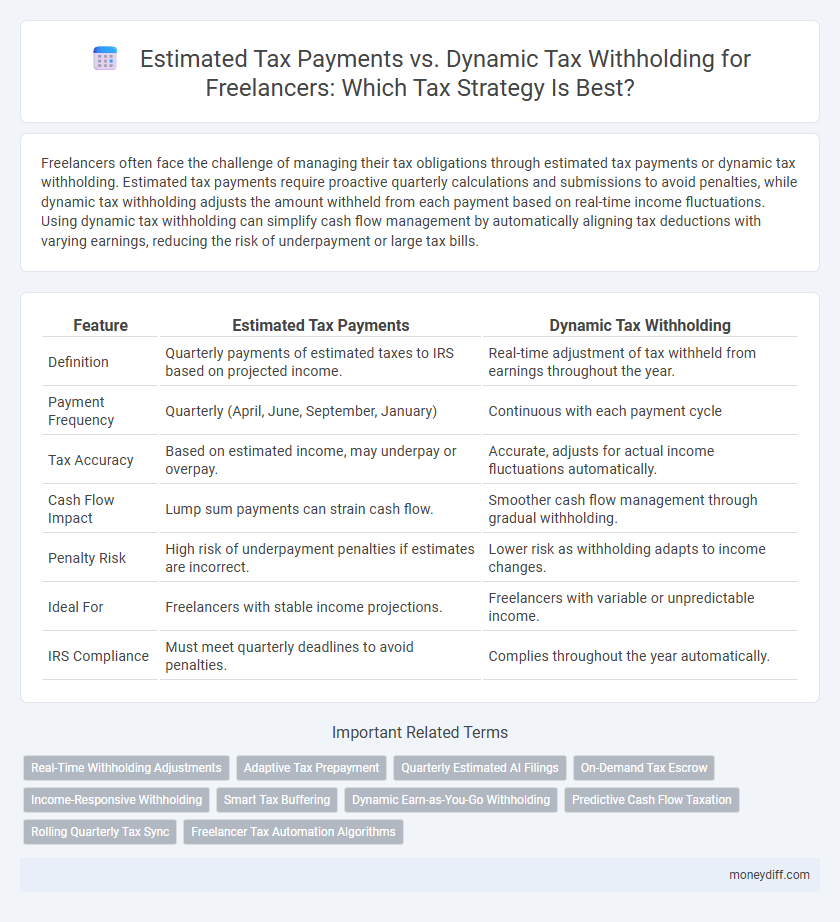

Freelancers often face the challenge of managing their tax obligations through estimated tax payments or dynamic tax withholding. Estimated tax payments require proactive quarterly calculations and submissions to avoid penalties, while dynamic tax withholding adjusts the amount withheld from each payment based on real-time income fluctuations. Using dynamic tax withholding can simplify cash flow management by automatically aligning tax deductions with varying earnings, reducing the risk of underpayment or large tax bills.

Table of Comparison

| Feature | Estimated Tax Payments | Dynamic Tax Withholding |

|---|---|---|

| Definition | Quarterly payments of estimated taxes to IRS based on projected income. | Real-time adjustment of tax withheld from earnings throughout the year. |

| Payment Frequency | Quarterly (April, June, September, January) | Continuous with each payment cycle |

| Tax Accuracy | Based on estimated income, may underpay or overpay. | Accurate, adjusts for actual income fluctuations automatically. |

| Cash Flow Impact | Lump sum payments can strain cash flow. | Smoother cash flow management through gradual withholding. |

| Penalty Risk | High risk of underpayment penalties if estimates are incorrect. | Lower risk as withholding adapts to income changes. |

| Ideal For | Freelancers with stable income projections. | Freelancers with variable or unpredictable income. |

| IRS Compliance | Must meet quarterly deadlines to avoid penalties. | Complies throughout the year automatically. |

Understanding Estimated Tax Payments for Freelancers

Estimated tax payments for freelancers are quarterly installments made to the IRS based on expected annual income, self-employment taxes, and deductions, preventing penalties for underpayment. Calculating these payments involves estimating net income after business expenses and applying the current tax rates to determine the amount owed, which must be submitted by April, June, September, and January deadlines. Properly managing estimated tax payments ensures cash flow stability and reduces the risk of large tax bills during filing season.

