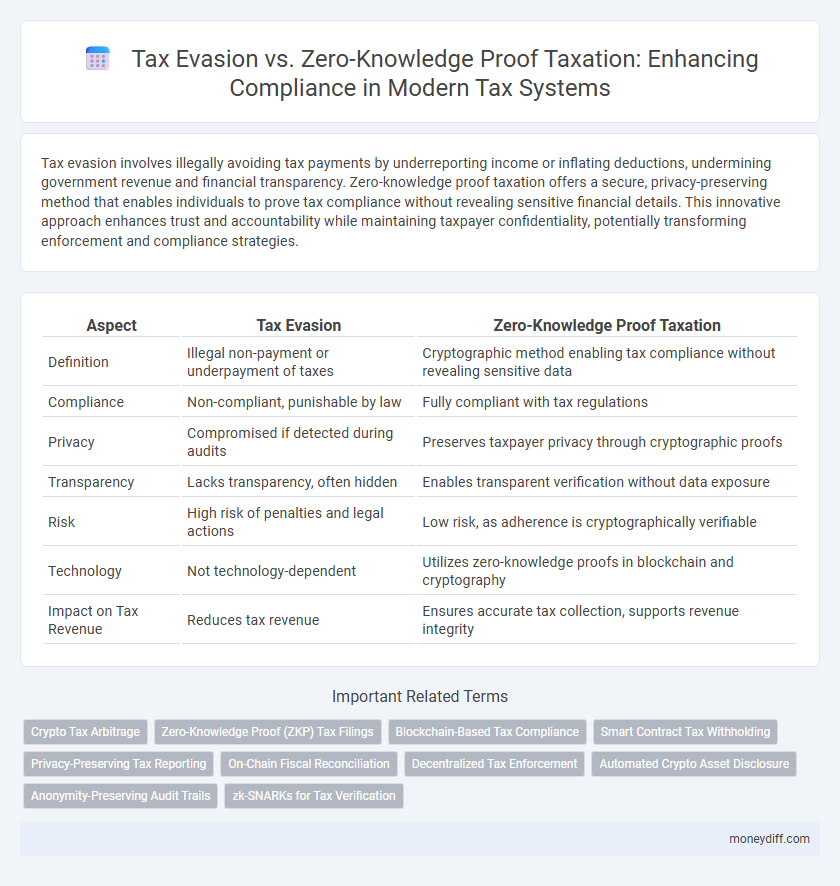

Tax evasion involves illegally avoiding tax payments by underreporting income or inflating deductions, undermining government revenue and financial transparency. Zero-knowledge proof taxation offers a secure, privacy-preserving method that enables individuals to prove tax compliance without revealing sensitive financial details. This innovative approach enhances trust and accountability while maintaining taxpayer confidentiality, potentially transforming enforcement and compliance strategies.

Table of Comparison

| Aspect | Tax Evasion | Zero-Knowledge Proof Taxation |

|---|---|---|

| Definition | Illegal non-payment or underpayment of taxes | Cryptographic method enabling tax compliance without revealing sensitive data |

| Compliance | Non-compliant, punishable by law | Fully compliant with tax regulations |

| Privacy | Compromised if detected during audits | Preserves taxpayer privacy through cryptographic proofs |

| Transparency | Lacks transparency, often hidden | Enables transparent verification without data exposure |

| Risk | High risk of penalties and legal actions | Low risk, as adherence is cryptographically verifiable |

| Technology | Not technology-dependent | Utilizes zero-knowledge proofs in blockchain and cryptography |

| Impact on Tax Revenue | Reduces tax revenue | Ensures accurate tax collection, supports revenue integrity |

Understanding Tax Evasion: Risks and Repercussions

Tax evasion involves illegally avoiding tax payments by underreporting income, inflating deductions, or hiding money, leading to severe legal penalties including fines, interest, and imprisonment. Governments employ advanced auditing techniques and data analytics to detect discrepancies, increasing the risk of being caught and prosecuted. Understanding these repercussions underscores the importance of transparent tax reporting and compliance to avoid escalating financial and criminal consequences.

