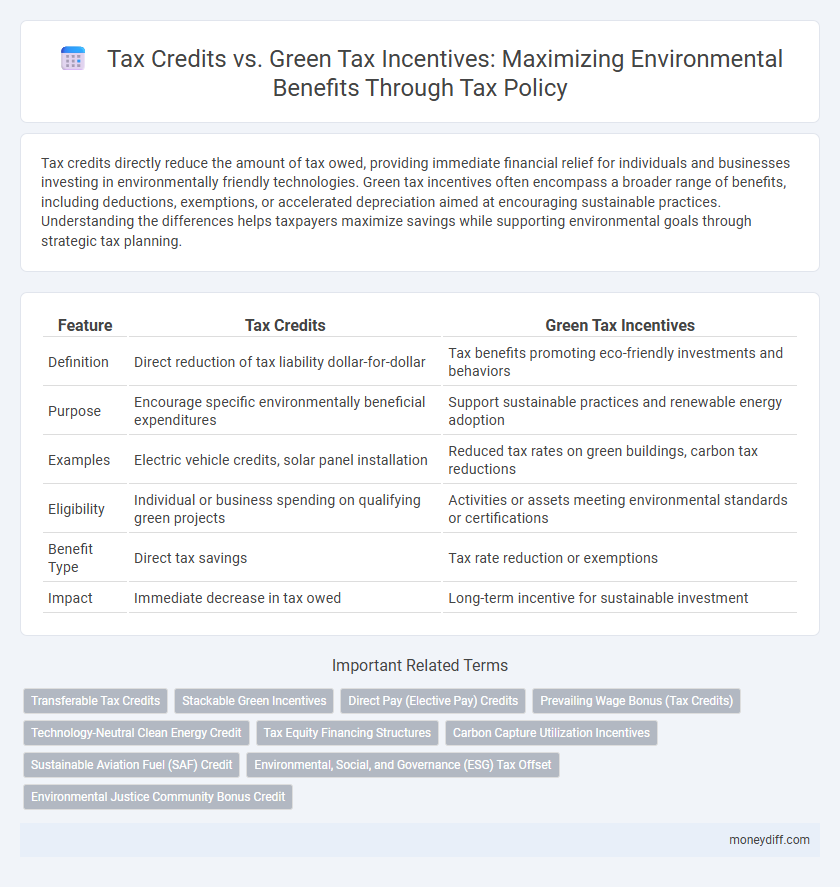

Tax credits directly reduce the amount of tax owed, providing immediate financial relief for individuals and businesses investing in environmentally friendly technologies. Green tax incentives often encompass a broader range of benefits, including deductions, exemptions, or accelerated depreciation aimed at encouraging sustainable practices. Understanding the differences helps taxpayers maximize savings while supporting environmental goals through strategic tax planning.

Table of Comparison

| Feature | Tax Credits | Green Tax Incentives |

|---|---|---|

| Definition | Direct reduction of tax liability dollar-for-dollar | Tax benefits promoting eco-friendly investments and behaviors |

| Purpose | Encourage specific environmentally beneficial expenditures | Support sustainable practices and renewable energy adoption |

| Examples | Electric vehicle credits, solar panel installation | Reduced tax rates on green buildings, carbon tax reductions |

| Eligibility | Individual or business spending on qualifying green projects | Activities or assets meeting environmental standards or certifications |

| Benefit Type | Direct tax savings | Tax rate reduction or exemptions |

| Impact | Immediate decrease in tax owed | Long-term incentive for sustainable investment |

Introduction to Tax Credits and Green Tax Incentives

Tax credits directly reduce the amount of tax owed by individuals or businesses investing in environmentally friendly technologies or practices, providing immediate financial benefits. Green tax incentives include a broader range of benefits such as deductions, rebates, and credits aimed at encouraging sustainable actions like renewable energy installation and energy-efficient upgrades. These incentives play a crucial role in promoting environmental responsibility by lowering the financial barriers to adopting green solutions.

