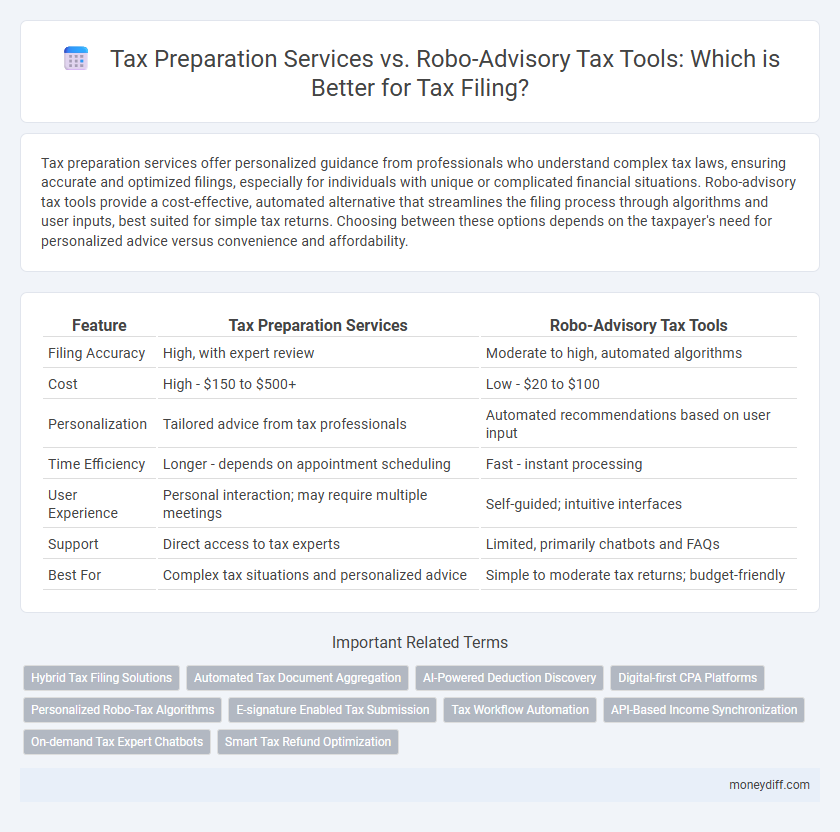

Tax preparation services offer personalized guidance from professionals who understand complex tax laws, ensuring accurate and optimized filings, especially for individuals with unique or complicated financial situations. Robo-advisory tax tools provide a cost-effective, automated alternative that streamlines the filing process through algorithms and user inputs, best suited for simple tax returns. Choosing between these options depends on the taxpayer's need for personalized advice versus convenience and affordability.

Table of Comparison

| Feature | Tax Preparation Services | Robo-Advisory Tax Tools |

|---|---|---|

| Filing Accuracy | High, with expert review | Moderate to high, automated algorithms |

| Cost | High - $150 to $500+ | Low - $20 to $100 |

| Personalization | Tailored advice from tax professionals | Automated recommendations based on user input |

| Time Efficiency | Longer - depends on appointment scheduling | Fast - instant processing |

| User Experience | Personal interaction; may require multiple meetings | Self-guided; intuitive interfaces |

| Support | Direct access to tax experts | Limited, primarily chatbots and FAQs |

| Best For | Complex tax situations and personalized advice | Simple to moderate tax returns; budget-friendly |

Understanding Traditional Tax Preparation Services

Traditional tax preparation services involve professional accountants or tax preparers who manually review financial documents, identify applicable deductions, and ensure compliance with tax laws to maximize refunds and minimize liabilities. These services offer personalized advice tailored to complex tax situations, including business income, investments, and deductions that automated tools may overlook. Clients benefit from expert guidance, audit support, and customized tax planning strategies that optimize long-term financial outcomes.

What Are Robo-Advisory Tax Tools?

Robo-advisory tax tools are automated software platforms that use algorithms and artificial intelligence to streamline tax filing and optimize deductions. These tools analyze financial data, generate accurate tax forms, and provide real-time recommendations to maximize tax refunds or minimize liabilities. By offering lower costs and 24/7 accessibility, robo-advisors have become a popular alternative to traditional tax preparation services for many taxpayers.

Cost Comparison: Tax Preparers vs. Robo-Advisors

Tax preparation services typically charge between $150 and $450 for standard returns, with prices rising for complex filings involving itemized deductions, small businesses, or investment income. Robo-advisory tax tools offer significantly lower costs, often ranging from $20 to $100, providing automated, software-driven tax filing solutions. Cost-efficient for simple tax situations, robo-advisors reduce expenses but may lack personalized support compared to traditional tax preparers.

Accuracy and Error Management in Tax Filing

Tax preparation services leverage expert knowledge and personalized review processes to ensure high accuracy and effective error management in tax filing, reducing the risk of costly mistakes. Robo-advisory tax tools utilize automated algorithms and real-time updates to detect and correct common errors quickly, but may lack the nuanced judgment required for complex tax situations. Prioritizing accuracy, professional services often provide tailored advice and thorough audits, while robo-tools excel in efficiency and consistency for straightforward filings.

Personalized Advice: Human Expertise vs. AI Algorithms

Tax preparation services offer personalized advice through experienced tax professionals who can navigate complex tax situations and provide tailored strategies to maximize refunds and minimize liabilities. Robo-advisory tax tools rely on AI algorithms to automate tax filing processes efficiently, but they lack the nuanced understanding of individual circumstances that humans provide. Clients with intricate financial scenarios benefit more from human expertise, while simple tax returns may be adequately handled by AI-driven platforms.