Zero-Knowledge Proofs: A Gamechanger in Tax Compliance

Zero-Knowledge Proofs (ZKPs) revolutionize tax compliance by enabling taxpayers to prove adherence to tax laws without revealing sensitive financial information, significantly reducing the risk of tax evasion. By leveraging cryptographic techniques, ZKPs ensure data privacy while providing tax authorities with verifiable proof of accurate declarations. This innovative approach enhances transparency and trust between taxpayers and regulators, fostering more efficient and secure tax systems.

Comparing Traditional Auditing vs Zero-Knowledge Verification

Traditional auditing relies on direct examination of financial records, increasing the risk of data exposure and lengthy compliance processes. Zero-knowledge verification enhances tax compliance by enabling taxpayers to prove accuracy without revealing sensitive information, improving privacy and efficiency. This method reduces audit costs and minimizes opportunities for tax evasion through cryptographic proof systems.

Privacy Concerns: Taxpayer Data in the Digital Age

Tax evasion exploits weaknesses in traditional reporting systems, risking exposure of sensitive taxpayer data through audits and data breaches. Zero-knowledge proof taxation enables compliance verification without revealing personal financial details, preserving privacy while ensuring transparency. This cryptographic approach addresses privacy concerns by minimizing data exposure in the digital age, enhancing taxpayer trust and security.

Technological Barriers to Zero-Knowledge Proof Adoption

Technological barriers to zero-knowledge proof adoption in tax compliance include high computational costs and the complexity of cryptographic protocols, which challenge the scalability and integration with existing tax systems. Limited expertise in zero-knowledge proof development and the need for robust cybersecurity measures further hinder widespread implementation among tax authorities. These obstacles delay the transition from conventional tax evasion detection methods to more privacy-preserving and transparent zero-knowledge proof taxation frameworks.

Legal Frameworks: Addressing Tax Evasion and Emerging Tech

Legal frameworks targeting tax evasion increasingly integrate zero-knowledge proof (ZKP) technologies to enhance compliance without compromising taxpayer privacy. Governments and regulatory bodies are developing statutes that mandate transparent yet confidential reporting mechanisms enabled by ZKP, ensuring accurate tax assessments while safeguarding sensitive information. This convergence of law and cryptographic innovation represents a pivotal shift toward effective enforcement and trust in tax systems amid rising digital financial activities.

Cost-Benefit Analysis: Evasion vs Compliance Innovation

Tax evasion imposes significant financial risks including hefty fines, legal prosecution, and reputational damage, which often exceed potential short-term monetary gains. Zero-Knowledge Proof (ZKP) taxation presents a cost-effective compliance innovation by ensuring privacy-preserving verification of tax obligations, reducing auditing expenses and minimizing fraud. Comparing long-term economic impacts, ZKP enables transparent tax reporting without compromising taxpayer confidentiality, creating a sustainable balance between enforcement costs and compliance incentives.

Practical Use Cases: Zero-Knowledge Proofs in Global Tax Systems

Zero-knowledge proofs enable taxpayers to demonstrate compliance without revealing sensitive financial data, enhancing privacy while satisfying regulatory requirements. Governments worldwide are piloting zero-knowledge proof systems to streamline audits and reduce tax evasion risks by verifying asset ownership and income declarations securely. Practical implementations in jurisdictions like the EU and Singapore show how cryptographic proofs facilitate transparent tax reporting without compromising individual confidentiality.

Reducing Fraud: Impact of Advanced Cryptography on Tax Reporting

Advanced cryptographic techniques like zero-knowledge proofs significantly reduce tax evasion by enabling taxpayers to prove compliance without revealing sensitive financial information. This technology enhances transparency and trust in tax reporting systems, allowing tax authorities to verify transactions while preserving privacy. The integration of zero-knowledge proof taxation fosters fraud detection and prevention by ensuring data integrity and minimizing opportunities for manipulation.

Future Outlook: The Role of Zero-Knowledge Proofs in Tax Policy

Zero-knowledge proofs offer a transformative approach to tax compliance by enabling individuals to verify accurate tax payments without revealing sensitive financial information, significantly reducing opportunities for tax evasion. Emerging tax policies integrating zero-knowledge proof technology promise enhanced transparency and security, fostering increased public trust and streamlined regulatory enforcement. The future of tax administration increasingly relies on these cryptographic methods to balance privacy rights with the rigorous demands of compliance and revenue collection.

