Payroll tax applies to traditional employees and employers, withholding taxes such as Social Security and Medicare directly from wages. In contrast, creator economy taxation often requires individuals to manage self-employment taxes, including quarterly estimated payments and deductions specific to digital content revenue. Understanding these differences is crucial for accurate tax compliance and maximizing deductions in diverse income streams.

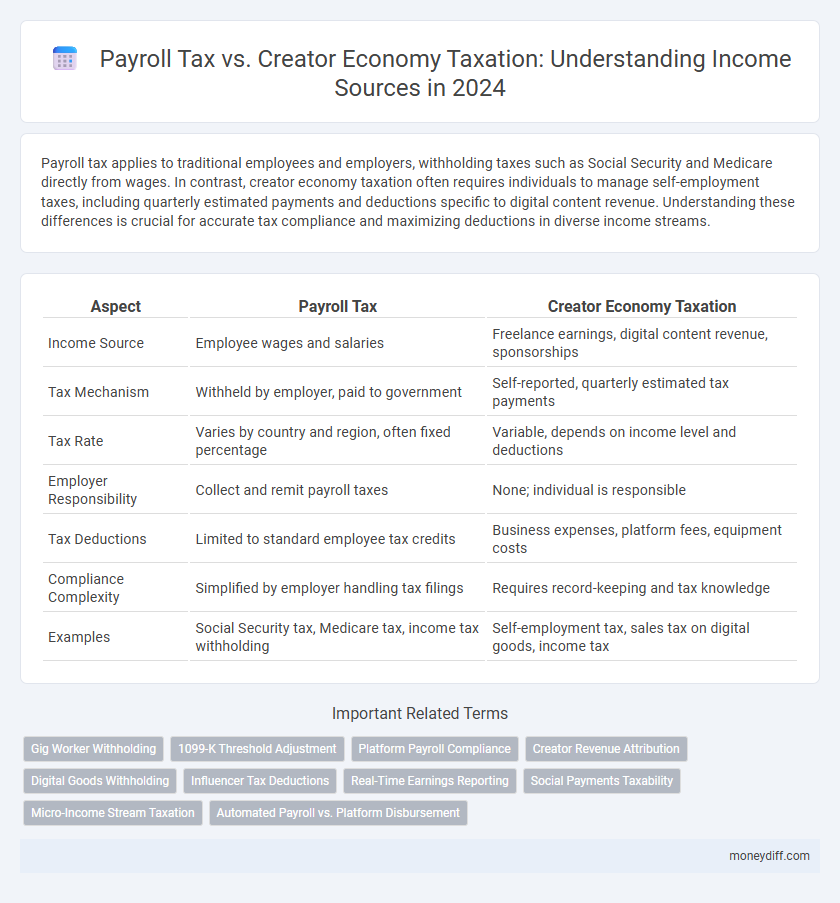

Table of Comparison

| Aspect | Payroll Tax | Creator Economy Taxation |

|---|---|---|

| Income Source | Employee wages and salaries | Freelance earnings, digital content revenue, sponsorships |

| Tax Mechanism | Withheld by employer, paid to government | Self-reported, quarterly estimated tax payments |

| Tax Rate | Varies by country and region, often fixed percentage | Variable, depends on income level and deductions |

| Employer Responsibility | Collect and remit payroll taxes | None; individual is responsible |

| Tax Deductions | Limited to standard employee tax credits | Business expenses, platform fees, equipment costs |

| Compliance Complexity | Simplified by employer handling tax filings | Requires record-keeping and tax knowledge |

| Examples | Social Security tax, Medicare tax, income tax withholding | Self-employment tax, sales tax on digital goods, income tax |

Understanding Payroll Tax: Basics and Implications

Payroll tax is a mandatory tax withheld from employee wages to fund social security and Medicare programs, directly affecting employers and employees through fixed percentage rates. In contrast, creator economy taxation often involves self-employment tax, including both employer and employee portions, requiring creators to manage quarterly estimated payments and additional deductions. Understanding payroll tax implications is critical for businesses to ensure compliance and accurate reporting of wage-based tax liabilities.