Key Differences Between Tax Credits and Green Tax Incentives

Tax credits directly reduce the amount of tax owed by offering dollar-for-dollar reductions, whereas green tax incentives often include deductions, exemptions, or rebates that lower taxable income or provide indirect financial benefits. Green tax incentives primarily target environmentally beneficial actions such as renewable energy adoption or energy efficiency improvements, while tax credits may apply to a broader range of activities but become more valuable when explicitly designed for environmental goals. The key difference lies in the mechanism of saving, with tax credits providing immediate tax relief and green tax incentives fostering long-term ecological impact through varied fiscal strategies.

How Tax Credits Support Environmental Actions

Tax credits directly reduce the amount of tax owed by individuals or businesses investing in renewable energy technologies, electric vehicles, and energy-efficient upgrades, providing immediate financial benefits that encourage eco-friendly choices. By lowering the effective cost of adopting sustainable practices, these credits accelerate the transition to a greener economy and promote widespread environmental responsibility. Key examples include the Investment Tax Credit (ITC) for solar energy systems and the Electric Vehicle Tax Credit, which have significantly increased clean energy adoption and reduced carbon emissions.

Types of Green Tax Incentives Available

Green tax incentives encompass a variety of measures designed to encourage environmentally friendly practices, such as tax credits, deductions, and exemptions related to renewable energy investments, energy-efficient home improvements, and electric vehicle purchases. Tax credits reduce the actual tax owed by a specific amount for qualifying activities like installing solar panels or using energy-efficient appliances, while deductions lower taxable income based on eligible environmental expenses. Other green tax incentives include accelerated depreciation for clean energy equipment and grants or rebates that complement federal and state tax benefits, collectively fostering sustainable economic behavior.

Financial Benefits of Tax Credits for Sustainable Practices

Tax credits offer direct financial benefits by reducing the amount of tax owed, making sustainable practices more affordable for individuals and businesses. Unlike green tax incentives that may provide indirect benefits such as subsidies or rebates, tax credits create immediate cash flow advantages and improve investment returns in renewable energy systems, energy-efficient appliances, and eco-friendly building materials. Maximizing tax credits accelerates the adoption of sustainable technologies while lowering operational costs and enhancing long-term financial sustainability.

Eligibility Criteria for Green Tax Incentives

Eligibility criteria for green tax incentives typically require individuals or businesses to invest in renewable energy systems, energy-efficient appliances, or sustainable building materials that meet specific environmental standards. Applicants must often provide proof of purchase, installation, or certification to qualify, ensuring compliance with local or national regulations designed to promote eco-friendly practices. These incentives are usually structured to target projects that demonstrably reduce carbon emissions and support broader climate goals.

Impact of Tax Credits on Business Environmental Strategies

Tax credits provide direct financial reductions on a business's tax liability, incentivizing investments in renewable energy, energy efficiency, and sustainable practices. These credits improve cash flow and lower upfront costs, enabling businesses to integrate environmental strategies into their operations more effectively. Enhanced profitability from tax credits encourages broader adoption of green technologies, driving long-term sustainability and compliance with environmental regulations.

Government Policies Shaping Green Tax Incentives

Government policies play a crucial role in shaping green tax incentives by establishing frameworks that reward environmentally friendly actions such as renewable energy adoption and energy-efficient upgrades. These incentives, often in the form of tax credits, reduce the financial burden on individuals and businesses investing in sustainable technologies, encouraging wider participation in green initiatives. The strategic design of these policies ensures alignment with national climate goals, promoting long-term environmental and economic benefits.

Common Challenges in Accessing Tax Credits and Green Incentives

Tax credits and green tax incentives often face barriers such as complex application processes, limited awareness among taxpayers, and varying eligibility criteria that hinder optimal utilization. Frequent updates in regulations and documentation requirements further complicate access and compliance for individuals and businesses. Navigating these challenges demands proactive education, streamlined procedures, and clear guidance to maximize the financial benefits linked to environmental actions.

Choosing the Right Incentive: Tax Credits vs Green Tax Incentives

Tax credits offer direct reductions in tax liability based on specific environmental investments, providing immediate financial benefits. Green tax incentives often include broader measures such as deductions, exemptions, or reduced rates designed to encourage sustainable practices over time. Selecting the right incentive depends on the nature of the environmental action, financial goals, and eligibility criteria within tax codes to maximize economic and ecological advantages.

