Actuarial computation relies on statistical models and historical data to estimate tax liabilities and forecast future obligations with precision. Blockchain-based tax reporting enhances record-keeping by providing a decentralized, immutable ledger that ensures transparency and reduces the risk of fraud. Combining actuarial methods with blockchain technology can streamline tax compliance and improve accuracy in financial reporting.

Table of Comparison

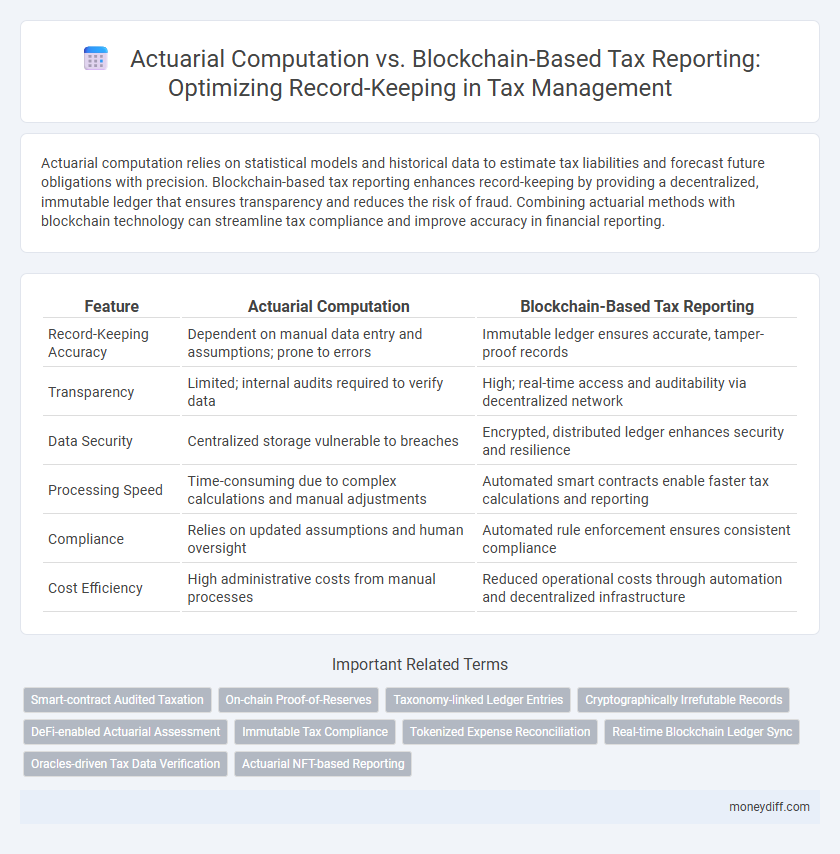

| Feature | Actuarial Computation | Blockchain-Based Tax Reporting |

|---|---|---|

| Record-Keeping Accuracy | Dependent on manual data entry and assumptions; prone to errors | Immutable ledger ensures accurate, tamper-proof records |

| Transparency | Limited; internal audits required to verify data | High; real-time access and auditability via decentralized network |

| Data Security | Centralized storage vulnerable to breaches | Encrypted, distributed ledger enhances security and resilience |

| Processing Speed | Time-consuming due to complex calculations and manual adjustments | Automated smart contracts enable faster tax calculations and reporting |

| Compliance | Relies on updated assumptions and human oversight | Automated rule enforcement ensures consistent compliance |

| Cost Efficiency | High administrative costs from manual processes | Reduced operational costs through automation and decentralized infrastructure |

Introduction to Tax Record-Keeping Methods

Actuarial computation in tax record-keeping relies on statistical models and probability theories to estimate liabilities and forecast financial outcomes, ensuring accuracy in long-term tax planning. Blockchain-based tax reporting enhances transparency and security by utilizing decentralized ledgers that provide immutable, real-time transaction records accessible by tax authorities and taxpayers alike. Combining actuarial methods with blockchain technology optimizes record-keeping accuracy, auditability, and compliance in modern tax systems.