The Rise of the Creator Economy: New Income Streams

The rise of the creator economy has introduced diverse income streams such as ad revenue, sponsorships, and digital product sales, complicating payroll tax obligations traditionally designed for employer-employee relationships. Unlike standard payroll taxes that withhold Social Security and Medicare contributions, creator economy taxation often requires self-employment tax filings, including the full 15.3% for Social Security and Medicare. Accurate categorization of income sources ensures compliance with IRS regulations while optimizing tax deductions for content creators and freelancers navigating this evolving financial landscape.

Key Differences Between Payroll and Creator Economy Taxation

Payroll tax is typically a fixed percentage withheld from employee wages by employers to fund Social Security, Medicare, and unemployment insurance, with defined contribution limits and reporting requirements. In contrast, creator economy taxation involves self-employment tax obligations, variable income streams from diverse platforms, and often requires quarterly estimated tax payments and detailed expense tracking for deductions. Key differences include the withholding mechanism, tax rate variability, and the complexity of income reporting due to the diverse revenue sources in the creator economy.

How Payroll Taxes Are Calculated and Withheld

Payroll taxes are calculated based on a percentage of an employee's gross wages, including Social Security and Medicare taxes, typically capped annually by the IRS limits. Employers are responsible for withholding these taxes from employees' paychecks and remitting them to the government, ensuring compliance with federal and state regulations. In contrast, creators in the gig economy often manage their own tax liabilities, including self-employment taxes, without employer withholding.

Tax Obligations for Freelancers, Influencers, and Online Creators

Freelancers, influencers, and online creators face distinct tax obligations that vary between payroll tax and creator economy taxation. Payroll tax typically applies to formal employees and includes mandatory employer contributions for social security and Medicare, whereas creator economy taxation focuses on self-employment tax, income reporting, and potential sales tax on digital products or services. Understanding local tax codes and maintaining accurate records of income streams are essential for compliance and optimizing tax liabilities in the evolving digital economy.

Withholding vs. Self-Reporting: Income Reporting Mechanisms

Payroll tax involves employer withholding where a portion of employee wages is automatically deducted and remitted to tax authorities, ensuring compliance and reducing taxpayer burden. In contrast, creator economy taxation relies heavily on self-reporting mechanisms, requiring independent creators to track and declare their diverse income streams, including platform payments and sponsorships, often leading to complex tax obligations. Understanding the differences in withholding versus self-reporting is crucial for accurate income reporting and avoiding penalties in both traditional employment and gig-based creator work.

Deductions and Allowances: Payroll Employees vs. Creators

Payroll employees benefit from standardized deductions and allowances set by tax authorities, including mandatory contributions like social security and health insurance, which are often automatically withheld by employers, simplifying compliance. In contrast, creators in the gig or creator economy face more complex deduction opportunities, as they must track business expenses such as equipment, software subscriptions, and home office costs to reduce taxable income. While payroll tax systems provide fewer flexible allowances, creator economy taxation requires proactive record-keeping to maximize allowable deductions and optimize tax liabilities.

Tax Compliance Challenges in the Digital Economy

Payroll tax compliance involves strict employer responsibilities for withholding and remitting taxes based on employee wages, which contrasts with the creator economy where income often comes from multiple digital platforms and gig work, complicating reporting and withholding processes. The decentralized nature of creator earnings increases the risk of underreporting and tax evasion, posing significant challenges for tax authorities trying to enforce compliance. Evolving digital payment systems and varying international regulations further complicate tax administration, requiring enhanced tracking mechanisms and clearer guidelines for creators to ensure accurate income declaration.

Common Tax Mistakes for Traditional Employees and Creators

Traditional employees often overlook payroll tax withholdings, leading to unexpected tax liabilities, while creators frequently misclassify income or fail to account for self-employment taxes, risking penalties. Both groups commonly neglect proper documentation of deductible expenses, resulting in higher taxable income. Accurate record-keeping and understanding distinct payroll and creator economy tax obligations are essential to prevent costly errors.