Related Important Terms

Transferable Tax Credits

Transferable tax credits offer businesses the ability to sell or transfer their environmental tax credits to other taxpayers, enhancing liquidity and incentivizing investments in sustainable projects more effectively than non-transferable green tax incentives. These credits often accelerate funding for renewable energy initiatives and pollution reduction efforts by providing upfront cash flow advantages that green tax incentives, typically realized only as future tax savings, may not deliver.

Stackable Green Incentives

Stackable green incentives allow businesses and individuals to combine multiple tax credits and environmental tax incentives, maximizing overall financial benefits for eco-friendly projects such as solar panel installations, energy-efficient appliances, and electric vehicle purchases. Utilizing stackable incentives accelerates return on investment while promoting sustainable practices and reducing carbon footprints.

Direct Pay (Elective Pay) Credits

Direct Pay Credits enable taxpayers to receive refundable tax credits for qualifying environmental actions, providing immediate financial support without needing to offset current tax liabilities. Unlike traditional green tax incentives that reduce tax owed, Direct Pay mechanisms allow entities, including non-profits and government agencies, to benefit directly from investments in clean energy and sustainability projects.

Prevailing Wage Bonus (Tax Credits)

The Prevailing Wage Bonus under tax credits offers significant financial benefits for contractors who pay workers the local prevailing wage, directly incentivizing fair labor practices in environmentally focused projects. Unlike broader green tax incentives that primarily reduce costs through energy-efficient investments, this bonus specifically promotes higher wage standards, enhancing workforce quality and project accountability while driving environmental improvements.

Technology-Neutral Clean Energy Credit

Technology-Neutral Clean Energy Credits provide tax benefits without favoring specific renewable technologies, enabling broader adoption of clean energy solutions through financial incentives that reduce taxable income. These credits differ from traditional green tax incentives by promoting neutral eligibility across various renewable sources, driving innovation and investment while supporting environmental policy goals.

Tax Equity Financing Structures

Tax credits provide direct reductions in tax liability for investments in renewable energy or energy efficiency, making them a crucial component of tax equity financing structures by offering predictable cash flow to investors. Green tax incentives, including accelerated depreciation and production incentives, complement these credits by enhancing project returns and supporting long-term environmental sustainability within tax equity models.

Carbon Capture Utilization Incentives

Tax credits for carbon capture utilization provide direct reductions in tax liability based on captured carbon volumes, promoting investment in advanced capture technology. Green tax incentives often include broader benefits like grants or accelerated depreciation but may not specifically target carbon capture projects with the same financial precision.

Sustainable Aviation Fuel (SAF) Credit

The Sustainable Aviation Fuel (SAF) Credit offers targeted financial benefits by directly reducing the tax liability of airlines investing in low-carbon aviation fuels, enhancing economic feasibility for decarbonization efforts. Green tax incentives, while broader in scope, provide refundable or non-refundable credits aimed at promoting overall environmental investments but may lack the specificity and immediate impact on aviation carbon reduction compared to SAF credits.

Environmental, Social, and Governance (ESG) Tax Offset

Environmental, Social, and Governance (ESG) tax offsets provide targeted financial benefits for companies implementing sustainable practices, enhancing their ESG profiles while lowering tax liabilities. Tax credits directly reduce tax owed dollar-for-dollar for specific environmental initiatives, whereas green tax incentives often offer broader deductions or accelerated depreciation on eco-friendly investments, collectively driving corporate responsibility and investment in green technologies.

Environmental Justice Community Bonus Credit

Environmental Justice Community Bonus Credit targets underserved communities by offering enhanced tax credits for renewable energy adoption and pollution reduction, fostering equitable environmental improvements. This credit surpasses standard green tax incentives by emphasizing social equity alongside environmental benefits, ensuring marginalized groups receive direct financial support for sustainable projects.

Tax Credits vs Green Tax Incentives for environmental actions. Infographic

moneydiff.com

moneydiff.com