Tax evasion involves illegally avoiding taxes through undeclared income or falsified documents, leading to severe legal consequences and financial penalties. Tax optimization, on the other hand, employs legal strategies such as deductions, credits, and investment planning to minimize tax liabilities and enhance wealth management. Effective wealth management hinges on leveraging tax optimization while strictly avoiding the risks associated with tax evasion.

Table of Comparison

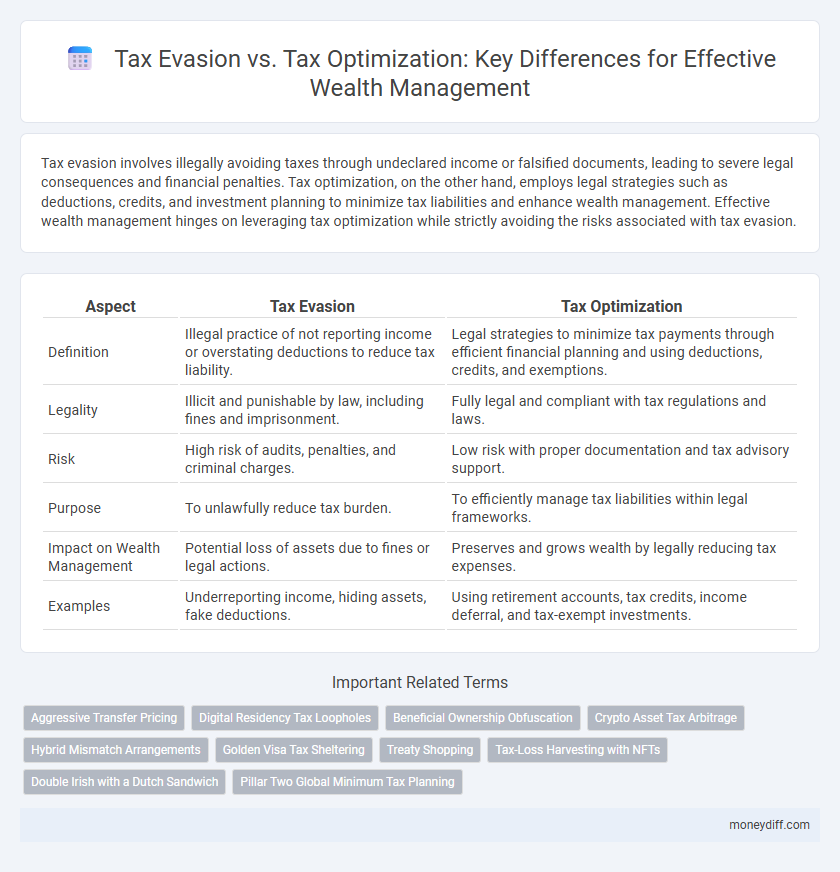

| Aspect | Tax Evasion | Tax Optimization |

|---|---|---|

| Definition | Illegal practice of not reporting income or overstating deductions to reduce tax liability. | Legal strategies to minimize tax payments through efficient financial planning and using deductions, credits, and exemptions. |

| Legality | Illicit and punishable by law, including fines and imprisonment. | Fully legal and compliant with tax regulations and laws. |

| Risk | High risk of audits, penalties, and criminal charges. | Low risk with proper documentation and tax advisory support. |

| Purpose | To unlawfully reduce tax burden. | To efficiently manage tax liabilities within legal frameworks. |

| Impact on Wealth Management | Potential loss of assets due to fines or legal actions. | Preserves and grows wealth by legally reducing tax expenses. |

| Examples | Underreporting income, hiding assets, fake deductions. | Using retirement accounts, tax credits, income deferral, and tax-exempt investments. |

Understanding Tax Evasion and Tax Optimization

Tax evasion involves illegal practices such as underreporting income or inflating deductions to reduce tax liability, leading to severe penalties and legal consequences. Tax optimization, on the other hand, uses lawful strategies like tax credits, deductions, and deferrals to minimize tax burden while complying with regulations. Understanding the distinction is crucial for effective wealth management that maximizes financial benefits without risking legal issues.