Related Important Terms

Crypto Tax Arbitrage

Tax evasion in crypto involves illegal concealment of taxable income through deceptive transactions, whereas zero-knowledge proof taxation enables compliance by allowing users to prove tax obligations are met without revealing sensitive transaction details. This cryptographic approach mitigates crypto tax arbitrage by ensuring transparent, audit-resistant reporting while preserving privacy, effectively reducing opportunities for illicit tax avoidance.

Zero-Knowledge Proof (ZKP) Tax Filings

Zero-Knowledge Proof (ZKP) tax filings enable individuals and businesses to prove tax compliance without revealing sensitive financial details, dramatically reducing the risk of tax evasion by preserving privacy while ensuring verification. This cryptographic approach enhances transparency for tax authorities and strengthens trust in the taxation system by validating accurate reporting through secure, immutable proofs.

Blockchain-Based Tax Compliance

Blockchain-based tax compliance leverages zero-knowledge proofs to enable secure, transparent transaction verification without revealing sensitive financial details, significantly reducing opportunities for tax evasion. This cryptographic method ensures accurate tax reporting and enforcement while maintaining individual privacy, transforming traditional compliance mechanisms through decentralized ledger technology.

Smart Contract Tax Withholding

Smart contract tax withholding leverages zero-knowledge proofs to ensure transparent and compliant tax collection without revealing sensitive transaction details, significantly reducing instances of tax evasion. This cryptographic approach enables automated, tamper-proof withholding processes that align with regulatory standards while preserving user privacy.

Privacy-Preserving Tax Reporting

Tax evasion exploits opaque financial activities to illegally avoid tax liabilities, undermining government revenues, while zero-knowledge proof taxation enables privacy-preserving tax reporting by cryptographically verifying compliance without revealing sensitive personal or transactional data. This innovative approach balances regulatory transparency and taxpayer privacy, enhancing trust and reducing fraudulent evasion risks in digital tax systems.

On-Chain Fiscal Reconciliation

On-chain fiscal reconciliation leverages zero-knowledge proof taxation to enable transparent tax compliance without exposing sensitive financial data, contrasting sharply with traditional tax evasion methods that exploit opaque transactions to avoid detection. This cryptographic approach ensures accurate tax reporting and real-time verification on blockchain platforms, reducing the risk of fraud and enhancing regulatory oversight.

Decentralized Tax Enforcement

Decentralized tax enforcement leverages zero-knowledge proof taxation to enhance compliance by enabling verification of tax obligations without revealing sensitive financial data, effectively reducing opportunities for tax evasion. This cryptographic approach ensures transparency and trust while preserving taxpayer privacy, transforming traditional enforcement mechanisms and promoting accurate, secure tax reporting on blockchain platforms.

Automated Crypto Asset Disclosure

Automated crypto asset disclosure leveraging zero-knowledge proof taxation enhances compliance by enabling taxpayers to prove asset holdings without revealing sensitive details, significantly reducing opportunities for tax evasion. This advanced cryptographic method ensures transparency and auditability while preserving privacy, streamlining tax authorities' verification processes in the decentralized digital asset ecosystem.

Anonymity-Preserving Audit Trails

Tax evasion undermines government revenue by concealing financial activities, whereas zero-knowledge proof taxation leverages cryptographic methods to ensure compliance while maintaining taxpayer anonymity. Anonymity-preserving audit trails created through zero-knowledge proofs enable verification of tax obligations without revealing sensitive personal or transactional information, enhancing privacy and trust in tax systems.

zk-SNARKs for Tax Verification

Tax evasion poses significant challenges to revenue collection, whereas zero-knowledge proof taxation using zk-SNARKs enables secure and privacy-preserving tax compliance verification without revealing sensitive financial details. Implementing zk-SNARKs for tax verification enhances transparency and trust while minimizing fraud by cryptographically proving accurate tax reporting.

Tax Evasion vs Zero-Knowledge Proof Taxation for Compliance Infographic

moneydiff.com

moneydiff.com