Overview of Actuarial Computation in Tax Management

Actuarial computation in tax management involves using statistical models to estimate future liabilities and risks, enabling precise forecasting of tax obligations and reserves. This approach enhances accuracy in tax planning by integrating historical data, demographic trends, and financial assumptions to calculate expected tax impacts over time. Actuarial methods provide a robust framework for assessing long-term tax exposures, contrasting with blockchain's real-time, immutable record-keeping capabilities.

Blockchain Technology in Tax Reporting

Blockchain technology in tax reporting ensures immutable, transparent, and real-time record-keeping that significantly reduces errors and fraud. Its decentralized ledger system enables efficient verification and streamlined audit processes while enhancing data security and regulatory compliance. Actuarial computation, while essential for risk assessment and forecasting, lacks the robust data integrity and automation capabilities provided by blockchain solutions.

Key Differences Between Actuarial and Blockchain Approaches

Actuarial computation relies on mathematical models and statistical methods to estimate future tax liabilities and assess risk over time, providing precise forecasts based on historical data and assumptions. Blockchain-based tax reporting leverages decentralized, immutable ledgers to securely record real-time transactions, enhancing transparency and reducing the risk of data manipulation. Key differences include the actuarial focus on predictive analytics and long-term risk management versus blockchain's emphasis on data integrity, real-time updates, and auditability in tax record-keeping.

Data Accuracy and Integrity in Record-Keeping

Actuarial computation ensures data accuracy through statistical models and historical financial data analysis, minimizing errors in tax projections and liability assessments. Blockchain-based tax reporting enhances data integrity by providing an immutable, transparent ledger that prevents tampering and fraud in tax record-keeping. Combining actuarial precision with blockchain's secure data structure optimizes both accuracy and integrity for reliable tax documentation.

Automation and Efficiency: A Comparative Analysis

Actuarial computation leverages statistical models and historical data to automate tax liability estimations, enhancing accuracy but often requiring complex, time-consuming calculations. Blockchain-based tax reporting streamlines record-keeping by providing immutable, transparent, and real-time transaction logs, significantly improving efficiency and reducing errors in tax audits and compliance. Comparing automation and efficiency, blockchain technology offers superior speed and reliability in data handling, whereas actuarial methods excel in precision for scenario-based tax forecasting.

Security and Privacy Considerations

Actuarial computation relies on traditional secure databases and encryption methods to protect sensitive tax data, but it may be vulnerable to centralized breaches and insider threats. Blockchain-based tax reporting enhances security through decentralized ledger technology, ensuring immutable records and transparent audit trails that reduce manipulation risks. Privacy in blockchain systems can be strengthened with cryptographic techniques like zero-knowledge proofs, enabling secure data sharing without exposing personal taxpayer information.

Scalability of Tax Reporting Solutions

Actuarial computation provides precise tax liability forecasts leveraging complex statistical models, but scalability challenges arise due to the intensive data processing requirements as transaction volumes grow. Blockchain-based tax reporting offers decentralized, immutable record-keeping that enhances scalability by enabling automated, real-time tax data validation across numerous participants without centralized bottlenecks. Integrating blockchain technology into tax reporting systems supports seamless scaling, improved transparency, and auditability, which are critical for handling expansive tax records and diverse jurisdictional compliance.

Regulatory Compliance and Audit Readiness

Actuarial computation offers precise risk assessment and financial forecasting, supporting regulatory compliance through detailed, actuarially sound valuations essential for accurate tax reporting. Blockchain-based tax reporting enhances audit readiness by providing tamper-proof, transparent records that streamline verification processes and reduce the risk of discrepancies during audits. Combining actuarial methods with blockchain technology improves both compliance accuracy and audit efficiency by ensuring data integrity and real-time accessibility of tax records.

Future Trends in Tax Record-Keeping Technologies

Actuarial computation leverages statistical models and historical data to predict tax liabilities and optimize financial planning, enhancing accuracy in complex tax scenarios. Blockchain-based tax reporting introduces immutable, decentralized ledgers that ensure transparency and real-time verification of tax records, reducing fraud and compliance costs. Future trends in tax record-keeping technologies indicate a convergence of advanced actuarial analytics with blockchain-enabled automation, driving smarter, more secure, and efficient tax compliance systems.