Key Differences Between Tax Evasion and Tax Optimization

Tax evasion involves illegal practices such as underreporting income or inflating deductions to reduce tax liability, resulting in penalties and legal consequences. Tax optimization, by contrast, leverages legal strategies like tax deductions, credits, and income deferrals to minimize taxes within the boundaries of the law. Understanding these distinctions is crucial for effective wealth management to ensure compliance while maximizing financial efficiency.

Legal Implications of Tax Evasion vs Tax Optimization

Tax evasion involves illegally underreporting income or falsifying deductions, resulting in severe penalties, including fines and imprisonment, under tax laws. In contrast, tax optimization employs lawful strategies such as tax credits, deductions, and income deferral to minimize tax liabilities within legal frameworks. Wealth management professionals must ensure compliance with regulatory authorities to avoid the significant legal risks associated with tax evasion while effectively utilizing tax optimization techniques.

Tax Optimization Strategies for Wealth Management

Tax optimization strategies for wealth management focus on legally minimizing tax liabilities through methods such as tax deferral, income splitting, and utilizing tax-advantaged accounts like IRAs and 401(k)s. Strategies include investing in municipal bonds to generate tax-free interest income and employing trusts to efficiently transfer wealth while reducing estate taxes. Effective tax optimization enhances after-tax returns and preserves capital for future generations, fostering long-term financial growth.

Common Tax Evasion Schemes Wealth Managers Should Avoid

Common tax evasion schemes wealth managers should avoid include underreporting income, inflating deductions, and hiding assets in offshore accounts. Engaging in these illegal practices can result in severe penalties, audits, and reputational damage. Instead, wealth managers should focus on legal tax optimization strategies, such as utilizing tax-efficient investment vehicles and legitimate deductions.

The Role of Ethics in Tax Planning and Wealth Management

Ethics in tax planning ensures that wealth management strategies comply with legal standards while promoting transparency and accountability. Distinguishing tax optimization from tax evasion hinges on adherence to ethical principles, where optimization legally minimizes tax liabilities and evasion involves illegal concealment or fraud. Upholding ethical tax practices fosters long-term financial sustainability and protects clients from reputational and legal risks.

Regulatory Frameworks Governing Tax Practices

Regulatory frameworks governing tax practices are designed to distinguish clearly between tax evasion and tax optimization, enforcing compliance through strict legal standards and penalties. Tax evasion, characterized by illegal concealment of income or falsification of documents, is penalized under laws such as the IRS Code in the United States or the General Anti-Avoidance Rule (GAAR) internationally. In contrast, tax optimization relies on lawful strategies within these frameworks, utilizing deductions, credits, and trusts to manage wealth efficiently without violating tax statutes.

Impact of Tax Optimization on Long-Term Wealth Preservation

Tax optimization strategically minimizes liabilities within legal frameworks, enhancing long-term wealth preservation by maximizing after-tax returns. Unlike tax evasion, which involves illegal concealment, tax optimization employs legitimate methods such as tax credits, deductions, and efficient asset allocation to reduce taxable income. Implementing tax optimization ensures sustainable wealth growth, protecting assets against excessive tax burdens over time.

Case Studies: Tax Evasion vs Tax Optimization in Practice

Case studies reveal that tax evasion involves illegal underreporting or concealment of income, leading to severe penalties and legal action, whereas tax optimization legally utilizes deductions, credits, and strategic planning to minimize tax liabilities. In practice, wealthy individuals and businesses employ tax optimization techniques such as income splitting, offshore accounts within compliance, and investment in tax-advantaged assets to enhance after-tax wealth. Real-world examples demonstrate that transparent tax optimization sustains long-term financial health, while evasion risks substantial fines, reputational damage, and criminal charges.