Time Efficiency: Manual vs. Automated Tax Filing

Tax preparation services offer personalized guidance but often require extensive document collection and appointment scheduling, resulting in longer time commitments. Robo-advisory tax tools automate data entry and calculations, significantly reducing the time needed for tax filing, often allowing users to complete returns within minutes. Automation streamlines the entire process, minimizing human errors and expediting submission deadlines compared to manual preparation.

Data Security and Privacy Concerns

Tax preparation services offer personalized support with robust data encryption and secure client portals to safeguard sensitive financial information during filing. Robo-advisory tax tools utilize automated algorithms and cloud-based platforms, which may pose higher risks of data breaches if not properly secured. Choosing between these options requires evaluating their compliance with industry standards like IRS Safeguards Rule and SOC 2 certifications to ensure optimal data privacy and protection.

User Experience and Ease of Use

Tax preparation services offer personalized support from certified professionals, ensuring accurate and tailored tax filing for complex financial situations. Robo-advisory tax tools provide streamlined, automated processes with user-friendly interfaces, ideal for straightforward returns and quick submissions. Users seeking expert guidance may prefer tax services, while those valuing speed and simplicity often opt for digital tools.

Suitability for Complex Tax Situations

Tax preparation services are highly suitable for complex tax situations involving multiple income sources, investments, or business expenses due to personalized expert guidance and in-depth knowledge of tax codes. Robo-advisory tax tools use algorithms that efficiently handle straightforward returns but may lack the nuance needed for intricate deductions, credits, or audit risks. Individuals with complex financial portfolios benefit from professional preparers who can tailor strategies to minimize liabilities and ensure compliance.

Making the Right Choice for Your Tax Filing Needs

Tax preparation services offer personalized advice and expert handling of complex tax situations, ensuring accuracy and maximizing deductions, while robo-advisory tax tools provide a cost-effective, automated solution ideal for straightforward tax returns. Evaluating factors such as the complexity of your financial situation, budget constraints, and preference for human interaction versus technology-driven processes is essential in making the right choice. Selecting the appropriate method can impact the efficiency, accuracy, and overall satisfaction of your tax filing experience.

Related Important Terms

Hybrid Tax Filing Solutions

Hybrid tax filing solutions combine the personalized expertise of traditional tax preparation services with the efficiency and automation of robo-advisory tax tools, offering accurate and tailored tax filing options. These integrated platforms leverage advanced algorithms alongside human oversight to optimize deductions, ensure compliance, and simplify the tax return process for individuals and small businesses.

Automated Tax Document Aggregation

Automated tax document aggregation in tax preparation services enhances accuracy by securely collecting and organizing financial statements, W-2s, and 1099 forms from multiple sources without manual input. Robo-advisory tax tools leverage algorithms and AI to streamline this process, offering real-time data integration and error reduction but may lack the personalized oversight provided by professional tax preparers.

AI-Powered Deduction Discovery

AI-powered deduction discovery in robo-advisory tax tools leverages machine learning algorithms to scan financial data and identify eligible deductions with high accuracy, often surpassing traditional tax preparation services' manual methods. These advanced tools provide real-time, personalized tax-saving insights that streamline the filing process, reduce errors, and maximize refund potential.

Digital-first CPA Platforms

Digital-first CPA platforms integrate personalized tax preparation services with advanced robo-advisory tax tools, delivering optimized filing accuracy and real-time compliance updates. These hybrid solutions leverage AI-driven data analytics to minimize errors and maximize deductions, outperforming traditional methods in both efficiency and user experience.

Personalized Robo-Tax Algorithms

Personalized robo-tax algorithms leverage artificial intelligence to analyze individual financial situations, providing tailored tax filing recommendations that adapt to changes in income, deductions, and credits in real time. These automated tools enhance accuracy and efficiency while minimizing human error, though they may lack the nuanced insight and complex problem-solving abilities offered by professional tax preparation services.

E-signature Enabled Tax Submission

E-signature enabled tax submission streamlines tax preparation services, allowing clients to securely sign and file documents electronically, enhancing convenience and compliance accuracy. In contrast, robo-advisory tax tools integrate automated e-signature features to expedite filing processes but may lack personalized support for complex tax situations.

Tax Workflow Automation

Tax preparation services leverage expert-driven tax workflow automation to streamline document collection, error detection, and compliance checks, ensuring accurate and personalized tax filing. Conversely, robo-advisory tax tools employ AI-based automation to simplify filing through algorithmic data analysis and deduction optimization but may lack the nuanced decision-making and customized advisory available in professional services.

API-Based Income Synchronization

API-based income synchronization in tax preparation services offers real-time, accurate financial data integration, reducing manual entry errors and ensuring comprehensive tax filings. Robo-advisory tax tools leverage this technology to automatically update income streams, streamlining the process with enhanced efficiency but may lack personalized guidance compared to traditional services.

On-demand Tax Expert Chatbots

On-demand tax expert chatbots integrated within robo-advisory tax tools offer real-time assistance, answering complex tax queries instantly and reducing errors common in self-preparation. These AI-driven platforms enhance accuracy and convenience by providing personalized guidance based on current tax laws, outperforming traditional tax preparation services in speed and accessibility.

Smart Tax Refund Optimization

Tax preparation services leverage expert knowledge and advanced algorithms to maximize smart tax refund optimization by accurately identifying deductions and credits tailored to individual circumstances. Robo-advisory tax tools provide automated, cost-effective filing solutions with real-time updates, but may lack the personalized insight and nuanced tax planning that professional services offer for optimizing refunds.

Tax Preparation Services vs Robo-Advisory Tax Tools for tax filing. Infographic

moneydiff.com

moneydiff.com