Related Important Terms

Smart-contract Audited Taxation

Smart-contract audited taxation enhances accuracy and transparency in actuarial computations by automating tax calculations and compliance through blockchain technology. This integration enables immutable record-keeping and real-time auditing, reducing errors and fraud in tax reporting processes.

On-chain Proof-of-Reserves

Actuarial computation relies on statistical models to estimate tax liabilities and forecast future obligations, providing detailed risk assessments for compliance and financial planning. Blockchain-based tax reporting with On-chain Proof-of-Reserves ensures transparent, immutable record-keeping by cryptographically verifying asset holdings and transaction history, enhancing auditability and reducing discrepancies in tax reporting.

Taxonomy-linked Ledger Entries

Actuarial computation relies on probabilistic models and historical data to estimate future tax liabilities, enhancing accuracy in long-term financial forecasting within tax systems. Blockchain-based tax reporting ensures tamper-proof, real-time record-keeping through taxonomy-linked ledger entries, improving transparency and auditability by encoding tax categories directly into immutable distributed ledgers.

Cryptographically Irrefutable Records

Actuarial computation relies on probabilistic models to estimate liabilities and future tax obligations, whereas blockchain-based tax reporting ensures cryptographically irrefutable records through decentralized ledger technology that enhances transparency and auditability. Blockchain's immutable data structure enables secure, tamper-proof record-keeping critical for regulatory compliance and fraud prevention in tax reporting.

DeFi-enabled Actuarial Assessment

DeFi-enabled actuarial assessment leverages decentralized finance protocols to enhance accuracy and transparency in tax-related risk evaluations, allowing for real-time, immutable record-keeping via blockchain technology. This integration reduces reliance on traditional actuarial computations by automating data verification and enabling secure, tamper-proof tax reporting within decentralized ecosystems.

Immutable Tax Compliance

Actuarial computation leverages statistical models for predicting tax liabilities and optimizing compliance strategies, while blockchain-based tax reporting ensures immutable tax compliance by creating transparent and tamper-proof transaction records. The integration of blockchain technology in tax reporting enhances record-keeping accuracy and auditability, reducing risks of fraud and errors inherent in traditional actuarial methods.

Tokenized Expense Reconciliation

Tokenized expense reconciliation leverages blockchain's immutable ledger to enhance accuracy and transparency in tax record-keeping, surpassing traditional actuarial computations which rely on probabilistic models prone to estimation errors. Employing smart contracts for automated validation and tokenization of expenses ensures real-time audit trails, reducing discrepancies and compliance risks in tax reporting.

Real-time Blockchain Ledger Sync

Actuarial computation provides precise long-term tax liability forecasts using statistical models, while blockchain-based tax reporting ensures real-time ledger synchronization with immutable, transparent records that enhance auditability and compliance. Integrating blockchain technology facilitates instant updates and verifiable transactions, reducing discrepancies and improving the accuracy of tax record-keeping compared to traditional actuarial methods.

Oracles-driven Tax Data Verification

Actuarial computation relies on traditional statistical models and historical data analysis for tax liabilities, while blockchain-based tax reporting uses decentralized ledgers to enhance transparency and security in record-keeping. Oracles-driven tax data verification integrates real-world financial information with blockchain smart contracts, ensuring accuracy and real-time validation of tax obligations.

Actuarial NFT-based Reporting

Actuarial NFT-based reporting leverages unique, blockchain-verified tokens to ensure precise, tamper-proof tax record-keeping and risk assessment by encoding actuarial data onto immutable digital assets. This innovative approach enhances transparency, auditability, and compliance accuracy compared to traditional actuarial computations, streamlining tax reporting within decentralized ecosystems.

Actuarial computation vs Blockchain-based tax reporting for record-keeping. Infographic

moneydiff.com

moneydiff.com