Strategic Planning: Optimizing Taxes for Payroll Earners and Creators

Strategic tax planning for payroll earners involves leveraging standard deductions, tax credits, and employer-provided benefits to minimize taxable income effectively. Creators, earning through diverse income streams such as sponsorships, subscriptions, and digital products, must navigate self-employment taxes, quarterly estimated taxes, and eligible business expense deductions to optimize their tax liability. Understanding the distinct tax treatment of wages versus creator income enables tailored strategies that enhance after-tax earnings while ensuring compliance with IRS regulations.

Related Important Terms

Gig Worker Withholding

Payroll tax applies to employee wages with mandatory employer withholding, while creator economy taxation often involves independent contractor income subject to self-employment tax without automatic withholding. Gig worker withholding mechanisms vary by jurisdiction, sometimes requiring estimated tax payments to cover income and payroll tax liabilities directly.

1099-K Threshold Adjustment

The 1099-K threshold adjustment affects creator economy taxation by lowering the reporting requirement for third-party payment processors, increasing tax compliance for gig and freelance income compared to traditional payroll tax structures. This change compels creators to report income more accurately, contrasting with payroll tax where employers withhold and remit taxes directly on wages.

Platform Payroll Compliance

Platform payroll compliance ensures accurate withholding and remittance of payroll taxes for employees, reducing liability risks for employers. In contrast, creator economy taxation requires platforms to navigate ambiguous classification and reporting standards for independent contractors and gig workers.

Creator Revenue Attribution

Payroll tax applies to wages paid by employers to employees, typically calculated as a percentage of salary and withheld at the source, while creator economy taxation requires detailed revenue attribution to accurately report income from diverse digital platforms, sponsorships, and content monetization. Precise allocation of income streams is essential for creators to meet tax obligations, as different revenue types may be subject to varying tax treatments and reporting requirements.

Digital Goods Withholding

Payroll tax applies to employee wages and requires employers to withhold income taxes and contributions like Social Security, whereas creator economy taxation on digital goods often involves withholding taxes on platform payments made to independent creators. Digital goods withholding mandates platforms to deduct a percentage of payments to non-employee creators for services such as content licensing or digital product sales, ensuring tax compliance in the evolving creator economy landscape.

Influencer Tax Deductions

Influencers in the creator economy can leverage specific payroll tax deductions such as home office expenses, business-related travel, and equipment costs to reduce taxable income. Proper classification of income sources and detailed record-keeping are essential for maximizing deductions under current IRS guidelines for self-employed individuals.

Real-Time Earnings Reporting

Real-time earnings reporting enhances payroll tax compliance by enabling employers to instantly report wages, facilitating accurate tax withholding and timely remittances to tax authorities. In contrast, creator economy taxation often challenges real-time reporting due to variable income streams and platform-based payments, necessitating innovative tracking solutions to ensure proper tax collection from freelance and gig income sources.

Social Payments Taxability

Payroll tax applies primarily to wages paid by employers, whereas creator economy taxation focuses on income generated from digital content and social platforms, with social payments like tips, donations, and subscriptions increasingly classified as taxable income. Social payments in the creator economy are subject to income tax and may also trigger self-employment tax liabilities, requiring creators to maintain detailed records and report these earnings accurately.

Micro-Income Stream Taxation

Payroll tax typically applies to wages paid by employers, focusing on income from traditional employment structures, whereas creator economy taxation targets micro-income streams generated through digital platforms such as content creation, freelance gigs, and online sales. Tax authorities increasingly implement tailored reporting requirements and thresholds for micro-income streams to ensure accurate taxation without burdening small-scale creators and gig workers.

Automated Payroll vs. Platform Disbursement

Automated payroll systems streamline tax withholding and reporting by directly integrating with tax authorities, ensuring compliance with payroll tax regulations for employees. Platform disbursement in the creator economy requires managing diverse income streams with varying tax obligations, often necessitating detailed tracking of payments and independent contractor tax rules.

Payroll Tax vs Creator Economy Taxation for income sources. Infographic

moneydiff.com

moneydiff.com