Best Practices for Compliance and Responsible Tax Management

Tax optimization involves strategic planning within legal frameworks to minimize liabilities, whereas tax evasion constitutes illegal practices to avoid taxes. Best practices for compliance include accurate financial reporting, thorough documentation, and engaging certified tax professionals for transparent wealth management. Responsible tax management ensures adherence to regulations while maximizing benefits through incentives and deductions legally available.

Related Important Terms

Aggressive Transfer Pricing

Aggressive transfer pricing in wealth management exploits intercompany transactions to shift profits to low-tax jurisdictions, often blurring the line between legal tax optimization and illegal tax evasion. Understanding the intricacies of OECD guidelines and compliance with local tax laws is crucial to mitigate risks while maximizing tax benefits through strategic transfer pricing arrangements.

Digital Residency Tax Loopholes

Tax evasion involves illegal practices to hide income or falsify information, while tax optimization legally uses strategies like digital residency to minimize tax liabilities. Exploiting digital residency tax loopholes enables high-net-worth individuals to strategically shift taxable presence to low-tax jurisdictions, enhancing wealth preservation without breaching tax laws.

Beneficial Ownership Obfuscation

Beneficial ownership obfuscation often blurs the line between tax evasion and tax optimization by hiding true asset control to minimize tax liabilities illegally or legally. Understanding regulatory frameworks and transparency requirements is crucial for effective wealth management strategies that avoid penalties linked to concealed ownership structures.

Crypto Asset Tax Arbitrage

Tax evasion involves illegal methods to hide or underreport crypto assets, resulting in severe penalties and fines, while tax optimization uses legitimate strategies such as tax loss harvesting and asset location to minimize taxable income within legal frameworks. Crypto asset tax arbitrage exploits differences in tax regulations across jurisdictions, enabling wealth managers to strategically allocate digital assets and optimize tax liabilities without violating compliance standards.

Hybrid Mismatch Arrangements

Hybrid mismatch arrangements exploit differences in tax treatment between jurisdictions to create artificial tax benefits, often leading to unintentional tax evasion risks. Effective wealth management requires distinguishing legitimate tax optimization strategies from abusive hybrid mismatches to ensure compliance and minimize regulatory scrutiny.

Golden Visa Tax Sheltering

Golden Visa programs offer strategic tax optimization opportunities by legally minimizing tax liabilities through residency-based incentives, distinguishing them from illegal tax evasion practices that involve concealment or fraud. Utilizing Golden Visa tax sheltering enables high-net-worth individuals to enhance wealth management by leveraging international tax treaties and residency advantages while maintaining full compliance with tax regulations.

Treaty Shopping

Treaty shopping involves exploiting international tax treaties to reduce tax liabilities through artificial arrangements, often bordering on tax evasion and triggering legal penalties. Proper tax optimization in wealth management leverages legitimate treaty benefits by aligning investments with treaty provisions to maximize tax efficiency within the bounds of law.

Tax-Loss Harvesting with NFTs

Tax-loss harvesting with NFTs enables investors to strategically sell underperforming digital assets to realize losses that offset capital gains, thereby optimizing tax liabilities within wealth management portfolios. This technique balances compliance by leveraging market volatility in NFTs while enhancing after-tax returns through effective tax optimization strategies.

Double Irish with a Dutch Sandwich

The Double Irish with a Dutch Sandwich is a complex tax avoidance strategy used by multinational corporations to shift profits through Irish and Dutch subsidiaries, significantly reducing their global tax burden without engaging in illegal tax evasion. This tax optimization technique leverages differences in international tax laws to minimize taxable income, contrasting with tax evasion, which involves unlawful concealment or falsification of income to avoid paying taxes.

Pillar Two Global Minimum Tax Planning

Tax evasion involves illegal practices to avoid paying taxes, while tax optimization employs legal strategies to minimize tax liabilities within regulatory frameworks. Pillar Two Global Minimum Tax planning ensures multinational enterprises comply with the OECD's minimum tax rate, preventing profit shifting and enhancing transparent wealth management.

Tax Evasion vs Tax Optimization for Wealth Management Infographic

moneydiff.com

moneydiff.com