What Is Dynamic Tax Withholding?

Dynamic tax withholding is an automated system that adjusts the amount of tax withheld from a freelancer's income in real-time based on their earnings and tax obligations, minimizing the risk of underpayment or overpayment. Unlike estimated tax payments that require quarterly calculations and manual submissions, dynamic withholding uses algorithms and software integration with income sources to optimize withholding amounts continuously. This approach ensures more accurate tax compliance and cash flow management for freelancers with fluctuating incomes.

Key Differences Between Estimated Tax and Withholding

Estimated tax payments require freelancers to periodically send payments directly to the IRS based on projected annual income, ensuring tax liabilities are met quarterly. Dynamic tax withholding, integrated with payroll or payment platforms, automatically adjusts withholding amounts in real-time according to income fluctuations and tax law changes. Key differences include payment frequency, automation level, and adaptability, with estimated taxes demanding proactive planning and withholding offering real-time optimization of tax obligations.

Pros and Cons of Estimated Tax Payments

Estimated tax payments allow freelancers to manage their tax liability by making quarterly payments based on income projections, reducing the risk of underpayment penalties. However, inaccurate income estimation can lead to overpayments or underpayments, causing cash flow challenges or unexpected tax bills. This method requires disciplined budgeting and regular income assessment, which may be time-consuming compared to dynamic tax withholding that adjusts automatically.

Benefits of Dynamic Tax Withholding for Freelancers

Dynamic tax withholding offers freelancers real-time tax deduction adjustments based on actual income fluctuations, reducing the risk of underpayment penalties and large year-end tax bills. This adaptive approach improves cash flow management by aligning tax payments closer to earnings, avoiding overpayments that stall capital use. Enhanced accuracy in withholding also simplifies tax planning and ensures compliance with IRS requirements more efficiently than fixed estimated tax payments.

Compliance Requirements: Estimated vs Withholding

Freelancers must meet IRS compliance requirements by accurately calculating and submitting quarterly estimated tax payments to avoid penalties, whereas dynamic tax withholding automatically adjusts income tax deductions in real time based on earnings and deductions reported. Estimated tax payments require proactive tracking of income fluctuations and tax liability projections, while dynamic withholding relies on continuous payroll data integration for precise tax remittance. Understanding these distinctions ensures freelancers maintain compliance under IRS regulations and minimize underpayment risks.

How to Calculate Your Tax Burden Accurately

Freelancers can calculate their tax burden accurately by comparing estimated tax payments and dynamic tax withholding methods. Estimated tax payments require calculating quarterly tax liabilities based on projected income, allowing proactive budgeting to avoid underpayment penalties. Dynamic tax withholding adjusts tax deductions in real-time considering actual earnings, providing a flexible approach to maintaining accurate tax payments throughout the year.

Avoiding IRS Penalties: Which Method is Better?

Freelancers can avoid IRS penalties by choosing between estimated tax payments and dynamic tax withholding, with each method offering unique advantages. Estimated tax payments require quarterly submissions based on income predictions, minimizing underpayment risks if accurately calculated. Dynamic tax withholding adjusts automatically throughout the year based on real-time earnings, providing a flexible way to meet tax obligations and reduce penalty risks as income fluctuates.

Technology Tools for Managing Freelancer Taxes

Technology tools like QuickBooks Self-Employed and TaxAct Self-Employed integrate automated algorithms for Estimated Tax Payments, providing freelancers with precise quarterly tax calculations based on income fluctuations. Dynamic tax withholding apps such as PayTracker utilize real-time income data to adjust tax deductions immediately, reducing the risk of underpayment penalties. These platforms offer seamless synchronization with bank accounts and invoicing software, streamlining tax compliance and cash flow management for freelancers.

Choosing the Best Tax Strategy for Your Freelance Business

Freelancers should evaluate estimated tax payments and dynamic tax withholding to optimize cash flow and avoid penalties. Estimated tax payments require quarterly self-reporting based on projected income, offering control but demanding disciplined budgeting. Dynamic tax withholding adjusts automatically with income fluctuations, providing flexibility and reducing the risk of underpayment for variable freelance earnings.

Related Important Terms

Real-Time Withholding Adjustments

Real-time withholding adjustments enable freelancers to dynamically update tax payments based on fluctuating income, minimizing the risk of underpayment penalties. This method contrasts with estimated tax payments, which require periodic manual calculations and fixed installment submissions that may not accurately reflect current earnings.

Adaptive Tax Prepayment

Adaptive tax prepayment allows freelancers to adjust estimated tax payments based on real-time income fluctuations, reducing the risk of underpayment penalties and cash flow strain. Dynamic tax withholding integrates automated withholding strategies that optimize tax liabilities throughout the year, providing a flexible alternative to fixed quarterly estimated payments.

Quarterly Estimated AI Filings

Quarterly estimated tax payments require freelancers to calculate and submit taxes based on projected income, often leading to overpayment or penalties due to inaccurate forecasts. Dynamic tax withholding, powered by AI-driven real-time income analysis and automated adjustments, optimizes cash flow and compliance by reducing the risk of underpayment penalties through precise, adaptive tax calculations aligned with actual earnings.

On-Demand Tax Escrow

On-demand tax escrow offers freelancers a flexible alternative to estimated tax payments by automatically setting aside a portion of income in real-time, minimizing underpayment penalties and cash flow disruptions. This dynamic tax withholding system adapts to fluctuating freelance earnings, providing accurate tax liability coverage throughout the year without the need for manual quarterly calculations.

Income-Responsive Withholding

Income-responsive withholding dynamically adjusts tax deductions based on freelancers' fluctuating earnings, reducing the risk of underpayment penalties often associated with fixed estimated tax payments. This method aligns tax obligations more closely with real-time income, promoting cash flow stability and accurate tax compliance throughout the year.

Smart Tax Buffering

Estimated tax payments require freelancers to calculate and send quarterly payments to the IRS, often leading to overpayment or penalties if miscalculated, whereas dynamic tax withholding uses real-time income data to adjust tax deductions automatically, optimizing cash flow and minimizing surprises. Smart tax buffering integrates dynamic withholding by maintaining an adaptive reserve based on fluctuating freelance income, ensuring precise tax coverage while maximizing usable funds throughout the year.

Dynamic Earn-as-You-Go Withholding

Dynamic earn-as-you-go withholding adjusts tax deductions in real-time based on freelancers' fluctuating income, reducing the risk of underpayment penalties compared to traditional estimated tax payments. This method leverages automated payroll systems to calculate and withhold precise tax amounts, enhancing cash flow management and compliance accuracy for independent contractors.

Predictive Cash Flow Taxation

Freelancers benefit from dynamic tax withholding by aligning estimated tax payments with real-time income fluctuations, enhancing predictive cash flow taxation accuracy and reducing underpayment risks. This method leverages automated adjustments based on income trends, unlike fixed estimated tax payments that often result in cash flow mismatches and penalties.

Rolling Quarterly Tax Sync

Rolling quarterly tax sync enables freelancers to align estimated tax payments with real-time income fluctuations, reducing the risk of underpayment penalties. Dynamic tax withholding adapts continuously to earned revenue, providing a more precise tax liability match compared to fixed quarterly estimates.

Freelancer Tax Automation Algorithms

Freelancer tax automation algorithms leverage real-time income data and predictive analytics to optimize estimated tax payments, reducing the risk of underpayment penalties by dynamically adjusting withholding amounts based on fluctuating freelance income streams. These AI-driven systems enhance cash flow management and tax accuracy compared to static estimated tax payments, ensuring compliance and maximizing financial efficiency for independent contractors.

Estimated Tax Payments vs Dynamic Tax Withholding for Freelancers Infographic

moneydiff.com

moneydiff.com